As Filed with the Securities and Exchange Commission on May 16, 2017

Registration No. 333-216666

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment

No. 1

to

Form S-3

REGISTRATION STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

STAFFING 360 SOLUTIONS, INC.

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

Nevada

|

|

68-0680859

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification No.)

|

641 Lexington Avenue, 27

th

Floor

New York, New York 10022

(646) 507-5710

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Brendan Flood

Executive

Chairman

641 Lexington Avenue, 27

th

Floor

New York, New York 10022

(646) 507-5710

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copies of

all communications, including communications sent to agent for service, should be sent to:

Rick A. Werner, Esq.

Haynes and Boone, LLP

30

Rockefeller Plaza, 26th Floor

New York, New York 10112

(212) 659-7300

Approximate

date of commencement of proposed sale to the public:

From time to time after the effective date of this Registration Statement.

If the

only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the

following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General

Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated

filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth

company” in Rule 12b–2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

Large accelerated filer

|

|

☐

|

|

Accelerated filer

|

|

☐

|

|

Non-accelerated filer

|

|

☐ (Do not check if a smaller reporting company)

|

|

Smaller reporting company

|

|

☒

|

|

|

|

|

|

Emerging growth company

|

|

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the

extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

Title of Each Class of

Securities to be Registered

|

|

Amount

to be

Registered(1)

|

|

Proposed

Maximum

Offering Price

Per Security(2)

|

|

Proposed

Maximum

Aggregate

Offering Price

|

|

Amount of

Registration Fee

|

|

Common Stock, par value $0.00001 per share

|

|

2,105,907(3)

|

|

$0.70

|

|

$1,474,134.90

|

|

$170.85

|

|

Common Stock, par value $0.00001 per share, issuable upon

exercise of Warrant

|

|

6,244,879(4)

|

|

$0.70

|

|

$4,371,415.30

|

|

$506.65

|

|

Common Stock, par value $0.00001 per share, issuable upon

conversion of up to 50% of the accrued unpaid interest on the Note

|

|

222,000(5)

|

|

$0.70

|

|

$155,400.00

|

|

$18.01

|

|

Common Stock, par value $0.00001 per share, issuable upon

conversion of up to 50% of the accrued unpaid interest on the April Note

|

|

72,692(6)

|

|

$0.70

|

|

$50,884.40

|

|

$5.90

|

|

Common Stock, par value $0.00001 per share, issuable in the

event that the Company has not fully and irrevocably discharged all of its obligations arising under the April Note

|

|

200,000(7)

|

|

$0.70

|

|

$140,000.00

|

|

$16.23

|

|

Common Stock, par value $0.00001 per share, upon the earlier

of approval by the stockholders at our upcoming special meeting of stockholders, or such time as NASDAQ listing requirements no longer require such approval.

|

|

370,921(8)

|

|

$0.70

|

|

$259,644.70

|

|

$30.09

|

|

Total:

|

|

9,216,399

|

|

|

|

$6,451,479.30

|

|

$747.73

|

|

|

|

|

|

(1)

|

Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”), this registration statement on Form S-3 shall also cover any additional shares of the registrant’s common stock

that become issuable by reason of any stock dividend, stock split, recapitalization or other similar transaction effected without receipt of consideration.

|

|

(2)

|

Estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(c) under the Securities Act of 1933, as amended. The offering price per share and aggregate offering price for the

common stock and the common stock issuable upon conversion of up to 50% of the accrued unpaid interest on the Note are based upon the average of the high and low prices for the registrant’s common stock as reported on the NASDAQ Capital Market

on May 10, 2017, a date within five business days prior to the filing of this registration statement. The offering price per share and aggregate offering price for the common stock issuable upon exercise of the Warrant is based upon the exercise

price of the Warrant.

|

|

(3)

|

This amount is comprised of (i) 1,650,000 shares of common stock that were issued to Jackson Investment Group LLC

pursuant to that certain Note and Warrant Purchase Agreement, dated January 25, 2017, by among the registrant, Jackson Investment Group LLC and certain subsidiaries of the registrant, (ii) 296,984 shares of common stock that were issued to Jackson

Investment Group LLC pursuant to that certain Omnibus Amendment and Reaffirmation Agreement, dated April 5, 2017, by among the registrant, Jackson Investment Group LLC and certain subsidiaries of the registrant (with an additional 370,921 shares to

be issued pursuant to (8) below), (iii) 155,577 shares of common stock that were acquired by Jackson Investment Group LLC pursuant to open market purchases, (iv) 721 shares of common stock that were acquired by to Richard L. Jackson, the chief

executive officer of Jackson Investment Group LLC, pursuant to open market purchases, and (v) 2,625 shares of common stock previously issued in connection with

|

|

|

certain amendments to the Series B Convertible Bonds (as defined herein), before the remaining holders were paid in full in cash pursuant to that certain 12% Series B Convertible Bond Purchase

Agreement, dated October 27, 2014, as amended, by among the registrant and the purchasers thereto. No Series B Convertible Bonds currently remain outstanding.

|

|

(4)

|

All 6,244,879 shares of common stock issuable upon exercise of the Warrant (as defined herein) may be offered by Jackson Investment Group LLC, which Warrant was issued to such selling stockholder pursuant to that

certain Note and Warrant Purchase Agreement, dated January 25, 2017, by among the registrant, Jackson Investment Group LLC and certain subsidiaries of the registrant, as amended. This amount includes (i) 4,527,537 shares of common stock issuable

upon exercise of the Warrant and (ii) 1,717,342 shares of common stock which may be issuable upon exercise of the Warrant as a result of certain price based anti-dilution protection in the Warrant, and a contractual minimum exercise price of $0.725.

|

|

(5)

|

All 222,000 shares of common stock issuable upon conversion of 50% of the accrued and unpaid interest on the Note (as defined herein) may be offered by Jackson Investment Group LLC, which Note was issued to Jackson

Investment Group LLC pursuant to that certain Note and Warrant Purchase Agreement, dated January 25, 2017, by among the registrant, Jackson Investment Group LLC and certain subsidiaries of the registrant, as amended by that certain Omnibus Amendment

and Reaffirmation Agreement, dated April 5, 2017, by among the registrant, Jackson Investment Group LLC and certain subsidiaries of the registrant. The number of shares of common stock issuable upon conversion of the Note is based on the $7,400,000

in principal amount of the Note currently outstanding, accrued but unpaid interest through July 25, 2018 (the maturity date of the Note) and $1.50, the conversion price per share of the Note.

|

|

(6)

|

All 72,692 shares of common stock issuable upon conversion of 50% of the accrued and unpaid interest on the April Note (as defined herein) may be offered by Jackson Investment Group LLC, which April Note was issued to

Jackson Investment Group LLC pursuant to that certain Omnibus Amendment and Reaffirmation Agreement, dated April 5, 2017, by and among the registrant, Jackson Investment Group LLC and certain subsidiaries of the registrant. The number of shares of

common stock issuable upon conversion of the April Note is based on the $1,650,000 in principal amount of the Note currently outstanding, accrued but unpaid interest through June 8, 2019 (the maturity date of the April Note) and $1.50, the

conversion price per share of the April Note.

|

|

(7)

|

All 200,000 shares of common stock issuable upon failure of the registrant to discharge its obligations under the April Note on or prior to the Trigger Date (as defined herein).

|

|

(8)

|

All 370,921 shares of common stock related to that certain Omnibus Amendment and Reaffirmation Agreement dated April 5, 2017, and issuable to Jackson Investment Group, LLC upon the earlier of approval by the

stockholders at our upcoming special meeting of stockholders, or such time as NASDAQ listing requirements no longer require such approval.

|

The registrant hereby amends

this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in

accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission acting pursuant to said Section 8(a) may determine.

