Record Second Quarter Revenue of $98.2 million, up 33% from

comparable prior year period

Record Second Quarter GAAP Net Income of $14.2 million, up 36%

from comparable prior year period, or $0.24 per diluted share

Record Second Quarter Adjusted EBITDA of $27.8 million, up 23%

from comparable prior year period

Record Second Quarter non-GAAP Net Income of $15.2 million, or

$0.26 per diluted share

Paycom Software, Inc. (“Paycom”) (NYSE: PAYC), a leading

provider of comprehensive, cloud-based human capital management

software, today announced its financial results for the quarter

ended June 30, 2017.

“Our second-quarter results reflect the strength of our position

as more companies look to technology to help attract, retain and

manage their talent,” said Paycom’s founder and CEO, Chad Richison.

“Our software solution is well-positioned to help our clients

achieve these goals and to drive growth for Paycom throughout the

year.”

Financial Highlights for the Second

Quarter of 2017

Total Revenue of $98.2 million represented a 33%

increase compared to total revenue of $73.9 million in the same

period last year. Recurring revenues of $96.4 million also

increased 33% from the comparable prior year period, and

constituted 98% of total revenues.

GAAP Net Income was $14.2 million, or $0.24 per diluted

share, compared to GAAP net income of $10.4 million, or $0.18 per

diluted share, in the same period last year.

Adjusted EBITDA1 was $27.8 million, compared to

$22.6 million in the same period last year.

Non-GAAP Net Income1 was $15.2 million, or $0.26

per diluted share, compared to $12.4 million, or $0.21 per diluted

share, in the same period last year.

Cash and Cash Equivalents were $68.1 million as of June

30, 2017.

Total Debt was $34.6 million as of June 30, 2017. This

debt consisted solely of debt on our corporate headquarters.

1 Adjusted EBITDA and non-GAAP net income are non-GAAP financial

measures. Please see the discussion below under the heading "Use of

Non-GAAP Financial Information" and the reconciliations at the end

of this release for additional information concerning these

non-GAAP financial measures.

Financial Outlook

Paycom provides the following expected financial guidance for

the quarter ending September 30, 2017 and year ending December 31,

2017:

Quarter Ending September 30, 2017

Total Revenues in the range of $99

million to $101 million.

Adjusted EBITDA in the range of $21

million to $23 million.

Year Ending December 31, 2017

Total Revenues in the range of $429.5

million to $431.5 million.

Adjusted EBITDA in the range of $122.5

million to $124.5 million.

We have not reconciled the Adjusted EBITDA ranges for the

quarter ending September 30, 2017 or the year ending December 31,

2017 to net income because applicable information for future

periods, on which this reconciliation would be based, is not

readily available due to uncertainty regarding, and the potential

variability of, depreciation and amortization, interest expense,

taxes, non-cash stock-based compensation expense and other items.

Accordingly, a reconciliation of these Adjusted EBITDA ranges to

net income is not available at this time without unreasonable

effort.

Use of Non-GAAP Financial Information

To supplement our financial information presented in accordance

with generally accepted accounting principles in the United States

(“GAAP”), we consider and have included certain non-GAAP financial

measures in this press release, including Adjusted EBITDA and

non-GAAP net income. Management uses Adjusted EBITDA and non-GAAP

net income as supplemental measures to review and assess the

performance of our core business operations and for planning

purposes. We define: (i) Adjusted EBITDA as net income plus

interest expense, taxes, depreciation and amortization, and

non-cash stock-based compensation expense; and (ii) non-GAAP net

income as net income plus non-cash stock-based compensation

expense, which is adjusted for the effect of income taxes. Adjusted

EBITDA and non-GAAP net income are metrics that provide investors

with greater transparency to the information used by management in

its financial and operational decision-making. We believe these

metrics are useful to investors because they facilitate comparisons

of our core business operations across periods on a consistent

basis, as well as comparisons with the results of peer companies,

many of which use similar non-GAAP financial measures to supplement

results under GAAP. In addition, Adjusted EBITDA is a measure that

provides useful information to management about the amount of cash

available for reinvestment in our business, repurchasing common

stock and other purposes. Management believes that the non-GAAP

measures presented in this press release, when viewed in

combination with our results prepared in accordance with GAAP,

provide a more complete understanding of the factors and trends

affecting our business and performance.

