VCA Inc. (NASDAQ:WOOF), a leading animal

healthcare company in the United States and Canada, today reported

financial results for the second quarter ended June 30, 2017, as

follows: revenue increased 13.7% to a second quarter record of

$743.1 million; gross profit increased 12.9% to $185.1 million;

operating income increased 7.8% to $125.1 million; net income

increased 5.7% to $67.7 million; and diluted earnings per common

share increased 5.1% to $0.82. Excluding transaction expenses

related to the proposed acquisition of VCA by Mars, Incorporated

(“Mars”), and acquisition-related amortization expense, our results

for this quarter are as follows: Non-GAAP operating income

increased 11.8% to $140.9 million; Non-GAAP net income increased

11.0% to $78.6 million; and Non-GAAP diluted earnings per common

share increased 10.3% to $0.96. Our results for the prior-year

quarter included transaction expenses related to the acquisition of

Companion Animal Practices, North America (“CAPNA”) and debt

retirement costs, detailed in the supplemental schedules of this

press release.

We also reported our financial results for the six months ended

June 30, 2017 as follows: revenue increased 16.8% to $1.4 billion;

gross profit increased 12.9% to $339.6 million; operating income

increased 9.3% to $220.9 million; net income increased 7.7% to

$118.8 million; and diluted earnings per common share increased

7.4% to $1.45. Excluding acquisition-related amortization expense,

transaction expenses related to the proposed acquisition of VCA by

Mars, our financial results for the six months ended June 30, 2017,

on a Non-GAAP basis, are as follows: gross profit increased 13.7%

to $359.3 million; operating income increased 13.7% to $251.5

million; net income increased 12.1% to $139.5 million; and Non-GAAP

diluted earnings per common share increased 11.1% to $1.70.

Bob Antin, Chairman and CEO, stated, “We had a good quarter

highlighted by 10.3% growth in our adjusted diluted earnings per

common share. We continue to experience organic revenue

growth and increasing gross margins in both our core Animal

Hospital and Laboratory businesses.” Bob Antin added, “On a

personal basis, it’s been a great pleasure to have achieved such

excellent growth over the past 30 years, while at the same time

working alongside many great people, including my two co-founders,

Art Antin and Neil Tauber, as well as Tom Fuller, our chief

financial officer, and Todd Tams, our chief medical officer, who

have been with VCA since the beginning. In addition to

providing consistent growth and returns to our shareholders, VCA

has established itself as a leading provider of petcare, with an

incredible group of people that have dedicated themselves to

creating a better world for pets.

“Animal Hospital revenue in the second quarter increased 16.4%,

to $628.8 million, driven by acquisitions made during the past 12

months and same-store revenue growth of 5.2%. Our same-store

gross profit margin increased 80 basis points to 18.6%, and our

total gross margin increased 40 basis points to 17.9%. Excluding

acquisition-related amortization expense, both our Non-GAAP

same-store gross profit margin and Non-GAAP Animal Hospital total

gross profit margin increased 40 basis points to 19.4%. During the

second quarter, we acquired nine independent animal hospitals which

had historical combined annual revenue of $26.7 million.

“Our Laboratory internal revenue in the second quarter increased

4.6% to $117.2 million; laboratory gross profit margin increased 10

basis points to 54.1% and operating margin increased 20 basis

points to 45.6%. Excluding acquisition-related amortization

expense, Non-GAAP Laboratory gross profit increased 10 basis points

to 54.5%; and Non-GAAP Laboratory operating margin increased 10

basis points to 45.9%.”

Non-GAAP Financial Measures

We believe investors’ understanding of our total performance is

enhanced by disclosing Non-GAAP financial measures including

Non-GAAP net income, Non-GAAP gross profit, Non-GAAP operating

income and Non-GAAP diluted earnings per common share. We define

these adjusted measures as the reported amounts, adjusted to

exclude certain significant items and amortization of intangibles

acquired in acquisitions.

