Alcoa Raises Profit Outlook as Tariffs Lift Aluminum Prices

October 17 2018 - 6:56PM

Dow Jones News

By Bob Tita

Alcoa Corp. said higher U.S. aluminum prices from a tariff on

imports and rising sales of the raw materials needed to make

aluminum improved its revenue in the third quarter and drove up its

profit outlook for the year.

The Pittsburgh-based company on Wednesday reported a 14%

increase in third-quarter revenue thanks to higher aluminum prices,

more efficient operations and sharply higher sales of the aluminum

oxide needed to make aluminum. Alcoa's shares were up 3.8% at

$38.10 in after-hours trading.

The company recorded a loss for the quarter because of

previously announced charges for pensions other expenses. Alcoa now

expects adjusted operating earnings of between $3.1 billion and

$3.2 billion, a slight increase on the lower end of the range the

company had forecast in July but in line with analysts'

expectations.

Aluminum prices in the U.S. have climbed this year after the

Trump administration imposed a 10% tariff on imported aluminum in

March. But Alcoa's heavy reliance on aluminum from foreign

smelters, particularly those based in Canada, has limited its

ability to benefit from the tariffs. Just 14% of the aluminum Alcoa

produced last year came from its U.S. smelters.

Alcoa said Wednesday that it paid $19 million in duties in

during the quarter, mostly on aluminum imported from its smelters

in Canada. The company said its U.S. smelters had a benefit of $27

million during the quarter as a result of higher prices on domestic

aluminum because of the tariff. Alcoa said its overall price for

raw aluminum sold in the quarter rose by 10% a ton.

Alcoa recently restarted a portion of its idle smelter in

southern Indiana but has refrained from restarting other curtailed

smelters in the U.S. because of high electricity costs.

The company opposed the Trump administration's blanket tariff on

imported aluminum as a strategy for countering excess aluminum

production in China, which has been blamed for undermining global

aluminum prices in recent years. While Alcoa has criticized Chinese

companies that overproduce, it has also called on the Trump

administration to negotiate reductions with China.

Alcoa reported a 57% increase in the price of aluminum oxide

sold the quarter as a result of the supply disruptions throughout

the world. Alcoa is a major supplier of the feedstock, also known

as alumina, to other aluminum producers.

"We're the world's largest producer outside of China. So while

increased alumina prices represent an added cost for our smelters,

Alcoa benefits overall due to the strength in third-party sales,"

chief executive Roy Harvey told analysts during a conference call

Wednesday.

The company reported a net loss of $41 million for the quarter

ended Sept. 30, or 22 cents per share, compared with a $113 million

profit, or 60 cents a share, during the same quarter last year.

Excluding the charges, earnings per share came in at 63 cents,

above the 36 cents expected by analysts.

Alcoa's third-quarter revenue rose to $3.39 billion compared

with $2.96 billion a year earlier. The company said revenue was 5%

lower from the second-quarter because of lower aluminum prices.

Write to Bob Tita at robert.tita@wsj.com

(END) Dow Jones Newswires

October 17, 2018 18:41 ET (22:41 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

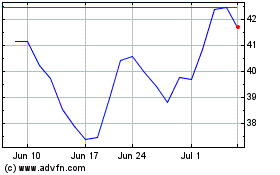

Alcoa (NYSE:AA)

Historical Stock Chart

From Mar 2024 to Apr 2024

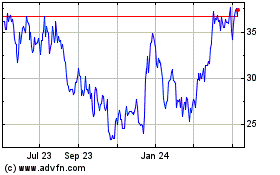

Alcoa (NYSE:AA)

Historical Stock Chart

From Apr 2023 to Apr 2024