By Ben Fritz

For years, many in Hollywood thought it was only a matter of

time until the six major movie studios that have dominated the

industry for decades would shrink to five or even four.

Few, however, thought the first to go would be Twentieth Century

Fox.

Fox has performed in the middle of the pack among major studios

for the past decade and the conventional wisdom has been that one

of the laggards, Viacom Inc.'s Paramount Pictures or Sony Pictures

Entertainment, would be bought first.

But now that Walt Disney Co. is in talks to buy most of the

assets of 21st Century Fox Inc. in a deal that could be announced

as soon as next week, people with knowledge of the deal talks said

Fox's movie studio may be scaled back significantly and folded into

Disney's own film operation.

The talks may not result in a deal, people close to the

discussions cautioned. Fox and Wall Street Journal parent News Corp

share common ownership.

Founded in 1935 with the merger of Twentieth Century Pictures

and Fox Films, the studio was in its earlier years known for stars

like Henry Fonda and Shirley Temple and films including

"Gentleman's Agreement," "The Sound of Music" and the Liz

Taylor-Richard Burton epic "Cleopatra," which became a cinematic

icon but nearly bankrupted the studio during its troubled

production. In 1977 it released "Star Wars," the beginning of a

relationship with George Lucas that would span six films and

generate $4.6 billion at the box office.

Since Rupert Murdoch took control of the studio in 1985, it has

had its biggest successes with "Avatar" and the "X-Men" film

series, as well as hits such as "Independence Day," "Home Alone"

and "The Martian."

Disney is looking to buy Fox primarily for its television

distribution and production businesses, the people close to the

talks said. It would gain control of Fox's foreign satellite

services, a set of U.S. cable networks and majority control of

streaming service Hulu.

Those assets would largely be put to work in Disney Chief

Executive Robert Iger's goal of transforming Disney into a

direct-to-consumer digital powerhouse that can rival companies like

Netflix Inc., rather than simply selling content to them.

The Twentieth Century Fox television studio would be kept busy

producing shows for Disney-owned streaming services, as well as for

other outlets, people with knowledge of the deal talks said.

But it isn't clear how Disney would integrate the Fox movie

studio, which is ranked fourth at the domestic box office this

year, with hits including "Logan" and "Kingsman: The Golden Circle"

and disappointments such as "Alien: Covenant" and "Snatched."

Some people close to the deal talks said Twentieth Century Fox

could become a production label within the Walt Disney Studios,

akin to Pixar and Marvel. In that scenario, Fox operations such as

theatrical and home-video distribution would likely be cut back,

resulting in job losses among the studio's approximately 3,200

employees.

Fox under Disney would likely make fewer movies, further

reducing the number of releases from traditional Hollywood studios

at a time when Netflix and Amazon are aggressively expanding their

film output, primarily for their streaming platforms, these people

said. The six major studios released 139 films last year compared

with 189 in 2007, according to the Motion Picture Association of

America.

Movies are essentially a stagnant business, with global

box-office revenues up just 1% last year and U.S.

home-entertainment revenues down 7%, according to the MPAA and the

Digital Entertainment Group. That is why many in Hollywood believe

consolidation is inevitable.

As he has reshaped Disney's movie operation in his 12 years

running the company, Mr. Iger has reduced the number of films it

makes. Disney now focuses almost exclusively on big-budget pictures

based on existing properties--meaning sequels, remakes and

comic-book adaptations.

The strategy has been successful, with higher average grosses

per picture and higher profit margins than competitors.

Fox's movie studio, led by CEO Stacey Snider, has a reputation

as more "filmmaker friendly" and releases more movies--24 this year

compared with Disney's eight--at all budget levels. Unlike Disney,

it makes a number of original live-action movies.

Combined profits from Fox's movie and television studios were

just over $1 billion in the company's most recent fiscal year,

compared with nearly $2.4 billion for Disney's film studio alone.

Fox doesn't report separate movie-studio results.

One certain thing, the people familiar with the talks said, is

that Disney has its eye on Fox's two biggest movie franchises.

"Avatar," which still ranks as the highest-grossing movie of all

time with $2.7 billion world-wide, was recently turned into a set

of attractions at Walt Disney World in Orlando. Fox recently began

production on a quartet of sequels to the 2009 hit and Disney would

likely integrate the brand into its movie business and exploit

synergy with its theme parks and merchandise units.

Fox also controls the movie rights to Marvel's X-Men under a

deal that dates to the 1990s, before Disney owned the super-hero

company. Reuniting characters that have long coexisted in comic

books but not on the big screen would be a creative coup for Marvel

Studios and create new merchandising opportunities.

Fox's Marvel pictures, including the R-rated hit "Deadpool,"

have been less family-friendly than Disney's, though, and it may be

a challenge to merge the two sensibilities.

On Fox's Los Angeles studio lot, anxiety is high as staffers

speculate about their future while also trying to focus on three

movies they will be opening in the next two weeks: the animated

"Ferdinand," the musical "The Greatest Showman" and the historical

drama "The Post."

Nodding to wildfires raging just a few miles away from the

studio, a Fox staffer on Wednesday tweeted, "Power outages here at

the office. Not sure if it's related to the fires or just the first

phase of Disney cost cutting measures."

"TOO SOON," replied a colleague.

Executives and producers who work at Fox say they expect their

business would be slimmed down but hope Disney would allow them to

maintain an independent culture and continue to make a range of

films, some of which aren't based on existing franchises. They said

they recognize their business would likely be oriented more toward

providing content for streaming platforms like Hulu, but hope

Disney would keep releasing movies of all types in theaters

first.

Write to Ben Fritz at ben.fritz@wsj.com

(END) Dow Jones Newswires

December 11, 2017 01:02 ET (06:02 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

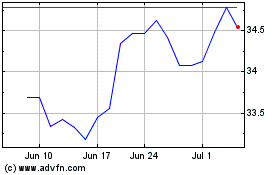

Fox (NASDAQ:FOXA)

Historical Stock Chart

From Aug 2024 to Sep 2024

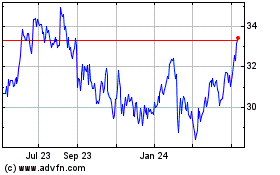

Fox (NASDAQ:FOXA)

Historical Stock Chart

From Sep 2023 to Sep 2024