BlackRock Gets GBP30 Billion Chunk of Giant Lloyds Mandate -Financial News

October 12 2018 - 6:03AM

Dow Jones News

By David Ricketts

Of Financial News

Lloyds Banking Group PLC (LLOY.LN) has handed BlackRock, the

world's largest asset manager, a slice of the 109 billion-pound

($144.1 billion) mandate it is in the process of pulling from

Standard Life Aberdeen PLC (SLA.LN).

The U.K. banking group said Friday that U.S.-based BlackRock

will manage GBP30 billion worth of index strategies on behalf of

its Scottish Widows division. The transfer will happen once an

ongoing legal dispute with Standard Life Aberdeen has completed, or

when the existing contract expires in February 2019.

Aberdeen Asset Management had previously managed the entirety of

the mandate for Scottish Widows, but Lloyds decided to pull the

contract following the asset manager's merger with Standard Life in

2017.

Lloyds argued that the money couldn't be managed by a rival

insurer and deemed Standard Life Aberdeen a competitor. In May, the

Scottish investment group said it didn't agree with Lloyds's

decision to terminate the contract and began a dispute resolution

with the bank that is in process.

In addition to the Scottish Widows mandate, Lloyds said it is

looking to form a strategic partnership with BlackRock "including

collaboration in alternative asset classes, risk management and

investment technology."

Antonio Lorenzo, chief executive of Scottish Widows and group

director of insurance and wealth, said: "BlackRock has been

selected following a competitive tender process in which it clearly

demonstrated its global market leading capabilities and deep

expertise in the U.K. market. The partnership will ensure that

Scottish Widows and the group can deliver good investment outcomes

for its customers over the coming years."

Schroders PLC (SDR.LN), the U.K.-listed asset manager, is the

favorite to oversee the remainder of the Lloyds mandate.

The asset manager confirmed earlier this week that it has had

talks with the bank about how the two parties can work together in

wealth management. It is expected that Schroders will sell a stake

of its Cazenove wealth business to Lloyds in return for managing

the money.

Lloyds said it is in the process of finalizing agreements for

the remaining assets.

Several other asset managers were initially in the frame to

scoop up the Lloyds contract, including J.P. Morgan Asset

Management and Goldman Sachs Asset Management.

However, BlackRock and Schroders emerged as the favorites after

both J.P. Morgan and Goldman Sachs fell out of the running last

month.

Website: www.efinancialnews.com

(END) Dow Jones Newswires

October 12, 2018 05:48 ET (09:48 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

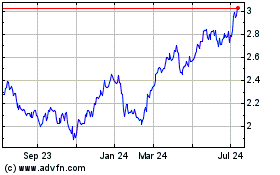

Lloyds Banking (NYSE:LYG)

Historical Stock Chart

From Aug 2024 to Sep 2024

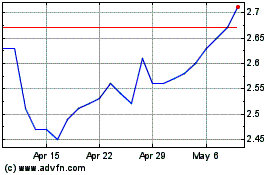

Lloyds Banking (NYSE:LYG)

Historical Stock Chart

From Sep 2023 to Sep 2024