Use these links to rapidly review the document

TABLE OF CONTENTS PROSPECTUS SUPPLEMENT

Table of Contents

Filed Pursuant to Rule 424(b)(5)

Registration No. 333-209888

PROSPECTUS SUPPLEMENT

(To Prospectus Dated June 3, 2016)

Intrepid Potash, Inc.

Up to $40,000,000

Common Stock

We have entered into a certain Controlled Equity Offering

SM

Sales Agreement, or sales agreement, with Cantor

Fitzgerald & Co., or Cantor Fitzgerald, relating to shares of our common stock, par value $0.001 per share, offered by this prospectus supplement and the accompanying prospectus. In

accordance with the terms of the sales agreement, from time to time, we may offer and sell shares of our common stock having an aggregate offering price of up to $40 million through Cantor

Fitzgerald, acting as sales agent. Our common stock is listed on the New York Stock Exchange, or NYSE, under the symbol "IPI." On May 25, 2017, the last reported sale price of our common stock

as reported on the NYSE was $2.36 per share.

Sales

of our common stock, if any, under this prospectus supplement and accompanying prospectus may be made in sales deemed to be an "at the market offering" as defined in

Rule 415(a)(4) promulgated under the Securities Act of 1933, as amended, or the Securities Act. Subject to terms of the sales agreement, Cantor Fitzgerald is not required to sell any specific

number or dollar amounts of securities but will act as our sales agent using commercially reasonable efforts consistent with its normal trading and sales practices, on mutually agreed terms between

Cantor Fitzgerald and us. There is no arrangement for funds to be received in any escrow, trust or similar arrangement.

Cantor

Fitzgerald will be entitled to compensation under the terms of the sales agreement at a fixed commission rate equal to 3.0% of the gross sales price per share sold. In connection

with the sale of our common stock on our behalf, Cantor Fitzgerald will be deemed to be an "underwriter" within the meaning

of the Securities Act, and the compensation of Cantor Fitzgerald will be deemed to be underwriting commissions or discounts. We have also agreed to provide indemnification and contribution to Cantor

Fitzgerald against certain civil liabilities, including liabilities under the Securities Act.

We

will use the net proceeds from any sales under this prospectus supplement as described herein under "Use of Proceeds."

Investing in our common stock involves risks. See "Risk Factors" beginning on page S-8 of this prospectus supplement and under similar

headings in the documents incorporated by reference into this prospectus supplement and on page 1 of the accompanying base prospectus.

None of the Securities and Exchange Commission (the "SEC"), any state securities commission or any other regulatory body

has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying base prospectus is truthful or complete. Any representation to the contrary is a

criminal offense.

The date of this prospectus supplement is May 26, 2017.

Table of Contents

TABLE OF CONTENTS

PROSPECTUS SUPPLEMENT

PROSPECTUS

S-i

Table of Contents

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement and the accompanying base prospectus are part of a universal shelf registration statement on Form S-3 that we

initially filed with the Securities and Exchange Commission (the "SEC") on March 2, 2016 and that was declared effective by the SEC on June 3, 2016. Under the shelf registration process,

we may offer and sell securities in one or more offerings from time to time. In the accompanying base prospectus, including the documents incorporated by reference, we provide you with a general

description of the securities we may offer from time to time under our shelf registration statement, some of which may not apply to our common stock or this offering. This prospectus supplement

describes the specific details regarding this offering, including the terms and the risks of investing in our common stock. Generally, when we refer to this prospectus supplement, we are referring to

both parts of this document combined. This prospectus supplement, the accompanying base prospectus and the documents incorporated by reference herein and therein include important information about

us, the common stock being offered and other information you should know before investing. See "Incorporation of Certain Information by Reference."

You

should rely only on the information contained in or incorporated by reference in this prospectus supplement, the accompanying base prospectus and any free writing prospectus we may

provide you in connection with this offering. If any information varies between this prospectus supplement, the accompanying base prospectus or documents incorporated by reference herein prior to the

date of this prospectus supplement, you should rely on the information in this prospectus supplement. We have not, and the sales agent has not, authorized any other person to provide you with

additional or different information. If anyone provides you with additional, different or inconsistent information, you should not rely on it. We are not, and the sales agent is not, making an offer

to sell these securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information appearing in this prospectus supplement, the accompanying base

prospectus, any free writing prospectus and the documents incorporated by reference are accurate as of any date subsequent to their respective dates.

The

information contained in this prospectus supplement and the accompanying base prospectus or in any document incorporated by reference herein or therein is accurate and complete only

as of the date hereof or thereof, respectively, regardless of the time of delivery of this prospectus supplement and the accompanying base prospectus or of any sale of our common stock by us or the

sales agent. Our business, financial condition, results of operations and prospects may have changed since those dates.

Trademarks, Service Marks and Trade Names

We own or have rights to various trademarks, service marks and trade names that we use in connection with the operation of our business. This

prospectus supplement may also contain or incorporate by reference trademarks, service marks and trade names of third parties, which are the property of their respective owners. Our use or display of

third parties' trademarks, service marks, trade names or products in this prospectus supplement and the documents incorporated by reference into this prospectus supplement is not intended to, and does

not, imply a relationship with, or endorsement or sponsorship by, us. Solely for convenience, the trademarks, service marks, and trade names presented or incorporated by reference into this

prospectus supplement may appear without the ®, TM, or SM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under

applicable law, our rights or the rights of the applicable licensor to these trademarks, service marks and trade names.

S-ii

Table of Contents

Certain Terms Used in This Prospectus Supplement

Unless the context otherwise requires, the following definitions apply throughout this prospectus

supplement:

-

•

-

"Intrepid," "our," "we," or "us" means Intrepid Potash, Inc. and its consolidated subsidiaries.

-

•

-

"East," "North," and "HB" mean our three operating facilities in Carlsbad, New Mexico. "Moab" means our operating facility in Moab, Utah.

"Wendover" means our operating facility in Wendover, Utah. "West" means our previous operating facility in Carlsbad, New Mexico, which was placed in care-and-maintenance mode in mid-2016.

-

•

-

"Ton" means a short ton, or a measurement of mass equal to 2,000 pounds.

S-iii

Table of Contents

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC allows us to "incorporate by reference" the information that we file with it. This permits us to disclose important information to you

by referring you to documents previously filed with the SEC. The information incorporated by reference is an important part of this prospectus supplement, and any information filed by us with the SEC

subsequent to the date of this prospectus supplement will automatically be deemed to update and supersede this information. We incorporate by reference the following documents (other than information

furnished and not deemed "filed" under the Securities Exchange Act of 1934, as amended (the "Exchange Act")) that we have filed with the SEC:

-

•

-

our Annual Report on Form 10-K for the year ended December 31, 2016, filed with the SEC on February 28, 2017;

-

•

-

the information specifically incorporated by reference into our Annual Report on Form 10-K for the year ended December 31, 2016

from our Definitive Proxy Statement on Schedule 14A filed on April 6, 2017;

-

•

-

our Quarterly Report on Form 10-Q for the quarter ended March 31, 2017, filed with the SEC on May 2, 2017;

-

•

-

our Current Reports on Form 8-K, filed with the SEC on March 21, 2017 and March 24, 2017; and

-

•

-

the description of our common stock set forth in the registration statement on Form 8-A filed with the SEC on April 16, 2008.

