Reports Record Revenue of $209 million, an

increase of 142%

Carvana Co. (NYSE: CVNA), a leading eCommerce platform for

buying used cars, today announced financial results for its second

quarter ended June 30, 2017. Carvana’s complete second quarter 2017

financial results and management commentary can be found by

accessing the Company’s shareholder letter at:

https://investors.carvana.com/financial-reports/sec-filings.

“Carvana accelerated its growth in retail unit sales and

revenues to 145% and 142%, respectively, during a very strong

second quarter. We are seeing tremendous growth in both our

existing and new markets as we continue our rapid expansion

nationwide. We also increased our gross profit per unit, both

sequentially and as compared to last year,” said Ernie Garcia,

Carvana co-founder and CEO. “Our mission is to change the way

people buy cars. More and more consumers are turning to Carvana for

a seamless, hassle-free car buying experience. We are scaling our

business to meet the growing demand, and with the recent

announcement of our launch in Phoenix we are excited to introduce

the simplicity of online car buying to the Southwest.”

Second Quarter 2017 Financial Summary

Carvana achieved significant unit and revenue growth in Q2 2017,

coupled with increased total gross profit per unit. All financial

comparisons are versus Q2 2016, unless otherwise noted.

- Retail units sold totaled 10,682, an

increase of 145%

- Revenue totaled $209.4 million, an

increase of 142%

- Total gross profit was $16.0 million,

an increase of 166%

- Total gross profit per unit was $1,501,

an increase of $332 per unit compared to Q1 2017

- Net loss was $38.9 million, an increase

of 115%

- EBITDA margin was (16.1%), an

improvement from (21.6%) in Q1 2017

- GAAP basic and diluted net loss per

Class A share was $0.28 based on 15 million shares of Class A

common stock outstanding

- Adjusted net loss per Class A share, a

non-GAAP measure, was $0.28, based on 136.7 million adjusted shares

of Class A common stock outstanding assuming the exchange of all

outstanding LLC Units for shares of Class A common stock

- We opened 7 new markets, bringing our

end-of-quarter total to 30

- We acquired fellow automotive tech

disruptor Carlypso

- On Aug. 4, 2017, we upsized our

inventory facility with Ally Bank to $275 million through Dec. 31,

2017 and then $350 million through Dec. 31, 2018

Q3 and Fiscal 2017 Outlook

We anticipate further unit and revenue growth, as well as total

gross profit per unit and EBITDA margin improvement. For Q3 2017,

we expect:

- Retail unit sales of 11,500 – 13,000,

an increase of 129% – 159% year-over-year

- Total revenue of $225 million – $255

million, an increase of 128% – 158% year-over-year

- Total gross profit per unit of $1,625 –

$1,725

- EBITDA margin of (14%) – (16%)

We are reiterating our FY 2017 guidance as follows:

- Retail unit sales of 44,000 – 46,000,

an increase of 135% – 145% year-over-year

- Revenue of $850 million – $910 million,

an increase of 133% – 149% year-over-year

- Total gross profit per unit of $1,475–

$1,575

- EBITDA margin of (14%) – (16%)

- 16 – 18 new market openings, bringing

our end-of-year total to 37 – 39

For more information regarding the non-GAAP financial measures,

please see the reconciliations of our non-GAAP measurements to

their most directly comparable GAAP-based financial measurements

included at the end of this press release. Guidance for EBITDA

margin excludes depreciation and amortization expense and interest

expense. We have not reconciled EBITDA guidance to GAAP net loss as

a result of the uncertainty regarding, and the potential

variability of, interest expense. Accordingly, a reconciliation of

the non-GAAP financial measure guidance to the corresponding GAAP

measure is not available without unreasonable effort. Depreciation

and amortization expense, which is a component of the

reconciliation between EBITDA and GAAP net loss, is expected to be

between 1.0% and 1.5% of total revenues for both Q3 2017 and FY

2017.

Conference Call Details

Carvana will host a conference call today, Aug. 8, 2017, at

2 p.m. PDT (5 p.m. EDT) to discuss financial results. To

participate in the live call, analysts and investors should dial

(877) 270-2148 or (412) 902-6510. A live audio webcast of the

conference call along with supplemental financial information will

also be accessible on the company's website

at investors.carvana.com. Following the webcast, an archived

version will be available on the website for one year. A telephonic

replay of the conference call will be available until Tuesday,

Aug. 15, 2017, by dialing (877) 344-7529 or (412)

317-0088 and entering passcode 10109151#.

