'Taste is king' again after turn to healthier versions failed to

break sales decline

By Annie Gasparro

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (April 6, 2018).

To get consumers to eat cereal, big food companies are doubling

down on sugary goodness.

Lucky Charms Frosted Flakes from General Mills Inc. and

Chocolate Frosted Flakes from Kellogg Co. are among the industry's

latest answers to the persistent decline in cereal sales.

For years, the big brands tried to go healthy as the main

strategy to win back consumers who had defected to Greek-style

yogurt, protein bars and other breakfast items with more protein

and fewer carbohydrates than cereal. General Mills in 2014 came out

with a higher-protein version of Cheerios and removed any

genetically modified ingredients from original Cheerios. In 2013,

Post Holdings Inc. introduced Honey Bunches of Oats Morning Energy,

which highlighted higher protein and fiber content. And in 2011,

Kellogg started selling a variety of Frosted Flakes with 25% less

sugar and three times the fiber.

That didn't work. Overall cereal sales in the U.S. have declined

11% over the past five years to around $9 billion in 2017,

according to Mintel, a consumer research firm. Post CEO Robert

Vitale said cereal has lost a tenth of its shelf space as a

result.

Now, many food manufacturers are going back to basics. Consumers

of cereal -- children and adults alike -- care less about nutrition

and more about fun flavors, range of colors, and sweet taste,

according to market research firms and food company executives. And

many aren't necessarily eating it for breakfast, and instead are

treating it as a snack or even dessert, they said.

"Taste is king," said Dana McNabb, General Mills' president of

cereal. Ms. McNabb, who oversaw the company's latest creations --

Chocolate Peanut Butter Cheerios, Lucky Charms Frosted Flakes and

Cinnamon Toast Crunch shredded wheat -- said those new products are

selling better than the company's healthier twists on their

so-called fun brands. "What we realized is that trying to do the

same thing across all of our cereals doesn't work."

General Mills revived its discontinued artificially

colored-and-flavored Trix cereal last year after consumers

complained about the dull look and different taste of the

all-natural ingredients the company had used as substitutes. "Trix

is the best example of what happens when you do something the

consumer doesn't like: They let us know," Ms. McNabb said.

Sales of children's cereal, which includes many indulgent

varieties with cartoon mascots, fell about 1% last year. Adult

cereal sales sank 7%, according to market research firm

Nielsen.

Big food makers say they are under no illusion that sales of

cereal -- and other processed foods -- will return to the growth

rates of 1980s. Consumers are moving toward options they think are

fresher and less processed, a trend that seems unlikely to change

anytime soon. Kellogg, General Mills and Post are diversifying

their businesses by buying smaller brands that make other foods, to

protect them from cereal sales determining their fate.

The cereal business, however, is still important, making up a

significant portion of their sales. The companies also stressed

that they aren't abandoning healthier cereals like Special K or

Grape-Nuts.

"Cereal is big, and it is profitable. We recognize that we have

to stabilize it," said Kellogg's new chief executive, Steve

Cahillane. "Frankly, we haven't done enough to keep the consumer

engaged."

Emphasizing taste and getting Americans to eat cereal at times

other than breakfast are the industry's best shot at recovering

from what has been an abysmal decade, said John Owen, a senior food

analyst at Mintel.

"Cereal is processed. It's carbs. It's not so healthy for

breakfast, but it's a permissible indulgence that seems not as bad

as eating a traditional dessert," he said.

Mintel's research shows that 43% of adults eat cereal as a snack

at home, and 30% of cereal consumers say they choose cereal that

tastes good regardless of how nutritious it is.

Dan Goubert, a college student from Grand Rapids, Mich., said he

eats cereal late at night while playing videogames. "I'm not trying

to be healthy. It's a midnight snack kind of thing for me now. It

doesn't fill you up in the morning," he said.

Marissa Kopp, who lives in Naperville, Ill., with her husband

and their two young sons, said that although she is careful to feed

her children unsweetened oatmeal and whole-wheat pasta with added

fiber, she occasionally has cereal for dinner. "I am so much more

into reading food labels for my kids than my husband and I.

Sometimes I'll just have Golden Grahams," she said.

General Mills, the maker of Golden Grahams, in March reported

that retail sales of its cereal rose 2% in the latest quarter,

thanks to Peanut Butter Chocolate Cheerios and Lucky Charms Frosted

Flakes.

Post recently brought back Oreo Os cereal, its offering made to

taste like the popular Nabisco cookies that it had discontinued in

2007. And it stopped selling its newer Morning Energy variety of

Honey Bunches of Oats. Kellogg discontinued its lower-sugar Frosted

Flakes and came out with chocolate and cinnamon varieties.

After working for years to remove the synthetic dyes in Lucky

Charms' marshmallows, General Mills has abandoned that goal and

instead recently came out with a new unicorn-shaped marshmallow to

boost sales. The unicorn has gotten a lot more attention from

consumers than Ancient Grain Cheerios ever did, Ms. McNabb said.

"Unicorns are popular. But unicorns and Lucky Charms are

magical."

Write to Annie Gasparro at annie.gasparro@wsj.com

(END) Dow Jones Newswires

April 06, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

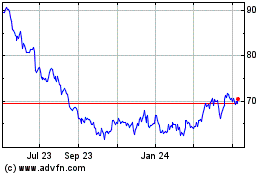

General Mills (NYSE:GIS)

Historical Stock Chart

From Mar 2024 to Apr 2024

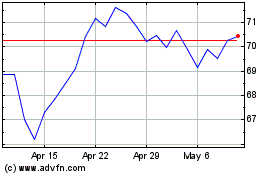

General Mills (NYSE:GIS)

Historical Stock Chart

From Apr 2023 to Apr 2024