- Sales were $880 million, up 2%

compared to Q1 2017

- High Performance Materials &

Components sales increased 3%, to $526 million

- Flat Rolled Products sales steady at

$354 million

- Business segment operating profit

was $71 million, or 8% of sales

- HPMC segment operating profit

increased by 34% to $68 million, or 13% of sales

- Includes $2 million of start-up

costs for Bakers Powder Operations

- FRP segment operating profit was $3

million, or 1% of sales

- FRP results adversely affected by

falling raw material surcharges

- Net income attributable to ATI was

$10 million, or $0.09 per share

Allegheny Technologies Incorporated (NYSE: ATI) reported second

quarter 2017 sales of $880 million and net income attributable to

ATI of $10 million, or $0.09 per share. Business segment operating

profit was $71 million, or 8.1% of sales.

“Sales of our next-generation products reached 40% of jet engine

sales in our High Performance Materials & Component (HPMC)

segment in the quarter. HPMC operating profit was nearly 13% of

sales,” said Rich Harshman, Chairman, President and Chief Executive

Officer.

“Our Flat Rolled Products (FRP) segment’s operating profit was

$3 million during a period of low and falling raw materials

prices.

“We remained on track in the HPMC segment in the first half

2017. HPMC jet engine sales increased 11%, highlighted by a 27%

increase of forged products sales in the first half 2017, compared

to the first half 2016. This is consistent with our previous

comments that specialty materials mill product sales lead the

next-generation ramp, as they did in 2016, followed by increased

sales of our forged products.

“In our FRP segment, sales to key markets and the segment’s

product mix remained steady. For standard stainless sheet products,

which are about 20% of segment sales, declines in raw material

prices in the second quarter 2017 negatively impacted product

profit margins due to timing of raw material surcharges included in

selling prices.”

- ATI’s sales to the key global markets

of aerospace and defense, oil & gas, automotive, medical and

electrical energy represented 79% of ATI first half 2017 sales:

- Sales to the aerospace and defense

markets were $853 million and represented 49% of ATI sales: 27%

commercial jet engine, 14% commercial airframe, 8% government

aero/defense.

- Sales to the oil & gas market were

$191 million and represented 11% of ATI sales.

- Sales to the automotive market were

$145 million and represented 8% of ATI sales.

- Sales to the medical market were $98

million and represented 6% of ATI sales.

- Sales to the electrical energy market

were $96 million and represented 5% of ATI sales.

- Direct international sales were $697

million, or 40% of ATI’s first half 2017 sales.

“HPMC segment sales increased 3% to $526 million, compared to

the first quarter 2017. Segment operating profit improved by more

than one-third, to $68 million, or 13% of sales,” Harshman

continued. “Sales to the aerospace and defense market increased 5%

compared to the first quarter 2017 and represented 76% of segment

sales: 45% commercial jet engine, 18% commercial airframe and 13%

government aero/defense. Our second quarter 2017 HPMC segment

operating profit at $68 million was more than this segment’s

operating profit in the first half of 2016. HPMC segment operating

profit reflects a richer product mix, higher volumes, and cost

structure improvements. Segment results include $2 million of

start-up costs for Bakers Powder Operations, our new nickel-based

powder alloys facility in North Carolina, as we continued our

commercial qualification process.

“Second quarter 2017 FRP segment sales were essentially

unchanged from the first quarter 2017 at $354 million. Demand was

consistent with the first quarter across our major end markets. FRP

segment operating profit was $3 million, or 1% of segment sales, as

falling raw material prices for ferrochrome and nickel resulted in

an out-of-phase surcharge condition, where higher cost material is

sold at lower, surcharge-based selling prices based on the timing

of the manufacturing cycle.

