Brookfield to Pick Up 25% Stake in European Money Manager

March 20 2018 - 3:28PM

Dow Jones News

By Justin Baer

Real estate giant Brookfield Asset Management Inc. agreed to buy

a 25% stake in the European private-debt investor LCM Partners Ltd.

and its loan-servicing arm.

LCM, which is based in London, manages and services about EUR25

billion ($31 billion) in assets ranging from credit-card debt and

car loans to mortgages. Brookfield oversees $285 billion in assets

from headquarters in New York and Toronto, making it one of the

world's largest investors in real estate, infrastructure and

private equity.

Under the agreement, Brookfield will buy the 25% stake in LCM's

parent company, Link Financial Group, and have an option to acquire

another 24.9% stake over time, the companies said. Terms of the

agreement weren't disclosed.

Paul Burdell, LCM's chief executive and co-founder, said his

firm had been on the lookout for about a year for a strategic

investor to "turbocharge" its business. He said he expects LCM and

Brookfield will be able to spot potential investments for one

another.

LCM bought out its previous outside investors, including Morgan

Stanley and HBOS PLC, after the financial crisis as the firm

shifted its focus toward managing money for pensions, companies and

other large institutions. The firm, whose clients include the

Arizona State Retirement System and Illinois's Teachers Retirement

System, has delivered an average annual return of 14.8% since

1999.

Write to Justin Baer at justin.baer@wsj.com

(END) Dow Jones Newswires

March 20, 2018 15:13 ET (19:13 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

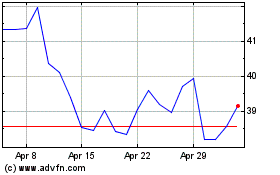

Brookfield Asset Managem... (NYSE:BAM)

Historical Stock Chart

From Aug 2024 to Sep 2024

Brookfield Asset Managem... (NYSE:BAM)

Historical Stock Chart

From Sep 2023 to Sep 2024