Amended Statement of Beneficial Ownership (sc 13d/a)

July 27 2017 - 2:02PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 1)*

SPHERE 3D CORP.

(Name of Issuer)

COMMON SHARES, WITHOUT PAR VALUE

(Title of Class of Securities)

84841L100

(CUSIP Number)

ThreeD Capital Inc.

69 Yonge Street, Suite 1010

Toronto, ON, M5E 1K3

Telephone: (416) 941-8900

Attention: Gerry Feldman

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

Copies to:

Ralph W. Norton, Esq.

Davis & Gilbert LLP

1740 Broadway

New York, New York 10019

(212) 468-4800

July 19, 2017

(Date of Event which Requires Filing of

this Statement)

If the filing person has previously filed a statement on Schedule

13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§ 240.13d-1(e),

240.13d-1(f) or 240.13d-1(g), check the following box.

¨

NOTE: Schedules filed in paper format shall include a signed

original and five copies of the schedule, including all exhibits. See §§ 240.13d-7 for other parties to whom copies are

to be sent.

*The remainder of this cover page shall be filled out for a

reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment

containing information which would alter the disclosures provided in a prior cover page.

The information required on the remainder of this cover page

shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however,

see the Notes).

|

1

|

names of reporting persons

THREED CAPITAL INC.

|

|

2

|

check the appropriate

box if a member of a group (S

ee Instructions

)

(a)

¨

(b)

x

|

|

3

|

sec use only

|

|

4

|

source of funds (S

ee

Instructions

)

WC

|

|

5

|

check if disclosure of

legal proceedings

is required pursuant

to items

2(d) or 2(e)

|

|

6

|

citizenship or place

of organization

ONTARIO, CANADA

|

|

|

7

|

sole voting power

0

See Items 2 and 5)

|

|

number

of

shares

beneficially

owned

by

each

reporting

person

with

|

8

|

shared voting power

84,000

(See Items 2 and 5)

|

|

9

|

sole dispositive power

0

(See items 2and 5)

|

|

10

|

shared dispositive power

84,000

(See Items 2 and 5)

|

|

11

|

aggregate amount beneficially

owned by each reporting person

84,000

(See Items 2 and 5)

|

|

12

|

check if the aggregate

amount in row (11) excludes certain shares

|

|

13

|

percent of class represented

by amount in row (11)

1.4%

(See items 2 and 5)

|

|

14

|

type of reporting person

(S

ee Instructions

)

CO

|

|

1

|

names of reporting persons

SHELDON INWENTASH

|

|

2

|

check the appropriate

box if a member of a group (S

ee Instructions

)

(a)

¨

(b)

x

|

|

3

|

sec use only

|

|

4

|

source of funds (S

ee

Instructions

)

PF

|

|

5

|

check if disclosure of

legal proceedings

is required pursuant

to items

2(d) or 2(e)

|

|

6

|

citizenship or place

of organization

ONTARIO, CANADA

|

|

|

7

|

sole voting power

249,280

(See Items 2 and 5)

|

|

number

of

shares

beneficially

owned

by

each

reporting

person

with

|

8

|

shared voting power

84,000

(See Items 2 and 5)

|

|

9

|

sole dispositive power

249,280

(See items 2and 5)

|

|

10

|

shared dispositive power

84,000

(See Items 5)

|

|

11

|

aggregate amount beneficially

owned by each reporting person

333,280

(See Items 2 and 5)

|

|

12

|

check if the aggregate

amount in row (11) excludes certain shares

|

|

13

|

percent of class represented

by amount in row (11)

5.7%

(See items 2 and 5)

|

|

14

|

type of reporting person

(S

ee Instructions

)

IN

|

|

1

|

names of reporting persons

LYNN

FACTOR

|

|

2

|

check the appropriate

box if a member of a group (S

ee Instructions

)

(a)

¨

(b)

x

|

|

3

|

sec use only

|

|

4

|

source of funds (S

ee

Instructions

)

