By Paul Page

Sign up:With one click, get this newsletter delivered to your

inbox.

E-commerce growth is proving expensive for United Parcel Service

Inc. The delivery giant saw strong gains in domestic package volume

in the first quarter, but the WSJ's Paul Ziobro and Joshua Jamerson

report that costs are also racing upward as the deliveries grow

more expensive to complete and the company builds infrastructure to

match changing consumer buying patterns. UPS says shipments to

homes, a proxy for e-commerce deliveries, rose about 7% in the

first quarter, ahead of the 2.6% volume increase in its U.S. parcel

business. Those home deliveries are tougher to serve than the more

concentrated and economical business-to-business deliveries. UPS is

also building two regional hubs that will rely heavily on

automation, taking some of the labor cost out of its distribution

channels. It's not all about cost: UPS saw operating profit at its

supply chain and freight division jump nearly 22%, partly from the

need driven by e-commerce for companies to store more goods closer

to where shoppers live.

DryShips Inc., like other commodities businesses, has been on a

business roller-coaster. But the ride has worked out very well for

the bulk carrier's chairman and chief executive. George Economou

has come out of a dizzying series of twists and turns in the

company's shares with tighter control of the business, the WSJ's

Spencer Jakab writes in a Heard on the Street column, and backing

for new vessel purchases amid a series of maneuvers that could earn

Mr. Economou tens of millions of dollars in profits. There are no

accusations of any wrongdoing and no evidence the company or its

CEO engineered a one-week stock rally that briefly pushed its

shares up 1,500% last November for no apparent reason. But the

ability of DryShips to reap ongoing gains from the runup, both for

the carrier and Mr. Economou, highlight how the complicated

structures of vessel ownership and management may be more important

to bulk carriers than the movement of supply and demand in

commodity shipping markets.

British regulators are stepping into an increasingly heated

furor over payments in the supply chain. New compliance rules will

require U.K.-registered firms to provide detailed information on

how they pay their suppliers, the WSJ's Nina Trentmann and Mara

Lemos Stein report. It's an attempt to settle the growing battles

between the U.K.'s biggest companies and the smaller suppliers that

depend on the business, and timely payments, for their survival.

The government says nearly half of the country's 5.5 million small-

and medium-sized companies receive payments late, with some $33.9

billion owed to them at the end of 2016. The new rules require that

companies disclose their payment terms and how well they've met the

terms, providing warning signals to regulators as well as

suppliers. There's some urgency to resolve the issue before the

U.K. leaves the European Union since a Brexit-induced slowdown

could leave even more companies looking to delay payments.

SUPPLY CHAIN STRATEGIES

Airbus SE's supply chain is still stuck in a low gear. The

European plane maker is facing another year of scrambling to meet

full-year delivery targets, the WSJ's Robert Wall reports, after

falling behind in the first three months because of problems with a

key engine supplier. The disconnect between Airbus and engine maker

Pratt & Whitney, a unit of United Technologies Corp., has been

troubling Airbus as it tries to ramp up production to meet soaring

demand for new jets. The aerospace industry's intricate supply

chains involving sophisticated components are having a hard time

keeping up with the production promises, however. Airbus plans to

build 200 of its A320neo jets with Pratt engines this year but

delivered only 26 in the first quarter. With many millions of

dollars at stake based on the delivery schedule, the pressure on

production will only grow as the year goes on.

Creditors are pushing a bankruptcy court to resolve the

long-running bankruptcy of National Air Cargo Inc. Led by aircraft

lessor Global BTG LLC, the creditors are asking a court to oust

National chief Christopher Alf, who founded the business and led it

through its tumultuous rise as a big military contract flier and

through a bankruptcy that's lasted nearly three years. The WSJ's

Katy Stech reports creditors said in a sharply-worded filing with a

bankruptcy court that debt-payment negotiations have broken down

and the company is "hemorrhaging cash" with no moves to end the

impasse. National has been hurt by the steady withdrawal of U.S.

military personnel from the Middle East, but Global BTG says there

are deeper problems with the company's management. A judge will

hear the arguments in court next month, potentially bringing

National's saga closer to conclusion.

