A.M. Best Revises Outlooks to Positive for Employers Holdings, Inc. and Its Subsidiaries

February 22 2018 - 9:40AM

Business Wire

A.M. Best has revised the outlooks to positive from

stable and affirmed the Financial Strength Rating of A- (Excellent)

and the Long-Term Issuer Credit Ratings (Long-Term ICR) of “a-” of

Employers Insurance Company of Nevada, Employers

Compensation Insurance Company, Employers Assurance

Company and Employers Preferred Insurance Company,

collectively referred to as the Employers Insurance Group

(Employers). Concurrently, A.M. Best has revised the outlook to

positive from stable and affirmed the Long-Term ICR of “bbb-” of

Employers Holdings, Inc. (EHI) [NYSE:EIG], the publicly

traded ultimate parent of Employers. All companies are

headquartered in Reno, NV.

The Credit Ratings (ratings) reflect Employers’ balance sheet

strength, which A.M. Best categorizes as strongest, as well as its

adequate operating performance, limited business profile and

appropriate enterprise risk management. The ratings are supported

by Employers’ risk-adjusted capitalization, considered as

strongest, improving operating earnings and significant market

expertise operating as a workers’ compensation writer. The ratings

also reflect the financial flexibility afforded by its publicly

traded parent, EHI. Improved underwriting margins in recent years

reflect the pricing flexibility afforded through the use of

multiple writing companies, combined with ongoing underwriting

initiatives focused on underperforming classes of business.

Employers maintains business concentration risk, operating as a

mono-line workers’ compensation insurer with a relatively high

concentration of premium volume in a select number of states. While

this concentration subjects the company to heightened degrees of

economic, regulatory and judicial risks, this concern is mitigated

partially by management’s market expertise.

The revised outlooks reflect Employers’ improving levels of

risk-adjusted capitalization as measured by Best’s Capital Adequacy

Ratio (BCAR) and continued improvement in underwriting and

operating performance, partially offset by a limited business

profile.

Further positive rating action could occur should underwriting

and operating results continue to improve and be sustained at a

level that performs in line with higher rated peers. Negative

rating action could occur if the group experiences a substantial

decline in risk-adjusted capitalization, or if the group

experiences deterioration in operating performance driven by

weakened underwriting performance or deterioration in the group’s

reserving position.

This press release relates to Credit Ratings that have been

published on A.M. Best’s website. For all rating information

relating to the release and pertinent disclosures, including

details of the office responsible for issuing each of the

individual ratings referenced in this release, please see A.M.

Best’s Recent Rating Activity web page. For

additional information regarding the use and limitations of Credit

Rating opinions, please view Understanding Best’s Credit

Ratings. For information on the proper media use of Best’s

Credit Ratings and A.M. Best press releases, please view

Guide for Media - Proper Use of Best’s Credit Ratings and A.M.

Best Rating Action Press Releases.

A.M. Best is the world’s oldest and most authoritative

insurance rating and information source. For more information,

visit www.ambest.com.

Copyright © 2018 by A.M. Best Rating

Services, Inc. and/or its affiliates. ALL RIGHTS RESERVED.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20180222005861/en/

A.M. BestJonathan Harris, CFA, FRM, +1 908-439-2200,

ext. 5771Senior Financial

Analystjonathan.harris@ambest.comorJacqalene Lentz, CPA, +1

908-439-2200, ext.

5762Directorjacqalene.lentz@ambest.comorChristopher

Sharkey, +1 908-439-2200, ext. 5159Manager, Public

Relationschristopher.sharkey@ambest.comorJim Peavy, +1

908-439-2200, ext. 5644Director, Public

Relationsjames.peavy@ambest.com

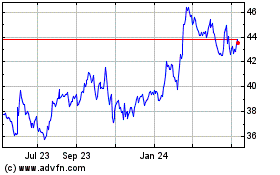

Employers (NYSE:EIG)

Historical Stock Chart

From Mar 2024 to Apr 2024

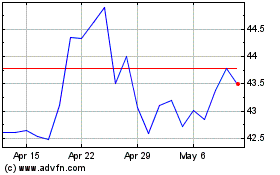

Employers (NYSE:EIG)

Historical Stock Chart

From Apr 2023 to Apr 2024