Adjusted EBITDA and non-GAAP net income are not measures of

financial performance under GAAP and should not be considered a

substitute for net income, which we consider to be the most

directly comparable GAAP measure. Adjusted EBITDA and non-GAAP net

income have limitations as analytical tools, and when assessing our

operating performance, you should not consider Adjusted EBITDA or

non-GAAP net income in isolation, or as a substitute for net income

or other consolidated statements of income data prepared in

accordance with GAAP. Adjusted EBITDA and non-GAAP net income may

not be comparable to similar titled measures of other companies and

other companies may not calculate such measures in the same manner

as we do.

Conference Call Details:

In conjunction with this announcement, Paycom will host a

conference call today, Aug. 1, 2017, at 5:00 p.m. Eastern time to

discuss its financial results. To access this call, dial (866)

270-1533 (domestic) or (412) 317-0797 (international) and announce

Paycom as the conference name to the operator. A live webcast as

well as the replay of the conference call will be available on the

Investor Relations page of Paycom’s website at investors.paycom.com. A replay of this conference

call can also be accessed by dialing (877) 344-7529 (domestic) or

(412) 317-0088 (international) until Aug. 8, 2017. The replay

passcode is 10108905.

About Paycom

As a leader in payroll and HR technology, Oklahoma City-based

Paycom redefines the human capital management industry by allowing

companies to effectively navigate a rapidly changing business

environment. Its cloud-based software is based on a core system of

record maintained in a single database for all human capital

management functions, providing the functionality that businesses

need to manage the complete employment lifecycle, from recruitment

to retirement. Paycom has the ability to serve businesses of all

sizes and in every industry. As one of the leading human capital

management providers, Paycom serves clients in all 50 states from

sales offices across the country.

Forward-Looking Statements

Certain statements in this press release are, and certain

statements on the related teleconference call may be,

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. Forward-looking

statements are any statements that refer to the Company’s estimated

or anticipated results, other non-historical facts or future events

and include, but are not limited to, statements regarding our

business strategy; anticipated future operating results and

operating expenses, cash flows, capital resources, dividends and

liquidity; trends, opportunities and risks affecting our business,

industry and financial results; future expansion or growth plans

and potential for future growth; our ability to attract new clients

to purchase our solution; our ability to retain clients and induce

them to purchase additional applications; our ability to accurately

forecast future revenues and appropriately plan our expenses;

market acceptance of our solution and applications; our

expectations regarding future revenues generated by certain

applications; the impact of future regulatory, judicial, or

legislative changes; how certain factors affecting our performance

correlate to improvement or deterioration in the labor market; our

plan to open additional sales offices and our ability to

effectively execute such plan; the sufficiency of our existing cash

and cash equivalents to meet our working capital and capital

expenditure needs over the next 12 months; our ability to expand

our corporate headquarters within an expected timeframe; our plans

regarding our capital expenditures and investment activity as our

business grows, including with respect to research and development;

our expected income tax rate for future periods; and our plans to

purchase shares of our common stock through a stock repurchase

plan. In addition, forward-looking statements also consist of

statements involving trend analyses and statements including such

words as “anticipate,” “believe,” “could,” “expect,” “may,”

“might,” “plan,” “possible,” “potential,” “project,” “should,”

“would,” and similar expressions or the negative of such terms or

other comparable terminology. These forward-looking statements

speak only as of the date hereof and are subject to business and

economic risks. As such, our actual results could differ materially

from those set forth in the forward-looking statements as a result

of the factors discussed in our filings with the Securities and

Exchange Commission, including but not limited to those discussed

in our Annual Report on Form 10-K for the year ended December 31,

2016. We do not undertake any obligation to update or revise the

forward-looking statements to reflect events or circumstances that

exist after the date on which such statements were made, except to

the extent required by law.

