South State Corporation (NASDAQ: SSB) today released its

unaudited results of operations and other financial information for

the three-month and six-month periods ended June 30, 2018.

Highlights for the second quarter of 2018 include the

following:

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20180730005661/en/

- Second quarter 2018 financial

results:

- Net income was $40.5 million, compared

with $42.3 million in the first quarter of 2018, a decrease of $1.8

million

- Diluted EPS of $1.09 compared with

$1.15, a decrease of $0.06

- Adjusted net income (non-GAAP) was

$52.7 million, compared to $51.2 million, a 2.8% increase, or $1.5

million

- Adjusted diluted EPS (non-GAAP) of

$1.43, compared to $1.39, a 2.9% increase

- There are four specific items to note:

(1) completed the system conversion from the Park Sterling (PSTB)

merger and closed 10 branches; (2) net loan growth totaled $191.6

million, or 7.2% annualized; (3) total deposits were flat and

interest expense increased by $3.1 million; and (4) increased the

cash dividend to $0.35 per share, up $0.01 per share over last

quarter.

- Performance ratios second quarter

2018 compared to first quarter 2018

- Return on average assets totaled 1.12%

compared to 1.19%

- Adjusted return on average assets

(non-GAAP) was 1.45% compared to 1.44%

- Return on average equity totaled 6.96%

compared to 7.41%

- Return on average tangible equity

(non-GAAP) was 13.79% compared to 14.69%

- Adjusted return on average tangible

equity (non-GAAP) increased to 17.68% from 17.60%

- Efficiency ratio was 65.6% down from

66.7%, due primarily to lower salaries and employee benefits

- Adjusted efficiency ratio (non-GAAP)

was 57.3% an improvement from 60.0% (excluding merger-related and

conversion expenses and securities losses (gains))

- Balance sheet linked quarter

- Cash and cash equivalents decreased by

$247.7 million

- Net loan growth for the quarter totaled

$191.6 million, or 7.2% annualized, spread across consumer real

estate, commercial & industrial, and commercial owner occupied

real estate, with limited CRE growth

- Noninterest bearing deposits increased

by $32.0 million, or 4.1% annualized; and interest bearing deposits

decreased by $56.8 million, or 2.7% annualized, led by a reduction

in brokered deposits of $54.3 million

- Other borrowings decreased $99.8

million from repayment of FHLB advances during the quarter

- Shareholders’ equity increased $25.8

million, primarily from net income, net of the dividends paid, of

$27.9 million offset by accumulated other comprehensive loss

(“AOCI”) of $5.7 million, net of tax, primarily from the available

for sale securities portfolio

- Total equity to total assets increased

to 16.12% from 15.81%

- Tangible equity to tangible assets

(non-GAAP) increased to 9.45% from 9.20%

- Asset quality

- Nonperforming assets (NPAs) increased

by $8.1 million, or 23.9%, to $42.2 million at June 30, 2018,

primarily due to properties from branch closures related to the

merger with PSTB taken into other real estate owned (OREO), from

the level at March 31, 2018, and increased by $7.8 million, or

22.70% from June 30, 2017

- NPAs to total assets increased to 0.29%

at June 30, 2018, from 0.23% at March 31, 2018 and improved from

0.31% at June 30, 2017

- Net charge-offs on non-acquired loans

were 0.01% annualized, or $189,000, compared to $367,000, or 0.02%

annualized in the first quarter of 2018. Compared to the second

quarter of 2017, net charge offs totaled $756,000, or 0.05%

annualized.

- Net charge-offs on acquired non-credit

impaired loans were 0.14% annualized, or $1.1 million, compared to

0.02% annualized, or $169,000 in the first quarter of 2018. In the

second quarter of 2017, net charge-offs were 0.10% annualized, or

$429,000.

- Coverage ratio of ALLL on non-acquired

non-performing loans was 322% at June 30, 2018 compared to 316% at

March 31, 2018 and 297% at June 30, 2017.

Quarterly Cash Dividend

The Board of Directors of South State Corporation declared a

quarterly cash dividend on July 26, 2018, of $0.35 per share

payable on its common stock. This per share amount is higher by

$0.01 per share, or 2.9%, compared to last quarter and $0.02 per

share, or 6.1%, higher than the same quarter one year ago. The

dividend will be payable on August 24, 2018 to shareholders of

record as of August 17, 2018.

Durbin Impact

Effective July 1, 2018, the cap on interchange fees under the

Durbin amendment will be in effect for the Company. We expect lower

interchange income of approximately $8.5 million (pre-tax) during

the last half of 2018.

Park Sterling – Fair Value Adjustments

During the second quarter of 2018, the Company adjusted the fair

values of certain acquired assets and liabilities. These

adjustments are reflected below in the column labeled “6/30/2018

Fair Value Adjustments”. The adjustments include the following:

1. Loans were adjusted to reflect movement

between acquired credit impaired (ACI) loan portfolio and acquired

noncredit impaired (ANCI) loan portfolio, and the movement in

interest rates (from 9/30/2017) between initial fair values and

interest rates at November 30, 2017. The fair value adjustment

(discount) on these loans totaled $9.1 million, with $2.4 million

related to credit and $6.7 million related to noncredit. This

resulted in more acquired loan interest income during the second

quarter of 2018 of approximately $516,000.

2. Intangible assets (core deposit

intangible) increased by $3.3 million from the movement in interest

rates, resulting in more amortization expense during the second

quarter of 2018 of $321,000.

3. Interest-bearing liabilities (time

deposits) fair values were adjusted as well for the movement in

interest rates resulting in less premium than originally valued.

This resulted in higher interest expense during the second quarter

of 2018 of $236,000.

The reduction in net income resulting from all of these

adjustments totaled approximately $41,000, pre-tax.

South State Corporation

Fair Value of Park Sterling Corporation

11/30/2017

Net Assets 11/30/2017 Initial

3/3/31/2018

6/30/2018

Acquired at As Recorded Fair Value Fair

Value Fair Value Date of (Dollars in thousands)

by PSTB Adjustments Adjustments

Adjustments Acquisition Assets Cash and cash

equivalents $ 116,454 $ -- $ 116,454 Investment securities 461,261

1,444 (a) 219 462,924 Loans held for sale 2,200 68,686 (b) (50 ) 46

70,882 Loans 2,346,612 (95,878 ) (c) -- (9,131 )

(1)

2,241,603 Premises and equipment 61,059 (4,882 ) (d) (387 ) 55,790

Intangible assets 73,090 (46,915 ) (e) 3,321

(2)

29,496 Other real estate owned and repossessed assets 2,549 (429 )

(f) 210 2,330 Bank owned life insurance 72,703 -- 72,703 Deferred

tax asset 17,963 11,596 (g) 3 2,022 31,584 Other assets

21,595 (476 ) (h) 21,119 Total assets $

3,175,486 $ (66,854 ) $ (5 ) $ (3,742 ) $ 3,104,885

Liabilities Deposits: Noninterest-bearing $ 561,874 $ -- $

561,874 Interest-bearing 1,886,810 2,692 (i)

(612 )

(3)

1,888,890 Total deposits 2,448,684 2,692 -- (612 ) 2,450,764

Federal funds purchased and securites sold

under agreements to repurchase

-- -- -- Other borrowings 329,249 11,689 (j) 340,938 Other

liabilities 24,179 2,131 (k)