Forward Looking

Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. These forward-looking statements reflect Carvana’s current

expectations and projections with respect to, among other things,

its financial condition, results of operations, plans, objectives,

future performance, and business. These statements may be preceded

by, followed by or include the words "aim," "anticipate,"

"believe," "estimate," "expect," "forecast," "intend," "likely,"

"outlook," "plan," "potential," "project," "projection," "seek,"

"can," "could," "may," "should," "would," "will," the negatives

thereof and other words and terms of similar meaning.

Forward-looking statements include all statements that are not

historical facts. Such forward-looking statements are subject to

various risks and uncertainties. Accordingly, there are or will be

important factors that could cause actual outcomes or results to

differ materially from those indicated in these

statements. Among these factors are risks related to: (1) our

history of losses and ability to maintain profitability in the

future, (2) our ability to effectively manage our rapid growth, (3)

our limited operating history, (4) the seasonal and other

fluctuations in our quarterly operating results, (5) our

relationship with DriveTime Automotive Group, Inc.,(6) our

management’s accounting judgments and estimates, as well as changes

to accounting policies, (7) our ability to compete in the highly

competitive industry in which we participate, (8) the changes in

prices of new and used vehicles, (9) our ability to acquire

desirable inventory, (10) our ability to sell our inventory

expeditiously, (11) our ability to sell and generate gains on the

sale of automotive finance receivables, (12) our dependence on the

sale of automotive finance receivables for a substantial portion of

our gross profits, (13) our reliance on potentially fraudulent

credit data for the automotive finance receivables we sell, (14)

our ability to successfully market and brand our business; (15) our

reliance on Internet searches to drive traffic to our website, (16)

our ability to comply with the laws and regulations to which we are

subject, (17) the changes in the laws and regulations to which we

are subject, (18) our ability to comply with the Telephone Consumer

Protection Act of 1991;(19) the evolution of regulation of the

Internet and eCommerce, (20) our ability to maintain reputational

integrity and enhance our brand, (21) our ability to grow

complementary product and service offerings, (22) our ability to

address the shift to mobile device technology by our customers,

(23) risks related to the larger automotive ecosystem, (24) the

geographic concentration where we provide services, (25) our

ability to raise additional capital, (26) our ability to maintain

adequate relationships with the third parties that finance our

vehicle inventory purchases, (27) the representations we make in

our finance receivables we sell, (28) our reliance on our

proprietary credit scoring model in the forecasting of loss rates,

(29) our reliance on internal and external logistics to transport

our vehicle inventory, (30) the risks associated with the

construction and operation of our inspection and reconditioning

centers, fulfillment centers and vending machines, including our

dependence on one supplier for construction and maintenance for our

vending machines, (31) our ability to protect the personal

information and other data that we collect, process and store, (32)

disruptions in availability and functionality of our website, (33)

our ability to protect our intellectual property, technology and

confidential information, (34) our ability to defend against claims

that our employees, consultants or advisors have wrongfully used or

disclosed trade secrets or intellectual property, (35) our ability

to defend against intellectual property disputes, (36) our ability

to comply with the terms of open source licenses, (37) conditions

affecting automotive manufacturers, including manufacturer recalls,

(38) our reliance on third party technology to complete critical

business functions, (39) our dependence on key personnel to operate

our business, (40) the costs associated with becoming a public

company, (41) the diversion of management’s attention and other

disruptions associated with potential future acquisitions, (42) the

legal proceedings to which we may be subject in the ordinary course

of business, (43) potential errors in our retail installment

contracts with our customers that could render them unenforceable

and (44) risks relating to our corporate structure and tax

receivable agreements.

There is no assurance that any forward-looking statements will

materialize. You are cautioned not to place undue reliance on

forward-looking statements, which reflect expectations only as of

this date. Carvana does not undertake any obligation to

publicly update or review any forward-looking statement, whether as

a result of new information, future developments, or otherwise.

Use of Non-GAAP Financial

Measures

As appropriate, we supplement our results of operations

determined in accordance with U.S. generally accepted accounting

principles (“GAAP”) with certain non-GAAP financial measurements

that are used by management, and which we believe are useful to

investors, as supplemental operational measurements to evaluate our

financial performance. These measurements should not be considered

in isolation or as a substitute for reported GAAP results because

they may include or exclude certain items as compared to similar

GAAP-based measurements, and such measurements may not be

comparable to similarly-titled measurements reported by other

companies. Rather, these measurements should be considered as an

additional way of viewing aspects of our operations that provide a

more complete understanding of our business. We strongly encourage

investors to review our consolidated financial statements included

in publicly filed reports in their entirety and not rely solely on

any one, single financial measurement or communication.