In

addition, all documents filed by us pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, subsequent to the date of this prospectus supplement, shall be deemed to

be incorporated in this prospectus and to be a part hereof from the date of filing of such documents with the SEC (other than any portions of any such documents that are not deemed "filed" under the

Exchange Act in accordance with the Exchange Act and applicable SEC rules). Any statement contained in a document incorporated by reference into this prospectus shall be deemed to be modified or

superseded for all purposes to the extent that a statement contained in this prospectus or in any other subsequently filed document that is also incorporated or deemed to be incorporated by reference,

modifies or supersedes such statement. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

You

may request a copy of our filings, other than an exhibit to a filing unless that exhibit is specifically incorporated by reference into that filing, at no cost, by writing or calling

us at Intrepid Potash, Inc., 707 17th Street, Suite 4200, Denver, Colorado 80202, telephone number (303) 296-3006.

S-1

Table of Contents

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement and the accompanying base prospectus contain forward-looking statements within the meaning of the Exchange Act, and

the Securities Act of 1933, as amended (the "Securities Act"). These forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995.

Forward-looking statements include statements about our future results of operations and financial position, our business strategy and plans, and our objectives for future operations, among other

things. In some cases, you can identify these statements by forward-looking words, such as "estimate," "expect," "anticipate," "project," "plan," "intend," "believe," "forecast," "foresee," "likely,"

"may," "should," "goal," "target," "might," "will," "could," "predict" and "continue." Forward-looking statements are only predictions based on our current knowledge, expectations, and projections

about future events. These forward-looking statements are subject to a number of risks, uncertainties and assumptions which include, but are not limited to, the heading "Risk Factors" in our most

recent Annual Report on Form 10-K, our most recent Quarterly Report on Form 10-Q, any subsequently filed Quarterly Reports on Form 10-Q and any subsequently filed Current Reports

on Form 8-K, all of which are incorporated by reference in this prospectus supplement, and the risk factors included in this prospectus supplement and in any documents incorporated by reference

herein. Forward-looking statements include statements relating to, among other things:

-

•

-

our growth strategies;

-

•

-

volatility of potash and Trio® prices and factors impacting such prices;

-

•

-

our liquidity and sufficiency of cash flow from operations, cash-on-hand and availability under our credit facility to fund our planned capital

expenditures, operating expenses and repayment of debt;

-

•

-

variations from our assumptions with respect to our financial condition, expected growth, results of operations, performance, business

prospects and opportunities and effective tax rates;

-

•

-

fluctuations in supply and demand in the fertilizer market;

-

•

-

results from planned mining operations and production operations;

-

•

-

payment of dividends;

-

•

-

loss contingencies;

-

•

-

impact of lower or higher commodity prices and interest rates;

-

•

-

impact of global geopolitical and macroeconomic events;

-

•

-

amount and allocation of forecasted capital expenditures and plans for funding capital expenditures, operating expenses, repayment of debt and

working capital requirements;

-

•

-

fair values and critical accounting estimates, including estimated asset retirement obligations;

-

•

-

implementation and impact of new accounting pronouncements;

-

•

-

factors impacting our ability to transport minerals;

-

•

-

potential for asset impairments and impact of impairments on financial statements;

-

•

-

ability to meet delivery and sales commitments; and

-

•

-

changes to production plans, operating costs and capital expenditures.

Any

or all forward-looking statements may turn out to be incorrect. They can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. Many such factors will

be

S-2

Table of Contents

important

in determining our actual future results. These statements are based on current expectations and the current economic environment. They involve a number of risks and uncertainties that are

difficult to predict. These statements are not guarantees of future performance, and there are no guarantees about the performance of any securities offered by this prospectus supplement. Actual

results could differ materially from those expressed or implied in the forward-looking statements. Factors that could cause actual results to differ materially include, but are not limited to the

following:

-

•

-

the risk factors discussed in this prospectus supplement or any document we incorporate by reference;

-

•

-

our ability to expand Trio® sales internationally and manage risks associated with international sales, including pricing pressure,

increased competition and the availability of chemically similar alternatives;

-

•

-

our ability to successfully identify and implement any opportunities to expand operations to include more by-products and non-potassium related

products;

-

•

-

our ability to successfully execute on our plans to transition our sales model after the idling of our West facility and the transitioning of

our East facility to Trio®-only production;

-

•

-

our ability to comply with the revised terms of our senior notes and our revolving credit facility, including the covenants in each agreement,

to avoid a default under those agreements;

-

•

-

changes in the price, demand, or supply of potash or Trio®;

-

•

-

the costs of, and our ability to successfully construct, commission and execute, any of our strategic projects;

-

•

-

declines or changes in agricultural production or fertilizer application rates;

-

•

-

further write-downs of the carrying value of our assets, including inventories;

-

•

-

circumstances that disrupt or limit our production, including operational difficulties or variances, geological or geotechnical variances,

equipment failures, environmental hazards and other unexpected events or problems;

-

•

-

changes in our reserve estimates;

-

•

-

currency fluctuations;

-

•

-

adverse changes in economic conditions or credit markets;

-

•

-

the impact of governmental regulations, including environmental and mining regulations, the enforcement of those regulations, and governmental

policy changes;

-

•

-

adverse weather events, including events affecting precipitation and evaporation rates at our solar solution mines;

-

•

-

increased labor costs or difficulties in hiring and retaining qualified employees and contractors, including workers with mining, mineral

processing, or construction expertise;

-

•

-

changes in the prices of raw materials, including chemicals, natural gas, and power;

-

•

-

our ability to obtain and maintain any necessary governmental permits or leases relating to current or future operations;

-

•

-

declines in the use of potash products by oil and gas companies in their drilling operations;

-

•

-

interruptions in rail or truck transportation services, or fluctuations in the costs of these services;

-

•

-

our inability to fund necessary capital investments; and

S-3

Table of Contents

-

•

-

other factors, most of which are beyond our control.

We

do not undertake any obligation to publicly correct or update any forward-looking statement if we later become aware that it is not likely to be achieved. You are advised, however, to

consult any further disclosures we make on related subjects in reports filed with the SEC.

S-4

Table of Contents

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights information contained elsewhere in this prospectus supplement and the accompanying base

prospectus. It does not contain all of the information that you should consider before making an investment decision. For a more complete understanding of our business and this offering, you should

carefully read the entire prospectus supplement, the accompanying base prospectus and the documents incorporated by reference herein, including our historical financial statements and the notes

thereto, which are incorporated herein by reference. You should read "Risk Factors" beginning on page S-7 of this prospectus supplement, on page 1 of the accompanying base prospectus and

Item 1A. "Risk Factors" in our Annual Report on Form 10-K for the year ended December 31, 2016, for more information about important risks that you should consider before making a

decision to invest in our common stock.

Unless the context requires otherwise, references in this prospectus supplement to "Intrepid," "the "Company," "we," "us" and "our" refer to Intrepid

Potash, Inc. and its direct and indirect subsidiaries on a consolidated basis.

Intrepid Potash, Inc.

We are the only producer of potash in the United States and one of two producers of langbeinite, which we market and sell as Trio®.

