Report of Foreign Issuer (6-k)

April 20 2017 - 3:41PM

Edgar (US Regulatory)

Table of Contents

United States

Securities and Exchange Commission

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the

Securities Exchange Act of 1934

For the month of

April

April 2017

Vale S.A.

Avenida das Américas, No. 700 — Bloco 8, Sala 218

22640-100 Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

(Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

(Check One) Form 20-F

x

Form 40-F

o

(Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1))

(Check One) Yes

o

No

x

(Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7))

(Check One) Yes

o

No

x

(Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

(Check One) Yes

o

No

x

(If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b). 82- .)

Vale production in 1Q17

www.vale.com rio@vale.com App Vale Investors & Media iOS: https://itunes.apple.com/us/app/vale-investor-media-english/id1087126847?mt=8 Android: https://play.google.com/store/apps/details?id=com.theirapp.valeeg Tel.: (55 21) 3485-3900 Investor Relations André Figueiredo Carla Albano Miller Fernando Mascarenhas Andrea Gutman Bruno Siqueira Claudia Rodrigues Denise Caruncho Mariano Szachtman Renata Capanema Department This press release may include statements that present Vale’s expectations about future events or results. All statements, when based upon expectations about the future, involve various risks and uncertainties. Vale cannot guarantee that such statements will prove correct. These risks and uncertainties include factors related to the following: (a) the countries where we operate, especially Brazil and Canada; (b) the global economy; (c) the capital markets; (d) the mining and metals prices and their dependence on global industrial production, which is cyclical by nature; and (e) global competition in the markets in which Vale operates. To obtain further information on factors that may lead to results different from those forecast by Vale, please consult the reports Vale files with the U.S. Securities and Exchange Commission (SEC), the Brazilian Comissão de Valores Mobiliários (CVM), and the French Autorité des Marchés Financiers (AMF), and in particular the factors discussed under “Forward -Looking Statements” and “Risk Factors” in Va le’s annual report on Form 20-F. BM&F BOVESPA: VALE3, VALE5 NYSE: VALE, VALE.P EURONEXT PARIS: VALE3, VALE5 LATIBEX: XVALO, XVALP

Production highlights Rio de Janeiro, April 20, 2017 – Vale S.A. (Vale) reached a record for a first quarter of 86.2 Mt of iron ore production1 in the first quarter of 2017 (1Q17), 11.2% higher than in 1Q16 mainly due to the ramp-up of the S11D and Itabiritos projects in the Southeastern System. The Northern System, which comprises Carajás, Serra Leste and S11D, achieved a record for a first quarter of 36.0 Mt in 1Q17, 11.1% higher than in 1Q16 as a result of the S11D ramp-up, which is advancing according to plan. Blended volumes in Asia totaled 12.4 Mt in 1Q17, 10.3 Mt and 6.5 Mt higher than in 1Q15 and 1Q16, respectively, as a result of the ongoing strategy to bring more flexibility to the integrated supply chain by increasing offshore blending capacity, enabling rapid responses to changes in market conditions. The ongoing offshore blending activities require the build-up of offshore inventories and, as a result, temporarily leads to lower sales volumes when compared to shipment volumes from Brazil. Nickel production reached 71.4 kt in 1Q17, 14.0% and 2.9% lower than in 4Q16 and 1Q16, respectively, mainly due planned maintenance shutdowns at our operations in Indonesia and Japan, and operational challenges at our Thompson operations. Production of finished nickel products from VNC reached the record of 10,200 t in 1Q17, 14.7% higher than 4Q16 and 6.0% higher than 1Q16. Copper production was 109,000 t in 1Q17, 11.0% and 2.6% lower than in 4Q16 and 1Q16, respectively, mainly due to the lower production from Sudbury. Production of copper in concentrate at Salobo in 1Q17 totaled a record 42,600 t for a first quarter, 3.6% higher than in 1Q16. Coal production in Mozambique reached a quarterly record of 2.4 Mt in 1Q17, 170.4% and 53.7% higher than in 1Q16 and 4Q16, respectively, mainly as a result of the continued and strong ramp-up of the second Coal Handling and Preparation Plant (CHPP2). CHPP2 production grew by 86% in 1Q17 compared to 4Q16. 1 Including iron ore acquired from third parties. 3

