SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Schedule 13D

(Rule 13d-101)

INFORMATION TO BE INCLUDED IN STATEMENTS

FILED PURSUANT TO RULE 13d-1(a) AND AMENDMENTS THERETO FILED PURSUANT TO RULE 13d-2(a)

GREENWAY TECHNOLOGIES, INC.

(Name of Issuer)

Common Stock, par value $0.0001 per share

(Title of Class of Securities)

90288A101

(CUSIP Number)

Raymond Wright

8851 Camp Bowie West Boulevard, Suite 240

Fort Worth, Texas 76116

(817) 346-6900

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

January 4, 2017

(Date of Event which Requires Filing

of this Statement)

If the

filing person has previously filed a statement on Schedule 13G to report the acquisition which is the subject of this Schedule

13D, and is filing this schedule because of §§ 240.13d-1(e), 240.13d(f), or 240.13d(g), check the following box

[_]

.

NOTE: Schedules filed in paper format

shall include a signed original and five copies of the schedule, including all exhibits. See Rule 240.13d-7 for other parties to

whom copies are to be sent.

|

1

|

NAME OF REPORTING PERSON

Raymond Wright

|

|

2

|

CHECK THE APPROPRIATE

BOX IF A MEMBER OF A GROUP* (a)

[_]

(b)

[_]

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

00 (See Item 3, below)

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS

REQUIRED PURSUANT TO ITEMS

2(d) or 2(e)

[_]

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

USA

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

17,500,000 shares of the Common Stock of the Issuer

|

|

|

8

|

SHARED VOTING POWER

None

|

|

|

9

|

SOLE DISPOSITIVE POWER

17,500,000 shares of the Common Stock of the Issuer

|

|

|

10

|

SHARED DISPOSITIVE POWER

None

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING

PERSON

17,500,000 shares of the Common Stock of the Issuer

|

|

12

|

CHECK BOX IF THE

AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

[_]

(SEE INSTRUCTIONS)

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW

(11)

6.36% of the Common Stock of the Issuer

|

|

14

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

IN

|

|

|

|

|

|

|

|

Item 1.

|

Security and Issuer.

|

This statement relates

to the Common Stock of Greenway Technologies, Inc. (the “Issuer”). The principal executive offices of the Issuer are

located at 8851 Camp Bowie West Boulevard, Suite 240, Fort Worth, Texas 76116.

|

|

Item 2.

|

Identity and Background.

|

Pursuant to Rule 13d-1(k)(1)

of Regulation 13D-G of the General Rules and Regulations under the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), this Schedule 13D Statement is hereby filed by Raymond Wright (the “Reporting Person”), the secretary

and a director of the Issuer. The Reporting Person’s business address is 8851 Camp Bowie West Boulevard, Suite 240, Fort

Worth, Texas 76116. The Issuer’s address is 8851 Camp Bowie West Boulevard, Suite 240, Fort Worth, Texas 76116.

During the last five

years, the Reporting Person (a) has not been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors),

(b) was not party to a civil proceeding of a judicial or administrative body of competent jurisdiction as a result of which was

or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject

to, federal or state securities laws or finding any violation with respect to such laws.

The Reporting Person

is an individual and is the secretary and a director of the Issuer. The Reporting Person is a citizen of the United States of America

and resides in the State of Texas.

|

|

Item 3.

|

Source and Amount of Funds or Other Consideration.

|

On January 4, 2017,

the Issuer issued to the Reporting Person 10,000,000 shares of the Common Stock of the Issuer as compensation for past services

rendered. The shares were valued at $0.04 per share. Consequently, the deemed value of the shares issued on January 4, 2017,

was $400,000.00. There was no cash payment by the Reporting Person to the Issuer for the shares. As a result of the issuance of

the subject shares, there was no change of control in the Issuer.

Except as described

herein, no arrangements or understandings exist among present or former controlling stockholders with respect to the election of

members of the board of directors of the Issuer and, to the Reporting Person’s knowledge, no other arrangement exists that

might result in a future change of control of the Issuer. The Issuer, for the foreseeable future, will continue to be a “smaller

reporting company,” as defined under the Exchange Act.

