Cheniere Energy Partners, L.P. (NYSE American: CQP):

Summary of Second Quarter 2018 Results

(in millions, except LNG data)

Three Months Ended Six Months

Ended June 30, June 30, 2018

2017 2018 2017 Revenues $ 1,407

$ 992

$

3,000

$ 1,883 Net income $ 281 $ 46

$

616

$ 93 Adjusted EBITDA1 $ 562 $ 283

$

1,221

$ 602 LNG exported: Number of cargoes 61 48 128 91 Volumes (TBtu)

219 170 463 322 LNG volumes loaded (TBtu) 222 167 463 321

Summary 2018 Full Year Distribution

Guidance

2018 Distribution per Unit

$

2.20

-

$ 2.30

Recent Achievements

Operational

- As of July 31, 2018, approximately 150

cargoes have been produced, loaded, and exported from the SPL

Project (defined below) in 2018. To date, more than 400 cumulative

LNG cargoes have been exported from the SPL Project, with

deliveries to 28 countries and regions worldwide.

Financial

- In June 2018, the date of first

commercial delivery was reached under the 20-year LNG Sale and

Purchase Agreement with BG Gulf Coast LNG, LLC relating to Train 3

of the SPL Project.

Liquefaction Project Update

SPL Project

Liquefaction Train Train

5 Train 6 Project Status Commissioning

Permitted Project Completion Percentage(1) 95.1% —

Expected Substantial Completion 1H 2019 —

Note: Project update excludes Trains in

operation

(1) Project completion percentage as of

June 30, 2018

Cheniere Energy Partners, L.P. (“Cheniere Partners”) (NYSE

American: CQP) reported net income of $281 million for the three

months ended June 30, 2018, compared to $46 million for the

comparable period in 2017.

Cheniere Partners reported net income of $616 million for the

six months ended June 30, 2018, compared to net income of $93

million for the comparable period in 2017.

The increase in net income was primarily due to increased income

from operations as a result of additional natural gas liquefaction

trains (“Trains”) in operation at the SPL Project, partially offset

by increased interest expense, net of amounts capitalized.

Adjusted EBITDA1 for the three and six months ended June 30,

2018 was $562 million and $1.2 billion, respectively, compared to

$283 million and $602 million for the comparable 2017 periods. The

increase in Adjusted EBITDA was primarily due to increased income

from operations.

Total revenues increased $415 million during the three months

ended June 30, 2018 as compared to the three months ended June 30,

2017. Total revenues increased $1.1 billion during the six months

ended June 30, 2018 as compared to the six months ended June 30,

2017. Total operating costs and expenses increased $160 million

during the three months ended June 30, 2018, as compared to the

three months ended June 30, 2017. Total operating costs and

expenses increased $573 million during the six months ended June

30, 2018, compared to the six months ended June 30, 2017. The

increases in revenues and total operating costs and expenses for

the three and six months ended June 30, 2018, as compared to the

comparable periods in 2017, were primarily driven by the timing of

completion of Trains at the SPL Project and the length of each

Train’s operations within the periods being compared.

During the three and six months ended June 30, 2018, 61 and 128

LNG cargoes, respectively, were exported from the SPL Project, none

of which were commissioning cargoes.

SPL Project

Through Cheniere Partners, we are developing up to six Trains at

the Sabine Pass LNG terminal adjacent to the existing

regasification facilities (the “SPL Project”). Each Train is

expected to have a nominal production capacity, which is prior to

adjusting for planned maintenance, production reliability, and

potential overdesign, of approximately 4.5 million tonnes per annum

(“mtpa”) of LNG, and an adjusted nominal production capacity of

approximately 4.3 to 4.6 mtpa of LNG. Trains 1 through 4 are

operational, Train 5 is undergoing commissioning, and Train 6 is

being commercialized and has all necessary regulatory approvals in

place.

Distributions to

Unitholders

We will pay a cash distribution per common and subordinated unit

of $0.56 to unitholders of record as of August 6, 2018 and the

related general partner distribution on August 14, 2018.

Investor Conference Call and

Webcast

Cheniere Energy, Inc. will host a conference call to discuss its

financial and operating results for the second quarter on Thursday,

August 9, 2018, at 10 a.m. Eastern time / 9 a.m. Central time.

A listen-only webcast of the call and an accompanying slide

presentation may be accessed through our website at

www.cheniere.com. Following the call, an archived recording will be

made available on our website. The call and accompanying slide

presentation may include financial and operating results or other

information regarding Cheniere Partners.

1 Non-GAAP financial measure. See “Reconciliation of

Non-GAAP Measures” for further details.

About Cheniere Partners

Cheniere Partners, through its subsidiary, Sabine Pass

Liquefaction, LLC (“SPL”), is developing, constructing, and

operating natural gas liquefaction facilities at the Sabine Pass

LNG terminal located in Cameron Parish, Louisiana, on the

Sabine-Neches Waterway less than four miles from the Gulf Coast.