26,310 Total liabilities 2,802,112 16,512

-- (612 ) 2,818,012 Net

identifiable assets acquired over liablities assumed 373,374

(83,366 ) (5 ) (3,130 ) 286,873 Goodwill -- 402,951

5 3,130 406,086 Net

assets acquired over liabilities assumed $ 373,374 $ 319,585

$ -- $ -- $ 692,959

Consideration:

South State Corporation common shares issued 7,480,343 Purchase

price per share of the Company's common stock $ 92.05

Company common stock issued and cash

exchanged for fractional shares

$ 688,654 Cash paid for stock option redemptions 4,305 Fair value

of total consideration transferred $ 692,959

Initial Fair Value

Adjustments: (a) Adjustment reflects marking the securities

portfolio to fair value as of the acquisition date. (b) Adjustment

reflects a reclass of $68.7 million by SSB of Shared National

Credits (loans) from loans held for investment to loans held for

sale. (c) Adjustment reflects the fair value adjustments (discount)

of $60.9 million based upon the Company's evaluation of acquired

loans. This amount excludes the allowance for loan losses (ALLL)

and fair value adjustment (discount) of $12.5 million and $21.3

million, respectively recorded by PSTB and is net of the $68.7

million reclass related to the Shard National Credits noted in (b)

above. (d) Adjustment reflects the fair value adjustments based on

the Company's evaluation of the acquired premises and equipment.

(e) Adjustment reflects the recording of a 1.66% CDI on the

acquired deposit accounts that totaled $26.2 million offset by a

write-off of $73.1 million of existing goodwill and CDI acquired

from PSTB.

(f) Adjustment reflects the fair value

adjustments to other real estate owned (OREO) based on the

Company's evaluation of the acquired OREO portfolio.

(g) Adjustment to record deferred taxes related to the fair value

adjustments and an adjustment from the PSTB rate to the SSB rate.

(h) Adjustment reflects the write-off of accrued interest

receivable and certain prepaid expenses.

(i) Adjustment reflects the premium for

fixed maturity time deposits of $2.95 million offset by the

write-off of existing fair value marks.

(j) Adjustment reflects fair value adjustment (discount) of $2.4

million of PSTB's trust preferred securities offset by the

write-off of existing PSTB discount on senior debt and TRUPs of

$14.0 million. (k) Adjustment reflects the fair value adjustments

to employee benefit plans of $1.5 million along with other

adjustments of miscellaneous liabilities.

Second Quarter 2018 Financial

Performance

Three Months Ended Six Months Ended (Dollars

in thousands, except per share data)

June 30, Mar.

31, Dec. 31, Sept. 30, June 30, June

30, INCOME STATEMENT 2018 2018 2017

2017 2017 2018 2017 Interest

income Loans, including fees (8)

$ 129,852 $ 127,041 $

108,319 $ 95,864 $ 93,600

$ 256,893 $ 185,352

Investment securities, federal funds sold

and securities purchased under agreements to resell

11,880 11,007 9,505 8,547 9,179

22,887 18,413 Total

interest income

141,732 138,048 117,824 104,411 102,779

279,780 203,765

Interest expense Deposits

10,009 6,913 4,220 2,974 2,661

16,922 5,158

Federal funds purchased, securities sold

under agreements to repurchase, and other borrowings

2,161 2,162 1,330 1,118 1,087

4,323 2,214 Total

interest expense

12,170 9,075 5,550 4,092 3,748

21,245 7,372

Net interest income 129,562

128,973 112,274 100,319 99,031

258,535 196,393 Provision for

loan losses

4,478 2,454 3,808 2,062 2,313

6,932 6,020

Net interest income after provision for loan losses

125,084 126,519 108,466 98,257 96,718

251,603 190,373

Noninterest income*

37,525 40,555 36,762 33,735 35,316

78,080 69,533 Pre-tax operating expense*

96,410

102,167 84,645 77,718 79,974

198,577 161,455 Branch

consolid./acquisition and merger expense

14,096 11,296

17,621 1,551 4,307

25,392 25,331

Total noninterest expense

110,506 113,463 102,266 79,269

84,281

223,969 186,786

Income before provision for income

taxes 52,103 53,611 42,962 52,723 47,753

105,714

73,120 Provision for income taxes, includes deferred tax

revaluation

11,644 11,285 40,541 17,677 15,930

22,929

23,033

Net income $ 40,459 $ 42,326 $ 2,421 $ 35,046

$ 31,823

$ 82,785 $ 50,087

Adjusted net income

(non-GAAP) (3) Net income (GAAP) $ 40,459 $

42,326 $ 2,421 $ 35,046 $ 31,823

$ 82,785 $ 50,087

Securities losses (gains), net of tax

505 -- (22) (349) (73)

505 (73) Provision for income

taxes, deferred tax revaluation

613 -- 26,558 -- --

613 -- Branch consolid./acquisition and merger expense, net

of tax

11,112 8,918 12,431 1,031 2,870

20,030 18,007

Adjusted net income (non-GAAP) $ 52,689 $ 51,244 $

41,388 $ 35,728 $ 34,620

$ 103,933 $ 68,021 Basic

earnings per common share

$ 1.10 $ 1.15 $ 0.08 $ 1.20 $ 1.09

$ 2.25 $ 1.73 Diluted earnings per common share

$

1.09 $ 1.15 $ 0.08 $ 1.19 $ 1.08

$ 2.24 $ 1.71 Adjusted

net income per common share - Basic (non-GAAP) (3)

$ 1.44 $

1.40 $ 1.31 $ 1.23 $ 1.19

$ 2.84 $ 2.35 Adjusted net income

per common share - Diluted (non-GAAP) (3)

$ 1.43 $ 1.39 $

1.30 $ 1.22 $ 1.18

$ 2.82 $ 2.33 Dividends per common share

$ 0.34 $ 0.33 $ 0.33 $ 0.33 $ 0.33

$ 0.67 $ 0.66

Basic weighted-average common shares outstanding

36,676,887

36,646,198 31,654,947 29,114,574 29,094,908

36,656,689

28,985,390 Diluted weighted-average common shares outstanding

36,928,981 36,899,068 31,905,505 29,385,041 29,364,916

36,909,739

29,252,321 Effective tax rate

22.35% 21.05% 94.36% 33.53%

33.36%

21.69% 31.50%

* These lines include a

reclassfiication of network costs directly related to interchange

and debit card transaction fees. ASU 2014-09 - Revenue

recognition requires netting of these expenses with the

related revenue. All periods have been adjusted for this

reclassification, and there was no impact to net income or capital

for any period presented.

The Company reported consolidated net income of $40.5 million,

or $1.09 per diluted common share for the three-months ended June

30, 2018, a $1.8 million decrease from the first quarter of 2018.

Interest income was up $3.7 million as a result of an increase in

non-acquired loan interest income of $5.5 million during the second

quarter, partially offset by lower acquired interest income of $2.8

million, as the acquired loan portfolio continued to decline during

the quarter. Interest expense increased by $3.1 million, with $1.8

million increase from transaction and money market accounts,

$812,000 attributable to certificate and other time deposits and

$486,000 in savings accounts. These increases in interest expense

were due to the continued higher cost of the deposit base. The

Company’s cost of funds was 0.55% for the second quarter of 2018,

an increase of 0.14% from the first quarter of 2018. Compared to

the second quarter of 2017, cost of funds increased by 0.33% which

was primarily the result of the addition of Park Sterling funding

cost and increases related to the Company’s deposit base. The total

provision for loan losses increased $2.0 million compared to the

first quarter of 2018. Valuation allowance (impairment) related to

acquired loans was $359,000 higher than in the first quarter of

2018, as several pools had reduced cash flows and extensions of

timing of expected cash flows. The provision for loan losses

related to acquired non-credit impaired loans was higher by $1.1

million, compared to the first quarter of 2018. One loan was

charged off during the quarter which totaled approximately

$750,000. The provision for loan losses on non-acquired loans was

$738,000 higher compared to the first quarter of 2018 due primarily

to loan growth during the quarter. Noninterest income decreased by

$3.0 million. Mortgage banking income was down $1.6 million and

acquired loan recoveries declined $808,000. Salaries and employee

benefits were $7.4 million lower. This decline was due to lower to

payroll taxes, $2.8 million in bonuses paid to all employees during

the first quarter, and fewer FTEs. Many noninterest expense

categories were lower for the second quarter of 2018 due to the

conversion and branch closures related to the Park Sterling

merger.