QUOTABLE

IN OTHER NEWS

Amazon.com Inc. posted a 41% rise in first-quarter profit, as

growth in shipping costs outpaced sales expansion. (WSJ)

National Air Cargo Inc.'s creditors are asking a court to oust

the operator's founder and leader to end National's long-running

bankruptcy case. (WSJ)

France's economic growth slowed to 0.3% in the first quarter.

(WSJ)

Growth in U.S. durable goods orders slowed in March on declining

demand for motor vehicles and parts. (WSJ)

First-time unemployment claims in the U.S. jumped by 14,000 in

the past week. (WSJ)

Mexico's exports rose 14.1% from a year in March while imports

grew 15%. (WSJ)

Australia's government will restrict natural-gas exports in an

attempt to avert a looming domestic gas shortage. (WSJ)

Brazilian mining giant Vale SA reported its biggest net profit

in three years as rising iron ore prices offset higher shipping

costs. (WSJ)

Ford Motor Co.'s first-quarter net income fell 35% on higher

costs and weaker sales in the U.S. (WSJ)

Kia Motors Corp. will build a $1.1 billion factory in India with

capacity to build 300,000 vehicles a year. (WSJ)

Under Armour Inc. posted its first quarterly loss as a public

company, amid cooling demand for its sneakers and athletic apparel.

(WSJ)

American Airlines wants to raise pay for pilots and flight

attendants next month to keep pace with its rivals. (WSJ)

Hong Kong's Li & Fung Ltd. faces a crucial period in its

attempt to restructure its supply chain for a digital era. (Nikkei

Asian Review)

Fashion retailer Kit and Ace is closing all its stores outside

Canada and moving its international sales entirely online.

(Business in Vancouver)

Union Pacific Railroad Corp.'s net profit grew 9% in the first

quarter on strong pricing and 25% more coal shipments. (Associated

Press)

South Korea's Daewoo Shipbuilding & Marine Engineering Co.

booked a $230 million first-quarter profit after two years of heavy

losses. (Yonhap)

Hyundai Merchant Marine Co. faces sharply higher costs since

selling its stake in a Korean container terminal to the Port of

Singapore Authority. (Business Korea)

Old Dominion Freight Line Inc. expanded its first-quarter profit

9.1% to $65.8 million on solid growth in demand and

less-than-truckload pricing. (Winston-Salem Journal)

C.H. Robinson Worldwide Inc.'s first-quarter net profit rose

2.6% to $122.1 million on a 13% boost in shipping volume.

(Minneapolis Star-Tribune)

Freight broker Echo Global Logistics fell to a $2.9 million loss

as rising transport costs offset a 2.6% gain in gross revenue.

(Associated Press)

Truck maker Paccar Inc. swung to a $310.3 million first-quarter

profit on a 40% gain in truck orders. (Commercial Carrier

Journal)

Mediterranean Shipping Co. believes misdeclared hazardous cargo

caused a fire that damaged one of its ships this month. (Splash

24/7)

Ace Hardware will place a 1.1 million-square-foot distribution

center for the northeast U.S. in Bethel Township, Pa. (WFMZ)

The research unit of International Business Machines Inc. won a

patent for the passing of package from one drone to another in

flight. (Mashable)

ABOUT US

Paul Page is deputy editor of WSJ Logistics Report. Follow him

at @PaulPage, and follow the entire WSJ Logistics Report team:

@brianjbaskin, @jensmithWSJ and @EEPhillips_WSJ and follow the WSJ

Logistics Report on Twitter at @WSJLogistics.

Subscribe to this email newsletter by clicking here:

http://on.wsj.com/Logisticsnewsletter .

Write to Paul Page at paul.page@wsj.com

(END) Dow Jones Newswires

April 28, 2017 06:41 ET (10:41 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

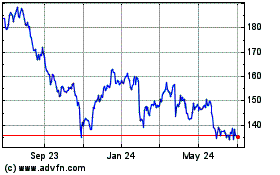

United Parcel Service (NYSE:UPS)

Historical Stock Chart

From Aug 2024 to Sep 2024

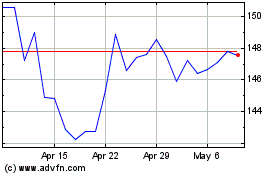

United Parcel Service (NYSE:UPS)

Historical Stock Chart

From Sep 2023 to Sep 2024