Paycom Software, Inc. Consolidated Balance

Sheets (in thousands, except share amounts)

(unaudited) June 30,

December 31, 2017 2016

Assets Current assets: Cash and cash equivalents $

68,117 $ 60,158 Accounts receivable 1,803 1,339 Prepaid expenses

5,737 4,475 Inventory 520 675 Income tax receivable 3,547

692 Current assets before funds held for

clients 79,724 67,339 Funds held for clients 787,015

858,244 Total current assets 866,739 925,583 Property

and equipment, net 116,957 96,848 Deposits and other assets 1,326

1,215 Goodwill 51,889 51,889 Intangible assets, net 1,065 1,871

Deferred income tax assets, net 7,967 1,207

Total assets $ 1,045,943 $ 1,078,613

Liabilities and Stockholders' Equity Current liabilities:

Accounts payable $ 3,439 $ 3,737 Accrued commissions and bonuses

5,236 8,003 Accrued payroll and vacation 5,857 4,769 Deferred

revenue 6,040 5,230 Current portion of long-term debt 1,139 1,113

Accrued expenses and other current liabilities 19,726

17,798 Current liabilities before client funds

obligation 41,437 40,650 Client funds obligation 787,015

858,244 Total current liabilities 828,452

898,894 Long-term deferred revenue 38,964 34,481 Net long-term

debt, less current portion 33,479 28,711

Total long-term liabilities 72,443

63,192 Commitments and contingencies Stockholders' equity:

Common stock, $0.01 par value (100,000,000

shares authorized, 59,520,637 and 58,453,283 shares issued at June

30, 2017 and December 31, 2016, respectively; 57,938,217 and

57,331,022 shares outstanding at June 30, 2017 and December 31,

2016, respectively)

595 585 Additional paid-in capital 114,287 95,452 Retained earnings

110,283 70,448

Treasury stock, at cost (1,582,420 and

1,122,261 shares at June 30, 2017 and December 31, 2016,

respectively)

(80,117 ) (49,958 ) Total stockholders' equity

145,048 116,527 Total liabilities and

stockholders' equity $ 1,045,943 $ 1,078,613

Paycom Software, Inc. Consolidated Statements of

Income (in thousands, except per share and share

amounts) (unaudited) Three

Months Ended June 30, Six Months Ended June

30, 2017 2016

2017 2016

Revenues Recurring $ 96,351 $ 72,492 $ 214,265 $

161,396 Implementation and other 1,876 1,388

3,470 2,610 Total revenues

98,227 73,880 217,735

164,006

Cost of revenues Operating expenses

15,609 10,479 30,695 21,264 Depreciation and amortization

2,267 1,386 4,327 2,572

Total cost of revenues 17,876 11,865

35,022 23,836

Administrative

expenses Sales and marketing 34,070 24,766 70,918 53,428

Research and development 8,095 4,202 14,892 8,062 General and

administrative 26,657 15,220 44,483 30,426 Depreciation and

amortization 2,440 1,823 4,666

3,546 Total administrative expenses

71,262 46,011 134,959

95,462 Total operating expenses 89,138

57,876 169,981 119,298 Operating

income 9,089 16,004 47,754 44,708 Interest expense (281 ) (170 )

(538 ) (481 ) Other income, net 149 116

244 150 Income before income taxes

8,957 15,950 47,460 44,377 Provision for income taxes (5,264

) 5,529 7,625 15,368 Net

income $ 14,221 $ 10,421 $ 39,835 $ 29,009

Earnings per share, basic $ 0.24 $ 0.18 $ 0.69 $ 0.50

Earnings per share, diluted $ 0.24 $ 0.18 $ 0.67 $ 0.49

Weighted

average shares outstanding: Basic 57,898,914

57,591,556 57,623,107 57,362,232

Diluted 58,816,442 58,697,229

58,817,181 58,707,213

Paycom Software, Inc. Consolidated Statements of Cash

Flows (in thousands) (unaudited)

Six Months Ended June 30, 2017

2016 Cash flows from operating

activities Net income $ 39,835 $ 29,009 Adjustments to

reconcile net income to net cash provided by operating activities:

Depreciation and amortization 8,993 6,118 Amortization of debt

issuance costs 59 63 Net loss on disposition of property and

equipment — 3 Stock-based compensation expense 17,524 4,817

Deferred income taxes, net (6,760 ) (4,936 ) Changes in operating

assets and liabilities: Accounts receivable (464 ) (421 ) Prepaid

expenses (1,262 ) (605 ) Inventory 434 652 Deposits and other

assets (111 ) 350 Accounts payable (319 ) 2,619 Income taxes, net

(2,855 ) 12,114 Accrued commissions and bonuses (2,767 ) (5,635 )