The information in this prospectus is not complete and may be changed. These securities may

not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the

offer or sale is not permitted.

Subject to Completion, dated May 16, 2017

PROSPECTUS

Staffing 360 Solutions, Inc.

9,216,399 Shares of Common Stock

This prospectus

relates to the resale of up to 9,216,399 shares of our common stock to be offered by the selling stockholders. These 9,216,399 shares of common stock consist of:

|

|

•

|

|

1,650,000 shares of common stock that were issued to Jackson Investment Group LLC pursuant to that certain Note and Warrant Purchase Agreement, dated January 25, 2017, by among us, Jackson Investment Group LLC and

certain of our subsidiaries (the “Note and Warrant Purchase Agreement”);

|

|

|

•

|

|

296,984 shares of common stock that were issued to Jackson Investment Group LLC pursuant to that certain Omnibus Amendment and Reaffirmation Agreement, dated April 5, 2017, by among the registrant, Jackson Investment

Group LLC and certain subsidiaries of the registrant (the “Amended Purchase Agreement”) (as referenced below, an additional 370,921 shares are to be issued upon the earlier of approval by the stockholders at our upcoming special meeting of

stockholders, or such time as NASDAQ listing requirements no longer require such approval).

|

|

|

•

|

|

4,527,537 shares of common stock that are issuable to Jackson Investment Group LLC upon the exercise of that certain 4.5 year warrant to purchase 4,527,537 shares of our common stock at an initial exercise price of

$1.00 per share, that was issued to Jackson Investment Group LLC pursuant to the Note and Warrant Purchase Agreement, as amended by the Amended Purchase Agreement, which amount may be increased to 6,244,879 shares of common stock upon the occurrence

of certain price based anti-dilution protections (the “Warrant”);

|

|

|

•

|

|

222,000 shares of common stock that are issuable upon the conversion of up to 50% of the accrued interest on the that certain 6% Subordinated Secured Note, in the principal amount of $7,400,000, that was issued to

Jackson Investment Group LLC and has a maturity date of July 25, 2018, pursuant to the Note and Warrant Purchase Agreement, as amended by the Amended Purchase Agreement, at a conversion price equal to $1.50 per share, subject to appropriate

adjustment for stock splits, reverse stock splits, stock dividends and similar transactions (the “Note”);

|

|

|

•

|

|

72,692 shares of common stock that are issuable upon the conversion of up to 50% of the accrued interest on the that certain 6% Subordinated Secured Note, in the principal amount of $1,650,000, that was issued to

Jackson Investment Group LLC and has a maturity date of June 8, 2019, pursuant to the Amended Agreement, at a conversion price equal to $1.50 per share, subject to appropriate adjustment for stock splits, reverse stock splits, stock dividends and

similar transactions (the “April Note”);

|

|

|

•

|

|

2,625 shares of common stock previously issued in connection with certain amendments to the Series B Convertible Bonds, before the remaining holders were paid in full in cash pursuant to that certain 12% Series B

Convertible Bond Purchase Agreement, dated October 27, 2014, as amended, by among the registrant and the purchasers thereto (the “Series B Convertible Bonds”);

|

|

|

•

|

|

155,577 shares of our common stock that were purchased in the open market by Jackson Investment Group LLC and 721 shares of our common stock that were purchased in the open market by Richard L. Jackson, Jackson

Investment Group LLC’s chief executive officer; and

|

|

|

•

|

|

200,000 shares of our common stock that are issuable upon our failure to discharge our obligations under the April Note on or prior to June 8, 2019 (the “Trigger Date”); provided that if our existing debt with

MidCap Funding X Trust is paid in full prior to its stated maturity date of April 8, 2019, then the Trigger Date will be July 25, 2018.

|

|

|

•

|

|

370,921 shares of common stock related to the Amended Purchase Agreement, and issuable to Jackson Investment Group, LLC upon the earlier of approval by the stockholders at our upcoming special meeting of stockholders,

or such time as NASDAQ listing requirements no longer require such approval.

|

Our registration of the shares of common

stock covered by this prospectus does not mean that the selling stockholders will offer or sell any of such shares of common stock. The selling stockholders may sell the shares of common stock covered by this prospectus in a number of different ways

and at varying prices. For additional information on the possible methods of sale that may be used by the selling stockholders, you should refer to the section of this prospectus entitled “Plan of Distribution”. We will not receive any of

the proceeds from the sale of common stock by the selling stockholders. However, we will generate proceeds in the event of the exercise of the Warrant.

No underwriter or other person has been engaged to facilitate the sale of the common stock in this offering. We will bear all costs, expenses

and fees in connection with the registration of the common stock. The selling stockholders will bear all commissions and discounts, if any, attributable to their respective sales of our common stock.

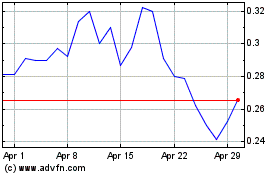

Our common stock is listed on the NASDAQ Capital Market under the symbol “STAF.” On May 10, 2017, the last reported sales price for

our common stock was $0.70 per share.

Investment in our common stock involves risk. See “

Risk Factors

” contained in this prospectus, in our

periodic reports filed from time to time with the Securities and Exchange Commission and in the accompanying prospectus supplement. You should carefully read this prospectus and the accompanying prospectus supplement, together with the documents we

incorporate by reference, before you invest in our common stock.

Neither the

Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or the accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is May 16, 2017.

TABLE OF CONTENTS

i

ABOUT THIS PROSPECTUS

This prospectus is part of the registration statement that we filed with the Securities and Exchange Commission. As permitted by the rules and

regulations of the Securities and Exchange Commission, the registration statement filed by us includes additional information not contained in this prospectus.

If information in this prospectus is inconsistent with any document incorporated by reference that was filed with the Securities and Exchange

Commission before the date of this prospectus, you should rely on this prospectus. This prospectus and the documents incorporated by reference into this prospectus include important information about us, the securities being offered and other

information you should know before investing in our securities. You should also read and consider information in the documents to which we have referred you in the section of this prospectus entitled “Where You Can Find More Information.”

