Johnson Controls Hits Snag in Process to Sell Car-Battery Business

November 08 2018 - 2:41PM

Dow Jones News

By Miriam Gottfried

Johnson Controls International PLC has hit a last-minute snag in

its quest to sell its automotive-battery business, according to

people familiar with the matter.

The company was nearing a deal to sell the unit to Brookfield

Asset Management Inc. for close to $14 billion, the people said.

Some analysts expected a deal with the private-equity firm to be

announced ahead of Johnson Controls' fiscal fourth-quarter earnings

report Thursday morning.

There was no deal announcement. Now, Apollo Global Management

LLC, an early contender, has been invited to rebid for the

business, the people said.

Apollo, which had offered around $13 billion, stopped its work

on the deal when it became clear that Brookfield had won the

auction, but it remains interested in the asset and is likely to

step back into the ring, they said. Apollo was further along than

Brookfield in its due diligence in what would be a complicated

carve-out and would have been ready to announce a deal for the

business soon after the Oct. 26 bidding deadline, some of the

people said.

It is unclear if other parties have also been asked to submit

new bids, and it is still possible that Brookfield will prevail or

that a deal won't happen.

If a deal is reached, it would be one of the largest leveraged

buyouts in a year filled with big ones. Private-equity firms have

raised record amounts of cash that they must put to work in order

to collect lucrative fees.

In January, Blackstone Group LP announced a $17 billion deal for

a majority stake in the financial-data business of Thomson Reuters

Corp. Carlyle Group LP in March said it, along with investment firm

GIC, would purchase the specialty chemicals business of Akzo Nobel

NV for about $12.6 billion, including debt. Also earlier this year,

KKR & Co. announced it would buy BMC Software Inc. and Envision

Healthcare Corp. for $8.3 billion and nearly $10 billion,

respectively, including debt.

Apollo, which raised $24.6 billion last year for the largest

private-equity fund ever and is also known for doing big buyouts,

has yet to do a deal of that magnitude. It is also bidding for

aluminum products maker Arconic Inc. in a deal that could top $10

billion, people familiar with the matter have told The Wall Street

Journal.

Johnson Controls is an industrial and technology conglomerate

headquartered in Cork, Ireland. It said in March it had hired

investment bank Centerview Partners to help it explore strategic

alternatives for its power solutions segment, as the battery

business is known.

The unit, which is the world's largest maker of automotive

batteries, generated $7.3 billion in revenue and $1.6 billion in

earnings before interest, taxes, depreciation and amortization in

2017. Fiscal fourth-quarter profit in the segment fell 2% compared

with the prior year, hit by higher lead prices and foreign

currency, the company said Thursday.

On a call with analysts to discuss its results, Johnson Controls

said it had made "significant progress" related to the strategic

review of its power business.

"We have assessed multiple options and are now in the final

stages of that review as we weigh all possibilities before reaching

a final decision," said Chief Executive George Oliver.

Write to Miriam Gottfried at Miriam.Gottfried@wsj.com

(END) Dow Jones Newswires

November 08, 2018 14:26 ET (19:26 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

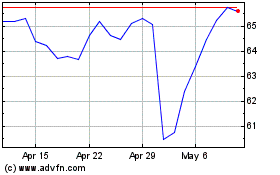

Johnson Controls (NYSE:JCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Johnson Controls (NYSE:JCI)

Historical Stock Chart

From Apr 2023 to Apr 2024