Cheniere Partners, through SPL, plans to construct up to six

Trains, which are in various stages of development, construction,

and operations. Trains 1 through 4 are operational, Train 5 is

undergoing commissioning, and Train 6 is being commercialized and

has all necessary regulatory approvals in place. Each Train is

expected to have a nominal production capacity, which is prior to

adjusting for planned maintenance, production reliability, and

potential overdesign, of approximately 4.5 mtpa of LNG and an

adjusted nominal production capacity of approximately 4.3 to 4.6

mtpa of LNG.

Through its wholly owned subsidiary, Sabine Pass LNG, L.P.,

Cheniere Partners owns and operates regasification facilities at

the Sabine Pass LNG terminal, which includes pre-existing

infrastructure of five LNG storage tanks with aggregate capacity of

approximately 16.9 billion cubic feet equivalent (“Bcfe”), two

marine berths that can each accommodate vessels with nominal

capacity of up to 266,000 cubic meters and vaporizers with

regasification capacity of approximately 4.0 Bcf/d. Cheniere

Partners also owns a 94-mile pipeline that interconnects the Sabine

Pass LNG terminal with a number of large interstate pipelines

through its wholly owned subsidiary, Cheniere Creole Trail

Pipeline, L.P.

For additional information, please refer to the Cheniere

Partners website at www.cheniere.com and Quarterly Report on Form

10-Q for the quarter ended June 30, 2018, filed with the

Securities and Exchange Commission.

Forward-Looking Statements

This press release contains certain statements that may include

“forward-looking statements.” All statements, other than statements

of historical or present facts or conditions, included herein are

“forward-looking statements.” Included among “forward-looking

statements” are, among other things, (i) statements regarding

Cheniere Partners’ business strategy, plans and objectives,

including the development, construction and operation of

liquefaction facilities, (ii) statements regarding expectations

regarding regulatory authorizations and approvals, (iii) statements

expressing beliefs and expectations regarding the development of

Cheniere Partners’ LNG terminal and liquefaction business, (iv)

statements regarding the business operations and prospects of third

parties, (v) statements regarding potential financing arrangements,

and (vi) statements regarding future discussions and entry into

contracts. Although Cheniere Partners believes that the

expectations reflected in these forward-looking statements are

reasonable, they do involve assumptions, risks and uncertainties,

and these expectations may prove to be incorrect. Cheniere

Partners’ actual results could differ materially from those

anticipated in these forward-looking statements as a result of a

variety of factors, including those discussed in Cheniere Partners’

periodic reports that are filed with and available from the

Securities and Exchange Commission. You should not place undue

reliance on these forward-looking statements, which speak only as

of the date of this press release. Other than as required under the

securities laws, Cheniere Partners does not assume a duty to update

these forward-looking statements.

(Financial Tables Follow)

Cheniere Energy Partners, L.P.

Consolidated Statements of

Income

(in millions, except per unit data)

(1)

(unaudited)

Three Months Ended

Six Months Ended June 30, June

30, 2018 2017 2018

2017 Revenues LNG revenues $ 1,155 $ 503 $ 2,170 $

995 LNG revenues—affiliate 178 422 681 753 Regasification revenues

65 65 130 130 Other revenues 9 2 19 4 Other revenues—affiliate —

— — 1 Total revenues 1,407 992 3,000

1,883 Operating costs and expenses

Cost of sales (excluding depreciation and

amortization expense

shown separately below)

698 577 1,535 1,090 Operating and maintenance expense 98 82 193 132

Operating and maintenance expense—affiliate 30 21 56 39 Development

expense 1 1 1 1 General and administrative expense 2 2 6 5 General

and administrative expense—affiliate 17 23 35 45 Depreciation and

amortization expense 106 86 211 152

Total operating costs and expenses 952 792 2,037

1,464 Income from operations 455 200 963 419

Other income (expense) Interest expense, net of capitalized

interest (184 ) (154 ) (369 ) (284 ) Loss on modification or

extinguishment of debt — — — (42 ) Derivative gain (loss), net 3 (3

) 11 (3 ) Other income 7 3 11 3 Total

other expense (174 ) (154 ) (347 ) (326 ) Net income $ 281

$ 46 $ 616 $ 93 Basic and

diluted net income (loss) per common unit $ 0.55 $ (3.71 ) $

1.22 $ (4.50 )

Weighted average number of common units

outstanding used for

basic and diluted net income (loss) per

common unit calculation

348.6 57.1 348.6 57.1

___________________

(1) Please refer to the Cheniere Energy Partners, L.P.

Quarterly Report on Form 10-Q for the quarter ended June 30, 2018,

filed with the Securities and Exchange Commission.

Cheniere Energy Partners, L.P.

