UNITED

STATES SECURITIES AND

EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

13D

(Rule 13d-101)

Under

the Securities Exchange Act of 1934

(Amendment

No. 1)

Trilogy

Metals Inc.

(Name

of Issuer)

Common

Shares

(Title

of Class of Securities)

89621C105

(CUSIP

Number)

Catherine

J. Boggs

Resource

Capital Funds

1400

Sixteenth Street, Suite 200

Denver,

CO 80202

United

States of America

(720)

946-1444

(Name,

Address and Telephone Number of Person

Authorized

to Receive Notices and Communications)

August

7, 2017

(Date

of Event which Requires Filing of this Statement)

If the filing person has previously filed

a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because

of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box.

¨

Note: Schedules filed in paper format shall

include a signed original and five copies of the schedule, including all exhibits. See §240.13d-7 for other parties to whom

copies are to be sent.

* The remainder of this cover page shall

be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for

any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required

on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities

Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject

to all other provisions of the Act (however, see the Notes).

PERSONS WHO RESPOND TO THE COLLECTION

OF INFORMATION CONTAINED IN THIS FORM ARE NOT REQUIRED TO RESPOND UNLESS THE FORM DISPLAYS A CURRENTLY VALID OMB CONTROL NUMBER.

|

1

|

NAMES OF REPORTING PERSONS

Resource Capital Fund VI L.P.

|

|

2

|

CHECK THE APPROPRIATE

BOX IF A MEMBER OF A GROUP (See Instructions)

(a)

¨

(b)

¨

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS (See Instructions)

WC

|

|

5

|

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

¨

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Cayman Islands

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON WITH

|

7

|

SOLE VOTING POWER

8,745,050

|

|

8

|

SHARED VOTING POWER

0

|

|

9

|

SOLE DISPOSITIVE POWER

8,745,050

|

|

10

|

SHARED DISPOSITIVE POWER

0

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING

PERSON

8,745,050

|

|

12

|

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

¨

(See Instructions)

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

8.28%

|

|

14

|

TYPE OF REPORTING PERSON (See Instructions)

PN

|

|

1

|

NAMES OF REPORTING PERSONS

Resource Capital Associates VI

L.P.

|

|

2

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP (See Instructions)

(a)

¨

(b)

¨

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS (See Instructions)

OO

|

|

5

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS

REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

¨

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Cayman Islands

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON WITH

|

7

|

SOLE VOTING POWER

8,745,050

|

|

8

|

SHARED VOTING POWER

0

|

|

9

|

SOLE DISPOSITIVE POWER

8,745,050

|

|

10

|

SHARED DISPOSITIVE POWER

0

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH

REPORTING PERSON

8,745,050

|

|

12

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11)

EXCLUDES CERTAIN SHARES

¨

(See Instructions)

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN

ROW (11)

8.28%

|

|

14

|

TYPE OF REPORTING PERSON (See Instructions)

PN

|

|

|

|

|

|

|

1

|

NAMES OF REPORTING PERSONS

RCA VI GP Ltd.

|

|

2

|

CHECK THE APPROPRIATE

BOX IF A MEMBER OF A GROUP (See Instructions)

(a)

¨

(b)

¨

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS (See Instructions)

OO

|

|

5

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS

REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

¨

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Cayman Islands

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON WITH

|

7

|

SOLE VOTING POWER

8,745,050

|

|

8

|

SHARED VOTING POWER

0

|

|

9

|

SOLE DISPOSITIVE POWER

8,745,050

|

|

10

|

SHARED DISPOSITIVE POWER

0

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH

REPORTING PERSON

8,745,050

|

|

12

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11)

EXCLUDES CERTAIN SHARES

¨

(See Instructions)

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN

ROW (11)

8.28%

|

|

14

|

TYPE OF REPORTING PERSON (See Instructions)

OO, HC

|

Item 1

.

Security and Issuer

.

