Report of Independent Registered Public Accounting Firm

Members of the Profit Sharing and 401(k) Trustee Committee

Universal Forest Products, Inc.

Employees’ Profit Sharing and 401(k) Plan

Grand Rapids, Michigan

We have audited the accompanying statements of net assets available for benefits of the Universal Forest Products, Inc. Employees’ Profit Sharing and 401(k) Plan (the Plan) as of December 31, 2016 and 2015, and the related statement of changes in net assets available for benefits for the years then ended. These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement.

The Plan is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Plan’s internal control over financial reporting. Accordingly, we express no such opinion.

An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 2016 and 2015, and the changes in net assets available for benefits for the years then ended, in conformity with accounting principles generally accepted in the United States of America.

The accompanying supplemental schedule of assets (held at end of year) as of December 31, 2016 has been subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements. The supplemental schedule is the responsibility of the Plan’s management. Our audit procedures included determining whether the supplemental schedule reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental schedule. In forming our opinion on the supplemental schedule, we evaluated whether the supplemental schedule, including its form and content, is presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental schedule is fairly stated, in all material respects, in relation to the financial statements as a whole.

|

|

|

s BDO USA, LLP

|

|

|

|

Grand Rapids, Michigan

|

|

June 14, 2017

|

Universal Forest Products, Inc. Employees’ Profit Sharing and

401(k) Plan

Statements of Net Assets Available for Benefits

|

|

|

|

|

|

|

|

|

December 31

|

|

|

2016

|

|

2015

|

|

Assets

|

|

|

|

|

|

|

Investments, at fair value

|

$

|

239,985,938

|

|

$

|

199,205,911

|

|

Notes receivable from participants

|

|

8,841,630

|

|

|

8,466,177

|

|

Employer contribution receivable

|

|

2,059,659

|

|

|

474,612

|

|

Due to investment broker

|

|

(634)

|

|

|

(2,709)

|

|

Net assets available for benefits

|

$

|

250,886,593

|

|

$

|

208,143,991

|

|

|

|

|

|

|

|

|

See accompanying notes.

|

|

|

|

|

|

Universal Forest Products, Inc. Employees’ Profit Sharing and

401(k) Plan

Statements of Changes in Net Assets Available for Benefits

|

|

|

|

|

|

|

|

|

Years Ended December 31

|

|

|

2016

|

|

2015

|

|

Additions

|

|

|

|

|

|

|

Investment income:

|

|

|

|

|

|

|

Dividend and interest income

|

$

|

2,962,557

|

|

$

|

2,644,549

|

|

Net appreciation in fair value of common stocks

|

|

25,449,865

|

|

|

11,963,942

|

|

Net appreciation in fair value of common collective trust funds

|

|

341,370

|

|

|

301,351

|

|

Net appreciation (depreciation) in fair value of mutual funds

|

|

9,350,394

|

|

|

(2,152,337)

|

|

Total investment income

|

|

38,104,186

|

|

|

12,757,505

|

|

Participant contributions

|

|

13,391,716

|

|

|

11,315,737

|

|

Rollover contributions

|

|

2,459,837

|

|

|

924,102

|

|

Employer contributions

|

|

4,309,240

|

|

|

2,343,185

|

|

Interest from notes receivable from participants

|

|

451,247

|

|

|

438,645

|

|

Total Additions

|

|

58,716,226

|

|

|

27,779,174

|

|

Deductions

|

|

|

|

|

|

|

Distributions to participants

|

|

(15,420,323)

|

|

|

(17,530,960)

|

|

Administrative expenses

|

|

(553,301)

|

|

|

(605,819)

|

|

Total Deductions

|

|

(15,973,624)

|

|

|

(18,136,779)

|

|

Net increase

|

|

42,742,602

|

|

|

9,642,395

|

|

Transfers out (Note 3)

|

|

-

|

|

|

21,926

|

|

Net assets available for benefits at beginning of year

|

|

208,143,991

|

|

|

198,479,670

|

|

Net assets available for benefits at end of year

|

$

|

250,886,593

|

|

$

|

208,143,991

|

|

|

|

|

|

|

|

|

See accompanying notes.

|

|

|

|

|

|

Table of Contents

Universal Forest Products, Inc. Employees’ Profit Sharing and

401(k) Plan

Notes to Financial Statements

1.