Potash, or "muriate of potash" or "potassium chloride," is used as a fertilizer in agricultural markets worldwide. Potash is also used in oil and gas drilling and stimulation fluids and in animal

feed. Langbeinite is a low-chloride potassium fertilizer that also contains sulfate and magnesium that is used primarily in magnesium- and sulfur-deficient soils and on crops that need a low-chloride

source of potassium such as citrus, vegetable, sugarcane and palm. Langbeinite is also used as an animal feed supplement. We also sell water and byproducts including salt, magnesium chloride and

brine.

We

produce potash from three solar evaporation solution mining facilities: (i) our HB solution mine in Carlsbad, New Mexico, (ii) our solution mine in Moab, Utah and

(iii) our brine recovery mine in Wendover, Utah. We also operate our North compaction facility in Carlsbad, New Mexico, which compacts and granulates product from our HB solution mine. We

produce Trio® from our conventional underground East mine in Carlsbad, New Mexico.

S-5

Table of Contents

Corporate Information

Our principal offices are located at 707 17th Street, Suite 4200, Denver, Colorado 80202, and our telephone number is

(303) 296-3006. Our website address is

www.intrepidpotash.com

. The information contained on or accessible through our website is not part of this

prospectus supplement, other than the documents that we file with the SEC that are expressly incorporated by reference into this prospectus supplement. See "Incorporation of Certain Information by

Reference."

S-6

Table of Contents

The Offering

|

|

|

|

|

Issuer

|

|

Intrepid Potash, Inc.

|

|

Common stock offered by us

|

|

Shares of common stock having an aggregate offering price of up to $40,000,000.

|

|

Plan of Distribution

|

|

At the market offering that may be made from time to time through our sales agent, Cantor Fitzgerald. See "Plan of

Distribution" on page S-15.

|

|

Use of Proceeds

|

|

We intend to use the net proceeds of sales of shares of our common stock offered hereby for general corporate purposes,

which may include, among other things, the repayment of indebtedness under our senior notes, repayment of indebtedness under our revolving credit facility, acquisitions, and funding capital expenditures.

|

|

Risk Factors

|

|

Investing in our common stock involves substantial risk. You should carefully consider the risk factors set forth or cross-

referenced in the sections entitled "Risk Factors" beginning on page S-8 of this prospectus supplement and beginning on page 1 of the accompanying base prospectus, and the other information contained in this prospectus supplement and the

accompanying base prospectus and the documents incorporated by reference herein and therein, prior to making an investment in our common stock.

|

|

New York Stock Exchange symbol

|

|

"IPI"

|

S-7

Table of Contents

RISK FACTORS

This section describes some, but not all, of the risks of investing in our common stock. The accompanying base

prospectus also contains a "Risk Factors" section beginning on page 1 thereof. You should carefully consider these risks, in addition to the risk factors and other information contained or

incorporated by reference in this prospectus supplement or the accompanying base prospectus, including matters discussed under "Risk Factors" in our Annual Report on Form 10-K for the year

ended December 31, 2016, before making a decision whether to invest in our common stock. See "Incorporation of Certain Information by Reference." You should carefully review the factors

discussed below and the cautionary statements referred to in "Cautionary Note Regarding Forward-Looking Statements." If any of the risks and uncertainties described below or incorporated by reference

in this prospectus supplement actually occur, our business, financial condition or results of operations could be materially adversely affected. In that case, the trading price of our common stock

could decline and you could lose all or part of your investment.

Risks Related to this Offering and Our Common Stock

The price of our common stock may be volatile and you could lose all or part of your investment.

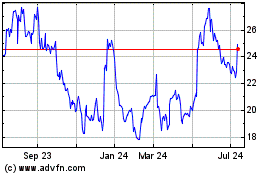

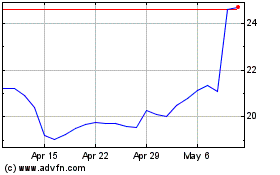

The market price of our common stock has historically experienced, and may continue to experience, volatility. For example, since

January 1, 2016, the market price of our common stock has ranged between $3.26 and $0.65. Such fluctuations may continue because of numerous factors,

including:

-

•

-

our operating performance and the performance of our competitors;

-

•

-

the public's reaction to our press releases, other public announcements or filings with the SEC;

-

•

-

changes in earnings estimates or recommendations by research analysts who follow us or other companies in our industry;

-

•

-

variations in general economic, market, and political conditions;

-

•

-

changes in certain commodity prices or foreign currency exchange rates;

-

•

-

actions of our current stockholders, including sales of common stock by our directors and executive officers;

-

•

-

the arrival or departure of key personnel;

-

•

-

other developments affecting us, our industry, or our competitors; and

-

•

-

the other risks described in this prospectus supplement and in our Annual Report on Form 10-K for the year ended December 31,

2016.

Our

financial position, our cash flows, our results of operations and our stock price could be materially adversely affected if commodity prices do not improve or decline further. In

addition, in recent years the stock market has experienced extreme price and volume fluctuations. This volatility has had a significant effect on the market prices of securities issued by many

companies for reasons unrelated to their operating performance. Our stock price may experience extreme volatility due to uncertainty regarding commodity prices. These market fluctuations, regardless

of the cause, may materially and adversely affect our stock price, regardless of our operating results.

Our

stock is currently listed on the NYSE. For continued listing, we are required to meet specified listing standards, including a minimum stock price, market capitalization, and

stockholders' equity. If we are unable to meet the NYSE's listing standards, including the requirement that our common stock continue to trade at over $1.00 per share, the NYSE would delist our common

stock. At that point, it is possible that our common stock could be quoted on the over-the-counter bulletin board or the pink

S-8

Table of Contents

sheets.

This could have negative consequences, including reduced liquidity for stockholders; reduced trading levels for our common stock; limited availability of market quotations or analyst coverage

of our common stock; stricter trading rules for brokers trading our common stock; and reduced access to financing alternatives for us. We also would be subject to greater state securities regulation

if our common stock was no longer listed on a national securities exchange.

Volatility

of our common stock may make it difficult for you to resell shares of our common stock when you want or at attractive prices.

The market price of our common stock may be adversely affected by the future issuance and sale of additional

shares of our common stock, including pursuant to the sales agreement, or by our announcement that such issuances and sales may occur.

We cannot predict the size of future issuances or sales of shares of our common stock, including those made pursuant to the sales agreement with

our sales agent or in connection with future acquisitions or capital raising activities, or the effect, if any, that such issuances or sales may have on the market price of our common stock. In

addition, the sales agent will not engage in any transactions that stabilize the price of our common stock. The issuance and sale of substantial amounts of shares of our common stock, including

issuances and sales pursuant to the sales agreement, or announcement that such issuances and sales may occur, could adversely affect the market price of our common stock.

We do not anticipate paying cash dividends on our common stock.

We currently intend to retain earnings to reinvest for future operations and growth of our business and do not anticipate paying any cash

dividends on our common stock. However, our board of directors, in its discretion, may decide to declare a dividend at an appropriate time in the future, subject to the terms of our debt agreements. A

decision to pay a dividend would depend upon, among other factors, our results of operations, financial condition and cash requirements and the terms of our unsecured credit facility and other

financing agreements at the time such a payment is considered.

Provisions in our charter documents and Delaware law may delay or prevent a third party from acquiring us.

