Report of Foreign Issuer (6-k)

July 13 2017 - 7:45AM

Edgar (US Regulatory)

1934 Act Registration

No. 1-14700

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM

6-K

REPORT OF

FOREIGN PRIVATE ISSUER

PURSUANT TO RULE

13a-16

OR

15d-16

OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of July 2017

Taiwan

Semiconductor Manufacturing Company Ltd.

(Translation of Registrant’s Name Into English)

No. 8, Li-Hsin Rd. 6,

Hsinchu Science Park,

Taiwan

(Address of

Principal Executive Offices)

(Indicate by check mark whether the registrant files or will file annual reports under cover of Form

20-F

or Form

40-F.)

Form

20-F ☒

Form

40-F ☐

(Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information

to the Commission pursuant to Rule

12g3-2(b)

under the Securities Exchange Act of 1934.)

Yes ☐ No ☒

(If “Yes” is marked, indicated below the file number assigned to the registrant in connection with Rule

12g3-2(b):

82: .)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

Taiwan Semiconductor Manufacturing Company Ltd.

|

|

|

|

|

|

|

Date: July 13, 2017

|

|

|

|

By

|

|

/s/ Lora Ho

|

|

|

|

|

|

|

|

Lora Ho

|

|

|

|

|

|

|

|

Senior Vice President & Chief Financial Officer

|

TSMC Reports Second Quarter EPS of NT$2.56

Hsinchu, Taiwan, R.O.C., July

13, 2017 —

TSMC today announced consolidated revenue of NT$213.86 billion, net income of

NT$66.27 billion, and diluted earnings per share of NT$2.56 (US$0.42 per ADR unit) for the second quarter ended June 30, 2017.

Year-over-year,

second quarter revenue decreased 3.6% while net income and diluted EPS both decreased 8.6%. Compared to first quarter 2017, second quarter results represent an 8.6% decrease in revenue, and a 24.4% decrease in net income. All figures were prepared

in accordance with TIFRS on a consolidated basis.

In US dollars, second quarter revenue was $7.06 billion, which decreased 5.9% from the previous

quarter but increased 3.2% year-over-year. The NT dollar exchange rate against the US dollar in the second quarter 2017 has appreciated 2.8% from 1Q’17 and 6.6% from 2Q’16.

Gross margin for the quarter was 50.8%, operating margin was 38.9%, and net profit margin was 31.0%.

In the second quarter, shipments of

10-nanometer

accounted for 1% of total wafer revenue;

16/20-nanometer

process technology accounted for 26% of total wafer revenue; and advanced technologies, defined as

28-nanometer

and more advanced technologies, accounted for

54% of total wafer revenue.

“In addition to supply chain inventory management and mobile product seasonality, the continuing unfavorable exchange

rate further impacted our second quarter business,” said Lora Ho, SVP and Chief Financial Officer of TSMC. “Moving into third quarter, we expect our business will benefit from new product launches of TSMC

10-nanometer

mobile devices. Based on our current business outlook, management expects overall performance for third quarter 2017 to be as follows”:

|

|

•

|

|

Revenue is expected to be between US$8.12 billion and US$8.22 billion;

|

And, based on the exchange

rate assumption of 1 US dollar to 30.3 NT dollars,

|

|

•

|

|

Gross profit margin is expected to be between 48.5% and 50.5%;

|

|

|

•

|

|

Operating profit margin is expected to be between 37% and 39%.

|

TSMC’s 2017 Second quarter consolidated results :

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Unit: NT$ million, except for EPS)

|

|

|

|

|

2Q17

Amount

a

|

|

|

2Q16

Amount

|

|

|

YoY

Inc. (Dec.) %

|

|

|

1Q17

Amount

|

|

|

QoQ

Inc. (Dec.) %

|

|

|

|

|

|

|

|

|

|

Net sales

|

|

|

213,856

|

|

|

|

221,810

|

|

|

|

(3.6

|

)

|

|

|

233,914

|

|

|

|

(8.6

|

)

|

|

Gross profit

|

|

|

108,708

|

|

|

|

114,334

|

|

|

|

(4.9

|

)

|

|

|

121,490

|

|

|

|

(10.5

|

)

|

|

Income from operations

|

|

|

83,256

|

|

|

|

91,321

|

|

|

|

(8.8

|

)

|

|

|

95,352

|

|

|

|

(12.7

|

)

|

|

Income before tax

|

|

|

86,118

|

|

|

|

93,406

|

|

|

|

(7.8

|

)

|

|

|

97,822

|

|

|

|

(12.0

|

)

|

|

Net income

|

|

|

66,271

|

|

|

|

72,506

|

|

|

|

(8.6

|

)

|

|

|

87,629

|

|

|

|

(24.4

|

)

|

|

EPS (NT$)

|

|

|

2.56

|

b

|

|

|

2.80

|

b

|

|

|

(8.6

|

)

|

|

|

3.38

|

b

|

|

|

(24.4

|

)

|

|

a:

|

2Q2017 figures have not been approved by Board of Directors

|

|

b:

|

Based on 25,930 million weighted average outstanding shares

|

About TSMC

TSMC is the world’s largest dedicated semiconductor foundry, providing the industry’s leading process technology and the foundry’s largest

portfolio of process-proven libraries, IPs, design tools and reference flows. The Company’s owned capacity in 2017 is expected to reach above 11 million

(12-inch

equivalent) wafers, including

capacity from three advanced

12-inch

GIGAFAB

®

facilities, four eight-inch fabs, one

six-inch

fab, as well as

TSMC’s wholly owned subsidiaries, WaferTech and TSMC China. TSMC is the first foundry to provide both 20nm and 16nm production capabilities. Its corporate headquarters are in Hsinchu, Taiwan. For more information about TSMC please visit

http://www.tsmc.com

.

# # #

|

|

|

|

|

|

|

|

|

TSMC Spokesperson:

Lora Ho

Senior VP & CFO

Tel:

886-3-505-4602

|

|

TSMC Acting Spokesperson:

Elizabeth Sun

Senior Director

Corporate Communication Division

Tel: 886-3-568-2085

Mobile:

886-988-937-999

E-Mail: elizabeth_sun@tsmc.com

|

|

For Further Information:

Michael Kramer

Project Manager

Tel:

886-3-563-6688

Ext.

7125031

Mobile:

886-988-931-352

E-Mail:

pdkramer@tsmc.com

|

|

Hui-Chung Su

Senior Administrator

PR Department

Tel:

886-3-563-6688

Ext.

7125033

Mobile:

886-988-930-039

E-Mail:

hcsuq@tsmc.com

|

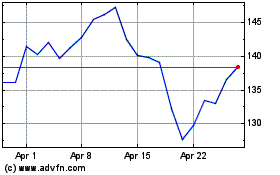

Taiwan Semiconductor Man... (NYSE:TSM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Taiwan Semiconductor Man... (NYSE:TSM)

Historical Stock Chart

From Apr 2023 to Apr 2024