Significant Accounting Policies

Recent Accounting Pronouncements

In May 2015, the Financial Accounting Standards Board ("FASB") issued Accounting Standards Update 2015-07 “Disclosures for Investments in Certain Entities that Calculate Net Asset Value Per Share (or its Equivalent),” (“ASU 2015-07”). ASU 2015-07 removes the requirement to categorize within the fair value hierarchy investments for which fair values are estimated using the net asset value practical expedient provided by Accounting Standards Codification 820, Fair Value Measurement. Disclosures about investments in certain entities that calculate net asset value per share are limited under ASU 2015-07 to those investments for which the entity has elected to estimate the fair value using the net asset value practical expedient. ASU 2015-07 is effective for fiscal years beginning after December 15, 2015, with early adoption permitted.

In July 2015, the FASB issued Accounting Standards Update 2015-12 “Plan Accounting: Defined Benefit Pension Plans (Topic 960), Defined Contribution Plans (Topic 962), Health and Welfare Benefit Plans (Topic 965)” (“ASU 2015-12”). The amendments in Part I of ASU 2015-12 eliminated the requirements that employee benefit plans measure the fair value of fully benefit-responsive investment contracts and provide the related fair value disclosures, rather these contracts will be measured and disclosed only at contract value. The amendments in Part II of ASU 2015-12 will require plans to disaggregate their investments measured using fair value only by general type, either on the financial statements or in the notes. Part II also eliminated the requirement to disclose the net appreciation/depreciation in fair value of investments by general type and the requirements to disclose individual investments that represent 5% or more of net assets available for benefits. The amendments in Part III of ASU 2015-12 provide a practical expedient to permit plans to measure its investments and investment related accounts as of a month-end date closest to its fiscal year for a plan with a fiscal year end that does not coincide with the end of a calendar month. The amendments in ASU 2015-12 are effective for reporting periods beginning after December 15, 2015, with early adoption permitted. As such, we early adopted ASU 2015-07 and ASU 2015-12 as of the year ended December 31, 2015. In regards to the early adoption of ASU 2015-07, the adoption of this standard did not have a material impact on the financial statements. In regards to the early adoption of ASU 2015-12, the adoption was applied retrospectively and certain reclassifications were made on the Statement of Net Assets Available for Benefits to present comparative statements and certain investment disclosures were revised or eliminated as a result of the adoption of this ASU.

Basis of Accounting

The financial statements of the Universal Forest Products, Inc. (Plan Sponsor) Employees’ Profit Sharing and 401(k) Plan (the Plan) are presented on the accrual method of accounting.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect reported amounts. Although actual results could differ from these estimates, management believes estimated amounts recorded are reasonable and appropriate.

Table of Contents

Universal Forest Products, Inc. Employees’ Profit Sharing and

401(k) Plan

Notes to Financial Statements (continued)

Risks and Uncertainties

The Plan utilizes various investment instruments. Investment securities, in general, are exposed to various risks, such as interest rate, credit, and overall market volatility. Due to the level of risk associated with certain investment securities, it is reasonably possible that changes in the values of investment securities will occur in the near term and that such changes could materially affect participants’ account balances and the amounts reported in the financial statements.

Investment Valuation and Income Recognition

The Plan’s investments are stated at estimated fair value. Fair value is the price that would be received to sell an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants on the measurement date.

Inputs to valuation techniques refer to the assumptions that market participants would use in pricing the asset or liability. The Plan utilizes a fair value hierarchy for valuation inputs that gives the highest priority to quoted prices in active markets for identical assets (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). A financial instrument’s level within the fair value hierarchy is based on the lowest level of any input that is significant to the fair value measurement. The following provides a description of the three levels of inputs that may be used to measure fair value:

Level 1

– Unadjusted quoted prices in active markets that are accessible at the measurement date for identical, unrestricted assets or liabilities.

Level 2

– Significant observable inputs such as quoted prices for similar assets or liabilities in active markets, quoted prices for identical or similar assets or liabilities in inactive markets, inputs other than quoted prices that are observable or can be derived from or corroborated by observable market data by correlation or other means.

Level 3

– Prices or valuations that require inputs that are both significant to the fair value measurement and unobservable.

