Efma and Accenture Announce Ceremony to Honor North American Winners of Their Global ‘Innovation in Insurance’ Awards

March 01 2018 - 7:59AM

Business Wire

For the third edition of their annual Innovation in Insurance

Awards, Efma and Accenture (NYSE: ACN) are introducing a

North-American awards ceremony, to be held in New York on Oct. 24,

following the global awards ceremony in Paris on June 12.

Accenture and Efma, a global association comprising thousands of

insurance and banking members, launched the global Efma-Accenture

Innovation in Insurance Awards program in 2016 to showcase the most

exciting and effective innovations in insurance. Although North

American insurers will be among the global winners, the New York

event will spotlight the best submissions from U.S. and Canadian

insurers.

“These awards recognize insurers that are leading innovation and

reveal the current state of the industry and where it is going,”

said Vincent Bastid, CEO of Efma. “Whether it’s the use of drones

to assess fire damage, connected devices that help reduce risks,

intelligent predictions to decrease accidents, or new technologies

like blockchain that help manage and pay claims faster –

innovations are changing the face of insurance.”

Recent research from Accenture highlights the importance of

innovation in the insurance industry, finding that insurers that

continuously innovate and adapt to changing customer needs will be

able to capture emerging growth opportunities and outperform

competitors. Specifically, the research found that North American

insurance carriers that embrace innovation could generate up to

US$128 billion in total new revenue, whether through new offerings

for emerging risks like cyber security and autonomous vehicles;

improved penetration of difficult-to-reach markets; value-added

services that help reduce customers’ risk; and harnessing existing

assets such as data, platforms and algorithms in new ways.

“The insurance industry can’t rest on its laurels in this era of

massive technological disruption,” said Michael Costonis, who leads

Accenture’s Insurance practice globally. “With today’s challenging

macroeconomic environment, changing customer behavior and wave

after wave of new regulations, technology’s role as an enabler has

never been more prominent. The Efma-Accenture Innovation in

Insurance Awards are a critical part of that process, recognizing

those who are pushing boundaries and stepping outside their

historical comfort zones to upend insurance as we know.”

The 2018 Efma-Accenture Innovation in Insurance awards canvass

the best solutions across eight categories:

- Artificial Intelligence:

Innovations that leverage the disruptive power of artificial

intelligence technologies – such as robotics, intelligent

automation, natural language processing, machine learning and

cognitive computing.

- Best Disruptive Product or Service

(special awards category – live vote onsite): Innovations that

enhance, extend or replace the traditional offering – creating new

profit pools by serving new or existing customer segments in new

ways and entering or creating new markets typically beyond the

reach of insurance players.

- Claims Management: Innovative

practices in claims management aimed at facilitating and/or

accelerating the claims management process or improving fraud

detection and prevention.

- Connected Insurance &

Ecosystems: Innovations that use the internet of things to

create new business models by combining insurance with technology,

ecosystem services and partners.

- Customer Experience &

Engagement: Innovations that radically enhance the way

insurance players engage customers. New approaches may include

seamless and personalized experiences across physical and/or

digital channels, new customer management (service) models, and

innovative management of customer loyalty and satisfaction.

- Global Innovator (special awards

category): The most-innovative insurer – i.e., the organization

whose corporate vision commits it successfully to continuous

innovation and transformation, to the development and leadership of

a broad ecosystem of partners extending beyond insurance, and to

the exploitation of emerging technologies that improve its

customers’ experience and the performance of its business.

- Insurtech: The creation and/or

application of innovative technology that substantially improves

any part of the insurance value chain, enhances the customer

experience, or explores new sources of value for insurers. New for

2018, this category recognizes the significant impact that

insurtechs – insurance start-ups and spin-offs and

insurance-specific technology firms – are having on the

industry.

- Underwriting: Significant

enhancement of the underwriting process through improved data

collection and analysis or other advances to support

personalization, efficiency and accuracy.

For information on the awards or to submit an entry, please

click here or visit www.efma.com/innovationininsurance/

Continue following the conversation on Twitter at

#InsAwards2018.

About Efma

A global non-profit organization established in 1971 by banks

and insurance companies, Efma facilitates networking between

decision-makers. It provides quality insights to help banks and

insurance companies make the right decisions to foster innovation

and drive their transformation. Over 3,300 brands in 130 countries

are Efma members. Headquarters in Paris. Offices in London,

Brussels, Barcelona, Stockholm, Bratislava, Dubai, Mumbai and

Singapore. Learn more at www.efma.com.

About Accenture

Accenture is a leading global professional services company,

providing a broad range of services and solutions in strategy,

consulting, digital, technology and operations. Combining unmatched

experience and specialized skills across more than 40 industries

and all business functions – underpinned by the world’s largest

delivery network – Accenture works at the intersection of business

and technology to help clients improve their performance and create

sustainable value for their stakeholders. With more than 435,000

people serving clients in more than 120 countries, Accenture drives

innovation to improve the way the world works and lives. Visit us

at www.accenture.com.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20180301005232/en/

EfmaHannah Moisand, +33 6 77 43 02

32hannah@efma.comorAccentureMichael McGinn,

+1-917-452-9458m.mcginn@accenture.com

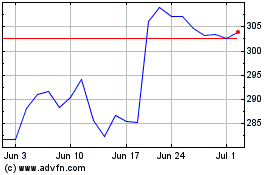

Accenture (NYSE:ACN)

Historical Stock Chart

From Aug 2024 to Sep 2024

Accenture (NYSE:ACN)

Historical Stock Chart

From Sep 2023 to Sep 2024