ADM Revenue Falls as M&A In Focus

February 06 2018 - 9:05AM

Dow Jones News

By Austen Hufford

Archer Daniels Midland Co. reported a decline in revenue in its

latest quarter even as it processed more corn and oilseed and

profit increased.

In January, The Wall Street Journal reported that ADM made a

takeover approach to Bunge Ltd., citing people familiar with the

matter. On Monday, Bloomberg reported that the company was in

advanced talks to acquire Bunge and could reach an agreement as

early as this week.

ADM and White Plains, N.Y.-based Bunge represent the "A" and "B"

in the so-called ABCDs, the global commodity-trading companies that

dominate the world-wide flow of basic foodstuffs. Minnesota-based

Cargill Inc. and Louis Dreyfus Commodities, with its headquarters

in the Netherlands, are the other two.

For its fourth quarter, Chicago-based ADM reported that revenue

fell 2.6% to $16.07 billion.

The company earned a profit of $788 million, or $1.39 a share,

compared with net income of $424 million, or 73 cents a share, in

the prior-year period.

The company said it took a $379 million gain in the quarter

related to the new U.S. tax law. With that and other charges

stripped out, the company reported adjusted earnings per share of

82 cents, above the 70 cents expected by Wall Street analysts.

Analysts polled by Thomson Reuters had expected revenue of

$16.66 billion.

"We pulled the levers under our control -- including cost and

capital initiatives and interventions throughout the year -- to

deliver value for shareholders," ADM Chief Executive Juan Luciano

said in prepared remarks. In the last 12 months through Monday,

shares have fallen 7.8% and were inactive in premarket trading.

Total volume processed of oilseed and corn rose 4.8%.

Corn processing revenue fell 0.3% to $2.51 billion while

adjusted profit rose 2.4% as sweeteners and starches helped results

while lower ethanol margins cut into profit.

Oilseeds processing revenue rose 2.7% to $5.42 billion while

adjusted profit fell 15% as strong volumes and continued growth in

demand were offset by weak margins.

ADM increased its quarterly cash dividend to 33.5 cents from 32

cents a share.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

February 06, 2018 08:50 ET (13:50 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

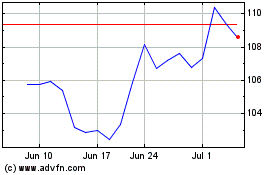

Bunge Global (NYSE:BG)

Historical Stock Chart

From Mar 2024 to Apr 2024

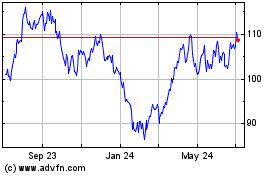

Bunge Global (NYSE:BG)

Historical Stock Chart

From Apr 2023 to Apr 2024