Consolidated Balance Sheets

(in millions, except unit data)

(1)

June 30,

December 31, 2018 2017 ASSETS

(unaudited) Current assets Cash and cash equivalents $ — $ —

Restricted cash 1,521 1,589 Accounts and other receivables 241 191

Accounts receivable—affiliate 19 163 Advances to affiliate 139 36

Inventory 87 95 Other current assets 54 65 Other current

assets—affiliate 1 — Total current assets 2,062 2,139

Property, plant and equipment, net 15,207 15,139 Debt

issuance costs, net 18 38 Non-current derivative assets 31 31 Other

non-current assets, net 224 206 Total assets $ 17,542

$ 17,553 LIABILITIES AND PARTNERS’ EQUITY

Current liabilities Accounts payable $ 14 $ 12 Accrued liabilities

572 637 Due to affiliates 39 68 Deferred revenue 98 111 Deferred

revenue—affiliate — 1 Derivative liabilities 7 —

Total current liabilities 730 829 Long-term debt, net 16,046

16,046 Non-current deferred revenue — 1 Non-current derivative

liabilities 7 3 Other non-current liabilities 8 10 Other

non-current liabilities—affiliate 23 25 Partners’ equity

Common unitholders’ interest (348.6

million units issued and outstanding at June 30,

2018 and December 31, 2017)

1,739 1,670

Subordinated unitholders’ interest (135.4

million units issued and outstanding at June

30, 2018 and December 31, 2017)

(1,016 ) (1,043 )

General partner’s interest (2% interest

with 9.9 million units issued and outstanding at

June 30, 2018 and December 31, 2017)

5 12 Total partners’ equity 728 639

Total liabilities and partners’ equity $ 17,542 $ 17,553

___________________

(1) Please refer to the Cheniere Energy Partners, L.P.

Quarterly Report on Form 10-Q for the quarter ended June 30, 2018,

filed with the Securities and Exchange Commission.

Reconciliation of Non-GAAP Measures

Regulation G Reconciliation

In addition to disclosing financial results in accordance with

U.S. GAAP, the accompanying news release contains a non-GAAP

financial measure. Adjusted EBITDA is a non-GAAP financial measure

that is used to facilitate comparisons of operating performance

across periods. This non-GAAP measure should be viewed as a

supplement to and not a substitute for our U.S. GAAP measures of

performance and the financial results calculated in accordance with

U.S. GAAP, and the reconciliation from these results should be

carefully evaluated.

Adjusted EBITDA is calculated by taking net income before

interest expense, net of capitalized interest, changes in the fair

value and settlement of our interest rate derivatives, taxes,

depreciation and amortization, and adjusting for the effects of

certain non-cash items, other non-operating income or expense items

and other items not otherwise predictive or indicative of ongoing

operating performance, including the effects of modification or

extinguishment of debt and changes in the fair value of our

commodity derivatives. Adjusted EBITDA is not intended to represent

cash flows from operations or net income (loss) as defined by U.S.

GAAP and is not necessarily comparable to similarly titled measures

reported by other companies.

We believe Adjusted EBITDA provides relevant and useful

information to management, investors and other users of our

financial information in evaluating the effectiveness of our

operating performance in a manner that is consistent with

management’s evaluation of business performance. Management

believes Adjusted EBITDA is widely used by investors to measure a

company’s operating performance without regard to items such as

interest expense, taxes, depreciation and amortization which vary

substantially from company to company depending on capital

structure, the method by which assets were acquired and

depreciation policies. Further, the exclusion of certain non-cash

items, other non-operating income or expense items and other items

not otherwise predictive or indicative of ongoing operating

performance enables comparability to prior period performance and

trend analysis.

Adjusted EBITDA

The following table reconciles our Adjusted EBITDA to U.S. GAAP

results for the three and six months ended June 30, 2018 and 2017

(in millions):

Three Months Ended

Six Months Ended June 30, June 30,

2018 2017 2018

2017 Net income $ 281 $ 46 $ 616 $ 93 Interest expense, net

of capitalized interest 184 154 369 284 Loss on modification or

extinguishment of debt — — — 42 Derivative loss (gain), net (3 ) 3

(11 ) 3 Other income (7 ) (3 ) (11 ) (3 ) Income from operations $

455 $ 200 $ 963 $ 419 Adjustments to

reconcile income from operations to Adjusted EBITDA: Depreciation

and amortization expense 106 86 211 152 Loss from changes in fair

value of commodity derivatives, net 1 (3 ) 47 31

Adjusted EBITDA $ 562 $ 283 $ 1,221 $

602

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180809005099/en/

Cheniere Energy Partners, L.P.InvestorsRandy Bhatia, 713-375-5479Megan Light,

713-375-5492orMedia RelationsEben

Burnham-Snyder, 713-375-5764

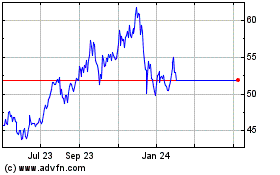

Cheniere Energy Partners (AMEX:CQP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cheniere Energy Partners (AMEX:CQP)

Historical Stock Chart

From Apr 2023 to Apr 2024