This Amendment No. 1 to the statement on

Schedule 13D (this “Amendment No. 1”) amends and supplements the statement on Schedule 13D (the “Original Schedule

13D”) filed on December 10, 2015 (the Original Schedule 13D, as amended and supplemented by this Amendment No. 1, the “Schedule

13D”), by the Reporting Persons, and relates to the disposal of beneficial ownership of Common Shares, no par value, (the

“Common Shares”) of Trilogy Metals Inc., (the “Company”), whose principal executive office is located at

Suite 1950, 777 Dunsmuir Street Vancouver, British Columbia. This Amendment No. 1 is being filed to disclose that the Reporting

Persons have sold a portion of their interests in the Company. Capitalized terms used herein without definition shall have the

meaning set forth in the Original Schedule 13D.

Item 2

.

Identity and Background

.

The persons filing this Amendment No. 1

(collectively, the “Reporting Persons”) are:

|

|

a.

|

Resource Capital Fund VI L.P. (“RCF VI”), a Cayman Islands exempt limited partnership, whose address is 1400 Sixteenth

Street, Suite 200, Denver, Colorado 80202. The principal business of RCF VI is investments.

|

|

|

b.

|

Resource Capital Associates VI L.P. (“Associates VI”), a Cayman Islands exempt limited partnership, whose address

is 1400 Sixteenth Street, Suite 200, Denver, Colorado 80202. Associates VI is the general partner of RCF VI. The principal business

of Associates VI is to act as the general partner of RCF VI.

|

|

|

c.

|

RCA VI GP Ltd. (“RCA VI”), a Cayman Islands exempt company, whose address is 1400 Sixteenth Street, Suite 200,

Denver, Colorado 80202. RCA VI is the general partner of Associates VI. The principal business of RCA VI is to act as the general

partner of Associates VI.

|

The sole members of RCA VI are

Messrs. Ryan T. Bennett, Ross R. Bhappu, Russ Cranswick, James McClements, Henderson G. Tuten and Ms. Sherri Croasdale

(collectively, the “Principals”). The business of RCA VI is directed by the officers of RCA VI. The Principals

serve as executive officers of RCA VI. The business address of each of Messrs. Bennett, Bhappu, Cranswick, McClements, Tuten

and Ms. Croasdale is 1400 Sixteenth Street, Suite 200, Denver, Colorado 80202. The principal occupation of Messrs. Bennett,

Bhappu, Cranswick, McClements, Tuten and Ms. Croasdale is serving as senior executives of the Resource Capital Funds which

include RCF VI.

RCF VI and Associates VI are each Cayman Islands exempt limited partnerships.

RCA VI is a Cayman Islands

exempt company.

Messrs. Bennett, Bhappu, Tuten and Ms. Croasdale are citizens of the United States. Mr. Cranswick is a

citizen of Canada. Mr. McClements is a citizen of Australia.

During the last five years, none of the

Reporting Persons nor any Principal has been convicted in any criminal proceeding (excluding traffic violations or similar misdemeanors).

During the last five years, none of the Reporting Persons nor any Principal has been a party to a civil proceeding of a judicial

or administrative body of competent jurisdiction making such Reporting Person or Principal subject to a judgment, decree or final

order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding

any violation with respect to such laws.

Item 4

.

Purpose of Transaction

.

The Reporting Persons are filing this

Amendment No. 1 to disclose the sale of Common Shares in the open market.

Between August 7, 2017 and August 10,

2017, RCF VI disposed of 1,608,250 Common Shares in the open market for net proceeds of $1,926,432.62 USD. The number of shares

disposed on each day and the price or volume weighed average price for such shares are set forth in Exhibit B: Open Market Dispositions

of Common Shares to this Statement and incorporated herein by reference.

None of the Reporting Persons currently

has any plans or proposals which relate to or would result in any of the actions or transactions specified in clauses (a) through

(j) of Item 4 of Schedule 13D. Each of the Reporting Persons reserves the right to acquire or dispose of the securities of the

Company or to formulate other purposes, plans or proposals regarding the Company or its securities to the extent deemed advisable

in light of general investment policies, market conditions and other factors.