Management believes these adjusted measures are useful to

management and investors in evaluating the Company's operational

performance and their use provides an additional tool for

evaluating the Company's operating results and trends. As a

result, these Non-GAAP financial measures help to provide

meaningful comparisons of our overall performance from one

reporting period to another and meaningful assessments of related

trends.

There is a material limitation associated with the use of these

Non-GAAP financial measures: our adjusted measures exclude the

impact of these significant items, and as a result, our computation

of adjusted diluted earnings per common share does not depict

diluted earnings per common share in accordance with GAAP.

To compensate for the limitations in the Non-GAAP financial

measures discussed above, our disclosures provide a complete

understanding of all adjustments found in Non-GAAP financial

measures, and we reconcile the Non-GAAP financial measures to the

GAAP financial measures in the attached financial schedules titled

“Supplemental Operating Data.”

Forward-Looking Statements

We have included herein statements that constitute

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. We generally identify

forward-looking statements in this document using words like

“believe,” “intend,” “expect,” “estimate,” “may,” “plan,” “should,”

“could,” “forecast,” “looking ahead,” “possible,” “will,”

“project,” “contemplate,” “anticipate,” “predict,” “potential,”

“continue,” or similar expressions. You may find some of these

statements below and elsewhere in this document. These

forward-looking statements are not historical facts and are

inherently uncertain and outside of our control. Any or all of our

forward-looking statements in this document may turn out to be

incorrect. They can be affected by inaccurate assumptions we might

make, or by known or unknown risks and uncertainties. Many factors

mentioned in our discussion in this document will be important in

determining future results. Consequently, no forward-looking

statement can be guaranteed. Actual future results may vary

materially. Many factors could cause actual future events to differ

materially from the forward-looking statements in this document,

including but not limited to: (i) the risk that the proposed

transaction with Mars may not be completed in a timely manner or at

all, which may adversely affect the Company’s business and the

price of the common stock of the Company; (ii) the failure to

satisfy or obtain waivers of the conditions to the consummation of

the proposed transaction with Mars, including the receipt of

certain governmental and regulatory approvals; (iii) the

occurrence of any event, change or other circumstances that could

give rise to the termination of the proposed transaction with Mars;

(iv) the effect of the announcement or pendency of the

proposed transaction on the Company’s business relationships,

operating results and business generally; (v) risks that the

proposed transaction disrupts current plans and operations of the

Company, including the risk of adverse reactions or changes to

business relationships with customers, suppliers and other business

partners of the Company; (vi) potential difficulties in the

hiring or retention of employees of the Company as a result of the

proposed transaction; (vii) risks related to diverting

management’s attention from the Company’s ongoing business

operations; (viii) potential litigation relating to the

proposed transaction with Mars; (ix) unexpected costs, charges

or expenses resulting from the proposed transaction;

(x) competitive responses to the proposed transaction; and

(xi) legislative, regulatory and economic developments. The

foregoing list of factors is not exclusive. Additional risks and

uncertainties that could affect the Company’s financial and

operating results are included under the captions “Risk Factors”

and “Management’s Discussion and Analysis of Financial Condition

and Results of Operations” and elsewhere in the Company’s most

recent Annual Report on Form 10-K for the year ended December 31,

2016 filed with the Securities and Exchange Commission (the “SEC”)

on February 28, 2017, and the Company’s more recent reports filed

with the SEC. The Company can give no assurance that the conditions

to the proposed transaction will be satisfied, or that it will

close within the anticipated time period. Investors and security

holders are cautioned not to place undue reliance on these

forward-looking statements, which speak only as of the date on

which statements were made. Except as required by applicable law,

the Company undertakes no obligation to revise or update any

forward-looking statement, or to make any other forward-looking

statements, whether as a result of new information, future events

or otherwise.

About VCA Inc.