Accrued payroll and vacation 1,088 3,640 Deferred revenue 5,293

4,675 Accrued expenses and other current liabilities (3,395

) 2,091 Net cash provided by operating activities

55,293 54,554

Cash flows from

investing activities Net change in funds held for clients

71,229 (337,611 ) Purchases of property and equipment

(21,909 ) (24,340 ) Net cash provided by (used in) investing

activities 49,320 (361,951 )

Cash flows

from financing activities Proceeds from issuance of long-term

debt 5,440 3,903 Repurchases of common stock (15,187 ) (3,490 )

Withholding taxes paid related to net share settlement (14,973 ) —

Principal payments on long-term debt (562 ) (448 ) Net change in

client funds obligation (71,229 ) 337,611 Payment of debt issuance

costs (143 ) — Net cash (used in) provided by

financing activities (96,654 ) 337,576

Increase in cash and cash equivalents 7,959 30,179

Cash and cash

equivalents Beginning of period 60,158

50,714 End of period $ 68,117 $ 80,893

Paycom Software, Inc. Reconciliation of GAAP to

non-GAAP Financial Measures (in thousands)

(unaudited) Three months ended June

30, Six months ended June 30, 2017

2016 2017

2016 Net income to

Adjusted EBITDA: Net income $ 14,221 $ 10,421 $ 39,835 $ 29,009

Interest expense 281 170 538 481 Provision for income taxes (5,264

) 5,529 7,625 15,368 Depreciation and amortization expense

4,707 3,209 8,993 6,118

EBITDA 13,945 19,329 56,991 50,976 Non-cash stock-based

compensation expense 13,839 3,269

17,527 4,622 Adjusted EBITDA $ 27,784

$ 22,598 $ 74,518 $ 55,598

Three months ended June 30, Six months ended June

30, 2017 2016

2017 2016 Net income to

non-GAAP net income: Net income $ 14,221 $ 10,421 $ 39,835 $

29,009 Non-cash stock-based compensation expense 13,839 3,269

17,527 4,622 Income tax effect on non-GAAP adjustments

(12,883 ) (1,258 ) (14,479 ) (1,762 ) Non-GAAP

net income $ 15,177 $ 12,432 $ 42,883 $ 31,869

Weighted average shares outstanding: Basic 57,898,914

57,591,556 57,623,107 57,362,232 Diluted 58,816,442 58,697,229

58,817,181 58,707,213 Earnings per share, basic $ 0.24 $ 0.18 $

0.69 $ 0.50 Earnings per share, diluted $ 0.24 $ 0.18 $ 0.67 $ 0.49

Non-GAAP net income per share, basic $ 0.26 $ 0.22 $ 0.74 $ 0.56

Non-GAAP net income per share, diluted $ 0.26 $ 0.21 $ 0.73 $ 0.54

Three months ended June 30, Six months

ended June 30, 2017 2016

2017 2016

Earnings per share to non-GAAP net income per share, basic:

Earnings per share, basic $ 0.24 $ 0.18 $ 0.69 $ 0.50 Non-cash

stock-based compensation expense 0.24 0.06 0.30 0.09 Income tax

effect on non-GAAP adjustment (0.22 ) (0.02 )

(0.25 ) (0.03 ) Non-GAAP net income per share, basic $ 0.26

$ 0.22 $ 0.74 $ 0.56

Three months ended June 30, Six months ended June 30,

2017 2016

2017 2016 Earnings per share

to non-GAAP net income per share, diluted: Earnings per share,

diluted $ 0.24 $ 0.18 $ 0.67 $ 0.49 Non-cash stock-based

compensation expense 0.24 0.05 0.30 0.08 Income tax effect on

non-GAAP adjustment (0.22 ) (0.02 ) (0.24 )

(0.03 ) Non-GAAP net income per share, diluted $ 0.26

$ 0.21 $ 0.73 $ 0.54

Three

months ended June 30, Six months ended June 30,

2017 2016 2017

2016 Adjusted gross profit:

Total revenues $ 98,227 $ 73,880 $ 217,735 $ 164,006 Less: Total

cost of revenues (17,876 ) (11,865 ) (35,022 )

(23,836 ) Total gross profit 80,351 62,015 182,713 140,170

Plus: Non-cash stock-based compensation expense 1,220

301 1,711 414 Total

adjusted gross profit $ 81,571 $ 62,316 $ 184,424 $ 140,584 Total

gross profit % 82 % 84 % 84 % 85 % Total adjusted gross profit % 83

% 84 % 85 % 86 %

Three months ended June 30,

Six months ended June 30, 2017

2016 2017 2016

Adjusted sales and marketing expenses: Sales and

marketing expenses $ 34,070 $ 24,766 $ 70,918 $ 53,428 Less:

