Report of Foreign Issuer (6-k)

July 10 2017 - 6:04AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

FOR THE MONTH OF JULY 2017

COMMISSION FILE NUMBER

000-51576

ORIGIN AGRITECH LIMITED

(Translation of registrant’s name into English)

No. 21 Sheng Ming Yuan Road, Changping District, Beijing 102206

(Address of principal executive office)

Indicate by check mark whether the registrant files or will

file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form

40-F ☐

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Indicate by check mark whether the registrant by furnishing

the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b)

under the Securities Exchange Act of 1934.

Yes ☐ No ☒

If “Yes” is marked, indicate below the file number

assigned to the registrant in connection with Rule 12g3-2(b): 82-________

Entry into Material Agreements

On July 5, 2017, Origin Agritech Limited

(the “Company”) entered into a series of financing agreements with L2 Capital LLC (“L2”). The capital secured

will support the global business expansion initiatives for biotechnology traits and elite corn germplasm deregulation and licensing.

Strict capital control restrictions imposed in China require that novel funding approaches be secured to enable the growth directives

implemented over the past year. By working with a strong financial partner in L2 Capital LLC, Origin will be able to keep critical

projects and collaborations on projected timelines and commercial horizons. The financing includes a promissory note for an aggregate

principal amount to be available in a series of tranches and an equity line of credit facility.

Because the Company is a foreign private

issuer, it is exempt from certain NASDAQ governance rules; therefore, all the securities described herein are not subject to the

approval of the shareholders of the Company. Notwithstanding the foregoing, the Company filed the required notice of the financing

terms and potential issuance of equity securities with NASDAQ which was reviewed and commented upon.

Loan Note Facility

The loan note is a short term credit arrangement,

for an aggregate principal amount of $2,344,828, which will be available in five tranches. The loan note bears interest at 8% per

annum. The first tranche of $1,402,298 in principal amount will be issued as of the closing of the transactions contemplated under

the Securities Purchase Agreement of the note and related shares and the agreements related to the equity line. The second tranche

of $114,942 in principal amount will be issued upon the filing of the registration statement for the equity line as described below.

The third tranche of $114,942 in principal amount will be issued upon the finalization with the Securities and Exchange Commission

of the registration statement. The fourth tranche of $114,942 in principal amount will be issued upon effectiveness of the registration

statement. The Company may request up to a further $597,704 of principal to be lent, which will be made available only with the

agreement of L2. Each principal amount will be issued with an original issue discount: the first tranche will yield $1,220,000.

In connection with each draw down of the loan, the Company will issue ordinary shares, for an aggregate maximum of 293,087 shares.

These shares have registration rights.

The principal of the note

is pre-payable, at any time, at a premium that increases from 115% to 130% over the life of the note, depending on the date

of repayment. The principal amount also is required to be pre-paid if the Company raises in any public or private financing

two million dollars or more. The maturity of each tranche of principal is six months from the date the funds are received by

the Company. Each maturity date can be extended by the prepayment of one-twelfth of the then outstanding principal due under

the particular tranche. On a default, the lender, L2, has the option to convert into ordinary shares the amount of

principal, interest, premium and other amounts owed, in amounts as it determines, from time to time. The default amount

will be at a 40% premium of the amount due. If there is a conversion of the default amount, the share conversion rate will be

at 100% of the lowest trading price during the 15 days prior to a conversion event.

The Company has also pledged its United

States assets to L2 as security for the loan.

Equity Line Facility

The equity line is under an equity purchase

agreement pursuant to which the Company can request L2 to purchase up to $4,500,000 worth of its ordinary shares from time to time

at a per share price that is 94% of the lowest VWAP for any trading day during the period of five trading days immediately following

the date of the Company’s put request. In addition, the Company will issue 108,696 ordinary shares for L2’s commitment to enter

into the equity purchase agreement. The amount of each put will be limited to a maximum of 150% of the average trading volume of

the ordinary shares as traded on NASDAQ or other exchange on which the ordinary shares are listed, and not less than $25,000 in

value. A subsequent put may only be made 10 trading days after the earlier put. Each put is subject to a variety of equity conditions,

including the Company being in full compliance with its various transaction document obligations, the listing and trading of the

ordinary shares, and not being in default under the note. The equity line may be terminated at any time, subject to a short notice

period.

The ordinary shares to be issued under the

equity credit line, the 108,696 shares issued under the equity purchase agreement, and some of the shares issued under the note

are subject to a registration rights agreement. The Company is obligated to file a resale prospectus within 40 days of the signing

of the transaction documents. Under the agreement the Company will indemnify L2 for securities law claims against it as a result

of Company actions or misstatements and omissions.

The Company is obligated to reserve, from

time to time, ordinary shares for each of the loan and equity line facilities, at three and one times, respectively, of the shares

required for puts and conversion on default.

The Company is subject to restrictive covenants

for further financing arrangements until the earlier payment or conversion of the note, unless the arrangement has been agreed

to by L2. Generally the limitation will apply to variable rate financing arrangements and other convertible securities arrangements.

It will not apply to merger and acquisition arrangements entered into by the Company, but such arrangements may require a full

prepayment of the note. The equity credit facility may not be transferred to any other issuer through a merger or acquisition where

the Company is not the surviving entity.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act

of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

ORIGIN AGRITECH LIMITED

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ William

Niebur

|

|

|

|

Name:

|

William Niebur

|

|

|

|

Title:

|

President and CEO

|

|

Dated: July 10, 2017

EXHIBIT

|

Exhibit Number

|

|

Description

|

|

|

|

|

|

10.1

|

|

Securities Purchase Agreement, related to $2,344,828 Secured Loan Note, dated July 5, 2017

|

|

10.2

|

|

Secured Loan Note, in aggregate principal of $2,344,828, dated July 5, 2017

|

|

10.3

|

|

Security Agreement, related to $2,344,828 Secured Loan Note, dated July 5, 2017

|

|

10.4

|

|

Equity Purchase Agreement, aggregate $4,500,000 of Ordinary Shares, dated July 5, 2017

|

|

10.5

|

|

Registration Rights Agreement, related to

$4,500,000 Equity Purchase Agreement, dated July 5, 2017

|

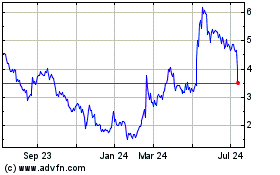

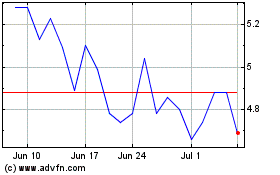

Origin Agritech (NASDAQ:SEED)

Historical Stock Chart

From Mar 2024 to Apr 2024

Origin Agritech (NASDAQ:SEED)

Historical Stock Chart

From Apr 2023 to Apr 2024