LIVESTOCK HIGHLIGHTS: Top Stories of the Day

June 13 2018 - 6:01PM

Dow Jones News

TOP STORIES

Tariffs Further Pinch Consumer-Staple Stocks -- Update

Escalating trade tensions have made times even harder for shares

of companies that provide everyday goods.

Already struggling with pricing pressures and sluggish growth,

the fortunes of consumer-staple companies in the S&P 500 were

further shaken after Canada, Mexico and the European Union

retaliated against the U.S.'s imposition of tariffs on steel and

aluminum imports.

Canadian Prime Minister Justin Trudeau pledged to impose

billions of dollars of tariffs on steel, aluminum and other U.S.

goods, such as food and agricultural products. Mexico's Economy

Ministry is targeting lamps, berries, grapes, apples, cold cuts,

pork chops and cheese products, among other goods the U.S. produces

and sends there. The EU will start imposing EUR2.8 billion worth of

tariffs in July, including 25% levies on peanut butter, orange

juice and cranberries, among other goods.

STORIES OF INTEREST

Kroger Scaling Down in Competitive NC Market -- Market Talk

15:13 ET - Kroger's Mid-Atlantic business entity is pulling out

of the Raleigh-Durham market in August, selling all 14

Kroger-branded stores employing 1,500 workers, the company says.

However, Kroger could maintain some presence in Raleigh, as its

Harris Teeter banner--a separate business entity within Kroger--is

expected to buy eight of the closing stores and convert them to

fancier Harris Teeter stores. Raleigh-Durham is one of the most

competitive markets in the U.S., with deep discounters and

higher-end grocery chains both expanding there. "We have not been

able to grow our business the way we would like in this market,"

says division president Jerry Clontz, adding that many retail

analysts say the market has too many grocery stores. Kroger reports

earnings next week, and shares are up 2.1% to $26.23.

(heather.haddon@wsj.com; @heatherhaddon)

Trade-Sensitive Stocks Slide on Tariff Report -- Market Talk

15:46 ET - Shares of companies that investors believe are

vulnerable to tightening trade policies are sliding as a report

suggests the Trump administration could levy tariffs on tens of

billions of dollars of Chinese goods in the coming week. Senior

trade officials have agreed that the U.S. should move forward with

the tariffs, people briefed on the talks told WSJ. Investors and

analysts have worried that the moves could trigger retaliatory

trade measures that crimp profits at U.S. firms. Farm-machinery

maker Deere off 2.9%, while Boeing down 1.6% and Caterpillar off

1.7%. Polaris, which relies on steel and aluminum to make off-road

vehicles, was down 0.6%. (akane.otani@wsj.com)

FUTURES MARKETS

Hog Futures Rally on Improving Supply-Demand Outlook -- Market

Talk

15:09 ET - Hog futures continued a recent rally sparked by

tighter supplies and solid demand. Meatpackers have paid more for

pigs to slaughter in recent days, with average prices rising $1.27

to $79.17 per 100 pounds on Tuesday. The rally has been helped by

falling hog weights, Midwest Market Solutions says, prompting a

seasonally tight patch that has given producers more leverage to

raise their asking prices. Wholesale pork prices, meanwhile, have

also recently risen. All that has futures traders betting the hog

market has higher to go. CME June lean hog contracts rose 0.6% to

81c a pound. June-dated cattle futures fell 0.6% to $.107925 a

pound. (benjamin.parkin@wsj.com; @b_parkyn)

CASH MARKETS

Zumbrota, Minn Hog Steady at $50.00 - Jun 13

Barrow and gilt prices at the Zumbrota, Minn., livestock market

are steady at $50.00 per hundredweight.

Sow prices are $2.00-$4.00 higher. Sows weighing 400-450 pounds

are at $32.00-$34.00, 450-500 pounds are $32.00-$34.00 and those

over 500 pounds are at $36.00-$38.00.

The day's total run is estimated at 100 head.

Prices are provided by the Central Livestock Association.

Estimated U.S. Pork Packer Margin Index - Jun 13

All figures are on a per-head basis.

Date Standard Margin Estimated margin

Operating Index at vertically -

integrated operations

*

Jun 13 -$ 6.84 +$43.90

Jun 12 -$ 4.47 +$42.97

Jun 11 -$ 4.79 +$40.00

* Based on Iowa State University's latest estimated cost of production.

A positive number indicates a processing margin above the cost of production of the animals.

Beef-O-Meter

This report compares the USDA's latest beef carcass composite

values as a percentage of their respective year-ago prices.

Beef

For Today Choice 89.2

(Percent of Year-Ago) Select 91.7

USDA Boxed Beef, Pork Reports

Wholesale choice-grade beef prices Wednesday fell $1.02 per

hundred pounds to $223.90, according to the USDA. Select-grade

prices fell $1.09 per hundred pounds to $202.30. The total load

count was 144. Wholesale pork prices rose 43 cents to $80.82 a

hundred pounds, based on Omaha, Neb., price quotes.

(END) Dow Jones Newswires

June 13, 2018 17:46 ET (21:46 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

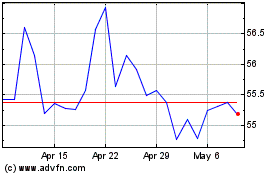

Kroger (NYSE:KR)

Historical Stock Chart

From Mar 2024 to Apr 2024

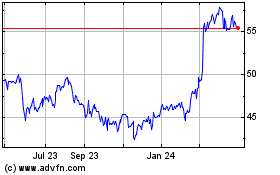

Kroger (NYSE:KR)

Historical Stock Chart

From Apr 2023 to Apr 2024