Income Tax Expense

During the second quarter of 2018, the Company’s effective

income tax rate was 22.35%, or $11.6 million. As a result of the

changes in fair value of the Park Sterling opening balance sheet,

the Company recorded $613,000 in additional income tax expense

related to the revaluation of deferred taxes. Without this charge,

the effective rate for the second quarter was 21.17%, compared to

the first quarter of 2018 was 21.05%. On a year-to-date basis, the

effective rate was 21.69%, including the additional deferred tax

charge and 21.11% without the charge.

“We continued to produce attractive levels of profitability in

the second quarter,” said Robert R. Hill, Jr., CEO of South State

Corporation. “The recently announced management changes put into

place the next generation of leadership at South State. Our bank’s

talented team combined with high growth markets, good core funding,

a diverse loan portfolio and a solid capital base put us in a good

competitive position.”

Balance Sheet and Capital

Ending Balance

June 30,

Mar. 31,

Dec. 31,

Sept. 30,

June 30,

BALANCE SHEET 2018 2018

2017 2017

2017 Assets Cash and cash equivalents

$

396,849 $ 644,504 $ 377,627 $ 403,934

$ 431,890 Investment securities: Securities held to

maturity

499 1,274 2,529 3,678 4,166 Securities available

for sale, at fair value

1,577,999 1,640,837 1,648,193

1,319,454 1,340,427 Other investments

19,229

23,479 23,047 13,664

14,301 Total investment securities

1,597,727 1,665,590 1,673,769

1,336,796 1,358,894 Loans held

for sale

36,968 42,690

70,890 46,321 65,995 Loans:

Acquired credit impaired

551,979 597,274 618,803 578,863

602,481 Acquired non-credit impaired

3,076,424

3,274,938 3,507,907 1,455,555 1,585,981 Non-acquired

7,197,539

6,762,512 6,492,155 6,230,327 5,992,393 Less allowance for

non-acquired loan losses

(47,874 )

(45,203 ) (43,448 ) (41,541 ) (40,149 ) Loans,

net

10,778,068

10,589,521 10,575,417

8,223,204 8,140,706 Other real estate owned

("OREO")

17,222 11,073 11,203 13,527 14,430 Premises and

equipment, net

245,288 253,605 255,565 198,146 201,539 Bank

owned life insurance

227,588 226,222 225,132 151,402 150,476

Deferred tax asset

48,853 46,736 45,902 41,664 39,921

Mortgage servicing rights

35,107 34,196 31,119 29,937 29,930

Core deposit and other intangibles

69,975 70,376 73,789

50,472 52,966 Goodwill

1,002,722 999,592 999,586 597,236

595,817 Other assets

110,121 105,004

126,590 76,471 71,877

Total assets

$

14,566,488

$ 14,689,109

$

14,466,589

$ 11,169,110 $ 11,154,441

Liabilities and Shareholders' Equity Deposits:

Noninterest-bearing

$

3,152,828

$ 3,120,818 $ 3,047,432 $ 2,505,570 $ 2,635,147 Interest-bearing

8,485,461 8,542,280

8,485,334 6,556,451 6,396,507

Total deposits

11,638,289

11,663,098 11,532,766

9,062,021 9,031,654

Federal funds purchased and securities

sold under agreements to repurchase

331,969 357,574 286,857 291,099 334,018 Other borrowings

115,754 215,589 216,385 83,307 98,147 Other liabilities

132,109 130,269 121,661

99,858 85,137 Total liabilities

12,218,121 12,366,530

12,157,669 9,536,285 9,548,956

Shareholders' equity: Preferred stock - $.01 par value;

authorized 10,000,000 shares

-- -- -- -- -- Common stock -

$2.50 par value; authorized 80,000,000 shares

92,064 91,958

91,899 73,168 73,148 Surplus

1,811,446 1,807,989 1,807,601

1,136,352 1,134,328 Retained earnings

480,928 452,982

419,847 427,093 401,706 Accumulated other comprehensive loss

(36,071 ) (30,350 ) (10,427 )

(3,788 ) (3,697 ) Total shareholders' equity

2,348,367 2,322,579 2,308,920

1,632,825 1,605,485 Total

liabilities and shareholders' equity

$

14,566,488

$ 14,689,109

$

14,466,589

$ 11,169,110 $ 11,154,441 Common shares

issued and outstanding

36,825,556

36,783,438 36,759,656 29,267,369

29,259,264

At June 30, 2018, the Company’s total assets were $14.6 billion,

a decrease of $122.6 million from March 31, 2018, and an increase

of $3.4 billion, or 30.6% from June 30, 2017. During the second

quarter of 2018, cash and cash equivalents decreased by $247.7

million. This was the result of a decline in total deposits, other

borrowings, federal funds purchased and securities sold under

repurchase agreements on the liability side, and total loans

increasing by $191.6 million, or 7.2% annualized, as nonacquired

loans increased by $435.0 million, and acquired loans declined by

$243.5 million. Partially offsetting these uses of cash was a

decline in investment securities by $67.9 million.

The Company’s book value per common share increased to $63.77

per share at June 30, 2018, compared to $63.14 at March 31, 2018

and $54.87 at June 30, 2017. The increase in capital during the

second quarter of 2018 of $25.8 million was related to net income

totaling $40.5 million, partially offset by $12.5 million dividend

paid to shareholders. AOCI reduced capital by $5.7 million.

Tangible book value (“TBV”) per common share increased by $0.59 per

share to $34.64 at June 30, 2018, compared to $34.05 at March 31,

2018, and increased by $1.94 per share, or 5.9%, from $32.70 at

June 30, 2017. The quarterly increase of $0.59 per share in

tangible book value was the result of (1) earnings per share,

excluding amortization of intangibles, of $1.18, offset by the

dividend paid to shareholders of $0.34 per share; (2) a decrease in

AOCI of $0.16 per share; (3) an increase from the exercise of stock

options and issuance of stock related to employee stock purchase

plan of $0.09 per share; and (4) a decrease of $0.18 per share due

to additional goodwill and core deposit intangible from the

revaluation of PSTB acquired assets and liabilities performed in

the second quarter of 2018.

“We continue to absorb and realign the 60% growth in assets from

our two mergers in 2017, and this strategy is producing a core

balance sheet both in terms of loans and funding,” said John C.

Pollok, CFO. “The result of this balanced earnings equation creates

tremendous optionality moving forward.”