Production summary 12,422 12,620 -1.6% 8.2% Pellets 11,478 Coal (Mozambique) 2,434 1,585 900 53.7% 170.4% 109.0 122.5 -11.0% -2.6% Copper2 111.9 105 137 118 -23.4% -11.0% Gold (000' oz troy) ¹ Including third party purchases. ² Including Lubambe’s attributable production. 4 Cobalt 1.259 1.600 1.400-21.3%-10.1% Nickel 71.4 83.0 73.5-14.0% -2.9% Manganese Ore 544 580 596 -6.1% -8.7% % change 000’ metric tons 1Q17 4Q16 1Q16 1Q17/4Q16 1Q17/1Q16 Iron ore 186,198 92,386 77,544 -6.7% 11.2%

Iron Ore Southeastern System 28,165 27,785 22,544 1.4% 24.9% Minas Centrais 10,337 10,516 9,987 -1.7% 3.5% Mariana 9,007 8,696 5,054 3.6% 78.5% Southern System -8.2% -2.4% 21,504 23,430 22,033 Paraopeba 6,104 6,789 5,630 -10.1% 8.4% Vargem Grande -3.7% -11.7% 6,466 6,716 7,323 Minas Itabirito 8,934 9,925 9,080 -10.0% -1.6% Midwestern System -3.8% -4.6% 555 577 582 Corumbá - - 329 n.m. n.m. Urucum -3.8% 119.1% 555 577 253 ¹ Including third party purchases. Production summary Vale’s iron ore production reached a record for a first quarter of 86.2 Mt in 1Q17, 8.6 Mt higher than in 1Q16 mainly due to the ramp-up of the S11D and Itabiritos projects in the Southeastern System. Production was 6.2 Mt lower than in 4Q16 due to usual weather-related seasonality in the first quarter of the year, which affected mainly the performance of the Northern System. The production guidance for 2017 remains within the 360-380 Mt range as previously announced and from the end of 2018 onwards Vale will most likely achieve the long-term base case target of 400 Mt, as per Vale’s presentation at the December 2016 “Vale Day”. Vale’s Global Recovery (GR)2 increased from 44% in 1Q15 to 49% in 1Q16 and to 51% in 1Q17, as a result of the continuing increase in operational productivity over the past few years. 2 Measured by output of final production divided by the total ton nages extracted (ROM and waste). 5 IRON ORE 186,198 92,386 77,544 -6.7% 11.2% Itabira 8,821 8,573 7,512 2.9% 17.4% % change 000’ metric tons 1Q17 4Q16 1Q16 1Q17/4Q16 1Q17/1Q16 Northern System 35,974 40,594 32,385 -11.4% 11.1%

Iron ore and pellets shipments from Brazil and Argentina totaled 77.7 Mt in 1Q17, 12.0 Mt and 6.1 Mt higher than in 1Q15 and 1Q16, respectively, mainly due to higher production in the Northern and Southeastern Systems. Blended volumes in Asia totaled 12.4 Mt in 1Q17, 10.3 Mt and 6.5 Mt higher than in 1Q15 and 1Q16, respectively, as a result of the ongoing strategy to bring more flexibility to the integrated supply chain by increasing offshore blending capacity, enabling rapid responses to changes in market conditions. The share of offshore inventories over total inventories increased from 15% in 2015 and 2016 to 23% in 1Q17, reflecting the ongoing strategy to shift inventories downstream along the supply chain. By the end of 2017, we expect to have 30% of our total inventories offshore. The ongoing offshore blending activities require the build-up of offshore inventories and, as a result, temporarily leads to lower sales volumes when compared to shipment volumes from Brazil. The average Fe content was 63.9% in 1Q17, remaining in line with the average grade achieved in 4Q16. Northern System The Northern System, which comprises Carajás, Serra Leste and S11D, achieved a record for a first quarter of 36.0 Mt in 1Q17, 11.1% higher than in 1Q16 as a result of the S11D ramp-up, which is advancing according to plan. Production was 11.4% lower than in 4Q16 due to the usual weather-related seasonality in 1Q17. Southeastern System The Southeastern System, which encompasses the Itabira, Minas Centrais and Mariana mining hubs, produced 28.2 Mt in 1Q17, 0.4 Mt higher than in 4Q16 due to the better operational performance of the dry beneficiation process in Alegria and the higher production in Conceição Itabiritos II, as its ramp-up was concluded in 1Q17. Production in 1Q17 was 5.6 Mt higher than 6

in 1Q16 due to the start-up of a crushing facility at the Fazendão mine and the other above-mentioned positive events from 4Q16 vs. 1Q17. Southern System The Southern System, which encompasses the Paraopeba, Vargem Grande and Minas Itabirito mining hubs, produced 21.5 Mt in 1Q17, 8.2% lower than in 4Q16 mainly due to stoppages in the Minas Itabirito complex to allow for the shift in beneficiation from wet to dry processing. Production was 2.4% lower than in 1Q16 due to quality of ROM being mined at current mine faces in the Vargem Grande mining hub. Midwestern System The Midwestern System, which encompasses the Urucum and the Corumbá mines, produced 0.6 Mt in 1Q17, remaining in line with 4Q16 and 1Q16, as a result of Vale’s continuing strategy to optimize margins. 7