“In June 2017, we extended the duration of our domestic

Asset-Based Lending (ABL) credit facility, including the $100

million term loan portion, to February 2022. At June 30, 2017, cash

on hand was $155 million and available additional liquidity under

our ABL was approximately $250 million, with $60 million borrowed

under the revolving credit portion. We generated $25 million of

cash flow from operations in the second quarter 2017, even with $51

million invested in additional managed working capital in the

quarter as we ramp to higher production levels to support business

growth. We continue to estimate that 2017 capital expenditures will

be $125 million, with $55 million expended in the first half of

this year.”

Strategy and Outlook

“We expect our second half 2017 HPMC segment results to sustain

strong performance in commercial aerospace and to continue a

low-double-digit operating profit level as a percentage of sales,

noting that quarterly results during the legacy to next-generation

jet engine transition could be uneven due to the timing of customer

demand pulls and product mix,” Harshman said. “We continue to

enhance ATI’s leading position in next-generation jet engines as

demonstrated in our recent announcements about our JV with GE

Aviation and our long-term agreement with Pratt & Whitney for

powder and forgings. Based on discussions at the Paris airshow and

our interactions with strategic customers, we remain confident

about increased demand for mill products, forgings, castings, and

components from increasing next-generation and legacy jet engine

build rates over the next several years.

“We expect the FRP segment to deliver an improved product mix

and to continue to realize operational improvements in the third

quarter. However, we expect the quarter to be negatively impacted

by the recent fall in raw material prices, especially ferrochrome

and nickel. This is expected to significantly reduce profit margins

as a result of out-of-phase raw material surcharges. This condition

is likely to continue until raw materials prices stabilize. As a

result, we expect the FRP segment to operate at a loss in the third

quarter 2017. For the full year 2017, we continue to expect that

the FRP segment will be modestly profitable.

“Looking beyond 2017, we will be relentless in our continuing

focus on enhancing ATI’s technology leadership in differentiated

specialty materials; generating healthy cash flow from operations;

improving our competitive cost position; and strengthening our

balance sheet. We continue to expect capital expenditures to

average no more than $100 million annually for the next several

years.”

Second Quarter 2017 Financial Results

- Sales for the second quarter

2017 were $880.2 million, a 2% increase compared to the first

quarter 2017 and a 9% increase compared to the second quarter 2016.

HPMC sales reflect stronger demand for nickel-based and specialty

alloys mill products, and forged components. FRP sales compared to

the prior year period include stronger shipments of standard

products due to higher operating levels following a new labor

agreement.

- Net income attributable to ATI

for the second quarter 2017 was $10.1 million, or $0.09 per share,

compared to $17.5 million, or $0.16 per share, in the first quarter

2017 and a net loss of $18.8 million, or $(0.18) per share in the

second quarter 2016. Results in all periods include impacts from

income taxes which differ from a standard 35% tax rate, primarily

related to impacts of income tax valuation allowances.

- Cash on hand at June 30, 2017

was $154.6 million, with $24.7 million provided by operations in

the second quarter 2017. For the first six months of 2017, cash

used in operations was $85.5 million, including a $135.0 million

contribution to the ATI Pension Plan. Cash used in investing

activities was $52.0 million, with $55.3 million for capital

expenditures partially offset by cash proceeds from sales of

assets. Cash provided by financing activities was $62.5 million,

primarily from $60.0 million of borrowings under the revolving

credit portion of the ABL.

High Performance Materials & Components Segment

Market Conditions

- Aerospace and defense sales were 5%

higher in the second quarter 2017, increasing $17.6 million

compared to the first quarter 2017 and representing 76% of segment

sales. Compared to the first quarter, commercial jet engine sales

were 9% higher, while commercial airframe sales declined 11% based

on the timing of orders. Sales to the electrical energy market were

down 18% as weak market conditions continued. Sales to other key

end markets were slightly lower. Sales of our nickel-based and

specialty alloys were 7% higher, sales of precision forgings and

castings increased 8%, and sales of zirconium and related alloys

were 1% higher, all compared to the first quarter 2017. Sales of

titanium and titanium-based alloys were 9% lower, primarily for

airframe applications. Direct international sales represented over

48% of total segment sales for second quarter 2017.