We own, operate and manage the largest networks of freestanding

veterinary hospitals and veterinary-exclusive clinical laboratories

in the country. We also supply diagnostic imaging equipment to the

veterinary industry.

| VCA Inc. |

| Condensed, Consolidated Income

Statements |

| (Unaudited) |

| (In thousands, except per share

amounts) |

| |

| |

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

|

2017 |

|

2016 |

|

2017 |

|

2016 |

| Revenue: |

|

|

|

|

|

|

|

|

| Animal

hospital |

|

$ |

628,798 |

|

|

$ |

540,376 |

|

|

$ |

1,196,979 |

|

|

$ |

998,999 |

|

|

Laboratory |

|

117,201 |

|

|

112,060 |

|

|

228,349 |

|

|

218,787 |

|

| All

other |

|

22,533 |

|

|

23,397 |

|

|

45,102 |

|

|

42,810 |

|

|

Intercompany |

|

(25,400 |

) |

|

(22,344 |

) |

|

(49,047 |

) |

|

(43,668 |

) |

| |

|

743,132 |

|

|

653,489 |

|

|

1,421,383 |

|

|

1,216,928 |

|

| |

|

|

|

|

|

|

|

|

| Direct costs |

|

558,039 |

|

|

489,541 |

|

|

1,081,822 |

|

|

916,200 |

|

| |

|

|

|

|

|

|

|

|

| Gross profit: |

|

|

|

|

|

|

|

|

| Animal

hospital |

|

112,559 |

|

|

94,679 |

|

|

198,869 |

|

|

168,096 |

|

|

Laboratory |

|

63,424 |

|

|

60,547 |

|

|

123,017 |

|

|

117,263 |

|

| All

other |

|

9,356 |

|

|

8,917 |

|

|

18,042 |

|

|

15,827 |

|

|

Intercompany |

|

(246 |

) |

|

(195 |

) |

|

(367 |

) |

|

(458 |

) |

| |

|

185,093 |

|

|

163,948 |

|

|

339,561 |

|

|

300,728 |

|

| |

|

|

|

|

|

|

|

|

| Selling, general and

administrative expense: |

|

|

|

|

|

|

|

|

| Animal

hospital |

|

16,745 |

|

|

14,277 |

|

|

34,356 |

|

|

26,362 |

|

|

Laboratory |

|

9,975 |

|

|

9,702 |

|

|

19,881 |

|

|

19,998 |

|

| All

other |

|

7,512 |

|

|

6,022 |

|

|

14,152 |

|

|

11,321 |

|

|

Corporate |

|

25,544 |

|

|

18,189 |

|

|

49,788 |

|

|

40,637 |

|

| |

|

59,776 |

|

|

48,190 |

|

|

118,177 |

|

|

98,318 |

|

| |

|

|

|

|

|

|

|

|

| Net loss (gain) on sale

or disposal of assets |

|

230 |

|

|

(271 |

) |

|

480 |

|

|

292 |

|

| Operating income |

|

125,087 |

|

|

116,029 |

|

|

220,904 |

|

|

202,118 |

|

| Interest expense,

net |

|

10,169 |

|

|

7,867 |

|

|

19,196 |

|

|

14,962 |

|

| Debt retirement

costs |

|

— |

|

|

1,600 |

|

|

— |

|

|

1,600 |

|

| Other income |

|

(280 |

) |

|

(600 |

) |

|

(582 |

) |

|

(864 |

) |

| Income before provision

for income taxes |

|

115,198 |

|