Three Months Ended Six Months Ended

June 30, Mar. 31, Dec. 31,

Sept. 30, June 30, June 30,

June 30, PERFORMANCE RATIOS 2018

2018 2017 2017 2017 2018

2017 Return on average assets (annualized)

1.12%

1.19% 0.08% 1.25% 1.15%

1.15% 0.92% Adjusted return on

average assets (annualized) (non-GAAP) (3)

1.45% 1.44% 1.33%

1.28% 1.25%

1.45% 1.25% Return on average equity

(annualized)

6.96% 7.41% 0.51% 8.57% 7.98%

7.18%

6.39% Adjusted return on average equity (annualized) (non-GAAP) (3)

9.06% 8.98% 8.75% 8.73% 8.69%

9.02% 8.68% Return on

average tangible common equity (annualized) (non-GAAP) (7)

13.79% 14.69% 1.59% 14.93% 14.16%

14.23% 11.56%

Adjusted return on average tangible common equity (annualized)

(non-GAAP) (3) (7)

17.68% 17.60% 15.83% 15.21% 15.34%

17.64% 15.44% Efficiency ratio (tax equivalent)

65.63% 66.67% 68.01% 58.79% 62.18%

66.16% 69.57%

Adjusted efficiency ratio (non-GAAP) (9)

57.26% 60.04%

56.29% 57.64% 59.00%

58.65% 60.14% Dividend payout ratio (2)

30.93% 28.68% 399.30% 27.56% 30.33%

29.78% 38.53%

Book value per common share

$ 63.77 $ 63.14 $ 62.81 $ 55.79

$ 54.87 Tangible common equity per common share (non-GAAP) (7)

$

34.64 $ 34.05 $ 33.61 $ 33.66 $ 32.70

CAPITAL

RATIOS Equity-to-assets

16.12% 15.81% 15.96% 14.62%

14.39% Tangible equity-to-tangible assets (non-GAAP) (7)

9.45% 9.20% 9.23% 9.36% 9.11% Tier 1 common equity (6)

12.0% 11.8% 11.6% 12.1% 11.9% Tier 1 leverage (6)

10.6% 10.5% 10.4% 10.3% 10.1% Tier 1 risk-based capital (6)

13.0% 12.8% 12.6% 12.9% 12.8% Total risk-based capital (6)

13.4% 13.3% 13.0% 13.5% 13.3%

OTHER DATA

Number of branches

169 179 182 129 129 Number of employees

(full-time equivalent basis)

2,654 2,700 2,719 2,255 2,261

Asset Quality

Ending Balance

June 30, Mar. 31, Dec. 31, Sept. 30,

June 30, (Dollars in thousands)

2018

2018 2017

2017 2017 NONPERFORMING

ASSETS: Non-acquired Non-acquired nonperforming loans

$ 14,870 $ 14,307 $ 14,831 $ 12,896 $ 13,499

Non-acquired OREO and other nonperforming assets

8,179 2,363 2,536

6,330 4,633 Total non-acquired nonperforming

assets

23,049 16,670

17,367 19,226 18,132

Acquired Acquired nonperforming loans

9,590 8,233

9,447 6,401 5,793 Acquired OREO and other nonperforming assets

9,527 9,139 9,263

7,846 10,439 Total acquired

nonperforming assets

19,117 17,372

18,710 14,247 16,232

Total nonperforming assets

$ 42,166 $

34,042 $ 36,077 $ 33,473 $ 34,364

Three Months Ended

Six Months Ended June 30, Mar. 31, Dec.

31, Sept. 30, June 30, June 30, June

30, 2018 2018

2017 2017 2017

2018 2017 ASSET QUALITY

RATIOS:

Allowance for non-acquired loan losses as

a percentage of non-acquired loans (1)

0.67 % 0.67 % 0.67 % 0.67 % 0.67 %

0.67

% 0.67 %

Allowance for non-acquired loan losses as

a percentage of non-acquired nonperforming loans

321.95 % 315.95 % 292.95 % 322.12 % 297.42 %

321.95 % 297.42 %

Net charge-offs on non-acquired loans as a

percentage of average non-acquired loans (annualized) (1)

0.01 % 0.02 % 0.02 % 0.04 % 0.05 %

0.02

% 0.05 %

Net charge-offs on acquired non-credit

impaired loans as a percentage of average acquired non-credit

impaired loans (annualized) (1)

0.14 % 0.02 % 0.07 % 0.00 % 0.10 %

0.08

% 0.09 %

Total nonperforming assets as a percentage

of total assets

0.29 % 0.23 % 0.25 % 0.30 % 0.31 %

Excluding

Acquired Assets NPLs as a percentage of period end non-acquired

loans (1)

0.21 % 0.21 % 0.23 % 0.21 % 0.23 %

Total nonperforming assets as a percentage

of total non-acquired loans and repossessed assets (1) (4)

0.32 % 0.25 % 0.27 % 0.31 % 0.30 %

Total nonperforming assets as a percentage

of total assets (5)

0.16 % 0.11 % 0.12 % 0.17 % 0.16 %

Total nonperforming assets increased by $8.1 million to $42.2

million, representing 0.29% of total assets, an increase of 6 basis

points from the balance at March 31, 2018. The increase was

primarily the result of the closing of branches acquired in the

Park Sterling merger during the second quarter which increased OREO

by $6.0 million. Non-accrual loans increased by $1.9 million during

the quarter, however, remain at very low levels. The allowance for

loan losses as a percentage of non-acquired nonaccrual loans was

322%, up from 316% in the first quarter of 2018.

During the second quarter of 2018, the Company reported $9.6

million in nonperforming loans related to “acquired non-credit

impaired loans.” This was an increase of $1.4 million from the

balance at March 31, 2018; and an increase of $3.8 million higher

than the balance at June 30, 2017, due primarily to the overall

growth within this loan portfolio. Additionally, acquired

nonperforming OREO and other assets owned increased by $388,000

from the balance at March 31, 2018 and declined by $912,000 from

the balance of June 30, 2018.

At June 30. 2018, the allowance for non-acquired loan losses was

$47.9 million, or 0.67%, of non-acquired period-end loans and $45.2

million, or 0.67%, at March 31, 2018, and $40.1 million, or 0.67%

at June 30, 2017. Net charge-offs within the non-acquired portfolio

were $189,000, or 0.01% annualized, in the second quarter of 2018,

compared to $367,000 for the first quarter of 2018, or 0.02%

annualized. Second quarter 2017 net charge-offs totaled $756,000,

or 0.05% annualized. The net charge-offs over the past several

quarters were primarily from overdraft and ready reserve accounts.

Net charge-offs related to the non-acquired loan portfolio were in

a net recovery position over the past four quarters. During the

second quarter of 2018, the provision for non-acquired loan losses

totaled $2.9 million compared to $2.1 million in the first quarter

of 2018, and $2.5 million in the second quarter of 2017. The

non-acquired provision for loan losses in the second quarter of

2018 and first quarter of 2017 resulted primarily from the risk and

uncertainties in new and expanded markets resulting from the merger

with PSTB.

Net charge offs related to “acquired non-credit impaired loans”

were $1.1 million, or 0.14% annualized, in the second quarter of

2018; and the Company recorded a provision for loan losses,

accordingly. This charge off level was primarily the result of a

specific relationship, and was not representative of a particular

trend within any of our markets. Net charge-offs in the first

quarter of 2018 totaled $169,000, or 0.02% annualized, and in the

second quarter of 2017, net charge-offs totaled $429,000, or 0.10%

annualized.

During the second of 2018, the Company recorded net impairment

within certain acquired credit impaired loan pools totaling

$522,000 compared to $163,000 valuation allowance in the first

quarter of 2018. During the second quarter of 2017, the Company

recorded net release of $572,000. Impairments are recognized

immediately and releases are generally spread over time.

