Toll Brothers Profit Jumps as Deliveries Rise -- 2nd Update

August 21 2018 - 4:33PM

Dow Jones News

By Kimberly Chin

The most affluent Americans continue to show confidence in the

economy, boosting spending on new homes, designer clothing and

other luxury products while shrugging off emerging threats to the

long-term U.S. economic expansion.

Toll Brothers Inc., one of the nation's largest builders of

high-end homes, offered fresh evidence Tuesday when it reported a

30% rise in profit in the quarter ended July 31.

The company said it expects the average price for its homes in

the current fiscal year to be between $835,000 and $860,000,

raising the low end of its previous guidance by $5,000. Toll

Brothers' share price surged nearly 14% in Tuesday intraday

trading.

Toll Brothers' strong results contrast with weakness in the

broader housing market. Rising prices, higher mortgage rates and a

lack of inventory have pushed many less wealthy buyers out of the

market. Sales of previously owned homes fell 2.2% in June compared

with a year earlier, the fifth time in six months they declined on

a year-over-year basis.

Wealthier buyers are more easily able to shrug off higher

mortgage rates and prices than middle-class purchasers, analysts

said.

High-end retailers also have reported robust results, another

sign that many wealthier Americans feel flush. Nordstrom Inc. said

sales were up 7% in its most recent quarter, and Coach, which is

owned by Tapestry Inc., reported a 5% increase.

Analysts expect strong results from Tiffany & Co. when it

reports next week. Kering, owner of Gucci, Saint Laurent and other

luxury brands, said first-half revenue in North America surged

45%.

"There's confidence in the economy," said Jack Micenko, a senior

analyst at Susquehanna International Group. "People having equity

in their homes is a huge confidence driver."

U.S. household net worth surpassed $100 trillion in the second

quarter, thanks to rising home and stock values, according to a

Federal Reserve report. Much of that is concentrated among high-end

households.

Inflation is edging up, which threatens to eat into wages of all

Americans. But the more affluent tend to have much of their savings

in stock and other financial instruments, which have been rising in

recent years. U.S. stocks are on the verge of surpassing their

longest-running rally, and on Tuesday the S&P 500 stock index

rose to its first intraday record since January.

This has given many wealthy consumers the confidence to spend on

big- ticket items like homes, despite a number of developments that

economists say could derail the long expansion. The prospect of a

trade war between the U.S. and major trading partners such as China

and Europe is already slowing some business spending, and rising

interest rates could slow borrowing and growth.

But executives at Toll said on an analyst call that they see

little evidence that rising rates are forcing their buyers to

stretch financially. Buyers' loan-to-value ratio in the third

quarter dropped to 67% from a more typical level of 70%. All-cash

buyers jumped to 24% of all customers this year from a more typical

20%. Both of those indicate that Tolls' buyers aren't straining and

taking on more debt to afford houses.

Toll's customers also were more willing to spend, putting in, on

average, $165,000 toward customization and design, Chief Executive

Douglas Yearley Jr. said on the investor call.

The Horsham, Pa.-based company said quarterly revenue rose 27%

to $1.91 billion.

Mr. Yearley said he isn't concerned that the slowdown i n the

existing-home market in California will hurt Toll Brothers in the

quarters to come. He said buyers are willing to pay a bigger

premium for a brand-new home than he has seen in his 28-year

career.

Economist will be looking to data from the National Association

of Realtors on July existing home sales on Wednesday for more clues

on the market direction.

Write to Kimberly Chin at kimberly.chin@wsj.com

(END) Dow Jones Newswires

August 21, 2018 16:18 ET (20:18 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

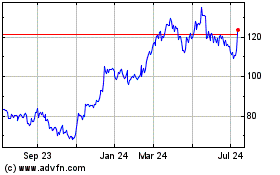

Toll Brothers (NYSE:TOL)

Historical Stock Chart

From Aug 2024 to Sep 2024

Toll Brothers (NYSE:TOL)

Historical Stock Chart

From Sep 2023 to Sep 2024