We are a Delaware corporation and the anti-takeover provisions of Delaware law impose various barriers to the ability of a third party to

acquire control of us, even if a change of control would be beneficial to our existing stockholders. In addition, our current certificate of incorporation and bylaws contain several provisions that

may make it more difficult for a third party to acquire control of us without the approval of our board of directors. These provisions may make it more difficult or expensive for a third party to

acquire a majority of our outstanding common stock. Among other things, these provisions provide for the following:

-

•

-

allow our board of directors to create and issue preferred stock with rights senior to those of our common stock without prior stockholder

approval, except as may be required by applicable NYSE rules;

-

•

-

do not permit cumulative voting in the election of directors, which would otherwise allow less than a majority of stockholders to elect

director candidates;

-

•

-

prohibit stockholders from calling special meetings of stockholders;

-

•

-

prohibit stockholders from acting by written consent, thereby requiring all stockholder actions to be taken at a meeting of our stockholders;

-

•

-

require vacancies and newly created directorships on the board of directors to be filled only by affirmative vote of a majority of the

directors then serving on the board;

S-9

Table of Contents

-

•

-

establish advance notice requirements for submitting nominations for election to the board of directors and for proposing matters that can be

acted upon by stockholders at a meeting; and

-

•

-

classify our board of directors so that only some of our directors are elected each year.

These

provisions also may delay, prevent or deter a merger, acquisition, tender offer, proxy contest or other transaction that might otherwise result in our stockholders receiving a

premium over the market price of the common stock they own.

We may issue additional securities, including securities that are senior in right of dividends, liquidation,

and voting to our common stock, without your approval, which would dilute your existing ownership interests.

Our board of directors may issue shares of preferred stock or additional shares of common stock without the approval of our stockholders, except

as may be required by applicable NYSE rules. Our board of directors may approve the issuance of preferred stock with terms that are senior to our common stock in right of dividends, liquidation or

voting. Our issuance of additional common shares or other equity securities of equal or senior rank will have the following effects:

-

•

-

our pre-existing stockholders' proportionate ownership interest in us will decrease;

-

•

-

the relative voting strength of each previously outstanding common share may be diminished; and

-

•

-

the market price of the common stock may decline.

If securities or industry analysts do not publish research or reports about our business, if they adversely

change their recommendations regarding our stock or if our operating results do not meet their expectations, our stock price could decline.

The trading market for our common stock will be influenced by the research and reports that industry or securities analysts publish about us or

our business. If one or more of these analysts cease coverage of Intrepid or fail to publish reports on us regularly, we could lose visibility in the financial markets, which in turn could cause our

stock price or trading volume to decline. Moreover, if one or more of the analysts who cover Intrepid downgrade our stock or if our operating results do not meet their expectations, our stock price

could decline.

Risks Related to Our Business

In addition to the risks set forth in this prospectus supplement, our business is subject to numerous risks and uncertainties that could

materially affect our business, financial condition or future results. These risks are discussed in our annual and quarterly reports and other documents we file with the SEC and are incorporated by

reference herein. You should carefully consider these risks before investing in our common stock. See "Incorporation of Certain Information by Reference."

S-10

Table of Contents

USE OF PROCEEDS

We intend to use the net proceeds from the sale of shares of our common stock offered hereby for general corporate purposes, which may include,

among other things, the repayment of indebtedness under our senior notes, repayment of indebtedness under our revolving credit facility, acquisitions and funding capital expenditures.

As

of March 31, 2017, there were no amounts outstanding under the revolving credit facility, other than $3.5 million in letters of credit. Considering the outstanding

letters of credit and certain financial covenants under the facility, we had $25.5 million available under the facility as of March 31, 2017. This revolving credit facility matures on

October 31, 2018, and the weighted average interest rate on the total amount outstanding at March 31, 2017 was 2.5%.

As

of May 25, 2017, we had outstanding $35.6 million aggregate principal amount of Series A Senior Notes bearing interest at 7.73%, $26.7 million aggregate

principal amount of Series B Senior Notes bearing interest at 8.63% and $26.7 million aggregate principal amount of Series C Senior Notes bearing interest at 8.78%.

S-11

Table of Contents

MATERIAL U.S. FEDERAL INCOME TAX CONSEQUENCES TO NON-U.S. HOLDERS

The following discussion is a summary of the material U.S. federal income tax consequences to Non-U.S. Holders (as defined below) of the

purchase, ownership and disposition of our common stock issued pursuant to this offering, but does not purport to be a complete analysis of all potential tax effects. The effects of other U.S. federal

tax laws, such as estate and gift tax laws, and any applicable state, local or non-U.S. tax laws are not discussed. This discussion is based on the U.S. Internal Revenue Code of 1986, as amended (the

"Code"), Treasury regulations promulgated thereunder ("Treasury Regulations"), judicial decisions, and published rulings and administrative pronouncements of the U.S. Internal Revenue Service (the

"IRS"), in each case as in effect as of the date hereof. These authorities may change or be subject to differing interpretations. Any such change or differing interpretation may be applied

retroactively in a manner that could adversely affect a Non-U.S. Holder of our common stock. We have not sought and will not seek any rulings from the IRS regarding the matters discussed below. There

can be no assurance the IRS or a court will not take a contrary position to those discussed below regarding the tax consequences of the purchase, ownership and disposition of our common stock.

This

discussion is limited to Non-U.S. Holders that hold our common stock as a "capital asset" within the meaning of Section 1221 of the Code (generally, property held for

investment). This discussion does not address all U.S. federal income tax consequences relevant to a Non-U.S. Holder's particular circumstances, including the impact of the Medicare contribution tax

on net investment income. In addition, it does not address consequences relevant to Non-U.S. Holders subject to special rules, including, without limitation:

-

•

-

U.S. expatriates and former citizens or long-term residents of the United States;

-

•

-

persons subject to the alternative minimum tax;

-

•

-

persons holding our common stock as part of a hedge, straddle or other risk reduction strategy or as part of a conversion transaction or other

integrated investment;

-

•

-

banks, insurance companies, and other financial institutions;

-

•

-

real estate investment trusts or regulated investment companies;

-

•

-

persons that own, or are deemed to own, actually or constructively more than five percent of our common stock;

-

•

-

brokers, dealers or traders in securities;

-

•

-

"controlled foreign corporations," "passive foreign investment companies," and corporations that accumulate earnings to avoid U.S. federal

income tax;

-

•

-

partnerships, or other entities or arrangements treated as partnerships for U.S. federal income tax purposes;

-

•

-

tax-exempt organizations or governmental organizations;

-

•

-

persons deemed to sell our common stock under the constructive sale provisions of the Code;

-

•

-

persons who hold or receive our common stock pursuant to the exercise of any employee stock option or otherwise as compensation;

-

•

-

"qualified foreign pension funds" as defined in Section 897(1)(2) of the Code and entities all of the interests of which are held by

qualified foreign pension funds; and

-

•

-

tax-qualified retirement plans.

S-12

Table of Contents

If

an entity (or arrangement) treated as a partnership for U.S. federal income tax purposes holds our common stock, the tax treatment of a partner in the partnership will depend on the

status of the partner, the activities of the partnership and certain determinations made at the partner level. Accordingly, partnerships holding our common stock and partners in such partnerships

should consult their tax advisors regarding the U.S. federal income tax consequences to them.