You should rely only on this prospectus and the information incorporated or deemed to be incorporated by reference in this prospectus. We

have not authorized anyone to provide you with information that is in addition to or different from that contained or incorporated by reference in this prospectus. If anyone provides you with different or inconsistent information, you should not

rely on it. This prospectus does not constitute an offer to sell or the solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction. You should not

assume that the information contained or incorporated by reference in this prospectus is accurate as of any date other than as of the date of this prospectus, or in the case of the documents incorporated by reference, the date of such documents

regardless of the time of delivery of this prospectus or any sale of our shares of common stock. Our business, financial condition, liquidity, results of operations and prospects may have changed since those dates.

We further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document

that is incorporated by reference in this prospectus were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be

a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately

representing the current state of our affairs.

Unless otherwise indicated, information contained or incorporated by reference in this

prospectus concerning our industry, including our general expectations and market opportunity, is based on information from our own management estimates and research, as well as from industry and general publications and research, surveys and

studies conducted by third parties. Management estimates are derived from publicly available information, our knowledge of our industry and assumptions based on such information and knowledge, which we believe to be reasonable. In addition,

assumptions and estimates of our and our industry’s future performance are necessarily uncertain due to a variety of factors, including those described in “Risk Factors” beginning on page 7 of this prospectus. These and other

factors could cause our future performance to differ materially from our assumptions and estimates.

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

The Securities and Exchange Commission allows us to “incorporate by reference” information into this prospectus, which means that we

can disclose important information about us by referring you to another document filed separately with the Securities and Exchange Commission. The information incorporated by reference is an important part of this prospectus, and information that we

file later with the Securities and Exchange Commission will automatically update and supersede this information. This prospectus incorporates by reference the documents and reports listed below and any future filings that we make with the Securities

and Exchange Commission under Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as

1

amended (other than filings or portions of filings that are furnished under applicable Securities and Exchange Commission rules rather than filed) until the date of completion of this offering:

|

|

|

|

|

Staffing 360 Solutions Filings

|

|

Period

|

|

Transition Report on Form 10-K/T

|

|

Transition period ended December 31, 2016 (filed with the Securities and Exchange Commission on April 12, 2017)

|

|

|

|

|

Annual Report on Form 10-K

|

|

Year ended May 31, 2016 (filed with the Securities and Exchange Commission on August 29, 2016)

|

|

|

|

|

Quarterly Report on Form 10-Q

|

|

Quarterly period ended August 31, 2016 (filed with the Securities and Exchange Commission on October 16, 2016)

|

|

|

|

|

Quarterly Report on Form 10-Q

|

|

Quarterly period ended November 30, 2016 (filed with the Securities and Exchange Commission on January 13, 2017)

|

|

|

|

|

Current Reports filed on Form 8-K

|

|

Dates filed: January 27, 2017; January 31, 2017; March 3, 2017; March 20, 2017; April 6, 2017, April 13, 2017 (excluding information furnished pursuant to Item 2.02), April 27, 2017, May 8, 2017 (excluding information furnished

pursuant to Item 2.02), and three (3) filings on May 11, 2017

|

|

|

|

|

The description of our capital stock set forth in our registration statement on Form 8-A

|

|

Date filed: September 28, 2015

|

Any reports filed by us with the Securities and Exchange Commission after the date of the registration

statement of which this prospectus forms a part, and prior to effectiveness of such registration statement, and any reports filed by us with the Securities and Exchange Commission after the date of this prospectus and before the date that the

offerings of the securities by means of this prospectus are terminated, will automatically update and, where applicable, supersede any information contained in this prospectus or incorporated by reference in this prospectus.

You may request a copy of the documents incorporated by reference into this prospectus, except exhibits to such documents unless those

exhibits are specifically incorporated by reference in such documents, at no cost, by writing or telephoning us at the following address and telephone number:

Staffing 360 Solutions, Inc.

641 Lexington Avenue, 27

th

Floor

New York, New York 10022

Attention: Executive Director

(646) 507-5710

You may

also find additional information about us, including the documents mentioned above, on our website at www.staffing360solutions.com. Our website and the information included in, or linked to on, our website are not part of this prospectus. We have

included our website address in this prospectus solely as a textual reference.

2

SUMMARY

This summary highlights selected information contained elsewhere in this prospectus or incorporated by reference in this prospectus, and does not contain

all of the information that you need to consider in making your investment decision. You should carefully read the entire prospectus and any applicable prospectus supplement, including the risks of investing in our common stock discussed under the

heading “Risk Factors” contained in this prospectus and any applicable prospectus supplement, and under similar headings in the other documents that are incorporated by reference into this prospectus. You should also carefully read the

information incorporated by reference into this prospectus, including our financial statements, and the exhibits to the registration statement of which this prospectus forms a part. In this prospectus, unless the context indicates otherwise,

“Staffing 360,” the “Company,” the “registrant,” “we,” “us,” “our,” or “ours” refer to Staffing 360 Solutions, Inc. and its consolidated subsidiaries.

Business Overview

We were incorporated

in the State of Nevada on December 22, 2009, as Golden Fork Corporation, and changed our name to Staffing 360 Solutions, Inc., trading symbol “STAF”, on March 16, 2012. On July 31, 2012, we commenced operations in the

staffing sector. As a rapidly growing public company in the international staffing sector, our high-growth business model is based on finding and acquiring, suitable, mature, profitable, operating, domestic and international staffing companies. Our

targeted consolidation model is focused specifically on the accounting and finance, information technology, engineering, administration and light industrial sectors.

For a complete description of our business, financial condition, results of operations and other important information, we refer you to our

filings with the Securities and Exchange Commission that are incorporated by reference in this prospectus, including our Annual Report on Form 10-K for the year ended May 31, 2016. For instructions on how to find copies of these documents, see

“Where You Can Find More Information”.

Corporate Information

We are a Nevada corporation. Our principal executive office is located at 641 Lexington Avenue,

27

th

Floor, New York, New York 10022, and our telephone number is (646) 507-5710. Our website is www.staffing360solutions.com, and the information included in, or linked to on, our website is

not part of this prospectus. We have included our website address in this prospectus solely as a textual reference. All trademarks, trade names and service marks appearing in this prospectus are the property of their respective owners.

Recent Events

On February 28, 2017, our

Board of Directors approved a change in our fiscal year end from a calendar year ending on May 31 to a 52-53 week year ending on the Saturday nearest to December 31, effective for the current fiscal year. The change to our fiscal year will not

impact our fiscal year results for the fiscal year ended May 31, 2016.

