Freight Costs Weighing on Earnings at Consumer-Goods Makers

April 24 2018 - 4:10PM

Dow Jones News

By Jennifer Smith

High freight costs are weighing on earnings at big

consumer-goods companies as they try to get products from soda and

toys to deodorant and household chemicals to stores.

Some companies and analysts expect the pressure on shipping,

which began late last year, to extend into the spring, when the

seasonal growth in volumes of produce, food and beverages could

place additional strain on already-tight trucking capacity.

Freight costs were up 20% from a year ago in the first quarter

at the Coca-Cola Co. North American division, the company said

Tuesday. "Like other [consumer packaged-goods] companies, we face

significant freight headwinds in North America this year," Kathy

Waller, the company's chief financial officer, said in a call

Tuesday on the company's first-quarter earnings.

Increased transportation expenses also hurt first-quarter

profits at toy maker Hasbro Inc., which said Monday it expects the

issue to persist through 2018 as shippers compete for a limited

number of available trucks.

Procter & Gamble Co. and food companies Danone SA and Nestlé

SA all cited rising freight costs in recent earnings calls, as did

lubricant-maker WD-40 Co.

"Everybody is seeing an increase," Graeme Pitkethly, chief

financial officer at Unilever PLC said in an earnings call last

week. The seller of Dove soap and Lipton tea expects U.S. freight

costs to rise by the "high-single digits to high-teens," Mr.

Pitkethly said, on higher demand and requests by retailers for more

frequent deliveries.

Manufacturers and retailers have been scrambling to book

transportation in recent months as freight volumes have expanded in

a surging U.S. economy. Bad weather, high turnover among truck

drivers and a new federal rule requiring drivers to electronically

track their hours behind the wheel have contributed to the tighter

capacity.

"It's really coming from the trucking industry and...the new

electronic logging-device rules and driver shortages," Hasbro's

chief financial officer, Deborah Thomas, said Monday. "The

contracting supply and increasing demand is expected to manifest

itself really kind of throughout 2018."

Truck capacity loosened up somewhat in February and March, which

tend to be slower shipping months. But demand was still elevated

compared to prior years, according to online freight marketplace

DAT Solutions LLC. Last month, there were 6.9 loads to be moved on

the spot truck transportation for every available dry van, the most

common type of big rig, compared to 3.2 loads in March 2017.

Freight rates also remain elevated. In March, the average rate

on the spot market for dry vans was up 32% year-over-year,

according to DAT.

Spot rates are a leading indicator of the contractual rates that

shippers set with large trucking companies. With capacity tight as

those negotiations get underway, some in the industry now expect

contract rates could increase by as much at 9.2%, according to

KeyBanc Capital Markets Inc.

At Werner Enterprises Inc., a large truckload carrier based in

Omaha, Neb., higher contract rates contributed to a 10% increase in

average revenue per total mile in the first quarter, compared to

the same period in 2017.

Demand for truckload services "was much stronger than normal for

the first quarter," Werner said in an earnings release last week.

"Freight volumes thus far in April 2018 continue to be much

stronger than normal."

Write to Jennifer Smith at jennifer.smith@wsj.com

(END) Dow Jones Newswires

April 24, 2018 15:55 ET (19:55 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

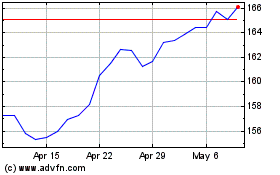

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Aug 2024 to Sep 2024

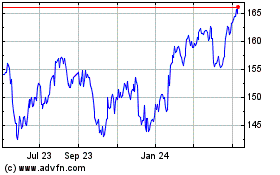

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Sep 2023 to Sep 2024