Total OREO increased to $17.2 million at June 30, 2018, up from

$11.1 million at March 31, 2018. The $6.1 million increase was

primarily the result of 10 branches closed during the second

quarter of 2018. The Company expects the OREO balance to decline

over the coming quarters as these assets are sold.

Net Interest Income and Margin

Three Months Ended

June 30, 2018 March 31, 2018 June 30, 2017

(Dollars in thousands)

Average Income/ Yield/

Average Income/ Yield/ Average

Income/ Yield/ YIELD ANALYSIS Balance

Expense Rate Balance Expense

Rate Balance Expense Rate

Interest-Earning Assets: Federal funds sold, reverse repo,

and time deposits

$ 203,189 $ 1,218

2.40 % $ 165,752 $ 660 1.61 % $ 266,672 $ 762 1.15 %

Investment securities (taxable)

1,439,334 9,048

2.52 % 1,453,480 8,788 2.45 % 1,206,992 7,020 2.33 %

Investment securities (tax-exempt)

213,712 1,614

3.03 % 212,719 1,559 2.97 % 188,496 1,397 2.97 %

Loans held for sale

32,313 337 4.18 %

32,517 307 3.83 % 48,171 460 3.83 % Loans

10,723,400

129,515 4.84 % 10,604,506

126,734 4.85 % 8,040,180 93,140 4.65 % Total

interest-earning assets

12,611,948 141,732

4.51 % 12,468,974 138,048 4.49 % 9,750,511 102,779

4.23 % Noninterest-earning assets

1,934,359

1,960,659 1,321,170

Total Assets

$

14,546,307

$

14,429,633

$ 11,071,681

Interest-Bearing Liabilities:

Transaction and money market accounts

$ 5,203,265

$ 4,691 0.36 % $ 5,221,974 $ 2,893 0.22

% $ 3,951,515 $ 1,021 0.10 % Savings deposits

1,459,851

1,160 0.32 % 1,443,868 674 0.19 % 1,379,719

526 0.15 % Certificates and other time deposits

1,784,269

4,158 0.93 % 1,758,223 3,346 0.77 % 1,050,225

1,114 0.43 % Federal funds purchased and repurchase agreements

339,917 642 0.76 % 343,974 454 0.54 %

329,256 240 0.29 % Other borrowings

165,940

1,519 3.67 % 225,496 1,708 3.07

% 106,413 847 3.19 % Total interest-bearing

liabilities

8,953,242 12,170 0.55 %

8,993,535 9,075 0.41 % 6,817,128 3,748 0.22 % Noninterest-bearing

liabilities

3,260,626 3,120,746 2,655,961 Shareholders'

equity

2,332,439 2,315,352 1,598,592

Total Non-IBL and shareholders' equity

5,593,065

5,436,098 4,254,553

Total liabilities and

shareholders' equity $ 14,546,307

$

14,429,633

$ 11,071,681

Net interest income and margin (NON-TAX EQUIV.)

$ 129,562 4.12 % $ 128,973 4.19 % $

99,031 4.07 %

Net interest margin (TAX EQUIVALENT)

4.14 % 4.22 % 4.13 %

Overall Cost of Funds

(including demand deposits) 0.40 % 0.31 % 0.16 %

Non-taxable equivalent net interest income was $129.6 million

for the second quarter of 2018, a $589,000 increase from the first

quarter of 2018, resulting from the additional interest income on

nonacquired loans, which was mostly offset by a decline in acquired

loan interest income and higher interest expense. The highlights

are below:

1. Average balance of non-acquired loans

increased by approximately $384.1 million and resulted in

non-acquired loan interest income of $70.7 million, a $5.5 million

increase from the first quarter of 2018. The yield on total

non-acquired loans was 4.06% up from 4.01% in the first quarter of

2018.

2. Acquired loan interest income decreased

$2.8 million from the first quarter of 2018, to $58.8 million. The

yield on acquired loans for the second quarter of 2018 was 6.30%,

an increase of seven basis points from the first quarter of 2018,

while the average balance of acquired loans declined by $265.2

million during the second quarter of 2018. This decline in average

balance was the result of the continued decline of the acquired

loan portfolio. In addition, during the second quarter of 2018, the

Company reviewed additional acquired loans acquired in the PSTB

merger and adjusted their fair values. Any future decline in the

acquired loan yield will be primarily dependent upon the level of

loan pay downs and pay-offs each quarter. The second quarter of

2018 total loan yield was 4.84% down from 4.85% in the first

quarter of 2018 and up from 4.65% in the second quarter of

2017;

3. Interest expense increased by $3.1 million

in the second quarter of 2018 compared to the first quarter of

2018. This increase was within all categories of funding, except

other borrowings. Deposit rates continued to increase in the rising

rate environment and accounted for all of the increase. Interest

expense on other borrowings declined due to the repayment of FHLB

advances totaling $100.0 million in the second quarter of 2018. The

rate increased in other borrowings due to the rate paid on trust

preferred debt, which is tied to a floating rate (three month LIBOR

plus a spread). Total cost of funds on interest-bearing liabilities

was 55 basis points, an increase of 14 basis points from the first

quarter of 2018 and up 33 basis points from the second quarter of

2017. The inclusion of the Park Sterling funding balances resulted

in an increase in the Company’s interest-bearing liabilities of

approximately $2.1 billion from the second quarter of 2017.

Tax-equivalent net interest margin declined 8 basis points from

the first quarter of 2018 and improved by 1 basis point from the

second quarter of 2017. During the second quarter of 2018, the

Company’s average total assets increased to $14.5 billion from

$14.4 billion at March 31, 2018 and from $11.1 billion at June 30,

2017. Average earning assets totaled $12.6 billion up $143.0

million compared to the first quarter of 2018. Average

interest-bearing liabilities totaled $9.0 billion for the second

quarter of 2018 which was flat compared to the first quarter 2018;

and up from $6.8 billion for the second quarter of 2017. Average

non-interest bearing demand deposits increased by $139.9 million

during the second quarter of 2018; and increased by $604.7 million

from June 30, 2017, due primarily to the merger with Park Sterling

and growth during the past year. Including the impact of

noninterest bearing deposits, the Company’s cost of funds was 40

basis points for the second quarter of 2018 compared to 31 basis

points in the first quarter of 2018, and compared to 16 basis

points in the second quarter of 2017.

Accretable Yield Rollforward

(Acquired credit impaired loans) June 30, 2018 June

30, Mar. 31, Dec. 31, Sept. 30, June

30, (Dollars in thousands) 2018 2018

2017 2017 2017 Balance at beginning of

period

$

129,857

$ 133,095 $ 132,575 $ 139,283

$

149,723

Interest income *

(12,829

)

(12,366 ) (13,561 ) (14,362 ) (14,297 ) Additions from Georgia Bank

& Trust Acquisition

-

- 307 - - Additions (decreases) from Park Sterling Bank Acquisition

(1,460

)

- 8,829 - - Improved cash flows affecting nonaccretable difference

6,381

9,204 5,118 7,756 3,954 Other changes, net

(145

)

(76 ) (173 ) (102 ) (97 )

Balance at end of period

$

121,804

$ 129,857 $ 133,095 $ 132,575

$

139,283

* Interest income does not include interest income from loan

advances post-acquisition on lines of credit, late fees or other

loan fees.

The table above reflects the quarterly roll forward of the

acquired credit impaired loan accretable yield, including a fair

value adjustment of $1.5 million recorded in the second quarter of

2018 for the Park Sterling merger.

The Company recognized noncash loan interest income from the

discount (fair value adjustment) on the acquired noncredit impaired

loan portfolio of $7.6 million, $9.6 million, $6.1 million; $2.2

million; and $3.3 million, respectively during the five quarters.