PF

|

|

5

|

check if disclosure of

legal proceedings

is required pursuant

to items

2(d) or 2(e)

|

|

6

|

citizenship or place

of organization

ONTARIO, CANADA

|

|

|

7

|

sole voting power

441,780

(See Items 2 and 5)

|

|

number

of

shares

beneficially

owned

by

each

reporting

person

with

|

8

|

shared voting power

0

(See Items 2 and 5)

|

|

9

|

sole dispositive power

441,780

(See items 2and 5)

|

|

10

|

shared dispositive power

0

(See Items 2 and 5)

|

|

11

|

aggregate amount beneficially

owned by each reporting person

441,780

(See Items 2 and 5)

|

|

12

|

check if the aggregate

amount in row (11) excludes certain shares

|

|

13

|

percent of class represented

by amount in row (11)

7.5%

(See items 2 and 5)

|

|

14

|

type of reporting person

(S

ee Instructions

)

IN

|

This Amendment No. 1 (this “Amendment”) amends the

Statement on Schedule 13D filed on February 22, 2017 (the “Schedule 13D”), by ThreeD Capital Inc., Sheldon Inwentash

and Lynn Factor. All capitalized terms used but not defined herein shall have the meanings assigned to them in the Schedule 13D.

Except as provided herein the Schedule 13D is unmodified.

Item 2. Identity and Background.

|

|

(f)

|

Each of ThreeD, Inwentash and Factor is a Canadian citizen. The name, citizenship, business address,

principal business occupation or employment of each of the directors and executive officers of ThreeD are set forth on

Annex

A

hereto.

|

Item 5. Interest in Securities of the Issuer.

|

|

(a)

|

Amount and percentage

of class beneficially owned:

|

On

July 11, 2017, the Company amended the Warrants and certain other outstanding warrants so that the Company could elect, in its

sole discretion, to acquire no fewer than all of the Warrants and such other warrants in exchange for the Common Shares represented

by the Warrants and such other warrants. On July 19, 2017, the Company notified ThreeD, Inwentash and Factor that it intended to

exchange the Warrants (and certain other outstanding warrants) for Common Shares, with such exchange to be automatically effective

three business days following the date of such notice (the “Warrant Exchange”). Concurrent with the amendment to the

Warrants and effective as of July 12, 2107, the Company effected a share consolidation of its Common Shares on 1-for-25 basis.

The

Company has disclosed in a registration statement on Form F-3 filed on July 20, 2017, that there would be a total of 5,823,660

Common Shares outstanding following completion of the Consolidation and the Warrant Exchange.

As

of July 19, 2017, ThreeD was deemed to beneficially own an aggregate of 84,000 Common Shares, representing approximately 1.4% of

the number of Common Shares outstanding.

As

of July 19, 2017, Inwentash was deemed to beneficially own an aggregate of 333,280 Common Shares, representing approximately 5.7%

of the Common Shares outstanding. These Common Shares include 324,480 outstanding Common Shares (of which 84,000 Common Shares

are held by ThreeD), and warrants to purchase 8,800 Common Shares at $62.50 per Common Share expiring on December 15, 2020.

As

of July 19, 2017, Factor was deemed to beneficially own an aggregate of 441,780 Common Shares, representing approximately 7.5%

of the Common Shares outstanding. These Common Shares include 399,000 outstanding Common Shares and warrants to purchase a total

of 42,780 Common Shares at prices ranging from $58.25 to $100.00 per Common Share and expiring between May 21, 2020 and December

15, 2020.

By

virtue of his position as Chief Executive Officer of ThreeD, Inwentash may be deemed to have shared power to direct the vote and

to direct the disposition of the Common Shares owned by ThreeD. By virtue of his marriage to Factor, Inwentash may be deemed to

have shared power to vote or dispose of the Common Shares owned by Factor and the Common Shares underlying the warrants owned by

Factor (collectively, the “

Factor Shares

”). However, Inwentash does not have such power and therefore disclaims

beneficial ownership of the Factor Shares. By virtue of her marriage to Inwentash, Factor may be deemed to have shared power to

vote or dispose of the Common Shares owned by Inwentash and the Common Shares issuable upon exercise of the warrants owned by Inwentash

