Oracle's Cloud-Computing Sales Climb

March 19 2018 - 5:13PM

Dow Jones News

By Jay Greene

Oracle Corp.'s quarterly cloud-computing revenue reached $1.57

billion, meeting the company's tamped down expectations following

two periods in which investors knocked its shares lower over

disappointing guidance for the key segment.

Even so, Oracle shares fell more than 3% in after-market trading

because investors thought healthy tech spending would push revenue

higher.

"It'd definitely somewhat disappointing that they didn't show

upside, given the healthy spending environment," said Stifel

Nicolaus & Co. analyst Brad Reback.

Meanwhile, the company swung to a quarterly loss as it booked a

net charge of $6.9 billion related to the U.S. tax overhaul in its

fiscal third quarter.

Cloud computing is key for Oracle, which is transitioning from a

leading vendor of database software companies run in their own

servers to one that also sells services that customers run in data

centers operated by Oracle and others.

The business-software giant Monday reported total cloud sales

grew 32% in the quarter, roughly what the company said it would be

three months ago.

Oracle disappointed investors in its fiscal first and second

quarters with guidance for its cloud-computing business that was

below what Wall Street had expected. While the stock fell each

time, it recovered and managed to close at an all-time high of

$52.97 earlier this month.

Over all, Oracle reported a net loss of $4.02 billion, or 98

cents a shares. The company said adjusted per-share earnings, which

exclude stock-based compensation and other items, were 83

cents.

Revenue rose 6% to $9.77 billion, while adjusted revenue climbed

5% to $9.78 billion.

According to estimates gathered by S&P Global Market

Intelligence, analysts expected Oracle to earn 72 cents a share on

an adjusted basis, on adjusted revenue of $9.78 billion.

Oracle's software-as-a-service business, in which it sells

access to web-based applications that compete against offerings

from Salesforce.com Inc. and Workday Inc., grew 33% to $1.15

billion.

Its platform-as-a-service business -- app-management and

data-analytics tools -- combined with infrastructure-as-a-service

-- computing resources and storage on demand -- climbed 28% to $415

million. It competes in those markets against Amazon.com Inc. and

Microsoft Corp.

While growth in Oracle's overall cloud business has decelerated,

it still grew faster than the declines in its legacy software

business. The cloud business grew $377 million year-over-year while

Oracle's new software-license revenue fell $26 million.

Overall, revenue from new software licenses fell 2%, or 6% on a

currency-adjusted basis, to $1.39 billion.

As important as shifting sales to the cloud is for Oracle, the

roughly half of its revenue comes from software-license updates and

product support. In the third quarter, that business grew 6% to

$5.03 billion.

Write to Jay Greene at Jay.Greene@wsj.com

(END) Dow Jones Newswires

March 19, 2018 16:58 ET (20:58 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

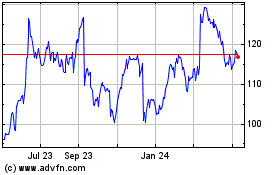

Oracle (NYSE:ORCL)

Historical Stock Chart

From Mar 2024 to Apr 2024

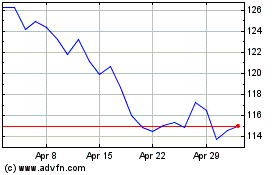

Oracle (NYSE:ORCL)

Historical Stock Chart

From Apr 2023 to Apr 2024