The shares issued to

the Reporting Person were issued in reliance upon an exemption from registration pursuant to Section 4(2) of the Securities Act

of 1933, as amended (the “Securities Act”), and Rule 506 of Regulation D promulgated under the Securities Act. The

Reporting Person took the securities for investment purposes without a view to distribution and had access to information concerning

the Issuer and its business prospects, as required by the Securities Act. In addition, there was no general solicitation or advertising

for the purchase of the shares of the Issuer’s Common Stock. The Issuer’s securities were issued only to an accredited

investor and sophisticated investor, as defined in the Securities Act with whom it had a direct personal preexisting relationship,

and after a thorough discussion. Finally, the Issuer’s stock transfer agent has been instructed not to transfer any of such

shares, unless such shares are registered for resale or there is an exemption with respect to their transfer.

The Reporting Person

who received shares of the Issuer’s Common Stock was provided with access to the filings of the Issuer with the SEC, including

the following:

|

|

·

|

The Issuer’s annual report to stockholders for the most recent

fiscal year, the definitive proxy statement filed in connection with that annual report, if any, and, if requested by the Reporting

Person in writing, a copy of the Issuer’s most recent Form 10-K under the Exchange Act.

|

|

|

·

|

The information contained in an annual report on Form 10-K under the

Exchange Act.

|

|

|

·

|

The information contained in any reports or documents required to be

filed by the Issuer under sections 13(a), 14(a), 14(c), and 15(d) of the Exchange Act since the distribution or filing of the reports

specified above.

|

|

|

·

|

A brief description of the securities being offered, and any material

changes in the Issuer’s affairs that are not disclosed in the documents furnished.

|

|

|

Item 4.

|

Purpose of Transaction.

|

The Reporting Person

acquired his interest in the Issuer solely for investment purposes.

Other than as discussed

below, the Reporting Person has no present plans or proposals that relate to or that would result in any of the following actions:

|

|

·

|

The acquisition by any person of additional securities of the Issuer,

or the disposition of securities of the Issuer;

|

|

|

·

|

An extraordinary corporate transaction, such as a merger, reorganization

or liquidation, involving the Issuer or any of its subsidiaries;

|

|

|

·

|

A sale or transfer of a material amount of assets of the Issuer or any

of its subsidiaries;

|

|

|

·

|

Any change in the present board of directors or management of the Issuer,

including any plans or proposals to change the number or term of directors or to fill any existing vacancies on the board;

|

|

|

·

|

Any material change in the present capitalization or dividend policy

of the Issuer;

|

|

|

·

|

Any other material change in the Issuer’s business or corporate

structure;

|

|

|

·

|

Changes in the Issuer’s charter, bylaws or instruments corresponding

thereto or other actions which may impede the acquisition of control of the Issuer by any person;

|

|

|

·

|

Causing a class of securities of the Issuer to be delisted from a national

securities exchange or to cease to be authorized to be quoted in an inter-dealer quotation system of a registered national securities

association;

|

|

|

·

|

A class of equity securities of the Issuer becoming eligible for termination

of registration pursuant to Section 12(g)(4) of the Exchange Act; or

|

|

|

·

|

Any action similar to any of those enumerated above.

|

Interest in Securities of the Issuer.

As of January 4,

2017, the Reporting Person may be deemed to be the beneficial owner of 17,500,000 shares of Common Stock of the Issuer, which constituted

approximately 6.36 percent of the outstanding shares of the Common Stock of the Issuer.

Other than the transaction

described in Item 4 above, there have been no transactions in the Common Stock of the Issuer by the Reporting Person during the

last 60 days.

|

|

Item 6.

|

Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer.

|

Other than as stated

above, to the best knowledge of the Reporting Person, there are no contracts, arrangements, understandings or relationships (legal

or otherwise) between the Reporting Person and any other person with respect to any securities of the Issuer, including but not

limited to, transfer or voting of any of the securities of the Issuer, finder’s fees, joint ventures, loan or option arrangements,

puts or calls, guarantees of profits, division of profits or loss, or the giving or withholding of proxies, or a pledge or contingency

the occurrence of which would give another person voting power or investment power over the securities of the Issuer.

|

|

Item 7.

|

Material to be Filed as Exhibits.

|

The following exhibits

are filed herewith: None.

SIGNATURE

After reasonable inquiry

and to the best of the knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: July24, 2017.

/S/ Raymond Wright

RAYMOND WRIGHT

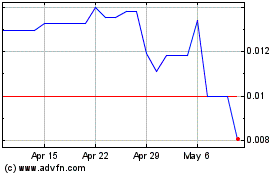

Greenway Technologies (QB) (USOTC:GWTI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Greenway Technologies (QB) (USOTC:GWTI)

Historical Stock Chart

From Apr 2023 to Apr 2024