SunLink Health Systems, Inc. (NYSE MKT: SSY) today announced a

loss from continuing operations of $890,000 or a loss of $0.10 per

fully diluted share for its third fiscal quarter ended March 31,

2017 compared to a loss from continuing operations of $1,392,000,

or a loss of $0.15 per fully diluted share, for the quarter ended

March 31, 2016. Net earnings for the quarter ended March 31, 2017

were a net loss of $1,025,000 or a loss of $0.11 per fully diluted

share compared to a net loss of $1,835,000 or a loss of $0.19 per

fully diluted share for the quarter ended March 31, 2016.

Consolidated net revenues from continuing operations for the

quarters ended March 31, 2017 and 2016 were $13,699,000 and

$16,205,000, respectively, a decrease of 15% in the current fiscal

year’s third quarter compared to the comparable quarter of the

prior fiscal year. Healthcare Facilities Segment net revenues of

$5,229,000 for the quarter ended March 31, 2017 decreased

$2,315,000 in the current fiscal year’s quarter primarily as a

result of the closure of one hospital in June 2016. The Specialty

Pharmacy Segment revenues of $8,198,000 in the quarter ended March

31, 2017 decreased $311,000, or 4%, over the comparable quarter of

the prior fiscal year due primarily to lower durable medical

equipment and retail pharmacy revenues, partially offset by

increased institutional pharmacy revenues.

SunLink had an operating loss for the quarter ended March 31,

2017 of $771,000, compared to an operating loss for the quarter

ended March 31, 2016 of $1,187,000. The decreased operating loss in

the quarter ended March 31, 2017 compared to the same quarter last

year was due primarily to the closure of an unprofitable hospital

in the prior fiscal year.

The loss from discontinued operations was $135,000 ($0.01 per

fully diluted share) for the quarter ended March 31, 2017 compared

to a loss from discontinued operations of $443,000 (a loss of $0.05

per fully diluted share) for the quarter ended March 31, 2016. The

loss from discontinued operations for the current year results

primarily from a negative settlement of a prior year’s Medicare

cost report at a previously sold hospital and insurance expense for

retained liabilities at sold hospitals.

For the nine months ended March 31, 2017, SunLink reported

earnings from continuing operations of $809,000 or $0.09 per fully

diluted share, compared to a loss from continuing operations of

$11,091,000 or a loss of $1.17 per fully diluted share, for the

comparable period of the prior fiscal year. For the nine months

ended March 31, 2017, SunLink reported net earnings of $5,096,000,

or $0.54 per fully diluted share compared to a net loss of

$12,849,000, or a loss of $1.36 per fully diluted share for the

nine months ended March 31, 2016. Earnings from discontinued

operations were $4,287,000 ($0.45 per fully diluted share) for the

nine months ended March 31, 2017 compared to a loss from

discontinued operations of $1,758,000 (a loss of $0.19 per fully

diluted share) for the nine months ended March 31, 2016. The loss

from continuing operations for the nine months ended March 31, 2016

included a non-cash charge of $7,101,000 to fully reserve the

company’s deferred income tax assets. The earnings from

discontinued operations for the first nine months of the current

fiscal year resulted from a pre-tax gain of $7,270,000 on the

August 2016 sale of a hospital.

Consolidated net revenues from continuing operations for the

nine months ended March 31, 2017 and 2016 were $41,000,000 and

$49,373,000, respectively, a decrease of 17% in the current fiscal

year. Healthcare Facilities Segment net revenues in the nine months

ended March 31, 2017 of $16,289,000 decreased $7,860,000 in the

current fiscal year’s nine months primarily from the closure of one

hospital in June 2016. The Specialty Pharmacy Segment revenues of

$23,946,000 in the nine months ended March 31, 2017 decreased

$698,000, or 3%, over the comparable nine months of the prior

fiscal year due primarily to lower durable medical equipment and

retail pharmacy revenues.

SunLink had an operating loss for the nine months ended March

31, 2017 of $1,696,000, compared to an operating loss for the nine

months ended March 31, 2016 of $3,615,000. Positive adjustments for

Medicare cost report adjustments of $385,000 this year compared to

negative adjustments of $662,000 last year contributed to the

reduction of the operating loss for the current year nine months

results compared to the same period last year.

