Omnicom Gets a Boost from Increase in Client Spending

October 16 2018 - 11:54AM

Dow Jones News

By Nick Kostov

Advertising giant Omnicom Group Inc. reported

better-than-expected earnings, easing investor concerns over the

advertising industry's ability to weather technological

disruption.

While Omnicom was dragged down by its customer-relationship

marketing execution and support group, the company said it had seen

a pick up in client spending in the third quarter and sounded an

optimistic note for 2019.

"A lot of clients are spending not huge sums more but they are

spending money and I think that's a trend that will only continue

as we go forward," Omnicom Chief Executive John Wren said during

the company's earnings call.

The world's second-largest ad company by revenue said

third-quarter net income increased to $298.9 million, or $1.32 a

share, up from $263.6 million, or $1.13, a year earlier. Profit was

helped by a lower U.S. tax rate and growth in Europe.

The company's revenue fell 0.1% to $3.71 billion, hurt by

unfavorable foreign-exchange rates and a lackluster performance in

North America.

Analysts polled by FactSet were expecting earnings of $1.24 a

share on $3.71 billion in revenue.

The holding company, which owns creative and media agencies such

as BBDO and OMD, reported 2.9% organic revenue growth, a closely

watched metric that excludes currency effects and acquisitions.

That exceeded analysts' average expectation of about 2.7%,

according to FactSet, as well as organic revenue growth in earlier

quarters this year.

Omnicom and other ad giants had previously said they believed

the second half of the year would be stronger than the first.

Organic revenue was up 0.6% in the U.S., 6.9% in Europe, 14% in

Asia Pacific and 1.7% in Latin America. The measure dropped 0.3% in

the U.K. and fell 0.4% in the Middle East.

Omnicom's shares rose more than 7% in morning trading, while

those of Europe-based rivals WPP PLC and Publicis rose 1.7% and 3%,

respectively.

As with its rivals, Omnicom is under pressure from increased

competition from consulting firms, marketers cutting back on the

fees they pay ad agencies, and changes in consumer behavior.

"We haven't lost any large clients," Mr. Wren said. "We've had

some pretty handsome wins which should start to kick in during the

first quarter next year."

On Omnicom's call, Mr. Wren said the company had "accelerated"

certain planned cost cuts and real estate consolidation during the

period.

In all, Omnicom sold 19 companies in the third quarter,

resulting in a reduction of its workforce by roughly 7,000 people,

Mr. Wren said. Most of the businesses sold were part of Omnicom's

CRM execution and support group, which offers services such as

research, field marketing, point-of-sale, sales support and

merchandising.

Omnicom said it had reduced head count in its continuing

operations by more than 1,400 people during the quarter.

The company booked a gain from disposals amounting to $178.4

million, primarily from the sale of Sellbytel, its European-based

provider of outsourced sales, service and support, but took a $149

million charge in connection with the repositioning of its

business.

Write to Nick Kostov at Nick.Kostov@wsj.com

(END) Dow Jones Newswires

October 16, 2018 11:39 ET (15:39 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

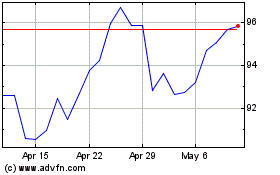

Omnicom (NYSE:OMC)

Historical Stock Chart

From Aug 2024 to Sep 2024

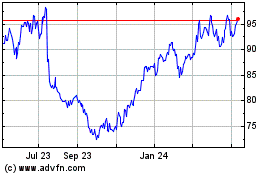

Omnicom (NYSE:OMC)

Historical Stock Chart

From Sep 2023 to Sep 2024