Item 5. Interest in Securities of

the Issuer

.

As of August 11, 2017, RCF VI beneficially

owned 8,745,050 Common Shares of the Company for a total aggregate holding by the Reporting Persons of 8,745,050 Common Shares

of the Company. Based on the foregoing and using 105,554,489 as the number of outstanding Common Shares of the Company, RCF VI

may be deemed to have sole voting and dispositive power over, and therefore beneficial ownership of, approximately 8.28% of the

issued and outstanding Common Shares of the Company.

As of August 11, 2017, Associates VI may

be deemed to have sole voting and dispositive power over, and therefore beneficial ownership of, approximately 8.28% of the issued

and outstanding Common Shares of the Company.

As of August 11, 2017, RCA VI may be deemed

to have sole voting and dispositive power over, and therefore beneficial ownership of, approximately 8.28% of the issued and outstanding

Common Shares of the Company.

Except as described above, none of the

Reporting Persons has effected any additional transactions with respect to the Common Shares of the Company during the past 60

days.

Item 7

.

Material to Be Filed

as Exhibits

.

Exhibit A: Joint Filing Agreement

(Incorporated by reference to Exhibit A to Original Schedule 13D filed on December 10, 2015)

Exhibit B: Open Market Dispositions

of Common Stock

SIGNATURE

After reasonable inquiry

and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and

correct.

August 11, 2017

|

|

RCA VI GP LTD.

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Catherine J. Boggs

|

|

|

|

|

Name: Catherine J. Boggs

|

|

|

|

|

Title: General Counsel

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RESOURCE CAPITAL ASSOCIATES VI L.P.

|

|

|

|

|

|

|

|

By:

|

RCA VI GP Ltd., General Partner

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Catherine J. Boggs

|

|

|

|

|

Name: Catherine J. Boggs

|

|

|

|

|

Title: General Counsel

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RESOURCE CAPITAL FUND VI L.P.

|

|

|

|

|

|

|

|

By:

|

Resource Capital Associates VI L.P.,

|

|

|

|

|

General Partner

|

|

|

|

|

|

|

|

|

By:

|

RCA VI GP Ltd., General Partner

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Catherine J. Boggs

|

|

|

|

|

Name: Catherine J. Boggs

|

|

|

|

|

Title: General Counsel

|

|

Index of Exhibits

.

Exhibit A: Joint

Filing Agreement (Incorporated by reference to Exhibit A to Original Schedule 13D filed on December 10, 2015)

Exhibit B: Open Market Dispositions of Common Stock

Exhibit B

Schedule of Transactions

in Shares

The following table sets forth all transactions

with respect to Shares effected in the last sixty days by the Reporting Persons or on behalf of the Reporting Persons in respect

of the Shares, inclusive of any transactions effected through 4 p.m., New York City time, on August 10, 2017.

Except as noted below, all such transactions

were effected in the open market through brokers and the price per share is net of commissions.

|

Transaction Date

|

Transaction

|

Security

|

Shared Purchased (Sold)

|

Price Per Share ($)

|

|

08/07/2017

|

Sell

|

Common Shares

|

(530,000)

|

$1.2768

|

|

08/08/2017

|

Sell

|

Common Shares

|

(78,250)

|

$1.2500

|

|

08/09/2017

|

Sell

|

Common Shares

|

(500,000)

|

$1.1664

|

|

08/10/2017

|

Sell

|

Common Shares

|

(500,000)

|

$1.1569

|

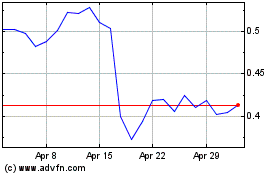

Trilogy Metals (AMEX:TMQ)

Historical Stock Chart

From Mar 2024 to Apr 2024

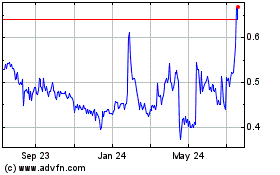

Trilogy Metals (AMEX:TMQ)

Historical Stock Chart

From Apr 2023 to Apr 2024