Second quarter 2017 compared to second quarter 2016

- Sales were $526.4 million, a 6%

increase compared to the second quarter 2016, primarily as a result

of higher sales of nickel-based and specialty stainless alloys, and

forged and cast components. Sales to the commercial aerospace

market, which represented 63% of second quarter 2017 sales, were 7%

higher than the second quarter 2016, with strong growth in the

commercial jet engine market partially offset by lower airframe

sales. Sales to the oil & gas market improved for the second

consecutive quarter, increasing over 57% from prior year levels.

Sales to the electrical energy market decreased 33%.

- Segment operating profit was $68.0

million, or 12.9% of sales, compared to $38.8 million, or 7.8% of

sales for the second quarter 2016. The 75% improvement in HPMC

segment operating profit reflects higher productivity from

increasing aerospace and defense sales, an improved product mix of

next-generation nickel alloys and forgings for the aero engine

market, and the benefits of the 2016 titanium operations

restructuring activities, including the Rowley, UT titanium sponge

operations idling.

Flat Rolled Products Segment

Market Conditions

- Market conditions in the second quarter

2017 were slightly improved in the oil & gas market, stable in

aerospace and defense, but weaker in automotive and consumer

durables. Demand levels for both high-value products and commodity

standard stainless products were similar to the first quarter 2017.

Sales of high-value products increased 1% and sales of standard

grade stainless sheet and plate products decreased 3%, both

compared to the first quarter 2017. FRP segment shipment

information is presented in the attached Selected Financial Data –

Mill Products table. Direct international sales represented 29% of

total segment sales for the second quarter 2017.

Second quarter 2017 compared to second quarter 2016

- Sales were $353.8 million, a 13%

increase compared to the prior year period, due to higher shipment

volume for standard stainless products, and higher selling prices

for most standard stainless products and high-value products. Prior

year results included effects from the work stoppage and the return

of USW-represented employees in March 2016.

- Segment operating profit was $2.9

million, or 0.8% of sales, compared to a second quarter 2016

segment operating loss of $31.8 million. Segment operating results

in the second quarter 2017 reflect improved profitability due to

higher operating levels and the benefits of cost reductions and

restructuring actions. Segment operating results in 2016 also

included $22.4 million of costs associated with the prior work

stoppage as operations returned to more normal activity

levels.

Closed Operations and Other Expenses

- Closed operations and other expenses in

the second quarter 2017 were $13.2 million, or $10.2 million higher

than the first quarter 2017, when the prior quarter benefitted from

certain non-routine items involving property tax adjustments,

changes to facility closure reserves, and non-operating royalty

income. Closed operations costs in fiscal year 2017 are expected to

be higher than in fiscal year 2016 due to costs associated with the

idled Rowley, UT, Midland, PA and Bagdad, PA facilities.

Income Taxes

- ATI continues to maintain income tax

valuation allowances on its U.S. Federal and state deferred tax

assets. Second quarter 2017 results include a $2.1 million net tax

benefit primarily related to the effects of amending tax returns

for prior periods in certain domestic jurisdictions.

Allegheny Technologies will conduct a conference call with

investors and analysts on Tuesday, July 25, 2017, at 8:30 a.m. ET

to discuss the financial results. The conference call will be

broadcast, and accompanying presentation slides will be available,

at ATImetals.com. To access the broadcast, click on “Conference

Call”. Replay of the conference call will be available on the

Allegheny Technologies website.

