Lloyds Banking Half-Year Profit Narrows on Compensation Charges

July 27 2017 - 2:59AM

Dow Jones News

By Max Colchester

Lloyds Banking Group PLC said Thursday half-year profits

narrowed, pinched by a 1 billion pounds ($1.3 billion) of charges

to compensate customers.

The U.K. retail bank said that it made a half-year net profit of

GBP1.3 billion compared to GBP1.59 billion a year ago. Total income

rose to GBP9.3 billion from GBP8.3 billion a year ago.

The bank said that the U.K. economy continued to be "resilient"

in the wake of the Brexit vote.

The bank said it was putting aside GBP700 million in extra

provisions to cover future payouts to customers sold insurance

products they didn't need. The provision came after a U.K.

regulator extended a deadline for claims until August 2019.

Lloyds also said it was putting in place a system to compensate

customers who were overcharged when they fell behind on mortgage

payments. It estimates this will cost GBP340 million.

Despite these charges the board recommended a dividend of 1

pence per share.

Earlier in the month, Chief Executive Antonio Horta-Osorio

outlined a management shake-up at the bank, signalling his

intention to stay at Lloyds to implement the next leg of its

strategic plan. The bank will outline its next plan in February,

following years of reshaping after its taxpayer bailout in 2009.

Earlier this year the government finally shed the remnants of its

investment in the bank.

Write to Max Colchester at max.colchester@wsj.com

(END) Dow Jones Newswires

July 27, 2017 02:44 ET (06:44 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

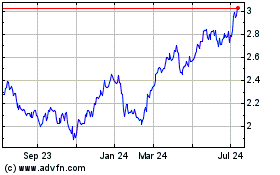

Lloyds Banking (NYSE:LYG)

Historical Stock Chart

From Aug 2024 to Sep 2024

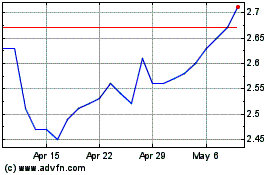

Lloyds Banking (NYSE:LYG)

Historical Stock Chart

From Sep 2023 to Sep 2024