(collectively, the “

Inwentash Shares

”). However, Factor does not have such power and therefore disclaims beneficial

ownership of the Inwentash Shares.

|

|

(b)

|

Number of Common Shares as to which such Reporting Person has

|

(i) Sole power to vote or to

direct the vote:

|

ThreeD:

|

|

|

0

|

|

|

Inwentash:

|

|

|

249,280

|

|

|

Factor:

|

|

|

441,780

|

|

(ii) Shared power to vote or

to direct the vote:

|

ThreeD:

|

|

|

84,000

|

|

|

Inwentash:

|

|

|

84,000

|

|

|

Factor:

|

|

|

0

|

|

(iii) Sole power to dispose

or to direct the disposition of:

|

ThreeD:

|

|

|

0

|

|

|

Inwentash:

|

|

|

249,280

|

|

|

Factor:

|

|

|

441,780

|

|

(iv) Shared power to dispose

or to direct the disposition of:

|

ThreeD:

|

|

|

84,000

|

|

|

Inwentash:

|

|

|

84,000

|

|

|

Factor:

|

|

|

0

|

|

Item 7. Material to be Filed as Exhibits.

|

|

1.

|

Joint Filing Agreement among ThreeD Capital Inc., Sheldon Inwentash and Lynn Factor dated as of February 22, 2017 (filed with

Schedule 13D on February 22, 2017).

|

|

|

2.

|

Form of amended Warrants (incorporated herein by reference to Exhibit 99.2 to the Company’s Form 6-K filed on July 20,

2017).

|

After reasonable inquiry and to the best

of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: July 27, 2017

|

|

THREED CAPITAL INC.

|

|

|

|

|

|

By:

|

/s/ Sheldon Inwentash

|

|

|

|

Name: Sheldon Inwentash

|

|

|

|

Title: Chief Executive Officer

|

|

|

/s/ Sheldon Inwentash

|

|

|

Sheldon Inwentash

|

|

|

|

|

|

/s/ Lynn Factor

|

|

|

Lynn Factor

|

Annex A

Executive Officers and Directors

|

Name and Citizenship

|

|

Principal Occupation or Employment and Business Address

|

|

|

|

|

|

Sheldon Inwentash

Canadian citizen

|

|

Chief Executive Officer and Director

ThreeD Capital Inc.

69 Yonge Street, Suite 1010

Toronto, Ontario M5E 1K3

|

|

|

|

|

|

Gerry Feldman

Canadian citizen

|

|

Chief Financial Officer and Corporate Secretary

ThreeD Capital Inc.

69 Yonge Street, Suite 1010

Toronto, Ontario M5E 1K3

|

|

|

|

|

|

Warrant Goldberg

|

|

Director

|

|

Canadian citizen

|

|

Partner in DNTW Toronto LLP

45 Sheppard Ave E. #703

North York, Ontario M2N 5W9

|

|

|

|

|

|

Allen Lone

Canadian citizen

|

|

Director

Chief Executive Officer of Augusta Capital Inc.

2455 Cawthra Road, Suite 75

Mississauga, Ontario L5A 3P1

|

|

|

|

|

|

Roger Rai

Canadian citizen

|

|

Director

Managing Director of R3 Concepts Inc.

333 Bay Street

Toronto, Ontario M5H 2R2

|

|

|

|

|

|

Daniel N. Bloch

Canadian citizen

|

|

Vice President of Business Development and General Counsel

ThreeD Capital Inc.

69 Yonge Street, Suite 1010

Toronto, Ontario M5E 1K3

|

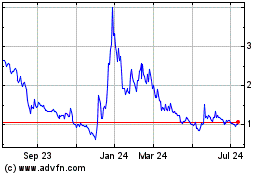

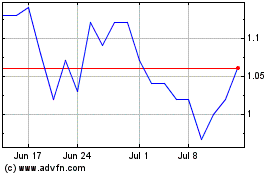

Sphere 3D (NASDAQ:ANY)

Historical Stock Chart

From Aug 2024 to Sep 2024

Sphere 3D (NASDAQ:ANY)

Historical Stock Chart

From Sep 2023 to Sep 2024