This news release contains “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of

1995. Certain statements in this news release relate to future

events and expectations and, as such, constitute forward-looking

statements. Forward-looking statements, which may contain such

words as “anticipates,” “believes,” “estimates,” “expects,”

“would,” “should,” “will,” “will likely result,” “forecast,”

“outlook,” “projects,” and similar expressions, are based on

management’s current expectations and include known and unknown

risks, uncertainties and other factors, many of which we are unable

to predict or control. Our performance or achievements may differ

materially from those expressed or implied in any forward-looking

statements due to the following factors, among others: (a) material

adverse changes in economic or industry conditions generally,

including global supply and demand conditions and prices for our

specialty metals; (b) material adverse changes in the markets we

serve; (c) our inability to achieve the level of cost savings,

productivity improvements, synergies, growth or other benefits

anticipated by management from strategic investments and the

integration of acquired businesses; (d) volatility in the price and

availability of the raw materials that are critical to the

manufacture of our products; (e) declines in the value of our

defined benefit pension plan assets or unfavorable changes in laws

or regulations that govern pension plan funding; (f) labor

disputes or work stoppages; (g) equipment outages and (h) other

risk factors summarized in our Annual Report on Form 10-K for the

year ended December 31, 2016, and in other reports filed with the

Securities and Exchange Commission. We assume no duty to update our

forward-looking statements.

Creating Value Thru Relentless Innovation™

ATI is a global manufacturer of technically advanced specialty

materials and complex components. With revenue of $3.3 billion for

the twelve month period ending June 30, 2017, our largest market is

aerospace & defense, particularly jet engines. We also have a

strong presence in the oil & gas, electrical energy, medical,

automotive, and other industrial markets. ATI is a market leader in

manufacturing differentiated specialty alloys and forgings that

require our unique manufacturing and precision machining

capabilities and our innovative new product development competence.

ATI produces nickel-based alloys and superalloys, titanium alloys,

specialty alloys, stainless steels, and zirconium and other related

alloys in many mill product forms. We also are a leader in

producing nickel-based alloy and titanium-based alloy powders for

use in next-generation jet engine forgings and 3D-printed products.

ATIMetals.com

Allegheny Technologies Incorporated and

Subsidiaries

Consolidated Statements of Operations (Unaudited, dollars in

millions, except per share amounts)

Three Months Ended Six Months

Ended June 30 March 31 June 30 June

30 June 30 2017 2017 2016

2017 2016 Sales $ 880.2

$ 865.9 $ 810.5 $ 1,746.1

$ 1,568.0 Cost of sales 767.9

753.1 762.3 1,521.0

1,553.0 Gross profit 112.3 112.8 48.2 225.1 15.0

Selling and administrative expenses 66.7 59.5 59.3 126.2

121.9 Restructuring charges - -

1.0 - 10.0 Operating income

(loss) 45.6 53.3 (12.1 ) 98.9 (116.9 ) Interest expense, net (34.5

) (33.5 ) (30.3 ) (68.0 ) (58.6 ) Other income, net 0.2

3.3 1.0 3.5

1.8 Income (loss) before income taxes 11.3 23.1 (41.4 ) 34.4

(173.7 ) Income tax provision (benefit) (2.1 ) 2.0

(25.9 ) (0.1 ) (60.1 )

Net income

(loss) $ 13.4 $ 21.1 $

(15.5 ) $ 34.5 $ (113.6

) Less: Net income attributable to noncontrolling interests

3.3 3.6 3.3 6.9

6.4

Net income (loss) attributable to

ATI $ 10.1 $ 17.5

$ (18.8 ) $ 27.6 $

(120.0 ) Basic net income (loss)

attributable to ATI per common share $ 0.09

$ 0.16 $ (0.18 )

$ 0.26 $ (1.12 )

Diluted net income (loss) attributable to ATI per common

share $ 0.09 $ 0.16

$ (0.18 ) $ 0.25 $

(1.12 )

Weighted average common shares outstanding

-- basic (millions)

107.7 107.5 107.3 107.6 107.3

Weighted average common shares outstanding

-- diluted (millions)

128.3 128.2 107.3 128.3 107.3

Actual common shares outstanding -- end of

period (millions)

