Current Report Filing (8-k)

May 17 2017 - 5:12PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT PURSUANT TO

SECTION

13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported)

May 9, 2017

INNERSCOPE

ADVERTISING AGENCY INC.

(Exact

Name of Registrant as Specified in Charter)

|

Nevada

|

|

(State

or Other Jurisdiction of Incorporation)

|

|

333-209341

|

|

46-3096516

|

|

(Commission

File Number)

|

|

(IRS

Employer Identification No.)

|

|

2281

Lava Ridge Court, Suite 130

Roseville,

CA

|

|

95661

|

|

(Address

of principal executive offices)

|

|

(Zip

code)

|

|

(916)

218-4100

|

|

(Registrant’s

telephone number, including area code)

|

|

Not

applicable

|

|

(Former

name or former address, if changed since last report)

|

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

|

☐

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement communications pursuant

to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Item 1.01

|

Entry

into a Material Definitive Agreement.

|

On

May 9, 2017, InnerScope Advertising Agency, Inc. (the “Company”) and Moore Holdings, LLC, a California Limited Liability

Company (“

Moore Holdings

”), a related party, agreed to purchase certain real property from an unaffiliated

party (Purchase Agreement). The Company agreed to purchase and own 49% of the building (the “

Building Interest

”)

and Moore Holdings will purchase and own 51%. The contracted purchase price for the building was $2,420,000 and the total amount

paid at closing was $2,501,783 (the “Closing Amount”), including, fees, insurance, interest and real estate taxes.

The

Company paid for their Building Interest by delivering cash at closing of $209,971, being responsible for $1,007,930 as co-borrower

on a $2,057,000 Small Business Administration Note (the “SBA Note”) and credits for tenant deposits and prepaid rent

of $8,135. The SBA Note carries a 25 year term, with a 6% per annum interest rate and is secured by a first position Deed of Trust,

(the “

Trust Deed

”) and business assets located at the property.

The

Company is planning on relocating from their current office space and occupying space in the building on or before July 1, 2017.

|

Item 2.03

|

Creation

of a Direct Financial Obligation or an Obligation Under an Off-Balance Sheet Arrangement of a Registrant

|

See

the disclosures in Item 1.01 above, which are incorporated herein by this reference.

On

August 5, 2016, the Company along with Mark Moore (“Mark”, the Company’s chairman), Matthew Moore (“Matthew”,

the Company’s Chief Executive Officer) and Kim Moore (“Kim”, the Company’s Chief Financial Officer) entered

into a Consulting Agreement (the “Consulting Agreement”) with a third party. Under the Consulting Agreement, including

the Non-Compete provision covering a ten mile radius of any retail store, the Company and the Moores will provide unlimited licensing

of the Intela-Hear brand name, exclusive access to the Aware Aural Rehab Program within 10 miles of retail stores, exclusive territory

of all services within 10 miles of retail stores and 40 hours per month of various consulting services. The Consulting Agreement

continues until January 31, 2019, unless terminated for cause, as defined in the Consulting Agreement.

On

May 2, 2017, the Company received a demand letter threatening litigation unless all monies paid pursuant to the Consulting Agreement

are returned on the basis that an injunction against certain Officers and Directors renders the Consulting Agreement impossible

to perform. The Company was not named as an enjoined party in such previous litigation, and the services contemplated under the

Consulting Agreement are not within the scope of the injunction, thus the Company believes this threat by the third party is frivolous

and without merit, as well as not providing sufficient cause for the Agreement to be terminated. The Company intends to vigorously

defend against any lawsuit filed against it in this matter, as well as take any required action to see that the obligations of

the third party in this matter are strictly enforced.

|

Item 9.01

|

Financial

Statements and Exhibits

|

|

Exhibit

No.

|

|

Description

|

|

10.1

|

|

Business Loan Agreement,

dated May 5, 2017, between InnerScope Advertising Agency, Inc. and Moore Holdings, LLC and First Community Bank.

|

|

10.2

|

|

Commercial Security

Agreement, dated May 5, 2017, between InnerScope Advertising Agency, Inc. and Moore Holdings, LLC and First Community Bank.

|

|

10.3

|

|

U.S. Small Business

Administration Note.

|

|

10.4

|

|

Deed of Trust,

dated May 5, 2017, among InnerScope Advertising Agency, Inc. and Moore Holdings, LLC. and First Community Bank and Placer

Title Company.

|

Signature(s)

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

Innerscope

Advertising Agency, Inc.

|

|

|

|

|

|

|

Date:

May 17, 2017

|

|

|

|

By:

|

|

/s/

Matthew Moore

|

|

|

|

|

|

|

|

Matthew

Moore

Chief

Executive Officer

|

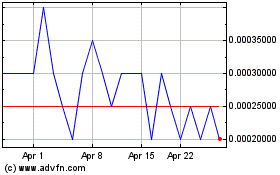

Innerscope Hearing Techn... (PK) (USOTC:INND)

Historical Stock Chart

From Mar 2024 to Apr 2024

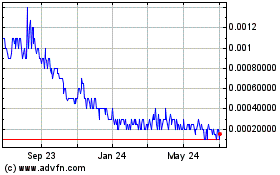

Innerscope Hearing Techn... (PK) (USOTC:INND)

Historical Stock Chart

From Apr 2023 to Apr 2024