Johnson & Johnson Results Driven by Pharmaceutical Sales Growth -- 3rd Update

January 23 2018 - 4:19PM

Dow Jones News

By Jonathan D. Rockoff and Allison Prang

Johnson & Johnson sales rose in the fourth quarter, but the

company reported a loss after taking a $13.6 billion charge as a

result of the new U.S. tax law.

J&J expects the new law will lower its effective tax rate by

1.5 to 2.5 percentage points from the current rate of 17.2%.

Analysts said the positive impact probably figured in the company's

better-than-expected financial outlook for this year.

New Brunswick, N.J.,-based J&J is the latest company to

report a charge as a result of the new tax law's levy on earnings

made abroad, part of the overhaul's efforts to shift to a

territorial system of taxation.

J&J has about $16 billion in foreign earnings it has held

overseas to avoid paying taxes under the old 35% corporate tax

rate. The new law will charge companies a one-time tax of 15.5% on

overseas profits held in cash and liquid assets.

Chief Executive Alex Gorsky praised the tax changes for

improving the competitiveness of U.S. companies and giving them

more flexibility to use their cash.

He said the law will prompt J&J to increase investment "with

the intent to have [the investment] substantially made in the

U.S."

In the fourth quarter, J&J swung to a loss of $10.71

billion, or $3.99 a share, compared with a profit of $3.81 billion,

or $1.38 a share, in the year-ago period, largely because of the

tax-law charge.

Excluding special items such as the tax provision, J&J's

profit rose 9.5% to $4.78 billion, or $1.74 a share. Analysts

polled by Thomson Reuters were expecting adjusted earnings of

$1.72.

J&J, one of the largest U.S. health-products companies by

revenue and a bellwether for the health-care sector, said sales

rose 12% to $20.2 billion.

The performance was driven by sales in the company's

pharmaceuticals business, which rose by 18% to $9.7 billion. Sales

of J&J's cancer drugs had some of the biggest gains.

Global sales of multiple-myeloma treatment Darzalex rose 86% in

the quarter to $371 million, making the drug a so-called

blockbuster, with annual sales over $1 billion.

But sales of arthritis therapy Remicade, J&J's longtime

top-selling product, fell 10% the quarter to $1.5 billion as the

company offered heavy discounts to compete with lower-priced

biosimilars.

Mr. Gorsky said the company was making moves to improve the

performance of its consumer-health and medical-device businesses,

which haven't been performing as well as the pharmaceuticals

unit.

For 2018, J&J said it expects sales between $80.6 billion

and $81.4 billion and adjusted earnings per share between $8 and

$8.20. Analysts had expected full-year adjusted earnings of $7.87

on revenue of $80.7 billion.

Also on Tuesday, a federal appeals court upheld a decision from

the U.S. Patent and Trademark Office invalidating a key patent

protecting Remicade. If J&J had won, the company could have

sought compensation from rivals like Pfizer Inc. for sales lost to

biosimilar versions of Remicade.

The news helped send J&J shares down around 4% during the

afternoon.

A spokesman said J&J was "disappointed" in the ruling.

Patents "enable us to invest in the discovery and development of

tomorrow's life-changing and life-saving new medicines," the

spokesman said.

Pfizer has sued J&J alleging anti-competitive behavior to

protect Remicade from competition from Pfizer's biosimilar, known

as Inflectra. A Pfizer spokesman praised the patent ruling, but

said "J&J continues to use their scheme of exclusionary

contracts to maintain Remicade's monopoly position that prevents

patients, payers and providers from the opportunity to benefit from

Inflectra."

Write to Jonathan D. Rockoff at Jonathan.Rockoff@wsj.com and

Allison Prang at allison.prang@wsj.com

(END) Dow Jones Newswires

January 23, 2018 16:04 ET (21:04 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

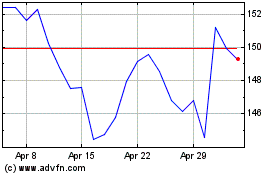

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

From Aug 2024 to Sep 2024

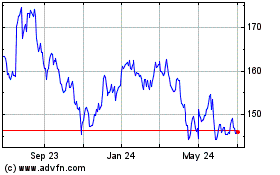

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

From Sep 2023 to Sep 2024