Non-cash stock-based compensation expense (1,559 )

(792 ) (2,492 ) (1,069 ) Total adjusted sales and

marketing expenses $ 32,511 $ 23,974 $ 68,426

$ 52,359 Total revenues $ 98,227 $ 73,880 $ 217,735 $

164,006 Total adjusted sales and marketing expenses as a % of

revenues 33.1 % 32.4 % 31.4 % 31.9 %

Three months

ended June 30, Six months ended June 30,

2017 2016 2017

2016 Adjusted administrative

expenses: Administrative expenses $ 71,262 $ 46,011 $ 134,959 $

95,462 Less: Non-cash stock-based compensation expense

(12,619 ) (2,968 ) (15,816 ) (4,208 ) Total

adjusted administrative expenses $ 58,643 $ 43,043 $ 119,143 $

91,254 Total revenues $ 98,227 $ 73,880 $ 217,735 $ 164,006

Total adjusted administrative expenses as a % of revenues 59.7 %

58.3 % 54.7 % 55.6 %

Three months ended June

30, Six months ended June 30, 2017

2016 2017

2016 Adjusted research and development

expenses: Research and development expenses $ 8,095 $ 4,202 $

14,892 $ 8,062 Less: Non-cash stock-based compensation expense

(621 ) (131 ) (780 ) (180 ) Total

adjusted research and development expenses $ 7,474 $ 4,071 $ 14,112

$ 7,882 Total revenues $ 98,227 $ 73,880 $ 217,735 $ 164,006

Total adjusted research and development expenses as a % of revenues

7.6 % 5.5 % 6.5 % 4.8 %

Three months ended June

30, Six months ended June 30, 2017

2016 2017

2016 Total research and development costs:

Capitalized research and development costs $ 3,507 $ 1,961 $ 6,383

$ 3,707 Research and development expenses 8,095

4,202 14,892 8,062 Total

research and development costs $ 11,602 $ 6,163 $

21,275 $ 11,769 Total revenues $ 98,227 $

73,880 $ 217,735 $ 164,006 Total research and development costs as

a % of total revenues 11.8 % 8.3 % 9.8 % 7.2 %

Total

adjusted research and development costs: Total research and

development costs $ 11,602 $ 6,163 $ 21,275 $ 11,769 Less:

Capitalized non-cash stock-based compensation (968 ) (251 ) (1,317

) (361 ) Less: Non-cash stock-based compensation expense

(621 ) (131 ) (780 ) (180 ) Total adjusted

research and development costs $ 10,013 $ 5,781 $

19,178 $ 11,228 Total revenues $ 98,227 $

73,880 $ 217,735 $ 164,006 Total adjusted research and development

costs as a % of total revenues 10.2 % 7.8 % 8.8 % 6.8 %

Paycom Software, Inc. Breakout of Non-Cash

Stock-Based Compensation Expense (in thousands)

(unaudited)

Three months ended June 30, Six months ended June

30, 2017 2016 2017 2016 Non-cash

stock-based compensation expense: Operating expenses $ 1,220 $

301 $ 1,711 $ 414 Sales and marketing 1,559 792 2,492 1,069

Research and development 621 131 780 180 General and administrative

10,439 2,045 12,544 2,959 Total

non-cash stock-based compensation expense $ 13,839 $ 3,269 $ 17,527

$ 4,622

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170801006553/en/

Paycom Software, Inc.Media Contact:Kathy Oden-Hall,

800-580-4505CMOKathy.Oden-Hall@paycom.comorInvestor Relations

Contact:David Niederman, 855-603-1620investors@paycom.com

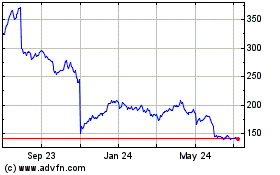

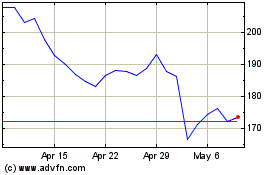

Paycom Software (NYSE:PAYC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Paycom Software (NYSE:PAYC)

Historical Stock Chart

From Apr 2023 to Apr 2024