Pellets Southeastern System 7,514 7,616 7,221 -1.3% 4.1% Hispanobras (Tubarão 4) 1,128 1,104 1,128 2.2% 0.0% Kobrasco (Tubarão 7) 1,171 1,150 1,088 1.8% 7.6% Southern System 2,545 2,551 2,330 -0.2% 9.2% Vargem Grande 1,626 1,570 1,469 3.6% 10.7% Production overview Vale’s pellet production totaled 12.4 Mt in 1Q17, 1.6% lower than in 4Q16 due to scheduled maintenance stoppages in Tubarão 8 and Oman, and 4.1% higher than in 1Q16 mainly as a result of productivity gains in both systems in Brazil, and the 30-day maintenance stoppage in the Oman plant in January of 2016. Vale is executing its project to re-start the São Luis pellet plant with its start-up envisioned for the first half of 2018 after the renewal of its operational license, the revamp of the plant and the upgrade of its automation system. Southeastern system The Tubarão pellet plants – Tubarão 3, 4, 5, 6, 7 and 8 – reached a production of 7.5 Mt in 1Q17, in line with 4Q16, and 4.1% higher than in 1Q16 mainly due to the better operational performance in plants 3 to 7. Southern system The Fábrica pellet plant achieved a production level of 0.9 Mt in 1Q17, in line with 4Q16 and 1Q16. 8 Oman2,3642,4531,927-3.7%22.6% TOTAL PELLETS12,42212,62011,478-1.6%8.2% Fábrica0,9190,9810,861-6.4%6.7% Tubarão 81,6831,8511,746-9.1%-3.6% Nibrasco (Tubarão 5 and 6)2,4012,3782,1591.0%11.2% Itabrasco (Tubarão 3)1,1301,1331,100-0.2%2.8% % change 000’ metric tons1Q174Q161Q161Q17/4Q161Q17/1Q16

The Vargem Grande pellet plant reached 1.6 Mt of production in 1Q17, in line with 4Q16, and 10.7% higher than in 1Q16, as a result of higher availability of pellet feed and better operational performance at the plant. Oman operations The Oman pellet plant reached 2.4 Mt in 1Q17, 3.7% lower than in 4Q16 due to 10-day scheduled maintenance stoppages in the plant in 1Q17 and 22.6% higher than in 1Q16 due to higher productivity and the 30-day maintenance stoppage that occurred in January 2016. 9

Manganese ore and ferroalloys Azul 367 391 434 -6.1% -15.4% Morro da Mina 14 22 - -36.6% n.m. Production overview Manganese ore production totaled 544,000 t in 1Q17, 6.2% and 8.7% lower than in 4Q16 and 1Q16, respectively. Ferroalloy production reached 36,000 t in 1Q17, 2.8% and 44.0% higher than in 4Q16 and 1Q16, respectively. Manganese ore production Production at the Azul manganese mine totaled 367,000 t in 1Q17, 6.1% and 15.4% lower than in 4Q16 and 1Q16, respectively, mainly due to the lower availability of high grade ore. Production at the Urucum mine totaled 163,000 t in 1Q17, in line with 4Q16 and 1Q16. Production at the Morro da Mina mine totaled 14,000 t in 1Q17, 36.6% lower than 4Q16 due to a scheduled stoppage in the mine, which began at the end of February and is scheduled to go on until May. The purpose of the stoppage is to adequate the mine to increase the manganese grade and to clean the bottom of the pit. Ferroalloy production Ferroalloy production in 1Q17 totaled 36,000 t, 44.0% higher than in 1Q16, mainly due to the resumption of the operations at the Barbacena unit in February 2016. Production was composed by 15.000 t of ferrosilicon manganese alloys (FeSiMn), 15.000 t of high-carbon manganese alloys (FeMnHC) and 6.000 t of medium-carbon manganese alloys (FeMnMC). 10 FERROALLOYS (Brazil)3635252.8%44.0% Urucum163167162-2.4%1.0% % change 000’ metric tons1Q174Q161Q161Q17/4Q161Q17/1Q16 MANGANESE ORE544580596-6.2%-8.7%