On March 14, 2017, we entered into Amendment No. 1 to the Warrant

with Jackson Investment Group LLC (the “First Amendment”). Specifically, among other things, the First Amendment includes provisions to (a) prevent Jackson Investment Group LLC from beneficially owning in excess of 19.9% of the number of

shares of common stock outstanding immediately after giving effect to such issuance or (b) controlling in excess of 19.9% of the total voting power of our securities outstanding immediately after giving effect to such issuance that are entitled to

vote on a matter being voted on by holders of the common stock, unless and until we obtain stockholder approval permitting such issuances in accordance with applicable Nasdaq rules. As part of the First Amendment we agreed to submit a proposal

seeking stockholder approval at a meeting to be held on or before

3

July 15, 2017, and if unsuccessful at that meeting then upon request of the holder not more often than once every six (6) months. We further agreed in connection with each such meeting to make a

recommendation of management to stockholders in favor of approval of the proposal, and to use its customary efforts to solicit proxies from stockholders in favor of the proposal.

On April 5, 2017, we, Jackson Investment Group LLC and various of our subsidiaries entered into the Amended Purchase Agreement which, among

other things, amended the Note and Warrant Purchase Agreement. Specifically, pursuant to the Amended Purchase Agreement, we agreed to issue and sell (i) 667,905 shares of our common stock (the “April Commitment Shares”) and (ii) the April

Note to the Jackson Investment Group LLC in return for total gross proceeds to the Company of $1,650,000. All accrued and unpaid interest on the outstanding principal balance of the April Note shall be due and payable in full on June 8, 2019 (the

“Maturity Date”). In the event, however, that our obligations under that certain Credit and Security Agreement, dated as of April 8, 2015, by and among us, MidCap Funding X Trust, as successor-by-assignment to Midcap Financial Trust, and

the other parties thereto, are discharged by payment in full in cash or if otherwise consented to in writing by MidCap Funding X Trust, the “Maturity Date” in respect of the April Note will be July 25, 2018. The April Note’s principal

is not convertible into shares of common stock, however 50% of the accrued interest on the April Note can be converted into shares of common stock, at the sole election of the holder of the April Note prior to maturity, at a conversion price equal

to $1.50 per share (subject to adjustment).

The Amended Purchase Agreement provides that, in the event that we have not fully and

irrevocably discharged all of its obligations under the April Note on or prior to the Maturity Date, the Company is obligated to issue 200,000 additional shares of its common stock (the “Fee Extension Shares”) to Jackson Investment Group

LLC. In addition, the Amended Purchase Agreement modified the conversion rate applicable upon the conversion of 50% of the accrued interest on the Note from $2.00 per share to $1.50 per share.

In connection with our entry into the Amended Purchase Agreement, we entered into Amendment No. 2 to the Warrant (the “Second

Amendment”). The Second Amendment modified the initial exercise price under the Warrant from $1.35 per share (subject to adjustment) to $1.00 per share (subject to adjustment). In addition, the Second Amendment allows the holder of the Warrant

to purchase up to 4,527,537 shares of our common stock.

Also in connection with our entry into the Amended Purchase Agreement, we,

Jackson Investment Group LLC, certain of our subsidiaries and MidCap Funding X Trust entered into Amendment No. 1 to the Subordination Agreement, pursuant to which the parties agreed that our obligations to Jackson Investment Group LLC under the

April Note shall also be subordinate to our obligations to MidCap Funding X Trust.

On April 5, 2017, we entered into a Second Amendment

to Stock Purchase Agreement (the “Amended SPA”) with the holder of our Series D Redeemable Convertible Preferred Stock (the “Series D Shares”), pursuant to which we used a portion of the proceeds we received in connection with

our entry into the Amended Purchase Agreement to redeem 62 shares of our Series D Shares. The Series D Shares were redeemed for an aggregate redemption price of $1,500,000 plus 300,000 free trading shares of our common stock. Following the

redemption of the 62 Series D Shares, no additional Series D Shares remain outstanding.

4

The Offering

|

Common stock to be Offered by the selling stockholders

|

9,216,399 shares of common stock consisting of (i) 1,650,000 shares of common stock issued as a commitment fee in connection with the acquisition of the Note by Jackson Investment Group LLC; (ii) 296,984 shares of common stock issued

as a commitment fee in connection with the acquisition of the April Note by Jackson Investment Group LLC; (iii) 156,298 shares of common stock purchased by Jackson Investment Group LLC and Richard L. Jackson, Jackson Investment Group LLC’s

chief executive officer, pursuant to open market purchases; (iv) up to 6,244,879 shares of common stock issuable upon the exercise of the Warrant; (v) up to 222,000 shares of common stock issuable upon the conversion of up to 50% of the

accrued interest on the Note, at a conversion price equal to $1.50 per share, subject to appropriate adjustment for stock splits, reverse stock splits, stock dividends and similar transactions; (vi) up to 72,692 shares of common stock issuable upon

the conversion of up to 50% of the accrued interest on the April Note, at a conversion price equal to $1.50 per share, subject to appropriate adjustment for stock splits, reverse stock splits, stock dividends and similar transactions; (vii) 2,625

shares of common stock previously issued in connection with certain amendments to the Series B Convertible Bonds, before the remaining holders were paid in full in cash; (viii) 200,000 shares of our common stock that are issuable upon our failure to

discharge our obligations under the April Note on or prior to the Trigger Date, and (ix) 370,921 shares of common stock issued as a commitment fee in connection with the acquisition of the April Note by Jackson Investment Group LLC, and issuable to

Jackson Investment Group, LLC upon the earlier of approval by the stockholders at our upcoming special meeting of stockholders, or such time as NASDAQ listing requirements no longer require such approval.

|

|

Shares Outstanding After this Offering

|

21,752,471 shares (excluding treasury shares) assuming the Warrant is exercised in full, 50% of the accrued interest on the Note is converted into shares of common stock, 50% of the accrued interest on the April Note is converted into shares of

common stock, we issue all of the Fee Extension Shares, and we issue all 370,921 shares of common stock upon approval by the stockholders at our upcoming special meeting of stockholders, or such time as NASDAQ listing requirements no longer require

such approval.

|

|

Use of Proceeds

|

We will not receive any proceeds from the sale of the common stock offered by the selling stockholders. However, we will generate proceeds in the event of an exercise of the Warrant. We intend to use those proceeds, if any, for general corporate

purposes. See “Use of Proceeds.”

|

|

Dividend Policy

|

We do not anticipate declaring or paying any cash dividends on our common stock.

|

5

|

Trading

|

Our common stock is listed on the NASDAQ Capital Market under the symbol “STAF.”

|

|

Risk Factors

|

Investing in our common stock involves significant risks. See “Risk Factors” beginning on page 7 of this prospectus and the documents incorporated by reference in this prospectus.

|

The number of shares of our common stock shown above to be outstanding after this offering is based on 14,641,979 shares of our common stock outstanding as of

