Oracle's Past Surprises on Guidance Leave Analysts Wary

June 19 2018 - 6:29AM

Dow Jones News

By Jay Greene

Oracle Corp. is set to report financial results for its fiscal

fourth quarter after the close of trading Tuesday. Here's what you

need to know:

EARNINGS FORECAST: Analysts surveyed by S&P Global Market

Intelligence expect Oracle to report adjusted profit of 94 cents a

share for the quarter that ended in May.

REVENUE FORECAST: Analysts expect Oracle to post revenue,

adjusted for acquisition accounting, of $11.17 billion, up from

$10.94 billion a year earlier. The company reported $10.89 billion

in nonadjusted revenue a year ago.

WHAT TO WATCH:

SOUR SENTIMENT: In each of the previous three quarters, Oracle

management shook investors with guidance that fell below

expectations. Three months ago, the Redwood City, Calif.,

business-software maker said cloud-computing revenue would climb

19% to 23% in the quarter that just ended, while analysts had

expected 23% growth. That sank Oracle shares more than 9% the next

day to $47.05. The stock hasn't closed above $50 since, and

finished Monday at $46.52. Barclays analyst Raimo Lenschow expects

Oracle to post 20.5% growth in its cloud business, writing in a

recent research report that he's uncertain if the fiscal fourth

quarter "will necessarily be the beginning of a sustained

multi-quarter recovery in the shares just yet." That said, Mr.

Lenschow added, "with investor sentiment being very low and the

shares at cheap valuation levels, we see limited downside risk this

quarter."

GUIDANCE WATCH: With Oracle's below-expectations guidance for

cloud revenue in recent quarters, Wall Street will focus on the

company's forecast for its fiscal first quarter. Management

typically provides that during a conference call with analysts

after the company reports results. The consensus among analysts is

for cloud revenue to climb 21.8% in the current quarter to $1.82

billion.

SPENDING SLIDES: Oracle shares took a hit last week after

JPMorgan Chase & Co. analyst Mark Murphy downgraded his rating

to 'neutral' from 'overweight' and reduced his December 2018 price

target to $53 from $55 based on corporate spending concerns.

Roughly 21% of the 154 chief information officers surveyed by

JPMorgan said they plan to reduce spending on Oracle products, the

worst performance among the 25 tech companies about which the firm

asked. Moreover, when asked to name the "most critical and

indispensable" tech vendors, CIOs cited Oracle less than in the

past, while increasingly mentioning Amazon.com Inc.'s rival Amazon

Web Services unit. That shift, Mr. Murphy wrote, is "creating the

appearance of a 'sucking sound' out of Oracle and into AWS."

DATA-CENTER COSTS: To compete against AWS, as well as Microsoft

Corp.'s Azure and Alphabet Inc.'s Google Cloud, Oracle is boosting

its development of offerings that provide computing resources and

storage over the internet, known as infrastructure as a service.

But building that business is costly, requiring multibillion-dollar

investments in data centers around the world to deliver the

technology. In February, the company said it planned to quadruple

the number of its biggest data-center complexes globally over the

next two years, adding that it will boost spending as business

needs dictate. Nonetheless, UBS Securities analyst Jennifer Lowe

expects $1.8 billion in capital expenditure in the latest quarter,

down from $2.0 billion a year ago.

Write to Jay Greene at Jay.Greene@wsj.com

(END) Dow Jones Newswires

June 19, 2018 06:14 ET (10:14 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

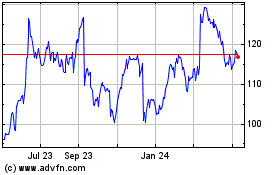

Oracle (NYSE:ORCL)

Historical Stock Chart

From Aug 2024 to Sep 2024

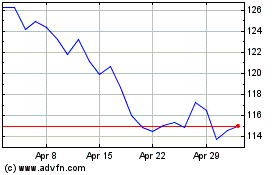

Oracle (NYSE:ORCL)

Historical Stock Chart

From Sep 2023 to Sep 2024