The remaining balance of the discount on the acquired noncredit

impaired loan portfolio totals $43.6 million at June 30, 2018.

Noninterest Income and Expense

June 30, Mar. 31, Dec. 31, Sept.

30, June 30, June 30, June 30, (Dollars in

thousands)

2018 2018

2017 2017 2017

2018 2017 Noninterest income:

Fees on deposit accounts *

$ 22,612 $ 22,543 $ 21,224

$ 20,143 $ 19,897

$

45,155

$ 39,398 Mortgage banking income

3,317 4,948 3,744 3,446

5,195

8,265 10,764 Trust and investment services income

7,567 7,514 6,698 6,310 6,452

15,081 12,393

Securities (losses) gains, net

(641 ) -- 33 525 110

(641 ) 110

Recoveries of fully charged off acquired loans

2,167 2,975

2,925 1,944 2,171

5,142 3,703 Other

2,503

2,575 2,138 1,367 1,491

5,078 3,165 Total noninterest income

$

37,525 $ 40,555 $ 36,762 $ 33,735 $ 35,316

$

78,080

$ 69,533

Noninterest expense: Salaries and

employee benefits

$ 55,026 $ 62,465 $ 50,735 $ 47,245

$ 47,580

$

117,491

$ 96,466 Net occupancy expense

7,815 8,166 6,707 6,214 6,048

15,981 12,436 Information services expense

8,903

9,738 6,686 6,003 6,413

18,641 12,773 Furniture and

equipment expense

4,519 4,626 4,146 3,751 3,877

9,145

7,671 Bankcard expense *

311 691 558 443 628

1,002

1,180 OREO expense and loan related

1,037 1,661 1,073 1,753

1,753

2,698 3,895 Business development and staff related

2,765 2,082 2,107 1,728 1,958

4,847 4,028

Amortization of intangibles

3,722 3,413 2,857 2,494 2,495

7,135 5,002 Professional fees

1,898 1,699 1,338 1,265

1,599

3,597 3,372 Supplies, printing and postage expense

1,406 1,392 1,433 1,491 1,570

2,798 3,224 FDIC

assessment and other regulatory charges

3,277 1,263 895 918

989

4,540 2,111 Advertising and marketing

1,163 736

1,563 852 989

1,899 1,548 Other operating expenses

4,568 4,235 4,547 3,561 4,075

8,803 7,749 Merger

& branch consolidation expense

14,096

11,296 17,621 1,551 4,307

25,392 25,331 Total noninterest expense

$

110,506

$ 113,463 $ 102,266 $ 79,269 $ 84,281

$

223,969

$ 186,786

* The company reclassified network

expenses directly related to interchange and transaction fee income

out of bankcard expense and into fees on deposit accounts, pursuant

to ASC 606, Revenue from Contracts with Customers. This resulted in

lower noninterest income and lower noninterest expense in all

periods presented as follows:

Reclassification amount $ 3,002 $ 2,963 $

2,336 $ 2,305 $ 2,258

$ 5,965 $ 4,476

Noninterest income totaled $37.5 million during the second

quarter of 2018, a decrease of $3.0 million from the first quarter

of 2018. The decrease was primarily attributable to mortgage

banking income and acquired loan recoveries. The following provides

additional explanations of noninterest income:

- Lower mortgage banking income of $1.6

million, from secondary market which was down $563,000 due to lower

sales volume, with more loans being retained on balance sheet; and

the income related to the mortgage servicing rights, net of the

hedge, declined $1.0 million as treasury rates and spreads compared

to mortgage rates were more muted than the sharp increase to both

experienced in the first quarter resulting in higher gains in Q1 of

2018;

- Lower recoveries on acquired loans by

$808,000; and

- Securities losses on the disposition of

certain lower yielding assets totaling $641,000.

Compared to the second quarter of 2017, noninterest income grew

by $2.2 million. The increase was primarily related to the merger

with PSTB:

1. Higher trust and investment services income of $1.1

million,

2. Higher fees on deposit accounts with more customers from the

merger totaling $2.7 million, and

3. Higher other income of $1.0 million from cash surrender value

of bank owned life insurance and capital markets income.

4. These increases were partially offset by $1.9 million decline

in mortgage banking income from the secondary market aspect of our

mortgage line of business; and

5. Securities losses recorded in 2Q 2018 of $641,000 compared to

$110,000 gain from 2Q 2017.

Noninterest expense was $110.5 million in the second quarter of

2018, a decrease of $3.0 million from $113.5 million in the first

quarter of 2018. Merger and conversion related expense increased

$2.8 million from the cost incurred in the first quarter of 2018,

as the system conversion related to the Park Sterling merger was

completed and 10 branches were closed during the second quarter of

2018. Salaries and employee benefits declined $7.4 million due

primarily to:

(1) Payment of $2.8 million in bonuses to

employees 1Q 2018;

(2) Reduced payroll taxes (FICA and

unemployment taxes) totaling $2.3 million; and

(3) Fewer FTEs resulting in lower salary

& benefits totaling $2.0 million

FDIC assessment and other regulatory charges increased by $2.0

million in the second quarter of 2018 compared to the first quarter

of 2018. The normal quarterly expense is expected to be

approximately $2.3 million given our current asset size and risk

within the balance sheet. Many other expenses came in lower than

the prior quarter, which is reflective of the conversion and the

closure of 10 branches during the quarter.

Compared to the second quarter of 2017, noninterest expense was

$26.2 million higher. The net increase was primarily due to five

categories of expense: (1) salaries and benefits increased $7.4

million due primarily to the additional employees from Park

Sterling and the related benefits and incentives, (2) information

services increased $2.5 million due primarily to the branches added

from Park Sterling, (3) net occupancy and furniture and equipment

expense increased by $1.8 million and $642,000, respectively, due

to the addition of branches added from Park Sterling, (4) $2.3

million increase in the FDIC assessment related to exceeding $10.0

billion in assets, and (5) amortization of intangibles increased

$1.2 million from additional core deposit intangible related to

Park Sterling. Merger-related and conversion cost increased $9.8

million. In the second quarter of 2017, these cost were primarily

related to the merger with Southeastern Bank Financial Corporation,

compared to PSTB conversion/merger-related cost in the second

quarter of 2018.

South State Corporation will hold a conference call tomorrow,

July 31, 2018 at 10 a.m. Eastern Time, during which management will

review earnings and performance trends. Callers wishing to

participate may call toll-free by dialing 877-506-9272. The number

for international participants is 412-380-2004. The conference ID

number is 10121321. Participants can also listen to the live audio

webcast through the Investor Relations section of

www.SouthStateBank.com. A replay will be available beginning July

31, 2018 by 2:00 p.m. Eastern Time until 9:00 a.m. on August 14,

2018. To listen to the replay, dial 877-344-7529 or 412-317-0088.

The passcode is 10121321.

South State Corporation is a financial services company

headquartered in Columbia, South Carolina with approximately $14.6

billion in assets. South State Bank, the company’s primary

subsidiary, provides consumer, commercial, mortgage, and wealth

management solutions throughout the Carolinas, Georgia and

Virginia. South State has served customers since 1934. Additional

information is available at www.SouthStateBank.com.