Lucas Pupo / Agência Vale Nickel Finished production by source Canada 36.1 43.4 36.6 -16.8% -1.4% Thompson 4.8 7.2 6.2 -33.3% -22.6% Indonesia 16.3 21.8 17.8 -25.2% -8.4% Brazil 6.1 5.6 5.6 8.9% 8.9% 1 Production at V NC reached 8,7 00 t in 1Q17, while production of finished nickel from V NC totaled 1 0,20 0 t in 1Q1 7; the differences stem from the required processing time into finished nickel. 2 External feed purchased from third parties and processed into finished nickel in our Canadian an d Asian operations. Production overview Production of nickel reached 71,400 t in 1Q17, 14.0% lower than in 4Q16 and 2.9% lower than in 1Q16, mainly due to planned maintenance shutdowns in Indonesia and Japan and operational challenges at our Thompson operations. Canadian operations Production from the Sudbury mines reached 17,900 t in 1Q17, 10.1% lower than in 4Q16 and 8.2% lower than in 1Q16. Sudbury source production was adversely impacted in 1Q17 mainly due to inventory drawdown during the 4Q16 and 1Q16 periods. Sudbury took furnace #2 off-line mid-March for a three-month long rebuild and expansion in its’ capacity as this will be the furnace in operation when Sudbury officially transitions to a single furnace in 4Q17. In 2Q17 Sudbury will have its three-week long surface plant wide scheduled maintenance shutdown, which occurs every 18 months. . 11 Feed from third parties 22.73.33.9 -18.2% -30.8% TOTAL NICKEL 71.483.073.5-14.0%-2.9% New Caledonia 110.28.99.714.6%5.2% Voisey's Bay13.516.310.9-17.2%23.9% Sudbury17.919.919.5-10.1%-8.2% % change 000’ metric tons 1Q174Q161Q161Q17/4Q161Q17/1Q16

Timeline of the transition to a single furnace operation in Sudbury In 1Q17, the Clydach refinery continued to consume feed from the Sudbury smelter above normal levels, contributing to the overall performance of the North Atlantic operations. Production from the Thompson mines reached 4,800 t in 1Q17, 34.3% lower than in 4Q16 and 23.6% lower than in 1Q16, output in 1Q17 was impacted by: (i) the planned 1Q17 transition to a single furnace operation; and (ii), certain operational issues, including deleterious elements in the smelter feed and a hot metal leak in the smelter that resulted in approximately ten days of production loss. The operational issues encountered were unrelated to the transition to the single furnace. Production from the Voisey’s Bay source reached 13,500 t in 1Q17, 17.0% lower than in 4Q16 and 23.4% higher than in 1Q16. Production decreased relative to 4Q16 mainly due to reduced consumption of Voisey’s Bay source concentrate in Thompson due to the single furnace operation and certain operational issues. The production increase over 1Q16 was due to the higher consumption rates at Sudbury and the continued successful ramp-up of the Long Harbour refinery. Production at the Long Harbour processing plant reached 4,100 t in 1Q17, 21.2% lower than in 4Q16 due to the start-up of additional processing circuits in January after a two-week shutdown to complete the necessary tie-ins. These new circuits successfully started up and both cobalt and copper metal were produced for the first time. A monthly production record for nickel was achieved in March. During 1Q17, the operating throughput increased to almost 65% of its nominal capacity. Indonesian operation (PTVI) PTVI nickel in matte production reached 17,200 t in 1Q17, 12% lower than in 4Q16 and 2.0% higher than in 1Q16. Compared to 4Q16, the weaker nickel in matte production was due to the adverse impact of a planned maintenance works in its kilns and furnaces. 12

Production of finished nickel from PTVI reached 16,300 t in 1Q17, 25.4% lower than in 4Q16 and 8.6% lower than in 1Q16. Production in 1Q17 of finished nickel was negatively impacted by the scheduled annual maintenance shutdown at the Matsusaka refinery in Japan. New Caledonia operation (VNC) Production of finished products from VNC reached a record of 10,200 t in 1Q17, 14.7% higher than in 4Q16 and 6.0% higher than in 1Q16. Production of NiO and NHC at VNC was 8,700 t in 1Q17. Site production was 6.5% lower than in 4Q16 and 4.0% lower than in 1Q16. Production was negatively impacted by decreased autoclave availability and unscheduled electrical power outages. NiO represented 81% and NHC 19% of VNC’s 1Q17 site production. Brazilian operation (Onça Puma) Production from the Onça Puma operation reached 6,100 t in 1Q17, 8.9% and 10.6% higher than in 4Q16 and in 1Q16, respectively. Onça Puma’s strong production rates were achieved through improved asset utilization and productivity. 13