THIS DISCUSSION IS FOR INFORMATIONAL PURPOSES ONLY AND IS NOT TAX ADVICE. INVESTORS SHOULD CONSULT THEIR TAX ADVISORS WITH RESPECT TO THE APPLICATION OF THE U.S.

FEDERAL INCOME TAX LAWS TO THEIR PARTICULAR SITUATIONS AS WELL AS ANY TAX CONSEQUENCES OF THE PURCHASE, OWNERSHIP AND DISPOSITION OF OUR COMMON STOCK ARISING UNDER THE U.S. FEDERAL ESTATE OR GIFT TAX

LAWS OR UNDER THE LAWS OF ANY STATE, LOCAL OR NON-U.S. TAXING JURISDICTION OR UNDER ANY APPLICABLE INCOME TAX TREATY.

Definition of a Non-U.S. Holder

For purposes of this discussion, a "Non-U.S. Holder" is any beneficial owner of our common stock that is neither a "U.S. person" nor an entity

treated as a partnership for U.S. federal income tax purposes. A U.S. person is any person that, for U.S. federal income tax purposes, is or is treated as any of the

following:

-

•

-

an individual who is a citizen or resident of the United States;

-

•

-

a corporation created or organized under the laws of the United States, any state thereof, or the District of Columbia;

-

•

-

an estate, the income of which is subject to U.S. federal income tax regardless of its source; or

-

•

-

a trust that (1) is subject to the primary supervision of a U.S. court and the control of one or more "United States persons" (within

the meaning of Section 7701(a)(30) of the Code), or (2) has a valid election in effect to be treated as a United States person for U.S. federal income tax purposes.

Distributions

As described in the section entitled "Dividend Policy" we do not anticipate declaring or paying dividends to holders of our common stock in the

foreseeable future. However, if we do make distributions of cash or property on our common stock, such distributions will constitute dividends for U.S. federal income tax purposes to the extent paid

from our current or accumulated earnings and profits, as determined under U.S. federal income tax principles. Amounts not treated as dividends for U.S. federal income tax purposes will constitute a

return of capital and first be applied against and reduce a Non-U.S. Holder's adjusted tax basis in its common stock, but not below zero. Any excess distribution will be treated as capital gain and

will be subject to the treatment described below under "—Sale or Other Taxable Disposition." Any such distributions would also be subject to the discussions below regarding backup

withholding and FATCA.

Subject

to the discussion below regarding a dividend received by a Non-U.S. Holder that is effectively connected with the Non-U.S. Holder's conduct of a U.S. trade or business, dividends

paid to a Non-U.S. Holder on our common stock will be subject to U.S. federal withholding tax at a rate of 30% of the gross amount of the dividends (or such lower rate specified by an applicable

income tax treaty, provided the Non-U.S. Holder furnishes a valid IRS Form W-8BEN or W-8BEN-E (or other applicable documentation) certifying qualification for the lower treaty rate). A Non-U.S.

Holder that does not timely furnish the required documentation, but that qualifies for a reduced treaty rate, may obtain a refund of any excess amounts withheld by timely filing an appropriate claim

for refund with

S-13

Table of Contents

the

IRS. Non-U.S. Holders should consult their tax advisors regarding their entitlement to benefits under any applicable income tax treaty.

If

dividends paid to a Non-U.S. Holder are effectively connected with the Non-U.S. Holder's conduct of a trade or business within the United States (and, if required by an applicable

income tax treaty, the Non-U.S. Holder maintains a permanent establishment in the United States to which such dividends are attributable), the Non-U.S. Holder will be exempt from the U.S. federal

withholding tax described above. To claim the exemption, the Non-U.S. Holder must furnish to the applicable withholding agent a valid IRS Form W-8ECI, certifying that the dividends are

effectively connected with the Non-U.S. Holder's conduct of a trade or business within the United States.

Any

such effectively connected dividends will be subject to U.S. federal income tax on a net income basis at the regular graduated rates. A Non-U.S. Holder that is a corporation also may

be subject to a

branch profits tax at a rate of 30% (or such lower rate specified by an applicable income tax treaty) on its effectively connected earnings and profits (as adjusted for certain items) that are

attributable to such dividend income. Non-U.S. Holders should consult their tax advisors regarding any applicable tax treaties that may provide for different rules.

Sale or Other Taxable Disposition

A Non-U.S. Holder will not be subject to U.S. federal income tax on any gain realized upon the sale or other taxable disposition of our common

stock unless:

-

•

-

the gain is effectively connected with the Non-U.S. Holder's conduct of a trade or business within the United States (and, if required by an

applicable income tax treaty, the Non-U.S. Holder maintains a permanent establishment in the United States to which such gain is attributable);

-

•

-

the Non-U.S. Holder is a nonresident alien individual present in the United States for 183 days or more during the taxable year of the

disposition and certain other requirements are met; or

-

•

-

our common stock constitutes a United States real property interest ("USRPI") by reason of our status as a United States real property holding

corporation ("USRPHC") for U.S. federal income tax purposes. Generally, a domestic corporation is a USRPHC if the fair market value of its USRPIs equals or exceeds 50% of the sum of the fair market

value of its worldwide real property interests plus its other assets used or held for use in its trade or business.

Gain

described in the first bullet point above generally will be subject to U.S. federal income tax on a net income basis at the regular graduated rates. A Non-U.S. Holder that is a

corporation also may be subject to a branch profits tax at a rate of 30% (or such lower rate specified by an applicable income tax treaty) on its effectively connected earnings and profits (adjusted

for certain items) that are attributed to such gain.

A

Non-U.S. Holder described in the second bullet point above will be subject to U.S. federal income tax at a rate of 30% (or such lower rate specified by an applicable income tax treaty)

on any gain derived from the disposition, which may be offset by U.S. source capital losses of the Non-U.S. Holder in the taxable year of the disposition (even though the individual is not considered

a resident of the United States).

With

respect to the third bullet point above, we believe that we currently are, and expect to remain for the foreseeable future, a USRPHC for U.S. federal income tax purposes. However,

so long as our common stock is "regularly traded on an established securities market," a Non-U.S. Holder will be subject to U.S. federal net income tax on a disposition of our common stock only if the

Non-U.S. Holder actually or constructively holds or held (at any time during the shorter of the five-year period preceding the date of disposition or the Non-U.S. Holder's holding period) more than 5%

of our

S-14

Table of Contents

common

stock. If our common stock is not considered to be regularly traded on an established securities market during the calendar year in which the relevant disposition by a Non-U.S. Holder occurs,

such holder (regardless of the percentage of stock owned) generally would be subject to U.S. federal income tax on the gain realized on a disposition of our common stock and generally would be

required to file a U.S. federal income tax return, and a 15% withholding tax would apply to the gross proceeds from such sale.

Non-U.S.

Holders should also consult their tax advisors (i) with respect to the application of the foregoing rules to their ownership and disposition of our common stock and

(ii) regarding potentially applicable income tax treaties that may provide for different rules.

Information Reporting and Backup Withholding

Payments of dividends on our common stock will not be subject to backup withholding, provided the applicable withholding agent does not have

actual knowledge or reason to know the Non-U.S. Holder is a United States person and the Non-U.S. Holder either certifies its non-U.S. status, such as by furnishing a valid IRS Form W-8BEN,

W-8BEN-E or W-8ECI, or otherwise establishes an exemption. However, information returns are required to be filed with the IRS in connection with any dividends on our common stock paid to the Non-U.S.