|

107,162 |

|

|

202,290 |

|

|

186,420 |

|

| Provision for income

taxes |

|

44,774 |

|

|

40,736 |

|

|

79,413 |

|

|

72,272 |

|

| Net income |

|

70,424 |

|

|

66,426 |

|

|

122,877 |

|

|

114,148 |

|

| Net income attributable

to noncontrolling interests |

|

2,712 |

|

|

2,376 |

|

|

4,072 |

|

|

3,871 |

|

| Net income attributable

to VCA Inc. |

|

$ |

67,712 |

|

|

$ |

64,050 |

|

|

$ |

118,805 |

|

|

$ |

110,277 |

|

| |

|

|

|

|

|

|

|

|

| Diluted earnings per

share |

|

$ |

0.82 |

|

|

$ |

0.78 |

|

|

$ |

1.45 |

|

|

$ |

1.35 |

|

| |

|

|

|

|

|

|

|

|

| Weighted-average shares

outstanding for diluted earnings per share |

|

82,228 |

|

|

81,729 |

|

|

82,204 |

|

|

81,630 |

|

| VCA Inc. |

| Condensed, Consolidated Balance

Sheets |

| (Unaudited) |

| (In thousands) |

| |

| |

|

June 30, 2017 |

|

December 31, 2016 |

|

Assets |

|

|

|

|

| Current assets: |

|

|

|

|

| Cash and

cash equivalents |

|

$ |

119,052 |

|

|

$ |

81,409 |

|

| Trade

accounts receivable, net |

|

86,323 |

|

|

85,593 |

|

|

Inventory |

|

56,541 |

|

|

57,590 |

|

| Prepaid

expenses and other |

|

42,721 |

|

|

44,752 |

|

| Prepaid

income taxes |

|

— |

|

|

11,705 |

|

| Total

current assets |

|

304,637 |

|

|

281,049 |

|

| Property and equipment,

net |

|

656,362 |

|

|

613,224 |

|

| Other assets: |

|

|

|

|

|

Goodwill |

|

2,264,265 |

|

|

2,164,422 |

|

| Other

intangible assets, net |

|

207,158 |

|

|

212,577 |

|

| Notes

receivable |

|

2,196 |

|

|

2,147 |

|

|

Other |

|

103,107 |

|

|

99,909 |

|

| Total

assets |

|

$ |

3,537,725 |

|

|

$ |

3,373,328 |

|

|

Liabilities and Equity |

|

|

|

|

| Current

liabilities: |

|

|

|

|

| Current

portion of long-term obligations |

|

$ |

49,347 |

|

|

$ |

38,320 |

|

| Accounts

payable |

|

57,231 |

|

|

68,587 |

|

| Accrued

payroll and related liabilities |

|

96,072 |

|

|

97,806 |

|

| Income

tax payable |

|

4,732 |

|

|

— |

|

| Other

accrued liabilities |

|

93,053 |

|

|

91,783 |

|

| Total

current liabilities |

|

300,435 |

|

|

296,496 |

|

| Long-term obligations,

net |

|

1,325,411 |

|

|

1,309,397 |

|

| Deferred income taxes,

net |

|

148,368 |

|

|

142,535 |

|

| Other liabilities |

|

47,472 |

|

|

44,560 |

|

| Total

liabilities |

|

1,821,686 |

|

|

1,792,988 |

|

| Redeemable

noncontrolling interests |

|

10,558 |

|

|

11,615 |

|

| VCA Inc. stockholders’