108.9 108.8 108.9 108.9 108.9

Allegheny

Technologies Incorporated and Subsidiaries Sales and

Operating Profit by Business Segment (Unaudited, dollars in

millions)

Three Months

Ended Six Months Ended June 30 March 31

June 30 June 30 June 30 2017

2017 2016 2017 2016 Sales: High

Performance Materials & Components $ 526.4 $ 510.4 $ 498.4 $

1,036.8 $ 991.4 Flat Rolled Products 353.8

355.5 312.1 709.3 576.6

Total External Sales $ 880.2

$ 865.9 $ 810.5

$ 1,746.1 $ 1,568.0

Operating Profit (Loss): High Performance Materials

& Components $ 68.0 $ 50.9 $ 38.8 $ 118.9 $ 67.9 % of Sales

12.9 % 10.0 % 7.8 % 11.5 % 6.8 % Flat Rolled Products 2.9

19.0 (31.8 ) 21.9 (141.4 ) % of Sales 0.8 % 5.3 %

-10.2 % 3.1 % -24.5 %

Operating

Profit (Loss) 70.9 69.9 7.0 140.8

(73.5 ) % of Sales 8.1 % 8.1 % 0.9 % 8.1 % -4.7 %

LIFO and net realizable value reserves (0.1 ) - 0.4

(0.1 ) 0.4 Corporate expenses (11.8 ) (10.3 ) (11.8 ) (22.1

) (22.8 ) Closed operations and other expenses (13.2 ) (3.0

) (5.7 ) (16.2 ) (9.2 ) Restructuring and other charges - -

(1.0 ) - (10.0 ) Interest expense, net (34.5 )

(33.5 ) (30.3 ) (68.0 ) (58.6 )

Income (loss) before income taxes $ 11.3

$ 23.1 $ (41.4 )

$ 34.4 $ (173.7 )

Allegheny Technologies Incorporated and Subsidiaries

Condensed Consolidated Balance Sheets (Unaudited, dollars in

millions)

June 30, December 31,

2017 2016 ASSETS Current Assets:

Cash and cash equivalents $ 154.6 $ 229.6

Accounts receivable, net of allowances for

doubtful accounts

538.6 452.1 Inventories, net 1,076.2 1,037.0 Prepaid expenses and

other current assets 30.7 47.8

Total Current

Assets 1,800.1 1,766.5 Property, plant and

equipment, net 2,492.3 2,498.9 Goodwill 643.5 641.9 Other assets

250.4 262.7

Total Assets $

5,186.3 $ 5,170.0 LIABILITIES AND

EQUITY Current Liabilities: Accounts payable $

355.5 $ 294.3 Accrued liabilities 278.0 309.3

Short term debt and current portion of

long-term debt

67.5 105.1

Total Current Liabilities

701.0 708.7 Long-term debt 1,876.6 1,771.9

Accrued postretirement benefits 308.0 317.7 Pension liabilities

682.9 827.9 Deferred income taxes 20.1 15.6 Other long-term

liabilities 83.3 83.4

Total Liabilities

3,671.9 3,725.2 Total ATI stockholders'

equity 1,413.5 1,355.2 Noncontrolling interests 100.9

89.6

Total Equity 1,514.4

1,444.8 Total Liabilities and Equity $

5,186.3 $ 5,170.0 Allegheny

Technologies Incorporated and Subsidiaries Condensed

Consolidated Statements of Cash Flows (Unaudited, dollars in

millions)

Six Months Ended June

30 2017 2016 Operating

Activities: Net income (loss) $ 34.5 $ (113.6 )

Depreciation and amortization 80.6 87.8 Deferred taxes 7.6 (62.4 )

Change in managed working capital (62.6 ) 10.3 Change in retirement

benefits (a) (135.0 ) 10.3 Accrued liabilities and other

(10.6 ) 34.0

Cash used in operating activities

(85.5 ) (33.6 ) Investing

Activities: Purchases of property, plant and equipment (55.3 )