Holder, regardless of whether any tax was actually withheld. In addition, proceeds of the sale or other taxable disposition of our common stock within the United States or conducted through certain

U.S.-related brokers generally will not be subject to backup withholding or information reporting if the applicable withholding agent receives the certification described above and does not have

actual knowledge or reason to know that

such Non-U.S. Holder is a United States person, or the Non-U.S. Holder otherwise establishes an exemption. Proceeds of a disposition of our common stock conducted through a non-U.S. office of a

non-U.S. broker generally will not be subject to backup withholding or information reporting.

Copies

of information returns that are filed with the IRS may also be made available under the provisions of an applicable treaty or agreement to the tax authorities of the country in

which the Non-U.S. Holder resides or is established.

Backup

withholding is not an additional tax. Any amounts withheld under the backup withholding rules may be allowed as a refund or a credit against a Non-U.S. Holder's U.S. federal

income tax liability, provided the required information is timely furnished to the IRS.

Additional Withholding Tax on Payments Made to Foreign Accounts

Withholding taxes may be imposed under Sections 1471 to 1474 of the Code (such Sections commonly referred to as the Foreign Account Tax

Compliance Act, or "FATCA") on certain types of payments made to non-U.S. financial institutions and certain other non-U.S. entities. Specifically, a 30% withholding tax may be imposed on dividends

on, or gross proceeds from the sale or other disposition of, our common stock paid to a "foreign financial institution" or a "non-financial foreign entity" (each as defined in the Code) (including, in

some cases, when such foreign financial institution or non-financial foreign entity is acting as an intermediary), unless (1) the foreign financial institution undertakes certain diligence and

reporting obligations, (2) the non-financial foreign entity either certifies it does not have any "substantial United States owners" (as defined in the Code) or furnishes identifying

information regarding each direct and indirect substantial United States owner, or (3) the foreign financial institution or non-financial foreign entity otherwise qualifies for an exemption

from these rules and provides appropriate documentation (such as IRS Form W-8BEN-E). If the payee is a foreign financial institution and is subject to the diligence and reporting requirements

in (1) above, it must enter into an agreement with the U.S. Department of the Treasury requiring, among other things, that it undertake to identify accounts held by certain "specified United

States persons" or "United States-owned foreign entities" (each as defined in the Code), annually report certain information about

S-15

Table of Contents

such

accounts, and withhold 30% on certain payments to non-compliant foreign financial institutions and certain other account holders. Foreign financial institutions located in jurisdictions that have

an intergovernmental agreement with the United States governing FATCA may be subject to different rules.

Under

the applicable Treasury Regulations and administrative guidance, withholding under FATCA generally applies to payments of dividends on our common stock, and will apply to payments

of gross proceeds from the sale or other disposition of such stock on or after January 1, 2019.

Prospective

investors should consult their tax advisors regarding the potential application of withholding under FATCA to their investment in our common stock.

S-16

Table of Contents

PLAN OF DISTRIBUTION

We have entered into a Controlled Equity Offering

SM

Sales Agreement with Cantor Fitzgerald under which we may issue and sell

shares of our common stock having an aggregate gross sales price of up to $40.0 million from time to time through Cantor Fitzgerald acting as agent. A copy of the sales agreement will be filed

as an exhibit to a Current Report on Form 8-K and incorporated by reference into the registration statement of which this prospectus supplement is a part.

Upon

delivery of a placement notice and subject to the terms and conditions of the sales agreement, Cantor Fitzgerald may sell our common stock by any method permitted by law deemed to

be an "at the market offering" as defined in Rule 415(a)(4) promulgated under the Securities Act, including sales made directly on or through the NYSE or on any other existing trading market

for our common stock. We may instruct Cantor Fitzgerald not to sell common stock if the sales cannot be effected at or above the price designated by us from time to time. We or Cantor Fitzgerald may

suspend the offering of common stock upon notice and subject to other conditions.

We

will pay Cantor Fitzgerald commissions, in cash, for its services in acting as agent in the sale of our common stock. Cantor Fitzgerald will be entitled to compensation at a fixed

commission rate equal to 3.0% of the gross sales price per share sold. Because there is no minimum offering amount required as a condition to close this offering, the actual total public offering

amount, commissions and proceeds to us, if any, are not determinable at this time. We have also agreed to reimburse Cantor Fitzgerald for certain specified expenses, including the fees and

disbursements of its legal counsel, in an amount up to $50,000. We estimate that the total expenses for the offering, excluding compensation and reimbursement payable to Cantor Fitzgerald under the

terms of the sales agreement, will be approximately $1 million.

Settlement

for sales of common stock will occur on the third business day following the date on which any sales are made, or on some other date that is agreed upon by us and Cantor

Fitzgerald in connection with a particular transaction, in return for payment of the net proceeds to us. Sales of our common stock as contemplated in this prospectus supplement will be settled through

the facilities of The Depository Trust Company or by such other means as we and Cantor Fitzgerald may agree upon. There is no arrangement for funds to be received in an escrow, trust or similar

arrangement.

Cantor

Fitzgerald will use its commercially reasonable efforts, consistent with its sales and trading practices, to solicit offers to purchase shares of our common stock under the terms

and subject to the conditions set forth in the sales agreement. In connection with the sale of the common stock on our behalf, Cantor Fitzgerald will be deemed to be an "underwriter" within the

meaning of the Securities Act and the compensation of Cantor Fitzgerald will be deemed to be underwriting commissions or discounts. We have agreed to provide indemnification and contribution to Cantor

Fitzgerald against certain civil liabilities, including liabilities under the Securities Act.

The

offering of our common stock pursuant to the sales agreement will terminate upon the termination of the sales agreement as permitted therein. We and Cantor Fitzgerald may each

terminate the sales agreement at any time upon ten days' prior notice.

Cantor

Fitzgerald and its affiliates have provided in the past and may provide various investment banking, commercial banking and other financial services for us and our affiliates, for

which services they have received and may in the future receive customary fees. To the extent required by Regulation M, Cantor Fitzgerald will not engage in any market making activities

involving our common stock while the offering is ongoing under this prospectus supplement in violation of Regulation M.

This

prospectus supplement and the accompanying prospectus in electronic format may be made available on a website maintained by Cantor Fitzgerald and Cantor Fitzgerald may distribute

this prospectus supplement and the accompanying prospectus electronically.

S-17

Table of Contents

LEGAL MATTERS

Latham & Watkins LLP, Houston, Texas will pass upon the validity of the shares of our common stock offered hereby. Cantor

Fitzgerald & Co. is being represented in connection with this offering by Cooley LLP, New York, New York.

EXPERTS

The consolidated financial statements of Intrepid Potash, Inc. and its subsidiaries as of December 31, 2016 and 2015, and for each

of the years in the three-year period ended December 31, 2016, and management's assessment of the effectiveness of internal control over financial reporting of Intrepid Potash, Inc. as

of December 31, 2016, have been incorporated by reference into this prospectus supplement in reliance upon the reports of KPMG LLP, independent registered public accounting firm, which

reports are incorporated by reference into this prospectus supplement, and upon the authority of said firm as experts in accounting and auditing.

