Current Report Filing (8-k)

August 08 2017 - 2:07PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported)

August 1, 2017

BROWNIE’S

MARINE GROUP, INC.

(Exact

name of registrant as specified in its charter)

|

Florida

|

|

333-99393

|

|

90-0226181

|

|

(State

or Other Jurisdiction of Incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S.

Employer

Identification No.)

|

3001

NW 25

th

Avenue, Suite 1, Pompano Beach, Florida 33069

(Address

of Principal Executive Office) (Zip Code)

(954)

462-5570

(Registrant’s

telephone number, including area code)

(Former

Name or Former Address, if Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

Emerging

growth company [ ]

|

|

If

an emerging growth company, indicate by checkmark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

|

Item

3.02

|

Unregistered

Sale of Equity Securities.

|

As

set forth in Item 8.01 of this report, effective August 1, 2017 Brownie’s Marine Group, Inc. (the “Company”)

issued Mr. Wesley P. Siebenthal 2,000,000 shares of its common stock valued at $25,000 as compensation under the terms of the

Advisory Agreement. Mr. Siebenthal is an accredited or otherwise sophisticated investor who had access to business and financial

information on the Company. The issuance of the shares is exempt from registration under the Securities Act of 1933, as amended

(the “Securities Act”), in reliance on an exemption provided by Section 4(a)(2) of such act.

As

also set forth in Item 8.01 of this report, effective August 1, 2017 the Company issued Mr. Blake Carmichael 2,000,000 shares

of its common stock valued at $25,000 as compensation under the terms of an employment agreement. Mr. Carmichael is an accredited

or otherwise sophisticated investor who had access to business and financial information on the Company. The issuance of the shares

is exempt from registration under the Securities Act in reliance on an exemption provided by Section 4(a)(2) of such act.

As

set forth in Item 5.02 of this report, effective August 1, 2017 the Company issued Mr. Mikkel Pitzner 2,000,000 shares of its

common stock valued at $25,000 as compensation for his services as a director. Mr. Pitzner is an accredited investor and the issuance

of the shares is exempt from registration under the Securities Act in reliance on an exemption provided by Section 4(a)(2) of

such act.

Effective

August 1, 2017, the board of directors issued Mr. Robert Carmichael, the Company’s chief executive officer, chief financial

officer and member of the Company’s board of directors, 2,000,000 shares of restricted common stock valued at $25,000 in

consideration of serving on the Company’s board of directors. Mr. Carmichael is an accredited investor and the shares issued

to him pursuant to the exemption from registration provided by Section 4(a)(2) of the Securities Act.

|

Item

5.02

|

Departure

of Directors or Principal Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain

Officers.

|

Effective

August 1, 2017, Mikkel Pitzner, was appointed by a unanimous written consent of the members of the Company’s board of directors

to serve on the Company’s board of directors, filling a vacancy on the board. Mr. Pitzner shall serve on the board of directors

and shall hold office until the next election of directors by stockholders and until his successor is elected and qualified or

until his earlier resignation or removal.

Mikkel

Pitzner, age 49, previously served on the Company’s board of directors from December 2010 through January 2016. During the

years 1996 - 2010, Mr. Pitzner has served as chief executive officer of Copenhagen Limousine Service, a corporate limousine service

company based in Denmark. During the years of 2001-2010 he has served as chief executive officer of The Private Car Company, also

a corporate transportation company located in Denmark. Since 2007, he has been a partner and board member with FT Group Holding,

an advertising company based in Denmark, with operations in Denmark, Sweden, Norway, Finland, Germany and Poland. From 2003 through

2005 he owned and operated Halcyon Denmark, an importer and distributor of Halcyon diving products. The Company’s chief

executive officer is an affiliate of Halcyon Manufacturing, Inc. During the years of 2006-2013 he also served on the board of

directors of VMC Pitzner, AGJ Pitzner, SMCE Pitzner, Corona Pitzner, construction companies in Denmark. Currently, Mr. Pitzner

consults small to medium sized businesses of any industry as a turn around business consultant. Mr. Pitzner was selected as a

director for his general business management with specific experience in diving industry.

Pursuant

to an independent director agreement, the Company has agreed to pay Mr. Pitzner an annual fee of $6,000 and has issued Mr. Pitzner

2,000,000 shares of restricted common stock valued at $25,000. A copy of the independent director agreement is incorporated herein

by reference and is filed as Exhibit 10.1 to this Form 8-K. The description of the transactions contemplated by the agreement

set forth herein does not purport to be complete and is qualified in its entirety by reference to the full text of the exhibit

filed herewith and incorporated by this reference.

Effective

August 1, 2017 the Company entered into an Advisory Agreement with Wesley P. Siebenthal to provide certain advisory services to

the Company and serve as its Chief Technology Advisor. Under the terms of the six month agreement, the services to be provided

to the Company by Mr. Siebenthal include researching, designing, and building prototype(s) and managing production tooling for

modification to current products and new products under consideration at the Company. As compensation for the services, the Company

issued him 2,000,000 shares of its common stock. The Advisory Agreement may be terminated by either party upon 30 days notice

in the event of a breach, and contains customary confidentiality and invention assignment provisions. The foregoing description

of the terms and conditions of the Advisory Agreement is qualified in its entirety by reference to the full text of the agreement

which is filed as Exhibit 10.2 to this report.

On

August 1, 2017, the Company entered into a six month employment agreement with Blake Carmichael, the son of the Company’s

chief executive officer and an electrical engineer, to serve as the Company’s products development manager, electrical engineer

and marketing team member. Under the terms of the employment agreement, in addition to a monthly salary of $3,600.00, the Company

issued Mr. Carmichael 2,000,000 shares of common stock. Mr. Carmichael is also entitled to performance bonuses at the discretion

of the board of directors. The employment agreement automatically terminates in the event of his death or disability, may be terminated

by the Company with or without cause (as defined in the agreement) or by the employee without cause. In the event of a termination

by the Company for cause or by the employee, he is not entitled to any additional compensation after the date of termination.

In the event of a termination by the Company without cause, he is entitled to receive his salary through the term of the agreement.

The employment agreement contains customary confidentiality, non-compete, non-solicitation and invention assignment provisions.

|

Item

9.01

|

Financial

Statements and Exhibits.

|

(d)

Exhibits.

|

Exhibit

No.

|

|

Description

|

|

|

|

|

|

10.1

|

|

Independent

Director Agreement effective August 1, 2017.

|

|

|

|

|

|

10.2

|

|

Advisory

Agreement with Wesley P. Siebenthal effective August 1, 2017.

|

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

BROWNIE’S MARINE GROUP, INC

|

|

|

|

|

Date: August 7, 2017

|

/s/ Robert Carmichael

|

|

|

Robert Carmichael, Chief Executive Officer

|

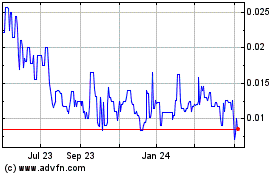

Brownies Marine (QB) (USOTC:BWMG)

Historical Stock Chart

From Mar 2024 to Apr 2024

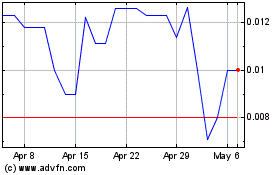

Brownies Marine (QB) (USOTC:BWMG)

Historical Stock Chart

From Apr 2023 to Apr 2024