(145.3 ) Asset disposals and other 3.3 1.8

Cash used in investing activities (52.0

) (143.5 ) Financing Activities:

Borrowings on long-term debt 7.3 387.5 Payments on long-term debt

and capital leases (0.8 ) (0.6 ) Net borrowings under credit

facilities 59.4 2.5 Debt issuance costs (0.8 ) (10.4 ) Dividends

paid to shareholders - (17.2 ) Sale (purchase) of noncontrolling

interests 2.2 (12.2 ) Taxes on share-based compensation and other

(4.8 ) -

Cash provided by financing

activities 62.5 349.6

Increase (decrease) in cash and cash equivalents

(75.0 ) 172.5 Cash and cash equivalents at

beginning of period 229.6 149.8

Cash

and cash equivalents at end of period $ 154.6

$ 322.3

(a)

Includes $(135) million contribution to

the U.S. defined benefit pension plan in 2017.

Allegheny Technologies Incorporated and

Subsidiaries Selected Financial Data (Unaudited)

Three Months Ended Six

Months Ended June 30 March 31 June 30

June 30 June 30 2017 2017 2016

2017 2016 Percentage of Total ATI Sales

High-Value Products Nickel-based alloys and specialty alloys

27 % 26 % 27 % 26 % 28 % Precision forgings, castings and

components 19 % 18 % 17 % 18 % 17 % Titanium and titanium-based

alloys 16 % 18 % 19 % 17 % 20 % Precision and engineered strip 13 %

14 % 13 % 14 % 12 % Zirconium and related alloys 7 %

6 % 8 % 7 % 8 % Total High-Value Products,

excluding GOES 82 % 82 % 84 % 82 % 85 % Grain-oriented electrical

steel (GOES) 0 % 0 % 1 % 0 % 2 %

Total High-Value Products, including GOES 82 % 82 %

85 % 82 % 87 %

Standard Products

Stainless steel sheet 9 % 10 % 7 % 9 % 6 % Specialty stainless

sheet 5 % 5 % 4 % 5 % 4 % Stainless steel plate and other 4

% 3 % 4 % 4 % 3 % Total Standard

Products 18 % 18 % 15 % 18 % 13

%

Grand Total 100 % 100 % 100 %

100 % 100 %

Three Months Ended Six

Months Ended June 30 March 31 June 30

June 30 June 30 Shipment Volume: 2017

2017 2016 2017 2016 Flat Rolled

Products (000's lbs.) High value* 74,089 75,333 77,757 149,422

144,400 Standard 114,677 114,985

103,558 229,662 170,594 Flat

Rolled Products total 188,766 190,318 181,315 379,084 314,994

Average Selling Prices: Flat Rolled

Products (per lb.) High value* $ 2.84 $ 2.77 $ 2.52 $ 2.81 $ 2.59

Standard $ 1.23 $ 1.26 $ 1.01 $ 1.24 $ 1.00 Flat Rolled Products

combined average $ 1.86 $ 1.86 $ 1.66 $ 1.86 $ 1.73 *

High value products exclude GOES for the quarter and six months

ended June 30, 2016.

Allegheny Technologies Incorporated and Subsidiaries

Computation of Basic and Diluted Earnings Per Share Attributable

to ATI (Unaudited, in millions, except per share amounts)