Certain

information with respect to our mineral reserves have been derived from the reports of Agapito Associates, Inc., an independent mineral reserve evaluation engineering

consultant, and has been included and incorporated by reference herein upon the authority of such firms as experts with respect to matters covered by such reports and in giving such reports.

S-18

PROSPECTUS

INTREPID POTASH, INC.

COMMON STOCK

PREFERRED STOCK

DEBT SECURITIES

GUARANTEES OF DEBT SECURITIES

WARRANTS

We may offer to sell from time to time in one or more offerings up to an aggregate of $300,000,000 of our common stock, preferred stock, debt

securities (which may be guaranteed by one or more of our subsidiaries), warrants or any combination of the foregoing.

This

prospectus provides you with a general description of the securities that may be offered hereby. Each time we sell securities pursuant to this prospectus, a prospectus supplement to

this prospectus will be provided that contains specific information about the offering and the specific terms of the securities offered, such as the amounts and prices. You should read this prospectus

and the applicable prospectus supplement carefully before you invest in our securities.

Our

common stock is listed on the New York Stock Exchange, or NYSE, under the symbol "IPI."

Investing in our securities involves a high degree of risk. You should carefully consider the "Risk Factors" on page 1 of this prospectus,

and in any applicable prospectus supplement, and in the documents which are incorporated by reference herein.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these

securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The

securities may be offered directly by us, or to or through underwriters, dealers or agents. For additional information on the method of sale, you should refer to the section entitled

"Plan of Distribution." The names of any underwriters, dealers or agents involved in the sale of any securities and the specific manner in which they may be offered, including any applicable purchase

price, fee,

commission or discount arrangement between or among them, will be set forth in the prospectus supplement covering the sale of those securities.

The date of this prospectus is June 3, 2016.

TABLE OF CONTENTS

|

|

|

|

|

|

|

|

Page

|

|

|

ABOUT THIS PROSPECTUS

|

|

|

i

|

|

|

RISK FACTORS

|

|

|

1

|

|

|

THE COMPANY

|

|

|

1

|

|

|

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

|

|

|

1

|

|

|

RATIO OF EARNINGS TO FIXED CHARGES

|

|

|

2

|

|

|

USE OF PROCEEDS

|

|

|

2

|

|

|

DIVIDEND POLICY

|

|

|

2

|

|

|

DESCRIPTION OF CAPITAL STOCK

|

|

|

2

|

|

|

DESCRIPTION OF DEBT SECURITIES AND GUARANTEES OF DEBT SECURITIES

|

|

|

6

|

|

|

DESCRIPTION OF WARRANTS

|

|

|

7

|

|

|

PLAN OF DISTRIBUTION

|

|

|

9

|

|

|

WHERE YOU CAN FIND MORE INFORMATION

|

|

|

10

|

|

|

INFORMATION INCORPORATED BY REFERENCE

|

|

|

10

|

|

|

LEGAL MATTERS

|

|

|

11

|

|

|

EXPERTS

|

|

|

11

|

|

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form S-3 under the Securities Act of 1933, as amended (the "Securities Act"), that

we filed with the Securities and Exchange Commission (the "SEC") using the "shelf" registration process. Under this shelf registration process, we may offer and sell any combination of the securities

described in this prospectus in one or more offerings. This prospectus provides you with a general description of the securities we may offer. Each time we offer the securities described in this

prospectus, we will provide you with a prospectus supplement that will describe the specific amounts, prices and terms of the securities being offered. The prospectus supplement may also add, update

or change information contained in this prospectus. This prospectus does not contain all the information provided in the registration statement filed with the SEC. You should carefully read both this

prospectus and any prospectus supplement together with the additional information described below under "Where You Can Find More Information" and "Information Incorporated By Reference" before you

make an investment decision.

You

should rely only on the information contained in or incorporated by reference into this prospectus or any accompanying prospectus supplement. We have not authorized anyone to provide

you with different information. This document may only be used where it is legal to sell these securities. You should not assume that the information contained in this prospectus, or in any prospectus

supplement, is accurate as of any date other than its date regardless of the time of delivery of the prospectus or prospectus supplement or any sale of the securities.

Any

statement made in this prospectus or in a document incorporated or deemed to be incorporated by reference in this prospectus will be deemed to be modified or superseded for purposes

of this prospectus to the extent that a statement contained in a prospectus supplement or in any other subsequently filed document that is also incorporated or deemed to be incorporated by reference

in this prospectus modifies or supersedes that statement. Any statement so modified or superseded will not be deemed, except as so modified or superseded, to constitute a part of this prospectus. See

"Information Incorporated By Reference."

This

prospectus and any accompanying prospectus supplements may include trademarks, service marks and trade names owned by us or other companies. All trademarks, service marks and trade

names included in this prospectus or any accompanying prospectus supplement are the property of their respective owners.

Unless

the context otherwise indicates, references in this prospectus to "Intrepid," the "Company," "we," "us" and "our" are to Intrepid Potash, Inc. and its consolidated

subsidiaries. The term "you" refers to a prospective investor.

i

RISK FACTORS

An investment in our securities involves significant risks. Before you invest in any of our securities, you should carefully consider the

information included and incorporated by reference in this prospectus and any applicable prospectus supplement, including the risk factors under the heading "Risk Factors" in our Annual Report on

Form 10-K for the year ended December 31, 2015, which is incorporated by reference into this prospectus. Each of the risks described in these sections and documents could materially and

adversely affect our business, financial condition, results of operations and prospects, and could result in a loss of your investment. Additional risks and uncertainties not known to us or that we

deem immaterial may also impair our business, financial condition, results of operations and prospects.

THE COMPANY

We are the only producer of muriate of potash ("potassium chloride" or "potash") in the United States and one of two producers of langbeinite

("sulfate of potash magnesia"), which we market and sell as Trio®. We also produce salt and magnesium chloride from our potash mining processes.

We

produce potash at three solution mining facilities and two conventional underground mining facilities. Our solution mining production comes from our HB mine near Carlsbad, New Mexico,

a solar solution mine near Moab, Utah and a solar brine recovery mine in Wendover, Utah. Our conventional production comes from our underground West and East mines near Carlsbad, New Mexico. We also

operate the North compaction facility near Carlsbad, New Mexico, which services the West and HB mines. Trio® production comes from underground conventional mining of a mixed ore body that

contains both potash and langbeinite, which is mined and processed at the East facility near Carlsbad, New Mexico.

Our

principal offices are located at 707 17th Street, Suite 4200, Denver, Colorado 80202, and our telephone number is (303) 296-3006. Our website address is

www.intrepidpotash.com

.

Information contained on, or that can be accessed through, our website is not incorporated into this prospectus or our other

filings with the SEC, and does not form a part of this prospectus.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements in this prospectus, the documents incorporated by reference or our other public statements include "forward-looking

statements" within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. All statements in this prospectus, the documents incorporated by reference or our other public

statements, other than statements of historical fact, are forward-looking statements. Forward-looking statements include statements about our future results of operations and financial position, our

business strategy and plans, and our objectives for future operations, among other things. In some cases, you can identify these statements by words, such as "estimate," "expect," "anticipate,"

"project," "plan," "intend," "believe," "forecast," "foresee," "likely," "may," "should," "goal," "target," "might," "will," "could," "predict," and "continue." Forward-looking statements are only

predictions based on our current knowledge, expectations, and projections about future events. These forward-looking statements are subject to a number of risks, uncertainties, and assumptions which

are described under the heading "Risk Factors" in our Annual Report on Form 10-K for the year ended December 31, 2015, which is incorporated by reference into this prospectus. In

addition, new risks emerge from time to time. It is not possible for our management to predict all risks that may cause actual results to differ materially from those contained in any forward-looking

statements we may make. We urge you to consider the risks and uncertainties described in "Risk Factors" in the documents incorporated by reference in this prospectus, in any prospectus supplement and

in the documents incorporated by reference therein.