equity: |

|

|

|

|

| Common

stock |

|

81 |

|

|

81 |

|

|

Additional paid-in capital |

|

40,985 |

|

|

32,157 |

|

| Retained

earnings |

|

1,603,196 |

|

|

1,484,391 |

|

|

Accumulated other comprehensive loss |

|

(37,075 |

) |

|

(45,406 |

) |

| Total VCA

Inc. stockholders’ equity |

|

1,607,187 |

|

|

1,471,223 |

|

| Noncontrolling

interests |

|

98,294 |

|

|

97,502 |

|

| Total

equity |

|

1,705,481 |

|

|

1,568,725 |

|

| Total

liabilities and equity |

|

$ |

3,537,725 |

|

|

$ |

3,373,328 |

|

| VCA Inc. |

| Condensed, Consolidated Statements of Cash

Flows |

| (Unaudited) |

| (In thousands) |

| |

| |

|

Six Months Ended June 30, |

| |

|

2017 |

|

2016 |

| Cash flows from

operating activities: |

|

|

|

|

| Net

income |

|

$ |

122,877 |

|

|

$ |

114,148 |

|

|

Adjustments to reconcile net income to net cash provided by

operating activities: |

|

|

|

|

|

Depreciation and amortization |

|

60,920 |

|

|

46,978 |

|

|

Amortization of debt issue costs |

|

767 |

|

|

865 |

|

| Provision

for uncollectible accounts |

|

4,319 |

|

|

2,891 |

|

| Debt

retirement costs |

|

— |

|

|

1,600 |

|

| Net loss

on sale or disposal of assets |

|

480 |

|

|

292 |

|

|

Share-based compensation |

|

7,993 |

|

|

9,104 |

|

| Excess

tax benefits from share-based compensation |

|

— |

|

|

(1,421 |

) |

|

Other |

|

(1,332 |

) |

|

6,665 |

|

| Changes

in operating assets and liabilities: |

|

|

|

|

| Trade

accounts receivable |

|

(5,318 |

) |

|

(7,065 |

) |

|

Inventory, prepaid expense and other assets |

|

1,287 |

|

|

(15,607 |

) |

| Accounts

payable and other accrued liabilities |

|

8,777 |

|

|

5,889 |

|

| Accrued

payroll and related liabilities |

|

(1,936 |

) |

|

2,817 |

|

| Income

taxes |

|

16,449 |

|

|

23,557 |

|

| Net cash

provided by operating activities |

|

215,283 |

|

|

190,713 |

|

| Cash flows from

investing activities: |

|

|

|

|

| Business

acquisitions, net of cash acquired |

|

(123,852 |

) |

|

(540,878 |

) |

| Property

and equipment additions |

|

(54,638 |

) |

|

(58,814 |

) |

| Proceeds

from sale of assets |

|

1,747 |

|

|

282 |

|

|

Other |

|

(7,900 |

) |

|

(4,924 |

) |

| Net cash

used in investing activities |

|

(184,643 |

) |

|

(604,334 |

) |

| Cash flows from

financing activities: |

|

|

|

|

| Repayment

of long-term obligations |

|

(58,259 |

) |

|

(1,256,250 |

) |

| Proceeds

from issuance of long-term obligations |

|

— |

|

|

1,255,000 |

|

| Proceeds

from revolving credit facility |

|

70,000 |

|

|

435,000 |

|

| Payment

of financing costs |

|

— |

|

|

(3,829 |

) |

|

Distributions to noncontrolling interest partners |

|

(2,333 |

) |

|

(2,554 |

) |

| Proceeds

from formation of noncontrolling interests |

|

335 |

|

|

— |

|

| Purchase

of noncontrolling interests |

|

(1,401 |

) |

|

(3,730 |

) |

| Proceeds

from issuance of common stock under stock incentive plans |

|

90 |

|

|

1,122 |

|

| Excess

tax benefits from share-based compensation |

|

— |

|

|

1,421 |

|

| Stock

repurchases |

|

(129 |

) |

|

(843 |

) |

|

Other |

|

(1,479 |

) |

|

(1,233 |

