CME Group to Launch New WTI Contract With Houston Delivery

September 24 2018 - 9:39AM

Dow Jones News

By Alistair MacDonald

CME Group Inc. said Monday that it is launching a West Texas

Intermediate future contract with physical delivery to Houston,

underscoring the rising importance of the city to energy

markets.

The exchange operator said it will offer a new WTI Houston Crude

Oil futures contract with three physical delivery locations on the

U.S. Gulf Coast, pending regulatory review.

Intercontinental Exchange Inc. said in July that it was planning

a new crude futures contract with physical delivery in Houston. The

exchange is aiming to launch this quarter, subject to regulatory

review.

Such contracts would provide traders with direct access to

Houston prices.

For decades, t he benchmark for U.S. oil prices has been in

Cushing, Okla., because of its accessibility through major

pipelines and extensive storage space. However, with the U.S. on

track to become a major energy exporter, some analysts say that

pricing power is shifting to the Gulf Coast, where oil gets loaded

onto tankers and shipped overseas.

Producers are already starting to look at the price of West

Texas Intermediate crude in Houston when they plan their

budgets.

"Houston's importance as a trading and export hub for physical

crude oil from Cushing and the Permian Basin continues to evolve

due to the shale oil revolution and repeal of the crude oil export

ban," said Peter Keavey, CME Group's global head of energy, in a

press release.

Write to Alistair MacDonald at alistair.macdonald@wsj.com

(END) Dow Jones Newswires

September 24, 2018 09:24 ET (13:24 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

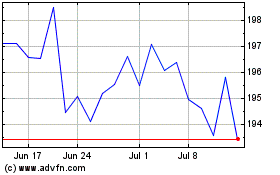

CME (NASDAQ:CME)

Historical Stock Chart

From Aug 2024 to Sep 2024

CME (NASDAQ:CME)

Historical Stock Chart

From Sep 2023 to Sep 2024