SunLink Health Systems, Inc. is the parent company of

subsidiaries that own and operate healthcare businesses in the

Southeast. Each of the Company’s healthcare businesses is operated

locally with a strategy of linking patients’ needs with dedicated

physicians and healthcare professionals. For additional information

on SunLink Health Systems, Inc., please visit the Company’s

website.

This press release contains certain forward-looking statements

within the meaning of the Private Securities Litigation Reform Act

of 1995 including, without limitation, statements regarding the

company’s business strategy. These forward-looking statements are

subject to certain risks, uncertainties and other factors, which

could cause actual results, performance and achievements to differ

materially from those anticipated. Certain of those risks,

uncertainties and other factors are disclosed in more detail in the

company’s Annual Report on Form 10-K for the year ended June 30,

2016 and other filings with the Securities and Exchange Commission

which can be located at www.sec.gov.

Adjusted earnings before income taxes,

interest, depreciation and amortization

Earnings before income taxes, interest, depreciation and

amortization (“EBITDA”) represent the sum of income before income

taxes, interest, depreciation and amortization. We understand that

certain industry analysts and investors generally consider EBITDA

to be one measure of the liquidity of the company, and it is

presented to assist analysts and investors in analyzing the ability

of the company to generate cash, service debt and to satisfy

capital requirements. We believe increased EBITDA is an indicator

of improved ability to service existing debt and to satisfy capital

requirements. EBITDA, however, is not a measure of financial

performance under accounting principles generally accepted in the

United States of America and should not be considered an

alternative to net income as a measure of operating performance or

to cash liquidity. Because EBITDA is not a measure determined in

accordance with accounting principles generally accepted in the

United States of America and is thus susceptible to varying

calculations, EBITDA, as presented, may not be comparable to other

similarly titled measures of other corporations. Net cash used in

operations for the nine months ended March 31, 2017 and 2016,

respectively, is shown below. Healthcare Facilities Adjusted EBITDA

and Specialty Pharmacy Adjusted EBITDA is the EBITDA for those

facilities without any allocation of corporate overhead, impairment

charges and gains on sale of businesses.

Nine Months Ended March 31,

2017 2016

Healthcare Facilities Adjusted EBITDA

$ 940,000 $ (1,589,000 ) Specialty Pharmacy Adjusted EBITDA 299,000

882,000 Corporate overhead costs (1,559,000 ) (1,552,000 ) Taxes

and interest expense (271,000 ) (7,488,000 )

Other non-cash expenses and net change in

operating assets and liabilities

(4,408,000 ) 9,456,000 Net cash used in

operations $ (4,999,000 ) $ (291,000 )

SUNLINK HEALTH SYSTEMS, INC.

ANNOUNCES FISCAL 2017 THIRD QUARTER RESULTS Amounts

in 000's, except per share and volume amounts

CONSOLIDATED STATEMENTS OF

EARNINGS

Three Months Ended March 31, 2017 Nine Months

Ended March 31, 2017 2016

2017 2016 % of Net % of

Net % of Net % of Net Amount

Revenues Amount Revenues

Amount Revenues Amount

Revenues Operating revenues (net of contractual

allowances) $ 13,883 101.3 % $ 16,418 101.3 % $ 41,321 100.8 % $

50,834 103.0 % Less provision for bad debts of Healthcare

Facilities Segment 184 1.3 % 213

1.3 % 321 0.8 % 1,461 3.0 % Net

Revenues 13,699 100.0 % 16,205 100.0 % 41,000 100.0 % 49,373 100.0

% Costs and Expenses: Cost of goods sold 5,523 40.3 % 5,614 34.6 %

15,592 38.0 % 15,582 31.6 % Salaries, wages and benefits 5,872 42.9

% 7,675 47.4 % 17,476 42.6 % 23,918 48.4 % Provision for bad debts

of Specialty Pharmacy Segment 126 0.9 % 69 0.4 % 342 0.8 % 429 0.9

% Supplies 455 3.3 % 647 4.0 % 1,373 3.3 % 2,486 5.0 % Purchased

services 692 5.1 % 761 4.7 % 2,113 5.2 % 2,510 5.1 % Other

operating expenses 1,194 8.7 % 1,958 12.1 % 4,015 9.8 % 6,125 12.4

% Rents and leases 142 1.0 % 191 1.2 % 409 1.0 % 582 1.2 %

Depreciation and amortization 466 3.4 %

477 2.9 % 1,376 3.4 % 1,356 2.7

% Operating Loss (771 ) -5.6 % (1,187 ) -7.3 % (1,696 ) -4.1 %

(3,615 ) -7.3 % Interest Expense - net (129 ) -0.9 % (211 )