May 10, 2017, and excludes as of such date:

|

|

•

|

|

1,629,565 shares of common stock issuable upon the exercise of stock options and units outstanding prior to this offering under our stock option plans and long term incentive plan (“LTIP”), including 627,300

shares from various stock options at a weighted average exercise price of $7.22 per share;

|

|

|

•

|

|

1,528,628 shares of common stock available for future grants under our stock option plans and stock incentive plans;

|

|

|

•

|

|

370,921 shares of common stock related to the Asset Purchase Agreement, and issuable to Jackson Investment Group, LLC upon the earlier of approval by the stockholders at our upcoming special meeting of stockholders, or

such time as NASDAQ listing requirements no longer require such approval;

|

|

|

•

|

|

216,191 shares of common stock issuable upon the potential conversion of Series A Preferred Stock;

|

|

|

•

|

|

4,561,167 shares of common stock issuable upon exercise of warrants outstanding prior to this offering, including 33,630 warrants at a weighted average exercise price of $19.52, and 4,527,537 warrants held by Jackson

Investment Group, LLC, at an exercise price of $1.00 per share, which are first exercisable on July 26, 2017, inclusive of shares of common stock which may be issuable as a result of certain price based anti-dilution protection; and

|

|

|

•

|

|

1,269,423 shares of common stock issuable upon the potential conversion of promissory notes and interest, including 294,692 shares upon conversion of 50% of the accrued and unpaid interest on promissory notes held by

Jackson Investment Group, LLC dated January 26, 2017, as amended, and April 5, 2017.

|

The number of shares of common stock issuable upon the

exercise or conversion of the above described securities are subject to adjustment in certain circumstances.

6

RISK FACTORS

Investment in our common stock involves significant risks. In addition to all of the other information contained or incorporated by reference

into this prospectus, you should carefully consider the following risk factors and any other information included in any prospectus supplement. The risks and uncertainties described below are not the only ones we face. Additional risks and

uncertainties not presently known to us or that we currently deem immaterial also may impair our business operations. If any of the following risks occur, our business, financial condition, results of operations, and cash flows could be materially

adversely affected. The trading price of shares of our common stock could decline due to any of these risks, and you may lose all or part of your investment.

We have incurred significant losses since our inception and anticipate that we will incur continued losses for the next several years and thus may never

achieve or maintain profitability.

We anticipate that we will incur operating losses for the foreseeable future. Because of the

numerous risks and uncertainties associated with the staffing industry, we are unable to predict the extent of any future losses or when we will become profitable, if at all. Expected future operating losses will have an adverse effect on our cash

resources, stockholders’ equity and working capital. Our failure to become and remain profitable could depress the value of our stock and impair our ability to raise capital, expand our business, maintain our development efforts, diversify our

portfolio of staffing companies, or continue our operations. A decline in our value could also cause you to lose all or part of your investment.

The number of shares that are eligible for sale under this prospectus could cause the market price for our common stock to decline or make it difficult

for us to sell securities in the future.

There are 14,641,979 shares of our common stock outstanding as of May 10, 2017

(without giving effect to the exercise of any options and warrants currently outstanding). The 9,216,399 shares of our common stock that may be sold by the selling stockholders under this prospectus represent a substantial number of shares relative

to our current shares outstanding. Expectations that shares of our common stock may be sold by the selling stockholders could create a market overhang that may adversely affect the market price for our common stock.

We cannot predict the effect on the market price of our common stock from time to time as a result of (i) sales by the selling

stockholders of some or all of the shares of our common stock under this prospectus, (ii) the availability of such shares of common stock for sale by the selling stockholders, or (iii) the perception that such shares or additional shares

of our common stock may be offered for sale by the selling stockholders. Sales of substantial numbers of shares of our common stock in the public market, or the perception that those sales will occur, could cause the market price of our common stock

to fluctuate or decline or make future offerings of our equity securities more difficult. In addition, the sale of these shares could impair our ability to raise capital, should we wish to do so, through the sale of additional common or preferred

stock.

We have significant debt that could adversely affect our financial health and prevent us from fulfilling our obligations or put us at a

competitive disadvantage.

Our level of debt and the limitations imposed on us by our lenders could have a material impact on

investors, including the requirement to use a portion of our cash flow from operations for debt service rather than for our operations and the need to comply with the various covenants associated with such debt. Additionally, we may not be able to

obtain additional debt financing for future working capital, capital expenditures or other corporate purposes or may have to pay more for such financing. We could also be less able to take advantage of significant business opportunities, such as

acquisition opportunities, and to react to changes in market or industry conditions, or we may be disadvantaged compared to competitors with less leverage.

7

Our debt instruments contain covenants that could limit our financing options and liquidity position, which

would limit our ability to grow our business.

Covenants in our debt instruments impose operating and financial restrictions on us.

These restrictions prohibit or limit our ability to, among other things:

|

|

•

|

|

pay cash dividends to our stockholders;

|

|

|

•

|

|

redeem or repurchase our common stock or other equity;

|

|

|

•

|

|

incur additional indebtedness;

|

|

|

•

|

|

permit liens on assets;

|

|

|

•

|

|

make certain investments (including through the acquisition of stock, shares, partnership or limited liability company interests, any loan, advance or capital contribution);

|

|

|

•

|

|

sell, lease, license, lend or otherwise convey an interest in a material portion of our assets; and

|

|

|

•

|

|

cease making public filings under the Securities Exchange Act of 1934, as amended.

|

Our

failure to comply with the restrictions in our debt instruments could result in an event of default, which, if not cured or waived, could result in us being required to repay these borrowings before their due date. The lenders may require fees and

expenses to be paid or other changes to terms in connection with waivers or amendments. If we are forced to refinance these borrowings on less favorable terms, our results of operations and financial condition could be adversely affected by

increased costs and rates.

In addition, these restrictions may limit our ability to obtain additional financing, withstand downturns in

our business or take advantage of business opportunities. Moreover, additional debt financing we may seek, if permitted, may contain terms that include more restrictive covenants, may require repayment on an accelerated schedule or may impose other

obligations that limit our ability to grow our business, acquire needed assets, or take other actions we might otherwise consider appropriate or desirable.

The exercise of our current debt instruments could be highly dilutive to the holdings of our existing stockholders.

Certain of our current debt instruments are highly dilutive. The number of shares of our common stock that may be issued pursuant to the

conversion premiums in such debt instruments and if we elect to pay such dividends in shares may be significant, but cannot be determined at this time because the applicable calculations are based on our stock price during a period surrounding the

date of the conversion. The exercise of our existing outstanding dilutive Common Stock equivalents, which are exercisable for or convertible into shares of our Common Stock, would dilute the proportionate ownership and voting power of existing

stockholders and may cause the market price for our common stock to decline.

We have significant working capital needs and if we are unable to

satisfy those needs from cash generated from our operations or borrowings under our debt instruments, we may not be able to continue our operations.

