UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement

Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. 1 )

Filed by the Registrant

x

Filed by a Party other than the Registrant

o

Check the appropriate box:

o

Preliminary Proxy Statement

o

CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (as permitted

by Rule 14a-6(e)(2))

x

Definitive Proxy Statement

o

Definitive Additional Materials

o

Soliciting Material Pursuant to Section 240.14a-12

REX

American Resources Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement,

if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x

No fee required.

o

Fee computed on table below per Exchange

Act Rules 14a-6(i)(1) and 0-11.

|

|

1)

|

Title of each class of securities to which transaction applies:

|

|

|

2)

|

Aggregate number of securities to which transaction applies:

|

|

|

3)

|

Per unit price or other underlying value of transaction computed pursuant

to Exchange Act Rule 0- 11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

4)

|

Proposed maximum aggregate value of transaction:

|

o

Fee previously paid with preliminary

materials.

o

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of

its filing.

|

|

1)

|

Amount Previously Paid:

|

|

|

2)

|

Form, Schedule or Registration Statement No.:

|

7720 Paragon Road

Dayton, Ohio 45459

__

May 4, 2018

Dear Shareholder:

We are sending you this letter, which has

also been filed as Amendment No. 1 to Schedule 14A, solely to correct a clerical error in the Definitive Proxy Statement filed

by REX American Resources Corporation (the “Company”) with the Securities and Exchange Commission on May 2, 2018 (the

“Proxy Statement”). After filing and mailing the Proxy Statement, the Company discovered that the table of beneficial

ownership under the heading “Security Ownership of Certain Beneficial Owners and Management” on pages 17 and 18 of

the Proxy Statement incorrectly stated that the directors and officers as a group beneficially owned 1,104,446 shares of common

stock of the Company as of April 24, 2018 (the correct number of shares of common stock beneficially owned by the them as a group

on that date was 809,872) and, in footnote 11 thereto, stated that the common stock of the Company beneficially owned by the directors

and officers as a group as of that date included 1,104,446 shares of restricted stock (the correct number of shares of restricted

stock owned by them as a group on that date was 12,808). The percentage of common stock beneficially owned by all directors and

officers as a group as of April 24, 2018 (12.5%) was correctly stated in the Proxy Statement. No other changes are being made in

the Proxy Statement. We apologize for the clerical oversight. The corrected table of beneficial ownership is attached for your

ease of reference.

|

|

On Behalf of REX American Resources Corporation

|

|

|

|

|

|

EDWARD

M. KRESS

Secretary

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL

OWNERS AND MANAGEMENT

The following table

sets forth, as of April 24, 2018 (the record date for the Annual Meeting), certain information with respect to the beneficial ownership

of REX Common Stock by each director and nominee for director, each named executive officer, all directors and executive officers

as a group and those persons or groups known by us to own more than 5% of our Common Stock.

For purposes of this

table, a person is considered to “beneficially own” any shares if the person, directly or indirectly, through any contract,

arrangement, understanding, relationship, or otherwise, has (or has the right to acquire within 60 days after April 24, 2018) sole

or shared power (i) to vote or to direct the voting of the shares or (ii) to dispose or to direct the disposition of the shares.

Unless otherwise indicated, voting power and investment power are exercised solely by the named person or shared with members of

his household.

|

|

|

Common Stock Beneficially Owned

|

|

|

Name and Address

|

|

Number

|

|

|

Percent

1

|

|

|

Stuart A. Rose

2

7720 Paragon Road, Dayton, OH 45459

|

|

|

573,528

|

|

|

|

8.9

|

%

|

|

Zafar A. Rizvi

3

7720 Paragon Road, Dayton, OH 45459

|

|

|

42,237

|

|

|

|

*

|

|

|

Douglas L. Bruggeman

4

7720 Paragon Road, Dayton, OH 45459

|

|

|

22,471

|

|

|

|

*

|

|

|

Edward M. Kress

5

One South Main Street, Suite 1300, Dayton, OH 45402

|

|

|

39,772

|

|

|

|

*

|

|

|

David S. Harris

6

24 Avon Road, Bronxville, NY 10708

|

|

|

1,528

|

|

|

|

*

|

|

|

Lawrence Tomchin

7

7720 Paragon Road, Dayton, OH 45459

|

|

|

113,084

|

|

|

|

1.8

|

%

|

|

Charles A. Elcan

8

3100 West End Avenue, Suite 500, Nashville, TN 37203

|

|

|

15,724

|

|

|

|

*

|

|

|

Mervyn L. Alphonso

9

3830 Kennent Square, Suwanee, GA 30024

|

|

|

764

|

|

|

|

*

|

|

|

Lee Fisher

10

15925 Shaker Blvd., Cleveland, OH 44120

|

|

|

764

|

|

|

|

*

|

|

|

All Directors and Executive Officers as a Group

11

(9 persons)

|

|

|

809,872

|

|

|

|

12.5

|

%

|

|

BlackRock, Inc.