The following valuation methodologies were used to measure the fair value of the Plan’s investments:

Common Stock:

Valued at quoted market prices in an exchange and active market in which the securities are traded.

Money Market Fund:

Valued at quoted market prices in an exchange and active market, which represent the net asset value (NAV) of shares held by the Plan. The money market fund seeks to maintain a $1.00 NAV.

Mutual Funds:

Valued at quoted market prices in an exchange and active market, which represent the net asset values of shares held by the Plan.

Common Collective Trust Funds:

The fair value of participation units held in Principal Global Investors Trust Company (formally known as “Union Bond & Trust Company”) Stable Value Fund, often referred to as "Morley Stable Value Fund", are based on net asset value, which is obtained on audited information reported by the issuer of the common collective trust at year-end, and is used as a practical expedient.

The Plan’s valuation methods may result in a fair value calculation that may not be indicative of net realizable value or reflective of future fair values. Although Plan management believes the valuation methods are appropriate and consistent with

Table of Contents

Universal Forest Products, Inc. Employees’ Profit Sharing and

401(k) Plan

Notes to Financial Statements (continued)

those participating in the market, the use of different methodologies or assumptions to determine the fair value of certain financial instruments could result in a different fair value measurement at the reporting date.

The investment objective of the Morley Stable Value Fund is to provide preservation of capital, relatively stable returns consistent with its comparatively low risk profile, and liquidity for benefit-responsive payments. Withdrawals from the Morley Stable Value Fund for benefit payments and participant transfers to noncompeting options are made to plan participants promptly upon request but in all cases within 30 days after written notification has been received. All plan sponsor-directed full or partial withdrawals are subject to a twelve month advance written notice requirement, though the Morley Stable Value Fund may waive this requirement at its discretion.

The Universal Forest Products Stock Fund (the Fund) is tracked on a unitized basis. At December 31, 2016, the Fund consists of common stock of Universal Forest Products, Inc. (Plan Sponsor) and funds that are held in the Wells Fargo Government Money Market Fund that are sufficient to meet the Fund’s daily cash needs. Unitization of the Fund allows for daily trades. The value of a unit reflects the combined market value of the common stock and the Wells Fargo Government Money Market Fund held by the Fund. At December 31, 2016 and 2015, 686,598 and 763,542 units, respectively, were outstanding with a value of $100.85 and $67.96 per unit, respectively.

Purchases and sales of securities are recorded on a trade date basis. Interest income is recorded on the accrual basis. Dividends are recorded on the ex-dividend date. Net appreciation and depreciation include the Plan’s gains and losses on investments bought or sold as well as held during the year.

Notes Receivable from Participants

Notes receivables from participants are measured at their unpaid principal balance plus any accrued but unpaid interest. Delinquent notes receivable from participants are deemed distributions based upon the terms of the Plan document.

Payment of Benefits

Benefits are recorded when paid.

Concentration of Investments

Included in investments at December 31, 2016 and 2015 are shares of the Plan Sponsor’s common stock with an aggregate fair value of $67,848,848 and $50,741,137, respectively. This investment represents 28% and 25% of total investments at December 31, 2016 and 2015, respectively. A significant decline in the market value of the sponsor’s stock would significantly affect the net assets available for benefits.

Administrative Expenses

Administrative expenses incurred in connection with the operations of the Plan are paid via certain investment and transactional fees which are borne by the Plan and applied to applicable participant balances. These fees are disclosed in the annual Fee Disclosure Notice and on individual account statements sent to all Plan participants. Substantially all of these expenses are paid to parties-in-interest of the Plan and are based on reasonable and customary rates for the related services. Certain administrative expenses not reflected in this report are paid directly by the Plan Sponsor.

Table of Contents

Universal Forest Products, Inc. Employees’ Profit Sharing and

401(k) Plan

Notes to Financial Statements (continued)

2.

Description of the Plan

General

The following description of the Plan provides only general information. Participants should refer to the Plan Document and Summary Plan Description, as amended, for a more complete description of the Plan’s provisions.

The Plan is a defined-contribution, profit sharing and 401(k) plan that provides tax-deferred benefits for substantially all eligible employees of the Plan Sponsor or other Participating Employers, excluding the employees of separate subsidiaries that maintain a similar defined-contribution plan and those covered under a collective bargaining agreement. The Plan is subject to the provisions of the Employee Retirement Security Act of 1974 (ERISA).