-1.3 % (507 ) -1.2 % (637 ) -1.3 % Loss on extinguishment of debt,

net - 0.0 % - 0.0 % (243 ) -0.6 % - 0.0 % Gain on sale of assets

2 0.0 % 5 0.0 % 3,019

7.4 % 12 0.0 %

Earnings (Loss) from Continuing Operations

before Income Taxes

(898 ) -6.6 % (1,393 ) -8.6 % 573 1.4 % (4,240 ) -8.6 % Income Tax

Expense (Benefit) (8 ) -0.1 % (1 ) 0.0 %

(236 ) -0.6 % 6,851 13.9 % Earnings (Loss)

from Continuing Operations (890 ) -6.5 % (1,392 ) -8.6 % 809 2.0 %

(11,091 ) -22.5 % Earnings (Loss) from Discontinued Operations, net

of tax (135 ) -1.0 % (443 ) -2.7 %

4,287 10.5 % (1,758 ) -3.6 % Net Earnings (Loss) $

(1,025 ) -7.5 % $ (1,835 ) -11.3 % $ 5,096 12.4 % $

(12,849 ) -26.0 %

Earnings (Loss) Per Share from Continuing

Operations:

Basic $ (0.10 ) $ (0.15 ) $ 0.09 $ (1.17 ) Diluted $ (0.10 )

$ (0.15 ) $ 0.09 $ (1.17 ) Earnings (Loss) Per Share from

Discontinued Operations: Basic $ (0.01 ) $ (0.05 ) $ 0.46 $

(0.19 ) Diluted $ (0.01 ) $ (0.05 ) $ 0.45 $ (0.19 ) Net

Earnings (Loss) Per Share: Basic $ (0.11 ) $ (0.19 ) $ 0.54

$ (1.36 ) Diluted $ (0.11 ) $ (0.19 ) $ 0.54 $ (1.36 )

Weighted Average Common Shares Outstanding: Basic 9,334

9,443 9,408 9,443

Diluted 9,334 9,443 9,429

9,443

HEALTHCARE FACILITIES VOLUME

STATISTICS Admissions 154 156 400 679 Nursing Home

Patient Days 13,428 14,099 41,989 43,091

SUMMARY BALANCE

SHEETS March 31, June 30, 2017

2017 ASSETS Cash and Cash Equivalents $

11,237 $ 3,261 Accounts Receivable - net 6,300 6,166 Other Current

Assets 5,955 8,465 Property Plant and Equipment, net 10,683 12,994

Long-term Assets 3,958 13,219 $ 38,133

$ 44,105 LIABILITIES AND SHAREHOLDERS' EQUITY Current

Liabilities $ 6,640 $ 20,051 Long-term Debt and Other Noncurrent

Liabilities 7,489 4,565 Shareholders' Equity 24,004

19,489 $ 38,133 $ 44,105

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170511006472/en/

SunLink Health Systems, Inc.Robert M. Thornton, Jr.,

770-933-7004Chief Executive Officer

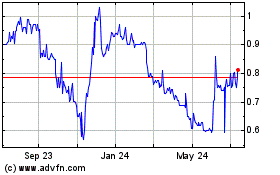

Sunlink Health Systems (AMEX:SSY)

Historical Stock Chart

From Mar 2024 to Apr 2024

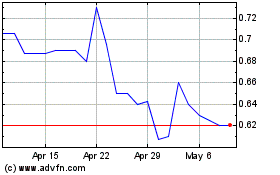

Sunlink Health Systems (AMEX:SSY)

Historical Stock Chart

From Apr 2023 to Apr 2024