1

In

light of these risks, uncertainties, and assumptions, actual results could differ materially and adversely from those anticipated or implied in these forward-looking statements. As a

result, you

should not place undue reliance on these forward-looking statements. We undertake no obligation to publicly update any forward-looking statements, except as required by law. You are advised, however,

to consult any further disclosures we make in those annual reports on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K which we incorporate by reference,

as well as in any prospectus supplement relating to this prospectus and other public filings with the SEC.

RATIO OF EARNINGS TO FIXED CHARGES

The following table sets forth our consolidated ratio of earnings to fixed charges for the periods indicated. As we have no shares of preferred

stock outstanding as of the date of this prospectus, no ratio of earnings to combined fixed charges and preferred stock dividends is presented. You should read this table in conjunction with the

consolidated financial statements and notes incorporated by reference in this prospectus.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended December 31,

|

|

|

|

Three Months Ended

March 31, 2016

|

|

|

|

2015

|

|

2014

|

|

2013

|

|

2012

|

|

2011

|

|

|

Ratio of earnings to fixed charges(1)

|

|

|

(5.5

|

)(2)

|

|

(40.4

|

)(2)

|

|

2.1

|

|

|

4.6

|

|

|

62.0

|

|

|

73.0

|

|

-

(1)

-

The

ratio of earnings to fixed charges was computed by dividing earnings by fixed charges. Earnings consist of income from continuing operations before income taxes,

fixed charges and amortization of capitalized interest, less capitalized interest. Fixed charges consist of interest expensed on indebtedness, capitalized interest, amortization of debt expense, and

interest within rent expense.

-

(2)

-

The

ratio of earnings to fixed charges for the year ended December 31, 2015 and the three months ended March 31, 2016 was less than 1:1. We would have

needed to generate additional earnings of approximately $375.0 million for the year ended December 31, 2015 and approximately $18.5 million for the three months ended March 31,

2016 to achieve a ratio of 1:1 in the respective periods.

USE OF PROCEEDS

We intend to use the net proceeds we receive from the sale of securities by us as set forth in the applicable prospectus supplement.

DIVIDEND POLICY

We currently intend to retain earnings to reinvest for future operations and growth of our business and do not anticipate paying any cash

dividends on our common stock. However, our board of directors, in its discretion, may decide to declare a dividend at an appropriate time in the future. A decision to pay a dividend would depend

upon, among other factors, our results of operations, financial condition and cash requirements and the terms of our unsecured credit facility and other financing agreements at the time such a payment

is considered.

DESCRIPTION OF CAPITAL STOCK

The following descriptions of our capital stock and provisions of our restated certificate of incorporation and amended and restated bylaws are

summaries and are qualified by reference to the complete text of the restated certificate of incorporation and amended and restated bylaws, which have been filed as exhibits to the registration

statement of which this prospectus is a part. For information

2

on

how to obtain copies of the restated certificate of incorporation and amended and restated bylaws, see "Where You Can Find More Information."

Authorized Capital Stock

Our authorized capital stock consists of:

-

•

-

100,000,000 shares of common stock, par value $0.001 per share; and

-

•

-

20,000,000 shares of preferred stock, par value $0.001 per share.

As

of May 20, 2016, we had 76,049,156 shares of common stock (including unvested shares of restricted stock), and no shares of preferred stock, outstanding.

Common Stock

The following is a summary of the terms of our common stock. For additional information regarding our common stock, please refer to our restated

certificate of incorporation, our amended and restated bylaws and the applicable provisions of Delaware law.

Voting Rights.

Each holder of common stock is entitled to one vote per share on all matters to be voted on by stockholders except those

matters on

which a separate class of stockholders vote by class to the exclusion of the shares of common stock. Except as otherwise required by law, NYSE rules or our organization documents, matters to be voted

on by stockholders must be approved by the vote of a majority of the votes cast with respect to the matter. Except as otherwise required by the Delaware General Corporation Law, or the DGCL, our

restated certificate of incorporation or the voting rights granted to any preferred stock we subsequently issue, the holders of outstanding shares of common stock and preferred stock entitled to vote

thereon, if any, will vote as one class with respect to all matters to be voted on by our stockholders.

Dividend Rights.

Subject to preferences that may apply to shares of preferred stock outstanding at the time, the holders of outstanding

shares of our

common stock are entitled to receive dividends out of funds legally available if our board of directors, in its discretion, determines to declare dividends and only then at the times and in the

amounts that our board of directors may determine.

Right to Receive Liquidation Distributions.

Upon our dissolution, liquidation or winding-up, the assets legally available for

distribution to our

stockholders are distributable ratably among the holders of our common stock, subject to prior satisfaction of all outstanding debts and liabilities and the preferential rights and payment of

liquidation preferences, if any, on any outstanding shares of preferred stock.

Other Provisions.

Holders of our common stock have no redemption, preemptive, subscription or conversion rights.

Preferred Stock

Our board of directors is authorized, without further stockholder approval, except as may be required by applicable NYSE rules, to issue from

time to time up to an aggregate of 20,000,000 shares of preferred stock in one or more series and to fix or alter the designations, preferences, rights and any qualifications, limitations or

restrictions of the shares of each such series thereof, including the dividend rights, dividend rates, conversion rights, voting rights, terms of redemption (including sinking fund provisions),

redemption price or prices, liquidation preferences and the number of shares constituting any series or designations of such series. No shares of preferred stock are presently outstanding.

3

Anti-Takeover Effects of Certain Provisions of Delaware Law, the Certificate of Incorporation and the

Bylaws

Some provisions of Delaware law and our restated certificate of incorporation and amended and restated bylaws could make the following

transactions more difficult:

-

•

-

acquisition of our company by means of a tender offer, a proxy contest or otherwise; and

-

•

-

removal of our incumbent officers and directors.

These

provisions, summarized below, are expected to discourage and prevent coercive takeover practices and inadequate takeover bids. These provisions are designed to encourage persons

seeking to acquire control of our company to first negotiate with our board of directors. They are also intended to provide our management with the flexibility to enhance the likelihood of continuity

and stability if our board of directors determines that a takeover is not in the best interests of our stockholders. These provisions, however, could have the effect of discouraging attempts to

acquire us, which could deprive our stockholders of opportunities to sell their shares of common stock at prices higher than prevailing market prices.

Delaware Anti-Takeover Statute.

We are subject to Section 203 of the DGCL. Section 203 is an anti-takeover law. In general,

Section 203 prohibits a publicly held Delaware corporation from engaging in a business combination with an interested stockholder for a period of three years following the date that the person

became an interested stockholder, unless the business combination or the transaction in which the person became an interested stockholder is approved in a prescribed manner. Generally, a