All newly eligible employees are automatically enrolled in the Plan at a deferral level of 3% of eligible compensation. Eligible employees are those who are 18 years or older, have completed 60 days of employment and are hired to work more than 180 days.

Contributions

Participants may voluntarily contribute up to 75% of their eligible compensation as a 401(k) contribution subject to certain regulatory limitations. Participant contributions to the Plan vest immediately.

The Plan Sponsor contributes regular discretionary matching contributions and may contribute additional discretionary matching contributions. Regular discretionary matching contributions are made quarterly and were 25% of participant deferrals in 2016 and 2015, on the first 6% of each participant’s eligible compensation. In 2016, an additional discretionary matching contribution of approximately $1.7 million was made subsequent to year-end, and is therefore included in the Employer contribution receivable at year-end. These amounts are not guaranteed, and may vary from year to year as the Plan Sponsor is not obligated to make such contributions.

The Plan Sponsor may also contribute a discretionary profit sharing amount annually as determined by management and approved by the Plan Sponsor’s Board of Directors. The Plan Sponsor’s annual profit sharing contributions are allocated to participants who had at least 1,000 hours of service during the plan year and are allocated to each participant’s account in the same ratio that each participant’s total compensation for the Plan year bears to the total compensation of all participants for such year. No discretionary profit sharing contributions were made in 2016 or 2015.

Employer contributions are subject to a vesting schedule as follows:

|

|

|

|

|

Years of Service

|

|

Vesting Percentage

|

|

Less than 2

|

|

0%

|

|

2 but less than 3

|

|

20

|

|

3 but less than 4

|

|

40

|

|

4 but less than 5

|

|

60

|

|

5 but less than 6

|

|

80

|

|

6 or more

|

|

100

|

Table of Contents

Universal Forest Products, Inc. Employees’ Profit Sharing and

401(k) Plan

Notes to Financial Statements (continued)

The Plan was amended effective January 1, 2012 to be designated as an ESOP for those Participants with a portion of their account balance invested in the Universal Forest Products, Inc. Common Stock Fund. This provision allows those Participants who are 100% vested the opportunity to elect to have the dividends on the employer stock fund paid to them in cash.

Participant Accounts

Participants may select from various investment options made available by the Plan. Each participant’s account is credited with the participant’s contribution, an allocation of the Plan Sponsor’s contribution, if any, Plan earnings and losses and certain administrative expenses. Earnings allocations are based on participant account balances, as defined in the Plan agreement.

The vested portion of terminated and retired participants’ accounts are available for distribution following a separation from service. Forfeitures are used to offset the Plan Sponsor’s matching contributions and for reasonable administrative expenses. During 2016 and 2015, forfeitures of approximately $270,000 and $200,000, respectively, were used to offset the Plan Sponsor’s matching contributions.

Participant Loans

Participants may borrow from their account a minimum amount of $1,000 up to a maximum equal to the lesser of $50,000 or 50% of their vested account balance, reduced by any outstanding loans as outlined in the Plan Document. Loan terms range from one to five years or up to 25 years for the purchase of a residence. The loans bear interest at a rate equal to the prime rate (3.75% at December 31, 2016) plus 2% calculated on a daily basis. Interest rates on outstanding loans ranged from 4.50% to 11.50% at December 31, 2016.

Payment of Benefits

Before attainment of age 59½, participants may request in-service withdrawals from the Rollover balance within their account. Participants may also request an in-service withdrawal from their Salary Deferral balance in the event of a financial hardship, subject to certain limitations as defined by the Plan. Once a participant attains age 59½, in-service withdrawals may be made from all contribution sources.

Upon separation from service, a participant is eligible for a lump sum distribution of their full, vested account balance. Participants may elect to receive the distribution in a lump sum amount, a qualified rollover to another plan, or may defer their distribution until a later date. However, in the absence of an election, if the vested portion of a participant’s account is $1,000 or less, this amount will be paid as a lump sum distribution as soon as administratively allowable. Participants who incur a separation from service as a result of their death, Total Disability, or Retirement will be vested at 100% prior to their distribution.

Termination

The Plan Sponsor intends to continue the Plan indefinitely, but reserves the right to terminate or amend the Plan at any time. In the event of termination of the Plan, all participants are automatically fully vested in the value of their accounts and will be paid in full.