Three Months Ended Six Months Ended June

30 March 31 June 30 June 30 June 30

2017 2017 2016 2017 2016

Numerator for Basic net income (loss) per common share - Net income

(loss) attributable to ATI $ 10.1 $ 17.5 $ (18.8 ) $ 27.6 $ (120.0

) Effect of dilutive securities: 4.75% Convertible Senior Notes due

2022 1.8 3.0 - 4.8 -

Numerator for Diluted net income (loss) per common share -

Net income (loss) attributable to ATI after assumed conversions $

11.9 $ 20.5 $ (18.8 ) $ 32.4 $ (120.0 ) Denominator for

Basic net income (loss) per common share - Weighted average shares

outstanding 107.7 107.5 107.3 107.6 107.3 Effect of dilutive

securities: Share-based compensation 0.7 0.8 - 0.8 - 4.75%

Convertible Senior Notes due 2022 19.9 19.9 -

19.9 - Denominator for Diluted net

income (loss) per common share - Adjusted weighted average shares

assuming conversions 128.3 128.2 107.3

128.3 107.3 Basic net income (loss)

attributable to ATI per common share

$ 0.09 $

0.16 $ (0.18 ) $ 0.26

$ (1.12 ) Diluted net income (loss)

attributable to ATI per common share

$ 0.09 $

0.16 $ (0.18 ) $ 0.25

$ (1.12 ) Allegheny

Technologies Incorporated and Subsidiaries Other Financial

Information Managed Working Capital (Unaudited, dollars

in millions)

June 30 December 31 2017

2016 Accounts receivable $ 538.6 $ 452.1 Inventory

1,076.2 1,037.0 Accounts payable (355.5 ) (294.3 )

Subtotal 1,259.3 1,194.8 Allowance for doubtful accounts 6.0

7.3 LIFO reserve (79.1 ) (97.3 ) Inventory reserves 150.2

169.0 Managed working capital $ 1,336.4

$ 1,273.8

Annualized prior 3 months sales

$ 3,520.9 $ 3,184.2

Managed working capital as a % of

annualized sales

38.0 % 40.0 %

June 30, 2017 change in managed working

capital

$ 62.6 As part of managing the liquidity in our business, we

focus on controlling managed working capital, which is defined as

gross accounts receivable and gross inventories, less accounts

payable. In measuring performance in controlling this managed

working capital, we exclude the effects of LIFO and other inventory

valuation reserves and reserves for uncollectible accounts

receivable which, due to their nature, are managed separately.

Allegheny Technologies Incorporated and

Subsidiaries Other Financial Information Debt to

Capital (Unaudited, dollars in millions)

June 30 December 31 2017 2016

Total debt (a) $ 1,960.1 $ 1,894.1 Less: Cash (154.6 )

(229.6 ) Net debt $ 1,805.5 $ 1,664.5 Net debt $

1,805.5 $ 1,664.5 Total ATI stockholders' equity 1,413.5

1,355.2 Net ATI capital $ 3,219.0 $ 3,019.7

Net debt to ATI capital 56.1 %

55.1 % Total debt (a) $ 1,960.1 $

1,894.1 Total ATI stockholders' equity 1,413.5

1,355.2 Total ATI capital $ 3,373.6 $ 3,249.3

Total debt to total ATI capital 58.1 %

58.3 % (a) Excludes debt issuance

costs. In managing the overall capital structure of the

Company, some of the measures that we focus on are net debt to net

capitalization, which is the percentage of debt, net of cash that

may be available to reduce borrowings, to the total invested and

borrowed capital of ATI (excluding noncontrolling interest), and

total debt to total ATI capitalization, which excludes cash

balances.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170725005728/en/

Allegheny Technologies IncorporatedDan L. Greenfield,

412-394-3004

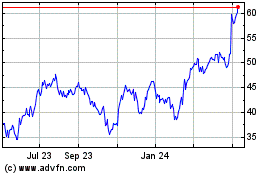

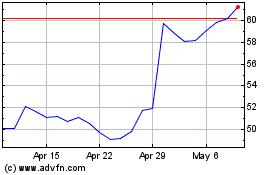

ATI (NYSE:ATI)

Historical Stock Chart

From Mar 2024 to Apr 2024

ATI (NYSE:ATI)

Historical Stock Chart

From Apr 2023 to Apr 2024