We require significant amounts of working capital to operate our business. We often have high receivables from our customers, and as a staffing

company, we are prone to cash flow imbalances because we funnel payroll payments from employers to temporary workers. Cash flow imbalances also occur because we must pay temporary workers even when we have not been paid by our customers. If we

experience a significant and sustained drop in operating profits, or if there are unanticipated reductions in cash inflows or increases in cash outlays, we may be subject to cash shortfalls. If such a shortfall were to occur for even a brief period

of time, it may have a significant adverse effect on our business. In particular, we use working capital to pay expenses relating to our temporary workers and to satisfy our workers’ compensation liabilities. As a result, we must maintain

sufficient cash availability to pay temporary workers and fund related tax liabilities prior to receiving payment from customers.

8

In addition, our operating results tend be unpredictable from quarter to quarter. Demand for our

services is typically lower during traditional national vacation periods in the United States and United Kingdom when customers and candidates are on vacation. No single quarter is predictive of results from future periods. Any extended period of

time with low operating results or cash flow imbalances could have a material adverse effect on our business, financial condition and results of operations.

We derive working capital for our operations through cash generated by our operating activities and borrowings under our debt instruments. We

believe that our current sources of capital are adequate to meet our working capital needs. However, our available sources of capital are limited. If our working capital needs increase in the future, we may be forced to seek additional sources of

capital, which may not be available on commercially reasonable terms. The amount we are entitled to borrow under our debt instruments is calculated monthly based on the aggregate value of certain eligible trade accounts receivable generated from our

operations, which are affected by financial, business, economic and other factors, as well as by the daily timing of cash collections and cash outflows. The aggregate value of our eligible accounts receivable may not be adequate to allow for

borrowings for other corporate purposes, such as capital expenditures or growth opportunities, which could reduce our ability to react to changes in the market or industry conditions.

We will need to raise additional capital to meet our business requirements in the future, which is likely to be challenging, could be highly dilutive

and may cause the market price of our common stock to decline.

As of November 30, 2016, we had a working capital deficiency

of approximately $14.5 million, an accumulated deficit of approximately $46.9 million, and approximately $5.3 million associated with debt and other amortizing obligations due in the next 12 months. In order to operate our business objectives, we

will need to raise additional capital, which may not be available on reasonable terms or at all. Additional capital would be used to accomplish the following:

|

|

•

|

|

financing our current operating expenses;

|

|

|

•

|

|

pursuing growth opportunities;

|

|

|

•

|

|

making capital improvements to improve our infrastructure;

|

|

|

•

|

|

hiring and retaining qualified management and key employees;

|

|

|

•

|

|

responding to competitive pressures;

|

|

|

•

|

|

complying with regulatory requirements; and

|

|

|

•

|

|

maintaining compliance with applicable laws.

|

To the extent that we raise additional

capital through the sale of equity or convertible debt securities, the issuance of those securities could result in substantial dilution for our current stockholders. The terms of any securities issued by us in future capital transactions may be

more favorable to new investors, and may include preferences, superior voting rights and the issuance of warrants or other derivative securities, which may have a further dilutive effect on the holders of any of our securities then-outstanding. We

may issue additional shares of our common stock or securities convertible into or exchangeable or exercisable for our common stock in connection with hiring or retaining personnel, option or warrant exercises, future acquisitions or future

placements of our securities for capital-raising or other business purposes. The issuance of additional securities, whether equity or debt, by us, or the possibility of such issuance, may cause the market price of our common stock to decline further

and existing stockholders may not agree with our financing plans or the terms of such financings.

In addition, we may incur substantial

costs in pursuing future capital financing, including investment banking fees, legal fees, accounting fees, securities law compliance fees, printing and distribution expenses and other costs. We may also be required to recognize non-cash expenses in

connection with certain securities we issue, such as convertible notes and warrants, which may adversely impact our financial condition.

9

Furthermore, any additional debt or equity financing that we may need may not be available on

terms favorable to us, or at all. If we are unable to obtain such additional financing on a timely basis, we may have to curtail our development activities and growth plans and/or be forced to sell assets, perhaps on unfavorable terms, which would

have a material adverse effect on our business, financial condition and results of operations, and ultimately could be forced to discontinue our operations and liquidate, in which event it is unlikely that stockholders would receive any distribution

on their shares. Further, we may not be able to continue operating if we do not generate sufficient revenues from operations needed to stay in business.

A more active, liquid trading market for our common stock may not develop, and the price of our common stock may fluctuate significantly.

Although our common stock is listed on the NASDAQ Capital Market, it has only been traded on the NASDAQ Capital Market since September 29,

2015. Before that time, our common stock was traded on the OTCBB tier of the over-the-counter securities market run by FINRA, as well as OTCQB run by OTC Markets, and it first began trading on February 15, 2013. Historically, the market price of our

common stock has fluctuated over a wide range. Between our stock split occurring on September 17, 2015 and March 7, 2017, our common stock traded in a range from $0.54 to $7.74 per share. There has been relatively limited trading volume in

the market for our common stock, and a more active, liquid public trading market may not develop or may not be sustained. In addition, on January 25, 2017, we received a letter from the Listing Qualifications Department of the NASDAQ Capital

Market notifying us that, based upon the closing bid price of our common stock for the last 30 consecutive business days, the common stock did not meet the minimum bid price of $1.00 per share required by NASDAQ Listing Rule 5550(a)(2), initiating

an automatic 180 calendar-day grace period for us to regain compliance.

Limited liquidity in the trading market for our common stock may

adversely affect a stockholder’s ability to sell its shares of common stock at the time it wishes to sell them or at a price that it considers acceptable. If a more active, liquid public trading market does not develop, or if our shares are

delisted from the NASDAQ Capital Market, we may be limited in our ability to raise capital by selling shares of common stock and our ability to acquire other companies or assets by using shares of our common stock as consideration. In addition, if

there is a thin trading market or “float” for our stock, the market price for our common stock may fluctuate significantly more than the stock market as a whole. Without a large float, our common stock would be less liquid than the stock

of companies with broader public ownership and, as a result, the trading prices of our common stock may be more volatile and it would be harder for you to liquidate any investment in our common stock. Furthermore, the stock market is subject to

significant price and volume fluctuations, and the price of our common stock could fluctuate widely in response to several factors, including:

|

|

•

|

|

our quarterly or annual operating results;

|

|

|

•

|

|

changes in our earnings estimates;

|

|

|

•

|

|

investment recommendations by securities analysts following our business or our industry;

|

|

|

•

|

|

additions or departures of key personnel;

|

|

|

•

|

|

changes in the business, earnings estimates or market perceptions of our competitors;

|

|

|

•

|

|

our failure to achieve operating results consistent with securities analysts’ projections;

|

|

|

•

|

|

changes in industry, general market or economic conditions; and

|

|

|

•

|

|

announcements of legislative or regulatory changes.

|

The stock market has experienced

extreme price and volume fluctuations in recent years that have significantly affected the quoted prices of the securities of many companies, including companies in the staffing industry. The changes often appear to occur without regard to specific

operating performance. The price of our common stock could fluctuate based upon factors that have little or nothing to do with us and these fluctuations could materially reduce our stock price.

