Pfizer, Glaxo Agree to Create Over-The-Counter Drug Giant -- 3rd Update

December 19 2018 - 7:09AM

Dow Jones News

By Denise Roland

Pfizer Inc. and GlaxoSmithKline PLC plan to combine their

consumer health-care units and eventually spin off the joint

venture, creating the world's largest seller of drugstore staples

like Advil and Sensodyne toothpaste.

The deal, announced Wednesday, is an unexpected conclusion to a

yearlong process by Pfizer to shed its consumer business, as it and

other pharmaceutical companies focus more on higher-margin

prescription drugs. Glaxo has been pursuing the same focus, though

has until now stayed committed to its consumer business, which its

chief executive led before her promotion to the top job.

Glaxo will hold a 68% stake and Pfizer the remaining 32% in the

new joint venture, which generated combined sales of $12.7 billion

last year and will be the world's largest over-the-counter

medicines business. It also will sell brands like nicotine

replacement gum Nicorette, heartburn tablets Tums and Centrum

multivitamins.

The British company said it expects to close the deal in the

second half of 2019 and then separate the joint venture within

three years via a listing on the U.K. stock market.

That planned move will represent a breakup of Glaxo, which

currently generates around a quarter of its revenue from such

consumer products. For Pfizer, consumer health represents a smaller

slice of its overall business, at around 7% of total revenue.

Investors welcomed the news, sending Glaxo shares up 7% in early

trading in London.

The deal will free up both companies to concentrate on

prescription medicines, which tend to be more profitable, though

higher risk. Companies have used the steady revenue of consumer

drugs to insulate them from the sometimes boom-and-bust cycles of

developing the next blockbuster treatment. For Glaxo, that role

will fall to the vaccines business -- which tends to generate

steadier revenue flows -- after it sheds consumer healthcare.

Pfizer also sells vaccines, as well as generic drugs.

"There are benefits to having a broader structure but these are

significantly outweighed by the value creation of the deal we are

announcing today," Glaxo Chief Executive Emma Walmsley said on a

call with reporters.

She said the increased cash flow from the joint venture would

allow the company to invest heavily in its pipeline of new

medicines. Bringing the two businesses together will also allow

them to cut costs: the companies said they expected savings of

GBP500 million ($570 million) a year by 2022.

For Pfizer, the deal represents a late swan song for departing

Chief Executive Ian Read, who earlier this year failed to sell the

consumer health-care business in an auction. Glaxo had been one of

the bidders in that process but walked away because it didn't want

to acquire the business outright, according to Ms. Walmsley.

"It became obvious that for both parties there was tremendous

value creation opportunity here in an all-equity transaction, and

that was the real difference versus where we were earlier in the

year," she said.

This deal is Ms. Walmsley's biggest move yet to reshape Glaxo,

and builds on the company's $13 billion buyout earlier in the year

of Novartis AG's stake in a previous consumer health-care joint

venture.

Since taking the helm in April last year, Ms. Walmsley has

bulked up the prescription-drug business with the $4.16 billion

acquisition of cancer drugmaker Tesaro Inc. and shed Glaxo's

nutrition business in a $3.75 billion sale to Unilever PLC.

She has also shaken up the company's top ranks and cut several

scientific programs to concentrate on researching drugs that focus

on immunology or that have a genetic basis.

Pfizer also is seeking to double down on its pipeline of new

drugs, after years of pruning investment in research and

development.

Pfizer and Glaxo aren't alone in shedding slower-growing

businesses in favor of prescription-drug pipelines. As well as

exiting its consumer health-care joint venture with Glaxo, Novartis

has sold off part of its generic-drug business. At the same time,

the Swiss health-care giant has acquired a series of businesses in

cutting-edge areas of medicine.

Sanofi SA earlier this year sold its generic-drug business

shortly after buying two biotech companies.

Bristol-Myers Squibb Co. Wednesday morning announced the sale of

its French consumer health-care business Upsa to Japan's Taisho

Pharmaceutical Holdings.

Write to Denise Roland at Denise.Roland@wsj.com

(END) Dow Jones Newswires

December 19, 2018 06:54 ET (11:54 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

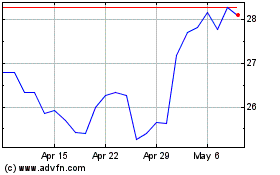

Pfizer (NYSE:PFE)

Historical Stock Chart

From Mar 2024 to Apr 2024

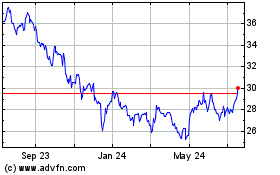

Pfizer (NYSE:PFE)

Historical Stock Chart

From Apr 2023 to Apr 2024