New Jacamar Oil Field

DiscoveryExtension of Jacana Oil Field BoundariesNew

Zone Addition in Jacana Oil FieldAdditional Production in

Tigana Oil Field

GeoPark Limited (“GeoPark” or the “Company”) (NYSE: “GPRK”), a

leading independent Latin American oil and gas explorer, operator

and consolidator with operations and growth platforms in Colombia,

Chile, Brazil, Argentina, and Peru, today announced new drilling

and testing successes in the Llanos 34 Block (GeoPark operated with

a 45% working interest) in Colombia.

New Jacamar Oil Field Discovery

Exploring a fault trend southeast of the Tigana/Jacana oil field

complex, GeoPark drilled and completed the Jacamar 1 exploration

well to a total depth of 10,627 feet. A test conducted with an

electric submersible pump in the Guadalupe formation resulted in a

production rate of approximately 1,000 bopd of 17.5 degrees API,

with 13% water cut, through a choke of 38/64 mm and wellhead

pressure of 79 pounds per square inch. Additional production

history is required to determine stabilized flow rates of the well.

Surface facilities are in place and the well is already in

production. Oil shows during drilling and petrophysical analysis

indicate the potential for hydrocarbon production also in the

shallower Mirador and the deeper Gacheta formations.

Jacana Oil Field Extension

Following the drilling of the Jacana Sur 2 appraisal well in the

first quarter of 2017 to test the northwest boundaries of the

Jacana oil field, a test was conducted with an electric submersible

pump in the Guadalupe formation. It resulted in a production rate

of approximately 270 bopd of 16.5 degrees API, with 21% water cut,

through a choke of 32/64 mm and wellhead pressure of 48 pounds per

square inch. Additional production history is required to determine

stabilized flow rates of the well. Surface facilities are in place

and the well is already in production.

Jacana Oil Field New Formation Addition

Following the drilling of the Jacana 8 appraisal well in the

first quarter of 2017 to test a channel sand in the Mirador

formation, which had not previously produced oil in the Jacana oil

field, a test conducted with an electric submersible pump resulted

in a production rate of approximately 1,850 bopd of 24.0 degrees

API, with 0.4% water cut, through a choke of 32/64 mm and wellhead

pressure of 100 pounds per square inch. The deeper Guadalupe

formation was also tested and oil was found in an area which

previously had no reserves assigned to it. Additional production

history is required to determine stabilized flow rates of the well.

Surface facilities are in place and the well is already in

production.

Tigana Oil Field Production Addition

GeoPark drilled and completed the Tigana Sur 5 development well

to a total depth of 11,310 feet. A test conducted with an electric

submersible pump in the Guadalupe formation resulted in a

production rate of approximately 1,010 bopd of 14.9 degrees API,

with a 0.4% water cut, through a choke of 32/64 mm and wellhead

pressure of 85 pounds per square inch. Additional production

history is required to determine stabilized flow rates of the well.

Surface facilities are in place and the well is already in

production.

Current Drilling

Current drilling by GeoPark includes:

- Colombia: Jacana 9 appraisal well to

test the northern limits of the Jacana oil field and Curucucu 1

exploration well to test a new prospect adjacent to the

newly-discovered Jacamar oil field – both wells in the Llanos 34

Block (GeoPark operated with a 45% WI) in the Llanos Basin

- Argentina: Rio Grande Oeste 1

exploration well in the CN-V Block (GeoPark operated with a 50% WI)

in the Neuquen Basin

- Chile: Kimiri Aike 4 development well

in the Fell Block (GeoPark operated with a 100% WI) in the

Magallanes Basin

GeoPark’s total oil and gas production is continuing to grow

with new drilling results and is currently over 27,900 boepd.

Oil Market Hedge Position

For the period July 2017 to December 2017, GeoPark secured a

minimum Brent price of $51 per barrel for 6,000 bopd through a

zero-cost collar structure that includes a maximum price of $57.5

per barrel. Approximately 50-60% of GeoPark’s production is hedged

through the third quarter of 2017 at a floor of $51-$53 per barrel

and 25-30% is hedged through the fourth quarter of 2017 at a floor

of $51.

James F. Park, CEO of GeoPark, commented: “Congratulations to

our team for being able to execute and deliver such impressive

results across our assets in such a compressed period. We continue

to find more oil and grow production in the Llanos 34 Block as we

work to extend limits, add new formations and explore new

accumulations. We also are now exploring and developing familiar

and reliable rocks in Argentina and Chile. GeoPark has always grown

by the drill bit and continues to demonstrate an exceptional

drilling success rate with world-beating finding and development

costs.”

GeoPark can be visited online at www.geo-park.com

NOTICE

Additional information about GeoPark can be found in the

“Investor Support” section on the website at www.geo-park.com.

Rounding amounts and percentages: Certain amounts and

percentages included in this press release have been rounded for

ease of presentation. Percentage figures included in this press

release have not in all cases been calculated on the basis of such

rounded figures, but on the basis of such amounts prior to

rounding. For this reason, certain percentage amounts in this press

release may vary from those obtained by performing the same

calculations using the figures in the financial statements. In

addition, certain other amounts that appear in this press release

may not sum due to rounding.

CAUTIONARY STATEMENTS RELEVANT TO

FORWARD-LOOKING INFORMATION

This press release contains statements that constitute

forward-looking statements. Many of the forward-looking statements

contained in this press release can be identified by the use of

forward-looking words such as ‘‘anticipate,’’ ‘‘believe,’’

‘‘could,’’ ‘‘expect,’’ ‘‘should,’’ ‘‘plan,’’ ‘‘intend,’’ ‘‘will,’’

‘‘estimate’’ and ‘‘potential,’’ among others.

Forward-looking statements that appear in a number of places in

this press release include, but are not limited to, statements

regarding the intent, belief or current expectations, regarding

various matters, including expected 2017 production growth, payback

timing, IRR and capital expenditures plan. Forward-looking

statements are based on management’s beliefs and assumptions, and

on information currently available to the management. Such

statements are subject to risks and uncertainties, and actual

results may differ materially from those expressed or implied in

the forward-looking statements due to various factors.

Forward-looking statements speak only as of the date they are

made, and the Company does not undertake any obligation to update

them in light of new information or future developments or to

release publicly any revisions to these statements in order to

reflect later events or circumstances, or to reflect the occurrence

of unanticipated events. For a discussion of the risks facing the

Company which could affect whether these forward-looking statements

are realized, see filings with the U.S. Securities and Exchange

Commission.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170612005387/en/

INVESTORS:Stacy Steimel, +562 2242 9600Shareholder Value

DirectorSantiago, Chilessteimel@geo-park.comorDolores Santamarina,

+5411 4312 9400Investor ManagerBuenos Aires,

Argentinadsantamarina@geo-park.comorMEDIA:Sard Verbinnen

& CoJared Levy, +1 212-687-8080New York,

USAjlevy@sardverb.comorSard Verbinnen & CoKelsey Markovich, +1

212-687-8080New York, USAkmarkovich@sardverb.com

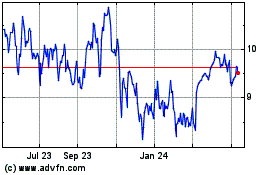

GeoPark (NYSE:GPRK)

Historical Stock Chart

From Mar 2024 to Apr 2024

GeoPark (NYSE:GPRK)

Historical Stock Chart

From Apr 2023 to Apr 2024