10

An investment in our common stock should be considered illiquid and high risk.

An investment in our common stock requires a long-term commitment, with no certainty of return. Because we did not become a public reporting

company by the traditional means of conducting an underwritten initial public offering of our common stock, we may be unable to establish a liquid market for our common stock. In addition, investment banks may be less likely to agree to underwrite

primary or secondary offerings on our behalf or our stockholders in the future than they would if we had become a public reporting company by means of an underwritten initial public offering of common stock. If all or any of the foregoing risks

occur, it would have a material adverse effect on us.

The United States Financial Industry Regulatory Authority, or FINRA, sales practice

requirements may also limit your ability to buy and sell our common stock, which could depress the price of our shares. FINRA rules require broker-dealers to have reasonable grounds for believing that an investment is suitable for a customer before

recommending that investment to the customer. Prior to recommending speculative low-priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status,

tax status and investment objectives, among other things. Under interpretations of these rules, FINRA believes that there is a high probability such speculative low-priced securities will not be suitable for at least some customers. Thus, FINRA

requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our shares, have an adverse effect on the market for our shares, and thereby depress our

share price.

There are inherent limitations in all control systems, and misstatements due to error or fraud may occur and not be detected.

The ongoing internal control provisions of Section 404 of the Sarbanes-Oxley Act of 2002 require us to identify material

weaknesses in internal control over financial reporting, which is a process to provide reasonable assurance regarding the reliability of financial reporting for external purposes in accordance with accounting principles generally accepted in the

United States. Our management, including our Executive Chairman and Chief Financial Officer, does not expect that our internal controls and disclosure controls will prevent all errors and all fraud. A control system, no matter how well conceived and

operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are met. In addition, the design of a control system must reflect the fact that there are resource constraints and the benefit of controls must

be relative to their costs. Because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues and instances of fraud, if any, in our company have been detected. These

inherent limitations include the realities that judgments in decision-making can be faulty and that breakdowns can occur because of simple errors or mistakes. Further, controls can be circumvented by individual acts of some persons, by collusion of

two or more persons, or by management override of the controls. The design of any system of controls is also based in part upon certain assumptions about the likelihood of future events, and there can be no assurance that any design will succeed in

achieving our stated goals under all potential future conditions. Over time, a control may be inadequate because of changes in conditions, such as growth of the company or increased transaction volume, or the degree of compliance with the policies

or procedures may deteriorate. Because of inherent limitations in a cost-effective control system, misstatements due to error or fraud may occur and not be detected.

In addition, discovery and disclosure of a material weakness, by definition, could have a material adverse impact on our financial statements.

Such an occurrence could discourage certain customers or suppliers from doing business with us, cause downgrades in our future debt ratings leading to higher borrowing costs and affect how our stock trades. This could, in turn, negatively affect our

ability to access public debt or equity markets for capital.

11

We face risks associated with litigation and claims.

We are a party to certain legal proceedings that are currently pending, including

NewCSI, Inc. vs. Staffing 360 Solutions, Inc.

and

Staffing 360 Solutions, Inc. v. Former Officers of Staffing 360 Solutions, Inc

., as further described in our most recent Annual Report on Form 10-K. In addition, from time to time, we may become involved in various claims, disputes and legal

or regulatory proceedings that arise in the ordinary course of business and relate to contractual and other obligations. Due to the uncertainties of litigation, we can give no assurance that we will prevail on any claims made against us in any such

lawsuit. Also, we can give no assurance that any other lawsuits or claims brought in the future will not have an adverse effect on our financial condition, liquidity or operating results. Adverse outcomes in some or all of these claims may result in

significant monetary damages that could adversely affect our ability to conduct our business.

The potential U.K. exit from the European Union

as a result of the U.K. triggering Article 50 of the Treaty on European Union could harm our business, financial condition or results of operations.

On March 29, 2017, the U.K. triggered Article 50 of the Treaty on European Union by notifying the European Council of its intention to withdraw

from the European Union (commonly referred to as the “Brexit”). Negotiations have commenced to determine the future terms of the U.K.’s relationship with the European Union, including the terms of trade between the U.K. and the

European Union. The effects of Brexit will depend on any agreements the U.K. makes to retain access to European Union markets either during a transitional period or more permanently. Brexit could lead to legal uncertainty and potentially divergent

national laws and regulations as the U.K. determines which European Union laws to replace or replicate.

The announcement of Brexit also

created (and the actual exit of the U.K. from the European Union may create future) global economic uncertainty. The actual exit of the U.K. from the European Union could cause disruptions to and create uncertainty surrounding our business. Any of

these effects of Brexit (and the announcement thereof), and others we cannot anticipate, could harm our business, financial condition or results of operations.

Our revenue may be adversely affected by fluctuations in currency exchange rates.

A significant portion of our expenditures are expected to be derived or spent in British pounds. However, we report our financial condition and

results of operations in U.S. dollars. As a result, fluctuations between the U.S. dollar and the British pound will impact the amount of our revenues and net income. For example, if the British pound appreciates relative to the U.S. dollar, the

fluctuation will result in a positive impact on the revenues that we report. However, if the British pound depreciates relative to the U.S. dollar, which was the case during 2016, there will be a negative impact on the revenues we report due to such

fluctuation. It is possible that the impact of currency fluctuations will result in a decrease in reported consolidated sales even though we may have experienced an increase in sales transacted in the British pound. Conversely, the impact of

currency fluctuations may result in an increase in reported consolidated sales despite declining sales transacted in the British pound. The exchange rate from the U.S. dollar to the British pound has fluctuated substantially in the past and may

continue to do so in the future. Though we may choose to hedge our exposure to foreign currency exchange rate changes in the future, there is no guarantee such hedging, if undertaken, will be successful.

We depend on attracting, integrating, managing, and retaining qualified personnel

.

Our success is substantially dependent upon our ability to attract, integrate, manage and retain personnel who possess the skills and

experience necessary to fulfill our customers’ needs. Our ability to hire and retain qualified personnel could be impaired by any diminution of our reputation, decrease in compensation levels relative to our competitors or modifications to our

total compensation philosophy or competitor hiring programs. If we cannot attract, hire and retain qualified personnel, our business, financial condition and results of operations may suffer. Our future success also depends upon our ability to

manage the performance of our personnel. Failure to successfully manage the performance of our personnel could affect our profitability by causing operating inefficiencies that could increase operating expenses and reduce operating income.

12

We depend on our ability to attract and retain qualified temporary workers.

In addition to the members of our own team, our success is substantially dependent on our ability to recruit and retain qualified temporary

workers who possess the skills and experience necessary to meet the staffing requirements of our customers. We are required to continually evaluate our base of available qualified personnel to keep pace with changing customer needs. Competition for

individuals with proven professional skills is intense, and demand for these individuals is expected to remain strong for the foreseeable future. There can be no assurance that qualified personnel will continue to be available.