Table of Contents

Universal Forest Products, Inc. Employees’ Profit Sharing and

401(k) Plan

Notes to Financial Statements (continued)

3.

Transfers

There were no transfers to or from the 401(k) plan during 2016. As permitted by the plan, funds totaling $21,926 were transferred from the Shawnlee Construction LLC 401(k) Plan (an affiliated plan) during 2015, due to employee transfers.

4.

Investments

The tables below set forth by level within the fair value hierarchy the Plan’s investments as of December 31, 2016 and 2015.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investment Assets at Fair Value as of December 31, 2016

|

|

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Total

|

|

Company common stock

|

|

$

|

67,848,848

|

|

$

|

—

|

|

$

|

—

|

|

$

|

67,848,848

|

|

Money market funds

|

|

|

1,397,361

|

|

|

—

|

|

|

—

|

|

|

1,397,361

|

|

Mutual funds

|

|

|

138,984,605

|

|

|

—

|

|

|

—

|

|

|

138,984,605

|

|

Total assets in fair value hierarchy

|

|

|

208,230,814

|

|

|

—

|

|

|

—

|

|

|

208,230,814

|

|

Investments measured at net asset value*

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

31,755,124

|

|

Total investments at fair value

|

|

$

|

208,230,814

|

|

$

|

—

|

|

$

|

—

|

|

$

|

239,985,938

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investment Assets at Fair Value as of December 31, 2015

|

|

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Total

|

|

Company common stock

|

|

$

|

50,741,137

|

|

$

|

—

|

|

$

|

—

|

|

$

|

50,741,137

|

|

Money market funds

|

|

|

1,149,904

|

|

|

—

|

|

|

—

|

|

|

1,149,904

|

|

Mutual funds

|

|

|

116,801,448

|

|

|

—

|

|

|

—

|

|

|

116,801,448

|

|

Total assets in fair value hierarchy

|

|

|

168,692,489

|

|

|

—

|

|

|

—

|

|

|

168,692,489

|

|

Investments measured at net asset value*

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

30,513,422

|

|

Total investments at fair value

|

|

$

|

168,692,489

|

|

$

|

—

|

|

$

|

—

|

|

$

|

199,205,911

|

* The investments in common/collective trusts are measured at fair value using the net asset value per share (or its equivalent) as a practical expedient and have not been categorized in the fair value hierarchy. The fair value amounts presented in this table are intended to permit reconciliation of the fair value hierarchy to the amounts presented in the Statements of Net Assets Available for Benefits.

There have been no changes in the methodologies used at December 31, 2016 and 2015, and there have been no significant transfers in or out of Levels 1, 2 or 3.

5.

Income Tax Status

The Plan Sponsor has received a determination letter from the Internal Revenue Service dated March 17, 2017, stating that the Plan is qualified under section 401(a) of the Internal Revenue Code (the Code), and, therefore, the related trust is exempt from taxation. Subsequent to this determination by the Internal Revenue Service, the Plan was amended. Once qualified, the Plan is required to operate in conformity with the Code to maintain its qualification. The Plan Sponsor believes the Plan is being operated in compliance with the applicable requirements of the Code and, therefore, believes that the Plan, as amended, is qualified and the related trust is tax exempt.

Accounting principles generally accepted in the United States of America require plan management to evaluate tax positions taken by the Plan and recognize a tax liability (or asset) if the Plan has taken an uncertain position that more likely than not would not be sustained upon examination by the Internal Revenue Service. The Plan administrator has analyzed the tax

Table of Contents

Universal Forest Products, Inc. Employees’ Profit Sharing and

401(k) Plan

Notes to Financial Statements (continued)

positions taken by the Plan and has concluded that as of December 31, 2016, there are no uncertain positions taken or expected to be taken that would require recognition of a liability (or asset) or disclosure in the financial statements. The Plan is subject to routine audits by taxing jurisdictions; however, there are currently no audits for any tax periods in progress.