) |

| Net cash

provided by financing activities |

|

6,824 |

|

|

424,104 |

|

| Effect of currency

exchange rate changes on cash and cash equivalents |

|

179 |

|

|

313 |

|

| Increase in cash and

cash equivalents |

|

37,643 |

|

|

10,796 |

|

| Cash and cash

equivalents at beginning of period |

|

81,409 |

|

|

98,888 |

|

| Cash and cash

equivalents at end of period |

|

$ |

119,052 |

|

|

$ |

109,684 |

|

| VCA Inc. |

| Supplemental Operating Data |

| (Unaudited - In thousands, except per share

amounts) |

|

|

| Table

#1 |

|

|

|

|

|

|

|

|

| Reconciliation

of net income attributable to |

|

Three Months Ended June

30, |

|

Six Months Ended June

30, |

|

VCA Inc., to Non-GAAP net income attributable |

|

|

|

to VCA Inc. (1) |

|

2017 |

|

|

2016 |

|

|

2017 |

|

|

2016 |

|

| |

|

|

|

|

|

|

|

|

| Net income attributable

to VCA Inc. |

|

$ |

67,712 |

|

|

$ |

64,050 |

|

|

$ |

118,805 |

|

|

$ |

110,277 |

|

|

Adjustments to other long-term liabilities, net of tax (2) |

|

— |

|

|

— |

|

|

— |

|

|

2,040 |

|

| Discrete

tax items (3) |

|

— |

|

|

— |

|

|

— |

|

|

1,045 |

|

|

Transaction costs related to the CAPNA acquisition, net of tax

(4) |

|

— |

|

|

141 |

|

|

— |

|

|

728 |

|

| Debt

retirement costs, net of tax (5) |

|

— |

|

|

974 |

|

|

— |

|

|

974 |

|

|

Transaction costs related to the Mars transaction (6) |

|

4,468 |

|

|

— |

|

|

7,851 |

|

|

— |

|

|

Acquisitions related amortization, net of tax (1) |

|

6,411 |

|

|

5,628 |

|

|

12,876 |

|

|

9,419 |

|

| |

|

|

|

|

|

|

|

|

| Non-GAAP net income

attributable to VCA Inc. |

|

$ |

78,591 |

|

|

$ |

70,793 |

|

|

$ |

139,532 |

|

|

$ |

124,483 |

|

| |

|

|

|

|

|

|

|

|

| Table

#2 |

|

Three Months Ended June

30, |

|

Six Months Ended June

30, |

| Reconciliation

of diluted earnings per share to |

|

|

|

Non-GAAP diluted earnings per share (1) |

|

2017 |

|

|

2016 |

|

|

2017 |

|

|

2016 |

|

| |

|

|

|

|

|

|

|

|

| Diluted earnings per

share |

|

$ |

0.82 |

|

|

$ |

0.78 |

|

|

$ |

1.45 |

|

|

$ |

1.35 |

|

|

Adjustments to other long-term liabilities, net of tax (2) |

|

— |

|

|

— |

|

|

— |

|

|

0.02 |

|

| Discrete

tax items (3) |

|

— |

|

|

— |

|

|

— |

|

|

0.01 |

|

|

Transaction costs related to the CAPNA acquisition, net of tax

(4) |

|

— |

|

|

— |

|

|

— |

|

|

0.01 |

|

| Debt

retirement costs, net of tax (5) |

|

— |

|

|

0.01 |

|

|

— |

|

|

0.01 |

|

|

Transaction costs related to the Mars transaction (6) |

|

0.05 |

|

|

— |

|

|

0.10 |

|

|

— |

|

|

Acquisitions related amortization, net of tax (1) |

|

0.08 |

|

|

0.07 |

|

|

0.16 |

|

|

0.12 |

|

| Non-GAAP diluted

earnings per share (7) |

|

$ |

0.96 |

|

|

$ |

0.87 |

|

|

$ |

1.70 |

|

|

$ |

1.53 |

|

| |

|

|

|

|

|

|

|

|

| Shares used for

computing diluted earnings per share |

|

82,228 |

|

|

81,729 |

|

|

82,204 |

|

|

81,630 |

|

| |

|

|

|

|

|

|

|

|

| Table

#3 |

|

Three Months Ended June

30, |

|

Six Months Ended June

30, |

| Reconciliation

of consolidated gross profit to |

|

|

|