Reconciliations of our non-GAAP measurements to their most

directly comparable GAAP-based financial measurements are included

at the end of this press release.

About Carvana Co.

Founded in 2012 and based in Phoenix, Carvana’s (NYSE: CVNA)

mission is to change the way people buy cars. By removing the

traditional dealership infrastructure and replacing it with

technology and exceptional customer service, Carvana offers

consumers an intuitive and convenient online automotive retail

platform, with a fully transactional website that enables consumers

to quickly and easily buy a car online, including finding their

preferred vehicle, qualifying for financing, completing the

purchase and loan with signed contracts, and receiving delivery or

pickup of the vehicle from one of Carvana’s proprietary automated

Car Vending Machines.

For further information on Carvana, please visit

www.carvana.com, or connect with us on Facebook, Instagram or

Twitter.

CARVANA CO. AND

SUBSIDIARIESRECONCILIATION OF GAAP TO NON-GAAP FINANCIAL

MEASURES(Unaudited)(In thousands, except per share

amounts)

Adjusted Net Loss and Adjusted Net Loss per Share

Adjusted net loss and adjusted net loss per share are

supplemental measures of operating performance that do not

represent and should not be considered alternatives to net loss and

net loss per share, as determined under GAAP. We believe that

adjusted net loss and adjusted net loss per share supplement GAAP

measures and enable us to more effectively evaluate our performance

period-over-period and relative to our competitors. A

reconciliation of adjusted net loss to net loss attributable to

Carvana Co., the most directly comparable GAAP measure, and the

computation of adjusted net loss per share are as follows:

Three MonthsEnded June 30,

2017

Numerator: Net loss attributable to Carvana Co. $ (14,542 ) Add:

Net loss attributable to non-controlling interests (1) (24,328 )

Adjusted net loss attributable to Carvana Co. $ (38,870 )

Denominator: Weighted-average shares of Class A common stock

outstanding 15,026 Adjustments:(2) Assumed exchange of LLC Units

for shares of Class A common stock (1) 121,666 Adjusted

shares of Class A common stock outstanding 136,692 Adjusted

net loss per share $ (0.28 )

(1) Assumes exchange of all outstanding LLC Units for shares of

Class A common stock retroactively applied as if the exchanges had

occurred at the beginning of each period presented under the terms

of the exchange agreement.(2) Excludes approximately 0.5 million

restricted stock awards and 0.5 million stock options outstanding

at June 30, 2017, because they were determined to be

anti-dilutive.

EBITDA and EBITDA Margin

EBITDA is a non-GAAP supplemental measure of operating

performance that does not represent and should not be considered an

alternative to net loss or cash flow from operations, as determined

by GAAP. EBITDA is defined as net loss before interest expense,

income tax expense and depreciation and amortization expense. We

use EBITDA to measure the operating performance of our business,

excluding specifically identified items that we do not believe

directly reflect our core operations and may not be indicative of

our recurring operations. EBITDA may not be comparable to similarly

titled measures provided by other companies due to potential

differences in methods of calculations. A reconciliation of EBITDA

to net loss, the most directly comparable GAAP measure, is as

follows:

Three Months Ended June 30, 2017

March 31, 2017 Net loss $ (38,870 ) $ (38,439 ) Depreciation

and amortization expense 2,584 2,061 Interest expense 2,507

2,059 EBITDA $ (33,779 ) $ (34,319 ) Total revenues $

209,365 $ 159,073

EBITDA Margin (16.1 )% (21.6

)%

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170808006420/en/

Investor Relations:The Blueshirt

Groupinvestors@carvana.comorMedia Contact:Olson EngageKate

Carvercarvana@olson.com

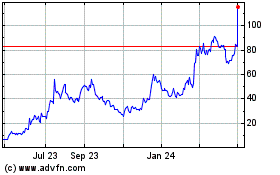

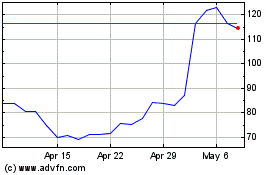

Carvana (NYSE:CVNA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Carvana (NYSE:CVNA)

Historical Stock Chart

From Apr 2023 to Apr 2024