MetLife Will Take Over Pensions for 41,000 FedEx Retirees

May 08 2018 - 7:09PM

Dow Jones News

By Leslie Scism

MetLife Inc. has reached an agreement with FedEx Corp. to take

responsibility for about $6 billion of pension payments to

approximately 41,000 retirees and beneficiaries, one of the biggest

risk-transfer deals for U.S. life insurers in recent years.

The transaction is smaller than Prudential Financial Inc.'s

groundbreaking $25 billion transaction in 2012 to oversee pensions

for 110,000 General Motors Co. retirees. It also is smaller than a

$8.4 billion transaction that same year in which Prudential began

paying pensions of 41,000 Verizon Communications retirees.

But it is larger than most since 2012. Pension-risk-transfer

deals generally have been below $5 billion in pension obligations

since GM and Verizon, according to benefits experts.

The new transaction follows recent disclosures of mistakes made

by MetLife's pension-risk transfer business. It has said it failed

in past years to properly search for 13,500 people in

private-sector pension plans for whom it owed payments, some from

as far back as the 1990s.

The insurer had reduced its reserves for pension obligations at

the time, thus improperly boosting profits in years past. In

detailing its fourth-quarter 2017 earnings, MetLife said it had

bolstered its reserves by $510 million pretax to bring them up to

the level that it says will now correctly reflect what it owes.

MetLife executives have said the company is working to locate

all the people owed money and to pay them interest.

Some analysts have asked whether the disclosures would affect

the company's ability to strike new deals. In a research note

Tuesday, Wells Fargo Securities analyst Sean Dargan said the FedEx

transaction is "a vote of confidence" and a sign that the insurer

"can move on" from the bad publicity.

In the new MetLife transaction, FedEx will purchase a group

annuity contract from a MetLife unit, and the insurer will assume

responsibility for making benefit payments to the retirees or their

beneficiaries, the insurer said. The transaction won't change the

amount of the monthly benefit for any person.

MetLife manages pension payments for more than 600,000 retirees.

The company issued its first group annuity contract in 1921 to fund

a traditional pension plan.

Write to Leslie Scism at leslie.scism@wsj.com

(END) Dow Jones Newswires

May 08, 2018 18:54 ET (22:54 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

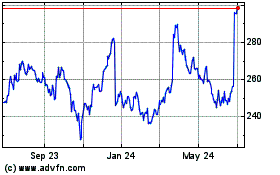

FedEx (NYSE:FDX)

Historical Stock Chart

From Aug 2024 to Sep 2024

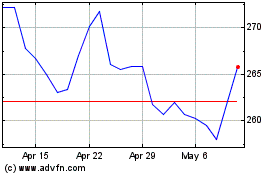

FedEx (NYSE:FDX)

Historical Stock Chart

From Sep 2023 to Sep 2024