12

|

|

|

775,024

|

|

|

|

12.0

|

%

|

|

JP Morgan Chase & Co.

13

270 Park Avenue, New York, NY 10017

|

|

|

501,659

|

|

|

|

7.8

|

%

|

|

Renaissance Technologies LLC

14

800 Third Avenue, New York, NY 10022

|

|

|

522,700

|

|

|

|

8.1

|

%

|

|

Dimensional Fund Advisors LP

15

Building One, 6300 Bee Cave Road, Austin, TX 78746

|

|

|

553,413

|

|

|

|

8.6

|

%

|

|

The Vanguard Group

16

100 Vanguard Boulevard, Malvern, PA 19355

55 East 52

nd

Street, New York, NY 10055

|

|

|

415,136

|

|

|

|

6.4

|

%

|

*One percent or less

1

Percentages

are calculated on the basis of the number of shares outstanding on April 24, 2018 plus the number of shares of restricted stock

awarded to the person or group that will vest within 60 days after April 24, 2018.

2

Includes

443,854 shares held by the Stuart Rose Family Foundation, an Ohio nonprofit corporation of which Mr. Rose is the sole member, chief

executive officer and one of three members of the board of trustees, the other two being members of his immediate family, and 3,380

shares of restricted stock.

3

Includes

4,610 shares of restricted stock.

4

Includes

2,305 shares of restricted stock.

5

Includes

5,000 shares held by Mr. Kress as a co-trustee of the Tomchin Family Trust, 2,000 shares held by Mr. Kress as co-trustee of the

Restated Brian Brooks Trust II and 359 shares of restricted stock.

6

Includes

718 shares of restricted stock.

7

Includes

359 shares of restricted stock and 282 shares held by Mr. Tomchin’s wife.

8

Includes

359 shares of restricted stock.

9

Includes

359 shares of restricted stock.

10

Includes

359 shares of restricted stock.

11

Includes

12,808 shares of restricted stock.

12

Based on

a Schedule 13G filing dated January 17, 2018. BlackRock, Inc., as parent holding company of BlackRock (Netherlands) B.V., BlackRock

Advisors, LLC, BlackRock Asset Management Canada Limited, BlackRock Asset Management Ireland Limited, BlackRock Asset Management

Schweiz AG, BlackRock Financial Management, Inc., BlackRock Fund Advisors (beneficially owns 5% or greater of the outstanding shares

of class reported), BlackRock Institutional Trust Company, N.A., Blackrock Investment Management, LLC, Blackrock International

Limited and Blackrock Japan Co., Ltd. has sole power to vote 761,108 shares and sole power to dispose of 775,024 shares.

13

Based

on a Schedule 13G filing dated January 25, 2018. JPMorgan Chase & Co., as parent holding company of JPMorgan Chase Bank, National

Association and J.P. Morgan Investment Management Inc., has sole power to vote 456,727 shares and sole power to dispose of 495,459

shares.

14

Based

on a Schedule 13G filing dated February 13, 2018. Renaissance Technologies LLC and Renaissance Technologies Holdings Corporation,

on behalf of certain funds and accounts managed by Renaissance Technologies LLC, have sole power to vote 522,700 shares and sole

power to dispose of 522,700 shares.

15

Based

on a Schedule 13G filing dated February 9, 2018. Dimensional Fund Advisors LP, a registered investment adviser, furnishes investment

advice to four registered investment companies and serves as investment manager or sub-adviser to certain other commingled funds,

group trusts and separate accounts. In its or its subsidiaries’ role as investment adviser, sub-adviser and/or manager, Dimensional

Fund Advisors LP or its subsidiaries may possess voting and/or investment power over the shares owned by these funds, trusts and

accounts. Dimensional Fund Advisors LP or its subsidiaries has sole power to vote 540,700 shares and sole power to dispose of 553,413

shares. Dimensional Fund Advisors LP disclaims beneficial ownership of all such shares.

16

Based on

a Schedule 13G filing dated February 7, 2018, The Vanguard Group, a registered investment advisor, has the sole power to vote 6,306

shares, shared power to vote 529 shares, sole power to dispose of 408,660 shares and shared power to dispose of 6,476 shares.

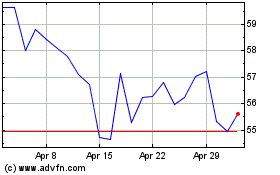

REX American Resources (NYSE:REX)

Historical Stock Chart

From Mar 2024 to Apr 2024

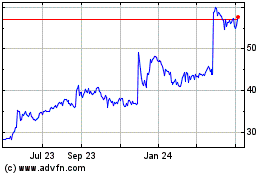

REX American Resources (NYSE:REX)

Historical Stock Chart

From Apr 2023 to Apr 2024