A Better Way to Pay Off Credit-Card Debt -- Journal Report

October 21 2018 - 10:36PM

Dow Jones News

By Grant E. Donnelly and Michael Norton

For most Americans not able to pay off a credit-card balance,

the most common choice at bill-paying time is to pay the minimum

balance -- an approach that keeps them treading water while the

amount they owe increases.

We propose a different choice: Pay off specific purchases each

month, such as a coffee from Starbucks, a pair of shoes or a gift

for a friend, which then disappear from the bill. It may be a small

amount, but it reduces the individual's debt incrementally, in

bite-size portions that they can actually afford.

Nearly half of all U.S. households report holding unsecured debt

from credit cards; for 2017 the Board of Governors of the Federal

Reserve put the national balance of revolving credit card debt at a

little over $1 trillion. Repayment-by-purchase offers individuals a

way to make progress toward reducing their debt instead of being

paralyzed by the mass of what they owe.

We conducted a study with our colleagues Cait Lamberton at the

University of Pittsburgh and Zoë Chance at the Yale School of

Management, in which we gave cardholders a menu of payment options,

including repayment-by-purchase. Those who maintain a revolving

balance on their credit card each month and those who are

delinquent in repaying their credit-card bills showed the largest

response to our intervention. (Consumers who regularly pay their

credit-card balance in full each month continued to do so.)

Consumers paid upward of 15% more toward their debt when allowed

to scan their statement and target specific purchases for

repayment. Why does this work? Because it reduces the feeling that

a statement is an endless sea of debts. It leads consumers to feel

as if they are making real progress toward reducing their debt with

each purchase paid off.

It was also interesting to us that in choosing what purchases to

pay for, people put essentials like groceries and utility bills

before nonessentials like vacations, alcohol and dining out. This

suggests to us that people feel more uncomfortable carrying a

balance for basic living expenses than they do for extraordinary

purchases. Previous research suggested that people would feel more

inclined to pay off vacations because it's hard to enjoy a vacation

you haven't paid for, whereas for durables like a washer-and-dryer

combo it would feel all right to owe a debt because you enjoy the

purchase over time. Our finding suggests that when picking among

many items, people are drawn to the things they need vs. the things

they wanted.

Repayment-by-purchase is a low-cost, practical intervention that

changes consumers' relationship to their debt. In fact, American

Express now offers the ability to do just this through their online

services: large purchases are flagged with a "Plan It" option, but

smaller purchases are flagged with a "Pay It" option -- allowing

consumers to experience the kinds of small wins that our research

suggests can help them reduce their debt.

Dr. Donnelly is an assistant professor of marketing at Ohio

State University Dr. Norton is a professor at Harvard Business

School. Email: reports@wsj.com.

(END) Dow Jones Newswires

October 21, 2018 22:21 ET (02:21 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

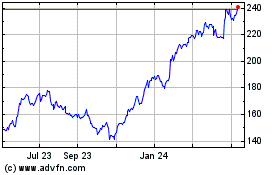

American Express (NYSE:AXP)

Historical Stock Chart

From Aug 2024 to Sep 2024

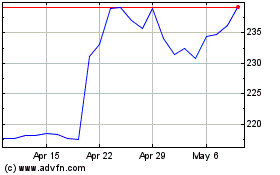

American Express (NYSE:AXP)

Historical Stock Chart

From Sep 2023 to Sep 2024