Non-GAAP consolidated gross profit (1) |

|

2017 |

|

|

2016 |

|

|

2017 |

|

|

2016 |

|

| |

|

|

|

|

|

|

|

|

| Consolidated gross

profit |

|

$ |

185,093 |

|

|

$ |

163,948 |

|

|

$ |

339,561 |

|

|

$ |

300,728 |

|

|

Acquisitions related amortization (1) |

|

9,606 |

|

|

9,187 |

|

|

19,757 |

|

|

15,415 |

|

| Non-GAAP consolidated

gross profit |

|

$ |

194,699 |

|

|

$ |

173,135 |

|

|

$ |

359,318 |

|

|

$ |

316,143 |

|

| Non-GAAP consolidated

gross profit margin |

|

26.2 |

% |

|

26.5 |

% |

|

25.3 |

% |

|

26.0 |

% |

| |

|

|

|

|

|

|

|

|

| VCA Inc. |

| Supplemental Operating Data

(cont) |

| (Unaudited - In thousands, except per share

amounts) |

|

|

| Table

#4 |

|

Three Months Ended June

30, |

|

Six Months Ended June

30, |

| Reconciliation

of consolidated operating income to |

|

|

|

Non-GAAP consolidated operating income (1) |

|

2017 |

|

|

2016 |

|

|

2017 |

|

|

2016 |

|

| |

|

|

|

|

|

|

|

|

| Consolidated operating

income |

|

$ |

125,087 |

|

|

$ |

116,029 |

|

|

$ |

220,904 |

|

|

$ |

202,118 |

|

|

Adjustments to other long-term liabilities (2) |

|

— |

|

|

— |

|

|

— |

|

|

1,954 |

|

|

Transaction costs related to the CAPNA acquisition (4) |

|

— |

|

|

231 |

|

|

— |

|

|

1,197 |

|

|

Transaction costs related to the Mars transaction (6) |

|

4,468 |

|

|

— |

|

|

7,851 |

|

|

— |

|

|

Acquisitions related amortization (1) |

|

11,338 |

|

|

9,799 |

|

|

22,763 |

|

|

16,027 |

|

| Non-GAAP consolidated

operating income |

|

$ |

140,893 |

|

|

$ |

126,059 |

|

|

$ |

251,518 |

|

|

$ |

221,296 |

|

| Non-GAAP consolidated

operating margin |

|

19.0 |

% |

|

19.3 |

% |

|

17.7 |

% |

|

18.2 |

% |

| |

|

|

|

|

|

|

|

|

_______________________________________________

(1) Management believes that investors'

understanding of our performance is enhanced by disclosing adjusted

measures as the reported amounts, adjusted to exclude certain

significant items and acquisition-related amortization. Non-GAAP

net income, Non-GAAP diluted earnings per common share, Non-GAAP

consolidated gross profit and Non-GAAP consolidated operating

income measures are not, and should not be viewed as substitutes

for U.S. generally accepted accounting principles (GAAP) net

income, its components and diluted earnings per share.

(2) In the first quarter of 2016, we

recorded a non-cash charge to adjust certain long-term liabilities

for $3.4 million, or $2.0 million net of tax. $2.0 million of this

amount relates to compensation and $1.4 million relates to interest

accretion.

(3) In the first quarter of 2016, we

recorded a tax adjustment to our income tax liabilities for $1.0

million.

(4) As of the second quarter of 2016, we

have recorded transaction costs of $1.2 million or $728,000 net of

tax related to our acquisition of CAPNA.

(5) In June of 2016, we incurred debt

retirement costs of $1.6 million, or $974,000 net of tax, in

connection with our new credit facility.

(6) As of the second quarter of 2017, we

have recorded transaction costs of $7.9 million related to the

proposed transaction with Mars.

(7) Amounts may not foot due to

rounding.