Table of Contents

Universal Forest Products, Inc. Employees’ Profit Sharing and

401(k) Plan

Schedule H, Line 4i – Schedule of Assets (Held at End of Year)

EIN #38-1465835 Plan #001

December 31, 2016

|

|

|

|

|

|

|

(a)

|

(b)

|

(c)

|

|

(e)

|

|

|

|

Description of Investment Including, Maturity Date,

|

|

|

|

|

Identity of Issuer, Borrower, Lessor, or Similar Party

|

Rate of Interest, Collateral, Par, or Maturity Value

|

|

Current Value

|

|

|

|

|

|

|

|

|

Common stock:

|

|

|

|

|

*

|

Universal Forest Products, Inc.

|

Universal Forest Products Common Stock

|

$

|

67,848,848

|

|

|

|

|

|

|

|

|

Common collective trust funds:

|

|

|

|

|

|

Principal Global Investors Trust Company

|

Stable Value Fund

|

|

31,755,124

|

|

|

|

|

|

|

|

|

Money market funds:

|

|

|

|

|

|

Wells Fargo

|

Government Money Market Fund

|

|

1,397,361

|

|

|

|

|

|

|

|

|

Mutual funds:

|

|

|

|

|

|

JP Morgan

|

Large Cap Growth Fund

|

|

10,399,076

|

|

|

Vanguard

|

Midcap Index Fund

|

|

14,142,362

|

|

|

Vanguard

|

Small Cap Index Fund

|

|

1,552,450

|

|

|

Vanguard

|

Total Bond Market Index

|

|

3,941,675

|

|

|

Vanguard

|

Total International Stock Index Fund

|

|

722,614

|

|

|

Vanguard

|

500 Index Fund

|

|

12,975,164

|

|

|

Neuberger Berman

|

Genesis Fund

|

|

9,770,249

|

|

|

Invesco

|

Growth and Income Fund

|

|

16,151,148

|

|

|

Dodge & Cox

|

Income Fund

|

|

5,700,018

|

|

|

Dodge & Cox

|

International Stock Fund

|

|

5,177,687

|

|

|

T. Rowe Price

|

Retirement 2050 Fund

|

|

7,997,805

|

|

|

|

Retirement 2040 Fund

|

|

12,838,099

|

|

|

|

Retirement 2030 Fund

|

|

14,992,377

|

|

|

|

Retirement 2020 Fund

|

|

18,735,603

|

|

|

|

Retirement 2010 Fund

|

|

2,119,153

|

|

|

|

Retirement Income Fund

|

|

1,769,125

|

|

|

|

|

|

138,984,605

|

|

|

|

|

|

239,985,938

|

|

*

|

Notes receivable from participants

|

Collateralized by vested account balances, payable in monthly installments with interest rates ranging from 4.50% to 11.50%

|

|

|

|

|

|

|

|

8,841,630

|

|

|

|

|

$

|

248,827,568

|

|

*

|

Indicates a party-in-interest to the Plan.

|

|

|

|

|

|

|

|

|

|

|

|

Note: Column (d), cost, is not applicable, as all investments are participant-directed.

|

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, Universal Forest Products, Inc., as Plan Administrator, has duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

Universal Forest Products, Inc. Employee's Profit

|

|

|

|

|

Sharing and 401(k) Plan

|

|

|

|

|

|

|

Date:

|

June 14, 2017

|

|

/s/ Michael R. Cole

|

|

|

|

|

Michael R. Cole,

|

|

|

|

|

Universal Forest Products, Inc., Plan Administrator

|

|

|

|

|

|

|

Date:

|

June 14, 2017

|

|

/s/ Nancy A. DeGood

|

|

|

|

|

Nancy A. DeGood,

|

|

|

|

|

Universal Forest Products, Inc., Plan Administrator

|

|

|

|

|

|

|

|

|

|

EXHIBIT INDEX

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

23

|

|

Consent of BDO USA, LLP

|

|

|

|

|

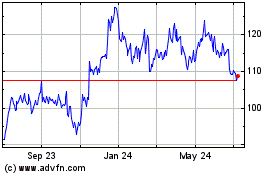

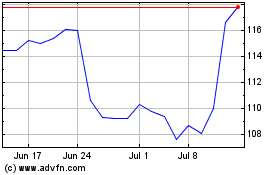

UFP Industries (NASDAQ:UFPI)

Historical Stock Chart

From Mar 2024 to Apr 2024

UFP Industries (NASDAQ:UFPI)

Historical Stock Chart

From Apr 2023 to Apr 2024