Our revenue can vary because our customers can terminate their relationship with us at any time with limited or no penalty.

We focus on providing mid-level professional and light industrial personnel on a temporary assignment-by-assignment basis, which customers can

generally terminate at any time or reduce their level of use when compared to prior periods. To avoid large placement agency fees, large companies may use in-house personnel staff, current employee referrals, or human resources consulting companies

to find and hire new personnel. Because placement agencies typically charge a fee based on a percentage of the first year’s salary of a new worker, companies with many jobs to fill have a large financial incentive to avoid agencies.

Our business is also significantly affected by our customers’ hiring needs and their views of their future prospects. Our customers may,

on very short notice, terminate, reduce or postpone their recruiting assignments with us and, therefore, affect demand for our services. As a result, a significant number of our customers can terminate their agreements with us at any time, making us

particularly vulnerable to a significant decrease in revenue within a short period of time that could be difficult to quickly replace. This could have a material adverse effect on our business, financial condition and results of operations.

If we are unable to retain existing customers or attract new customers, our results of operations could suffer.

Increasing the growth and profitability of our business is particularly dependent upon our ability to retain existing customers and capture

additional customers. Our ability to do so is dependent upon our ability to provide high quality services and offer competitive prices. If we are unable to execute these tasks effectively, we may not be able to attract a significant number of new

customers and our existing customer base could decrease, either or both of which could have an adverse impact on our revenues.

We operate in an

intensely competitive and rapidly changing business environment, and there is a substantial risk that our services could become obsolete or uncompetitive.

The markets for our services are highly competitive. Our markets are characterized by pressures to provide high levels of service, incorporate

new capabilities and technologies, accelerate job completion schedules and reduce prices. Furthermore, we face competition from a number of sources, including other executive search firms and professional search, staffing and consulting firms.

Several of our competitors have greater financial and marketing resources than we do. New and existing competitors are aided by technology, and the market has low barriers to entry. Furthermore, Internet employment sites expand a company’s

ability to find workers without the help of traditional agencies. Personnel agencies often work as intermediaries, helping employers accurately describe job openings and screen candidates. Increasing the use of sophisticated, automated job

description and candidate screening tools could make many traditional functions of staffing companies obsolete. Specifically, the increased use of the internet may attract technology-oriented companies to the professional staffing industry. Free

social networking sites such as LinkedIn and Facebook are also becoming a common way for recruiters and employees to connect without the assistance of a staffing company.

Our future success will depend largely upon our ability to anticipate and keep pace with those developments and advances. Current or future

competitors could develop alternative capabilities and technologies that are more effective, easier to use or more economical than our services. In addition, we believe that, with continuing development and increased availability of information

technology, the industries in which we compete may

13

attract new competitors. If our capabilities and technologies become obsolete or uncompetitive, our related sales and revenue would decrease. Due to competition, we may experience reduced margins

on our services, loss of market share, and loss of customers. If we are not able to compete effectively with current or future competitors as a result of these and other factors, our business, financial condition and results of operations could be

materially adversely affected.

Our operations may be affected by global economic fluctuations.

Customers’ demand for our services may fluctuate widely with changes in economic conditions in the markets in which we operate. Those

conditions include slower employment growth or reductions in employment, which directly impact our service offerings. As a staffing company, our revenue depends on the number of jobs we fill, which in turn depends on economic growth. During economic

slowdowns, many customer companies stop hiring altogether. For example, in prior economic downturns, many employers in our operating regions reduced their overall workforce to reflect the slowing demand for their products and services. We may face

lower demand and increased pricing pressures during these periods, which this could have a material adverse effect on our business, financial condition and results of operations.

We could be adversely affected by risks associated with acquisitions and joint ventures

.

We are engaged in the acquisition of U.S. and U.K. based staffing companies, and our typical acquisition model is based on paying consideration

in the form of cash, stock, earn-outs and/or promissory notes. To date, we have completed six acquisitions. We intend to expand our business through acquisitions of complementary businesses, technologies, services or products, subject to our

business plans and management’s ability to identify, acquire and develop suitable investments or acquisition targets in both new and existing service categories. In certain circumstances, acceptable investments or acquisition targets might not

be available. Acquisitions involve a number of risks, including:

|

|

•

|

|

difficulty in integrating the operations, technologies, products and personnel of an acquired business, including consolidating redundant facilities and infrastructure;

|

|

|

•

|

|

potential disruption of our ongoing business and the distraction of management from our day-to-day operations;

|

|

|

•

|

|

difficulty entering markets in which we have limited or no prior experience and in which competitors have a stronger market position;

|

|

|

•

|

|

difficulty maintaining the quality of services that such acquired companies have historically provided;

|

|

|

•

|

|

potential legal and financial responsibility for liabilities of acquired businesses;

|

|

|

•

|

|

overpayment for the acquired company or assets or failure to achieve anticipated benefits, such as cost savings and revenue enhancements;

|

|

|

•

|

|

increased expenses associated with completing an acquisition and amortizing any acquired intangible assets;

|

|

|

•

|

|

challenges in implementing uniform standards, accounting policies, customs, controls, procedures and policies throughout an acquired business;

|

|

|

•

|

|

failure to retain, motivate and integrate key management and other employees of the acquired business; and

|

|

|

•

|

|

loss of customers and a failure to integrate customer bases.

|

Our business plan for

continued growth through acquisitions is subject to certain inherent risks, including accessing capital resources, potential cost overruns and possible rejection of our business model and/or sales methods. Therefore, we provide no assurance that we

will be successful in carrying out our business plan. We continue to pursue additional debt and equity financing to fund our business plan. We have no assurance that future financing will be available to us on acceptable terms or at all.

14

In addition, if we incur indebtedness to finance an acquisition, it may reduce our capacity to

borrow additional amounts and require us to dedicate a greater percentage of our cash flow from operations to payments on our debt, thereby reducing the cash resources available to us to fund capital expenditures, pursue other acquisitions or

investments in new business initiatives and meet general corporate and working capital needs. This increased indebtedness may also limit our flexibility in planning for, and reacting to, changes in or challenges relating to our business and

industry. The use of our common stock or other securities (including those convertible into or exchangeable or exercisable for our common stock) to finance any such acquisition may also result in dilution of our existing shareholders.

The potential risks associated with future acquisitions could disrupt our ongoing business, result in the loss of key customers or personnel,

increase expenses and otherwise have a material adverse effect on our business, results of operations and financial condition.

We are dependent

upon technology services, and if we experience damage, service interruptions or failures in our computer and telecommunications systems, our customer relationships and our ability to attract new customers may be adversely affected.

Our business could be interrupted by damage to or disruption of our computer and telecommunications equipment and software systems, and we may