Non-GAAP Measures

Statements included in this press release include non-GAAP

measures and should be read along with the accompanying tables

which provide a reconciliation of non-GAAP measures to GAAP

measures. Management believes that these non-GAAP measures provide

additional useful information which allows readers to evaluate the

ongoing performance of the Company. Non-GAAP measures should not be

considered as an alternative to any measure of performance or

financial condition as promulgated under GAAP, and investors should

consider the company's performance and financial condition as

reported under GAAP and all other relevant information when

assessing the performance or financial condition of the company.

Non-GAAP measures have limitations as analytical tools, and

investors should not consider them in isolation or as a substitute

for analysis of the company's results or financial condition as

reported under GAAP.

Three Months Ended

Six Months Ended

(Dollars in thousands, except per share data)

June 30,

Mar.31, Dec. 31, Sept.

30, June 30, June 30, June

30, RECONCILIATION OF GAAP TO Non-GAAP

2018 2018 2017

2017 2017

2018 2017 Adjusted net income

(non-GAAP) (3) Net income (GAAP)

$ 40,459 $

42,326 $ 2,421 $ 35,046 $ 31,823

$

82,785

$ 50,087 Securities losses (gains), net of tax

505 -- (22 )

(349 ) (73 )

505 (73 ) Provision for income taxes - Deferred

Tax Asset Write-Off

613 -- 26,558 -- --

613 -- Merger

and branch consolidation/acq. expense, net of tax

11,112 8,918 12,431

1,031 2,870

20,030

18,007 Adjusted net income (non-GAAP)

$

52,689 $ 51,244 $ 41,388 $ 35,728

$ 34,620

$

103,933

$ 68,021

Adjusted net income per common

share - Basic (3) Earnings per common share - Basic (GAAP)

$ 1.10 $ 1.15 $ 0.08 $ 1.20 $ 1.09

$

2.25 $ 1.73 Effect to adjust for securities losses (gains)

0.01 -- (0.00 ) (0.01 ) (0.00 )

0.01 -- Effect to

adjust for provision for income tax DTA Write-Off

0.02 --

0.84 -- --

0.02 -- Effect to adjust for merger & branch

consol./acq expenses

0.31 0.25

0.39 0.04 0.10

0.56 0.62 Adjusted net income per

common share - Basic (non-GAAP)

$ 1.44 $ 1.40

$ 1.31 $ 1.23 $ 1.19

$

2.84 $ 2.35

Adjusted net income per

common share - Diluted (3) Earnings per common share - Diluted

(GAAP)

1.09 $ 1.15 $ 0.08 $ 1.19 $ 1.08

$ 2.24

$ 1.71 Effect to adjust for securities losses (gains)

0.01

-- (0.00 ) (0.01 ) (0.00 )

0.01 0.00 Effect to adjust for

provision for income tax DTA Write-Off

0.02 -- 0.83 - --

0.02 -- Effect to adjust for merger & branch consol./acq

expenses

0.31 0.24 0.39

0.04 0.10

0.55

0.62 Adjusted net income per common share -

Diluted (non-GAAP)

$ 1.43 $ 1.39 $ 1.30

$ 1.22 $ 1.18

$ 2.82 $

2.33

Adjusted Return of Average Assets (3)

Return on average assets (GAAP)

1.12 % 1.19 % 0.08 %

1.25 % 1.15 %

1.15 % 0.92 % Effect to adjust for

securities losses (gains)

0.01 % 0.00 % 0.00 % 0.00 %

0.00 %

0.01 % 0.00 % Effect to adjust for provision

for income tax DTA Write-Off

0.02 % 0.00 % 0.85 %

-0.01 % 0.00 %

0.01 % 0.00 % Effect to adjust for

merger & branch consol./acq expenses

0.30

% 0.25 % 0.40 % 0.04 % 0.10 %

0.28 % 0.33 % Adjusted return on

average assets (non-GAAP)

1.45 % 1.44 %

1.33 % 1.27 % 1.25 %

1.45

% 1.25 %

Adjusted Return of Average Equity

(3) Return on average equity (GAAP)

6.96 % 7.41 %

0.51 % 8.57 % 7.98 %

7.18 % 6.39 % Effect to adjust

for securities losses (gains)

0.09 % 0.00 % 0.00 %

-0.09 % -0.02 %

0.04 % -0.01 % Effect to adjust for

provision for income tax DTA Write-Off

0.11 % 0.00 %

5.62 % 0.00 % 0.00 %

0.11 % 0.00 % Effect to adjust

for merger & branch consol./acq expenses

1.90

% 1.57 % 2.62 % 0.25 % 0.73 %

1.69 % 2.30 % Adjusted return on

average equity (non-GAAP)

9.06 % 8.98 %

8.75 % 8.73 % 8.69 %

9.02

% 8.68 %

Adjusted Return on Average Common

Tangible Equity (3) (7) Return on average common equity (GAAP)

6.96 % 7.41 % 0.51 % 8.57 % 7.98 %

7.18

% 6.39 % Effect to adjust for securities losses (gains)

0.09 % 0.00 % 0.00 % -0.09 % -0.02 %

0.04

% -0.01 % Effect to adjust for provision for income tax DTA

Write-Off

0.11 % 0.00 % 5.62 % 0.00 % 0.00 %

0.11 % 0.00 % Effect to adjust for merger &

branch consol./acq expenses

1.91 % 1.56 % 2.63 % 0.25

% 0.72 %

1.74 % 2.30 % Effect to adjust for

intangible assets

8.61 % 8.63 %

7.07 % 6.48 % 6.66 %

8.57 %

6.76 % Adjusted return on average common tangible equity

(non-GAAP)

17.68 % 17.60 % 15.83

% 15.21 % 15.34 %

17.64 %

15.44 %

Tangible Book Value Per Common Share (7) Book

value per common share (GAAP)

$ 63.77 $ 63.14 $ 62.81

$ 55.79 $ 54.87 Effect to adjust for intangible assets

(29.13 ) (29.09 ) (29.20 )

(22.13 ) (22.17 ) Tangible book value per common share

(non-GAAP)

$ 34.64 $ 34.05 $ 33.61

$ 33.66 $ 32.70

Tangible

Equity-to-Tangible Assets (7) Equity-to-assets (GAAP)

16.12 % 15.81 % 15.96 % 14.62 % 14.39 % Effect to

adjust for intangible assets

-6.67 %

-6.61 % -6.73 % -5.26 % -5.28 % Tangible

equity-to-tangible assets (non-GAAP)

9.45 %

9.20 % 9.23 % 9.36 % 9.11 %

Footnotes to tables:

(1) Loan data excludes mortgage loans held for sale. (2) The

dividend payout ratio is calculated by dividing total dividends

paid during the period by the total net income for the same period.

(3)

Adjusted earnings, adjusted return on

average assets, and adjusted return on average equity are non-GAAP

measures and exclude the after-tax effect of gains on acquisitions,

gains or losses on sales of securities,

other-than-temporary-impairment (OTTI), and merger and branch

consolidation related expense. It also reflects an adjustment for

the deferred tax asset revaluation in the second quarter of 2018

and the fourth quarter of 2017. Management believes that non-GAAP

adjusted measures provide additional useful information that allows

readers to evaluate the ongoing performance of the company.