| VCA Inc. |

| Supplemental Operating Data

(cont) |

| (Unaudited - In thousands, except per share

amounts) |

|

|

| |

|

|

|

As of |

| Table

#5 |

|

|

|

|

|

June 30, 2017 |

|

December 31, 2016 |

| Selected

consolidated balance sheet data |

|

|

|

|

|

|

|

|

| Long-term

obligations: |

|

|

|

|

|

|

|

|

| Senior

term notes |

|

|

|

|

|

$ |

858,000 |

|

|

$ |

869,000 |

|

| Revolving

credit |

|

|

|

|

|

440,000 |

|

|

400,000 |

|

| Other

debt and capital leases |

|

|

|

|

|

82,689 |

|

|

85,415 |

|

| Total long-term

obligations |

|

|

|

|

|

$ |

1,380,689 |

|

|

$ |

1,354,415 |

|

| |

|

|

|

|

|

|

|

|

| |

|

Three Months Ended June

30, |

|

Six Months Ended June

30, |

| Table

#6 |

|

|

| Selected

expense data |

|

2017 |

|

2016 |

|

2017 |

|

2016 |

| |

|

|

|

|

|

|

|

|

| Rent expense |

|

$ |

25,609 |

|

|

$ |

23,449 |

|

|

$ |

50,777 |

|

|

$ |

44,313 |

|

| |

|

|

|

|

|

|

|

|

| Depreciation and

amortization included |

|

|

|

|

|

|

|

|

| in direct

costs: |

|

|

|

|

|

|

|

|

| Animal

hospital |

|

$ |

25,196 |

|

|

$ |

21,190 |

|

|

$ |

50,575 |

|

|

$ |

38,714 |

|

|

Laboratory |

|

3,139 |

|

|

2,803 |

|

|

6,011 |

|

|

5,551 |

|

| All

other |

|

124 |

|

|

767 |

|

|

698 |

|

|

1,519 |

|

|

Intercompany |

|

(704 |

) |

|

(597 |

) |

|

(1,390 |

) |

|

(1,183 |

) |

| |

|

$ |

27,755 |

|

|

$ |

24,163 |

|

|

$ |

55,894 |

|

|

$ |

44,601 |

|

| Depreciation and

amortization included in selling, |

|

|

|

|

|

|

|

|

| general

and administrative expense |

|

2,764 |

|

|

1,526 |

|

|

5,026 |

|

|

2,377 |

|

| Total depreciation and

amortization |

|

$ |

30,519 |

|

|

$ |

25,689 |

|

|

$ |

60,920 |

|

|

$ |

46,978 |

|

| |

|

|

|

|

|

|

|

|

| Share-based

compensation included in direct costs: |

|

|

|

|

|

|

|

|

|

Laboratory |

|

$ |

192 |

|

|

$ |

181 |

|

|

$ |

381 |

|

|

$ |

358 |

|

| |

|

|

|

|

|

|

|

|

| Share-based

compensation included in |

|

|

|

|

|

|

|

|

| selling,

general and administrative expense: |

|

|

|

|

|

|

|

|

| Animal

hospital |

|

864 |

|

|

724 |

|

|

1,696 |

|

|

1,508 |

|

|

Laboratory |

|

362 |

|

|

407 |

|

|

703 |

|

|

836 |

|

| All

other |

|

159 |

|

|

147 |

|

|

313 |

|

|

300 |

|

|

Corporate |

|

2,454 |

|

|

2,739 |

|

|

4,900 |

|

|

6,102 |

|

| |

|

3,839 |

|

|

4,017 |

|

|

7,612 |

|

|

8,746 |

|

| Total share-based

compensation |

|

$ |

4,031 |

|

|

$ |

4,198 |

|

|

$ |

7,993 |

|

|

$ |

9,104 |

|

Contact: Tomas Fuller

Chief Financial Officer

(310) 571-6505

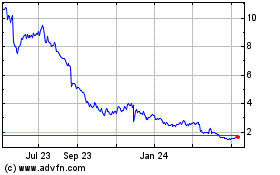

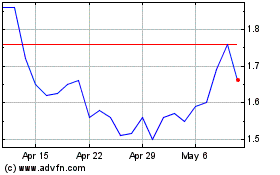

Petco Health and Wellness (NASDAQ:WOOF)

Historical Stock Chart

From Aug 2024 to Sep 2024

Petco Health and Wellness (NASDAQ:WOOF)

Historical Stock Chart

From Sep 2023 to Sep 2024