By Bradley Olson

HOUSTON -- One of the pioneers of the U.S. shale boom plans to

deliver a surprising message at a major energy conference here this

week: U.S. oil production won't keep growing as fast as the market

seems to think.

Mark Papa, the former chief executive of industry bellwether EOG

Resources Inc., said in an interview he is eager to tell the

assemblage of oil chieftains that a widely held view that shale oil

producers can quickly ramp up production, and sustain those levels

if needed, is wrong.

"The oil market is in a state of misdirection now," said Mr.

Papa, 71 years old, currently head of smaller shale company

Centennial Resource Development Inc., suggesting future supplies

may be more constrained than experts believe. "Someone needs to

speak out."

Mr. Papa is among a group of shale executives set to meet for a

private dinner Monday evening with Mohammad Barkindo, the

secretary-general of the Organization of the Petroleum Exporting

Countries, which has been constricting its oil output along with

Russia to reduce an oversupply of crude that Americans helped

create. Mr. Papa is then scheduled to speak publicly Tuesday at

CERAWeek, the annual energy confab put on by IHS Markit Ltd.

An engineer by trade, Mr. Papa speaks in kindly tones but often

delivers a blunt message. While he stops short of saying the

industry is headed for trouble, his main point is that shale isn't

the "big bad wolf," or all-powerful disrupter of oil and gas

markets, that it has been made out to be. He strongly takes issue

with the notion -- held by market analysts, executives and

investors -- that U.S. production will long swamp global supplies,

perpetuating lower prices.

In a January speech, he told executives and investors that most

of the best drilling locations in North Dakota and South Texas have

already been tapped. He has lately called out rivals for being too

optimistic about their prospects. And he points to recent

operational challenges such as sand shortages that companies have

disclosed in the Permian Basin in West Texas and New Mexico, the

hottest U.S. drilling region, as a harbinger.

Such constraints, coupled with mounting investor demands for

returns, will equate to much slower U.S. oil production growth than

what most forecasts expect, he said.

Some of Mr. Papa's broadsides are laced with sarcasm, including

his skeptical take on the industry's trend of the moment, the push

to use "big data" and automation to modernize oil fields and

drilling.

"Apparently, you can just use your imagination to dream what

might happen with big data in five or 10 years," he said,

smirking.

Privately, some executives chafe at Mr. Papa's critiques, saying

his commentary is self-serving, since Centennial already holds the

rights to prime drilling land in Texas. Started with little more

than Mr. Papa's reputation, the Permian-focused company went public

in 2016 and is now worth about $5 billion. If the market were to

adopt Mr. Papa's view that shale growth will be limited, it could

push up oil prices and benefit his business. Mr. Papa said he is

motivated by a desire to warn the industry, not any potential

personal benefit.

But Mr. Papa hasn't been alone in disputing forecasts for

spectacular growth in U.S. oil production, which surpassed 10

million barrels a day and broke a 47-year-old record in November,

according to the U.S. Energy Information Administration.

Continental Resources Inc. Chief Executive Harold Hamm, another

shale pioneer, also has questioned the forecasts.

More than a dozen U.S. producers either set lower targets for

2018 production than analysts expected or said they would have to

spend more than anticipated to reach previous output goals. Shares

in an index of U.S. oil companies have fallen 8% this year even as

U.S. oil prices have risen 1.4%, while the S&P 500 index has

gained roughly 0.7%, an indication that investors lack confidence

in their ability to capitalize on higher crude prices.

While some geologists and industry gadflies have incorrectly

predicted the demise of shale for years, Mr. Papa's credentials

make his criticism harder for industry optimists to discount.

"He has a reputation for challenging conventional wisdom and

fostering innovation by creating a culture where people could ask

uncomfortable questions," said Les Csorba, who advises energy

company boards as a partner at executive search firm Heidrick &

Struggles International Inc.

Mr. Papa said he developed a healthy skepticism after his

experience at EOG. As he saw more companies perfect the art of

extracting natural gas from shale, he came to worry that the market

would tip into oversupply.

Engineers doubted the drilling techniques would work for oil

extraction, believing larger oil molecules wouldn't flow as easily

through fractured shale as natural gas. But EOG thought otherwise

and announced its intention to pivot to oil.

EOG proved to be correct as gas prices cratered, and producing

oil from shale became more economically viable. Mr. Papa believes

he is right again this time and shrugs off critics.

"Even though 99% of the industry is dead certain about certain

things, 99% of the industry is often wrong," he said. "I have a

minority opinion right now, but within the next year or two, I feel

pretty strongly that it's going to be proven out."

Write to Bradley Olson at Bradley.Olson@wsj.com

(END) Dow Jones Newswires

March 05, 2018 09:01 ET (14:01 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

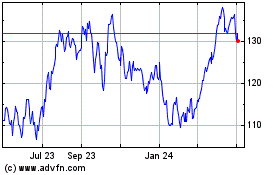

EOG Resources (NYSE:EOG)

Historical Stock Chart

From Aug 2024 to Sep 2024

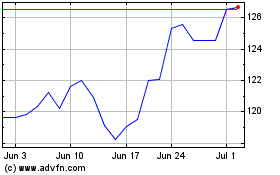

EOG Resources (NYSE:EOG)

Historical Stock Chart

From Sep 2023 to Sep 2024