Non-GAAP measures should not be considered as an alternative to any

measure of performance or financial condition as promulgated under

GAAP, and investors should consider the company's performance and

financial condition as reported under GAAP and all other relevant

information when assessing the performance or financial condition

of the company. Non-GAAP measures have limitations as analytical

tools, and investors should not consider them in isolation or as a

substitute for analysis of the company's results or financial

condition as reported under GAAP. Adjusted earnings and the related

adjusted return measures (non-GAAP) exclude the following from net

income (GAAP) on an after-tax basis: (a) pre-tax merger and branch

consolidation related expense of $14.1 million, $11.3 million,

$17.6 million, $1.6 million, and $4.3 million, for the quarters

ended June 30, 2018, March 31, 2018, December 31, 2017, September

30, 2017, and June 30, 2017, respectively; and (b) securities gains

(losses), net of ($641,000), $33,000, $525,000 and $110,000 for the

quarter ended June 30, 2018, December 31, 2017, September 30, 2017

and June 30, 2017. In the second quarter of 2018 and the fourth

quarter of 2017, the Company revalued its net deferred tax assets

with the Tax Act of 2017 with an increase in our income tax

provision of $613,000 and $26.6 million, respectively.

(4) Repossessed assets include OREO and other nonperforming assets.

(5) Calculated by dividing total non-acquired NPAs by total assets.

(6) June 30, 2018 ratios are estimated and may be subject to change

pending the final filing of the FR Y-9C; all other periods are

presented as filed. (7) The tangible measures are non-GAAP measures

and exclude the effect of period end or average balance of

intangible assets. The tangible returns on equity and common equity

measures also add back the after-tax amortization of intangibles to

GAAP basis net income. Management believes that these non-GAAP

tangible measures provide additional useful information,

particularly since these measures are widely used by industry

analysts for companies with prior merger and acquisition

activities. Non-GAAP measures should not be considered as an

alternative to any measure of performance or financial condition as

promulgated under GAAP, and investors should consider the company's

performance and financial condition as reported under GAAP and all

other relevant information when assessing the performance or

financial condition of the company. Non-GAAP measures have

limitations as analytical tools, and investors should not consider

them in isolation or as a substitute for analysis of the company's

results or financial condition as reported under GAAP. The sections

titled "Reconciliation of Non-GAAP to GAAP" provide tables that

reconcile non-GAAP measures to GAAP. (8) Includes noncash loan

interest income related to the discount on acquired performing

loans of $7.6 million, $9.6 million, $6.1 million, $2.2 million,

and $3.3 million, respectively during the five quarters above. (9)

Adjusted efficiency ratio is calculated by taking the noninterest

expense excluding branch consolidation cost and merger cost divided

by net interest income and noninterest income excluding securities

gains (losses) and OTTI.

Cautionary Statement Regarding Forward Looking Statements

Statements included in this communication, which are not

historical in nature are intended to be, and are hereby identified

as, forward looking statements for purposes of the safe harbor

provided by Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934. Forward

looking statements generally include words such as “expects,”

“projects,” “anticipates,” “believes,” “intends,” “estimates,”

“strategy,” “plan,” “potential,” “possible” and other similar

expressions. South State Corporation (“South State”) cautions

readers that forward looking statements are subject to certain

risks and uncertainties that could cause actual results to differ

materially from anticipated results. Such risks and uncertainties,

include, among others, the following possibilities: (1) the

outcome of any legal proceedings instituted against South State or

Park Sterling Corporation (“Park Sterling”); (2) the

possibility that the anticipated benefits of the transaction are

not realized when expected or at all, including as a result of the

impact of, or problems arising from, the integration of the two

companies or as a result of the strength of the economy and

competitive factors in the areas where South State and Park

Sterling do business; (3) the possibility that the transaction

may be more expensive to complete than anticipated, including as a

result of unexpected factors or events; (4) diversion of

management’s attention from ongoing business operations and

opportunities; (5) potential adverse reactions or changes to

business or employee relationships, including those resulting from

the announcement or completion of the transaction; (6) South

State’s ability to complete the integration of Park Sterling

successfully; (7) credit risks associated with an obligor’s

failure to meet the terms of any contract with the bank or

otherwise fail to perform as agreed under the terms of any

loan-related document; (8) interest risk involving the effect

of a change in interest rates on the bank’s earnings, the market

value of the bank’s loan and securities portfolios, and the market

value of South State’s equity; (9) liquidity risk affecting

the bank’s ability to meet its obligations when they come due;

(10) risks associated with an anticipated increase in South

State’s investment securities portfolio, including risks associated

with acquiring and holding investment securities or potentially

determining that the amount of investment securities South State

desires to acquire are not available on terms acceptable to South

State; (11) price risk focusing on changes in market factors that

may affect the value of traded instruments in “mark-to-market”

portfolios; (12) transaction risk arising from problems with

service or product delivery; (13) compliance risk involving risk to

earnings or capital resulting from violations of or nonconformance

with laws, rules, regulations, prescribed practices, or ethical

standards; (14) regulatory change risk resulting from new laws,

rules, regulations, accounting principles, proscribed practices or

ethical standards, including, without limitation, increased capital

requirements (including, without limitation, the impact of the

capital rules adopted to implement Basel III), Consumer

Financial Protection Bureau rules and regulations, and

potential changes in accounting principles relating to loan loss

recognition; (15) strategic risk resulting from adverse business

decisions or improper implementation of business decisions; (16)

reputation risk that adversely affects earnings or capital arising

from negative public opinion; (17) terrorist activities risk that

results in loss of consumer confidence and economic disruptions;

(18) cybersecurity risk related to the dependence of South State

and Park Sterling on internal computer systems and the technology

of outside service providers, as well as the potential impacts of

third party security breaches, subjects each company to potential

business disruptions or financial losses resulting from deliberate

attacks or unintentional events; (19) economic downturn risk

potentially resulting in deterioration in the credit markets,

greater than expected non-interest expenses, excessive loan losses

and other negative consequences, with risks could be exacerbated by

potential negative economic developments resulting from federal

spending cuts and/or one or more federal budget-related impasses or

actions; (20) greater than expected noninterest expenses; (21)

excessive loan losses; (22) failure to realize synergies and other

financial benefits from, and to limit liabilities associated with,

mergers and acquisitions within the expected time frame; (23)

potential deposit attrition, higher than expected costs, customer

loss and business disruption associated with merger and acquisition

integration, including, without limitation, potential difficulties

in maintaining relationships with key personnel and other

integration related-matters; (24) the risks of fluctuations in

market prices for South State common stock that may or may not

reflect economic condition or performance of South State; (25) the

payment of dividends on South State common stock is subject to

regulatory supervision as well as the discretion of the board of

directors of South State, South State’s performance and other

factors; and (26) other risks and uncertainties disclosed in South

State’s or Park Sterling’s most recent Annual Report on

Form 10-K filed with the U.S. Securities and Exchange

Commission (“SEC) or disclosed in documents filed or furnished by

South State or Park Sterling with or to the SEC after the filing of

such Annual Reports on Form 10-K, and of which could cause

actual results to differ materially from future results expressed,

implied or otherwise anticipated by such forward-looking

statements.

All forward-looking statements speak only as of the date they

are made and are based on information available at that time. South

State does not undertake any obligation to update or otherwise

revise any forward-looking statements, whether as a result of new

information, future events, or otherwise, except as required by

federal securities laws. As forward-looking statements involve

significant risks and uncertainties, caution should be exercised

against placing undue reliance on such statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180730005661/en/

South State CorporationMedia Contact:Kellee McGahey,

843-529-5574orAnalyst Contact:Jim Mabry, 843-529-5593

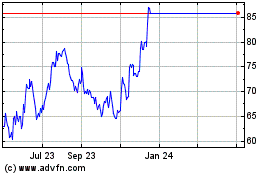

SouthState (NASDAQ:SSB)

Historical Stock Chart

From Mar 2024 to Apr 2024

SouthState (NASDAQ:SSB)

Historical Stock Chart

From Apr 2023 to Apr 2024