Wells Fargo to Pay $1 Billion to Settle Risk Management Claims -- 2nd Update

April 20 2018 - 11:19AM

Dow Jones News

By Yuka Hayashi

WASHINGTON -- Wells Fargo & Co. agreed to pay $1 billion to

settle federal claims of misconduct in its auto and mortgage

lending businesses.

The settlement with the Consumer Financial Protection Bureau and

Office of the Comptroller of the Currency concerned the bank's

failures to catch and prevent problems, including improper charges

to consumers in its mortgage and auto-lending businesses.

The fine is the largest against a bank so far in the Trump

administration and a signal that while officials are working to

ease postcrisis regulatory rules they won't let companies off the

hook for misconduct.

"We have said all along that we will enforce the law. That is

what we did here," CFPB acting director Mick Mulvaney said in a

statement.

As part of the settlement, the bank also agreed to offer

restitution to customers and improve risk and compliance management

practices.

"The OCC took these actions given the severity of the

deficiencies and violations of law, the financial harm to

consumers, and the bank's failure to correct the deficiencies and

violations in a timely manner," the OCC said in its release

detailing the settlement.

The regulator added that it "found deficiencies in the bank's

enterprisewide compliance risk management program that constituted

reckless, unsafe or unsound practices."

The settlement covers the bank's practices in two main areas:

charging improper fees for rate-lock extensions in mortgage lending

and selling unwanted insurance products to auto-loan customers.

"While we have more work to do, these orders affirm that we

share the same priorities with our regulators and that we are

committed to working with them as we deliver our commitments," said

Timothy J. Sloan, president and chief executive officer of Wells

Fargo.

The settlement is the latest in a series of regulatory woes for

the San Francisco-based bank. It has faced a number of regulatory

problems in recent years, including regulatory scrutiny of illegal

sales practices that involved the opening of as many as 3.5 million

accounts without customers' consent. Regulators have since probed

the bank's practices in auto lending, mortgages, wealth and

investment management and foreign exchange.

Wells Fargo restated its first-quarter earnings, lowering its

net income to $4.7 billion, or 96 cents a diluted share, a

reduction of $800 million, or 16 cents a diluted share, from

previously reported figures.

Write to Yuka Hayashi at yuka.hayashi@wsj.com

(END) Dow Jones Newswires

April 20, 2018 11:04 ET (15:04 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

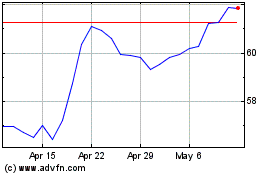

Wells Fargo (NYSE:WFC)

Historical Stock Chart

From Aug 2024 to Sep 2024

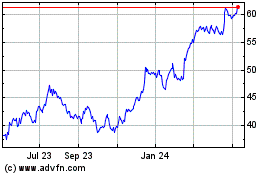

Wells Fargo (NYSE:WFC)

Historical Stock Chart

From Sep 2023 to Sep 2024