General Mills Struggles to Lift Sales in North America

December 19 2018 - 8:06AM

Dow Jones News

By Micah Maidenberg

General Mills Inc. reported weaker-than-expected revenue in its

latest quarter, as the packaged-foods company failed to lift sales

volume in retail stores in North America.

The maker of Cheerios cereal and Häagen-Dazs ice cream said

Wednesday net sales increased 5% from a year earlier to $4.41

billion, less than the $4.51 billion analysts polled by FactSet

expected.

Like other packaged-foods companies, General Mills is pushing to

attract customers who say they are looking for healthier foods and

simpler options. In July, the company said it would focus on what

it believes are unique product lines, including its natural and

organic brands and its snack bars business, and consider

divestitures.

The Minneapolis-based company struggled to reach shoppers in the

U.S. and Canada in the latest quarter, as revenue from North

American retail stores fell 3% compared with the same period last

year to $2.68 billion

Sales volume in the unit, the company's largest, dropped by 4

percentage points. Prices and the company's product mix ticked up 1

percentage point in the unit.

"We're taking actions to strengthen our second-half top-line

trends in North America retail, led by U.S. cereal and snacks,"

Chief Executive Officer Jeff Harmening said in prepared

remarks.

General Mills earned a profit of $343 million in the quarter

ended Nov. 25, or 57 cents a share, compared with $431 million, or

74 cents a share a year earlier. Adjusted profit of 85 cents a

share beat the 81 cents a share analysts expected.

The company took $193 million in impairment charges related to

its Progresso, Food Should Taste Good, and Mountain High brands in

the quarter primarily because it now expects those product lines to

generate weaker sales in the future.

The company's dog food results -- it completed an $8 billion

acquisition of Blue Buffalo Pet Products in April -- included sales

of $335 million in the latest quarter. But operating profit of $71

million was $18 million lower than the prior year due to cost

inflation, lower volume and factory startup costs.

Write to Micah Maidenberg at micah.maidenberg@wsj.com

(END) Dow Jones Newswires

December 19, 2018 07:51 ET (12:51 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

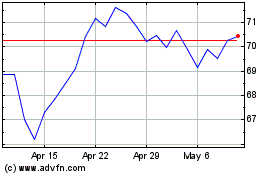

General Mills (NYSE:GIS)

Historical Stock Chart

From Aug 2024 to Sep 2024

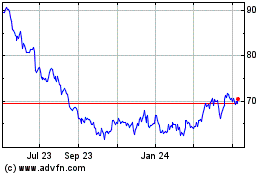

General Mills (NYSE:GIS)

Historical Stock Chart

From Sep 2023 to Sep 2024