Marcelo Coelho / Agência Vale Copper Finished production by source 10.7% 11.7% 24.9 22.5 22.3 Sossego -17.7% -14.2% Sudbury 26.5 32.2 30.9 -17.3% 16.7% Voisey's Bay 9.1 11.0 7.8 1.8 2.0 -16.7% -25.0% Lubambe1 1.5 1 Attributable production. Production overview Copper production3 reached 107,400 t in 1Q17, being 11.0% and 2.3% lower than in 4Q16 and 1Q16, respectively. The decrease was mainly due to lower production in Sudbury as a result of lower production from the copper rich mines and some unscheduled maintenance in the mines. Brazilian operations Production of copper in concentrate at Sossego totaled 24,900 t in 1Q17, 10.7% and 11.7% higher than in 4Q16 and 1Q16, respectively, due to strong asset performance with high concentrator utilization and productivity along with higher feed grades in 1Q17 compared to previous quarters. 3 Excluding Lubambe attributable production. 14 TOTAL COPPER 109.0122.5111.9-11.0%-2.6% Feed from third parties 4.14.87.1-14.6%-42.3% TOTAL EX-LUBAMBE 107.4120.7109.9-11.0%-2.3% Thompson 0.30.40.6-25.0%-50.0% Salobo 42.649.841.1-14.5%3.6% CANADA 39.948.446.5-17.6%-14.2% % change 000’ metric tons 1Q174Q161Q161Q17/4Q161Q17/1Q16 BRAZIL67.572.363.4-6.6%6.5%

Production of copper in concentrate at Salobo reached 42,600 t in 1Q17, 14.5% lower than in 4Q16 and 3.6% higher than in 1Q16. Production was negatively impacted by conveyor belt and plant repairs in February, as well as by lower grades when compared to 4Q16. Canadian operations Production of copper from the Sudbury mines reached 26,500 t in 1Q17, 17.7% and 14.2% lower than in 4Q16 and 1Q16, respectively. During 1Q17 the copper production in Sudbury was adversely impacted as a result of lower production from the copper rich mines. . Production of copper from Voisey’s Bay reached 9,100 t in 1Q17, 17.3% lower than in 4Q16 and 16.7% higher than in 1Q16. Copper production is in line with the expected seasonal fluctuations due to the severe winter conditions and logistical constraints. Voisey’s Bay continues to run at planned rates. African operation (Lubambe) Lubambe delivered 3,800 t of copper in concentrate on a 100% basis (attributable production of 1,500 t). 15

Olli Geibel / AFP / Agência Vale Nickel and copper Finished production by source by-products Sudbury 215 286 173 -24.8% 24.3% Voisey’s Bay 211 320 145 -34.1% 45.5% Others 17 23 50 -26.1% -66.0% Sudbury 36 27 46 33.3% -21.7% Sudbury 61 48 100 27.1% -39.0% Sudbury 403 621 516 -35.1% -21.9% Cobalt Cobalt production totaled 1,259 t in 1Q17, 21.3% and 10.1% lower than in 4Q16 and 1Q16, respectively, mainly driven by lower production from New Caledonia sources. Cobalt production from Sudbury was 215 t in 1Q17, 71 t lower than the 286 t in 4Q16 and 42 t higher than the 173 t in 1Q16. Production from Voisey’s Bay was 211 t in 1Q17, 109 t lower than the 320 t in 4Q16 and 66 t higher than the 145 t in 1Q16. Overall recovery of cobalt will increase upon the commissioning of all production circuits at Long Harbour. Platinum and palladium Platinum production was 36,000 oz and palladium production was 61,000 oz, 33.3% and 27.1% higher than in 4Q16, respectively. 16 GOLD BY-PRODUCT (000' oz troy)105137118-23.4%-11.0% SILVER BY-PRODUCT (000' oz troy)403621516-35.1%-21.9% PALLADIUM (000' oz troy)614810027.1%-39.0% PLATINUM (000' oz troy)36274633.3%-21.7% VNC678814849-16.7%-20.1% Thompson138156182-11.5%-24.2% % change 1Q174Q161Q161Q17/4Q161Q17/1Q16 COBALT (metric tons)1,2591,6001,400-21.3%-10.1%

Gold as a by-product of nickel and copper concentrates The contained volume of gold as a by-product in the nickel and copper concentrates reached 105,000 oz in 1Q17, 23.4% lower than in 4Q16 and 11.0% lower than in 1Q16. 17

Coal Metallurgical coal 1,632 1,006 603 62.2% 170.6% Metallurgical coal - 139 763 - - Production overview Coal production reached a quarterly production of 2.4 Mt in 1Q17, despite the divestment of the Carborough Downs operations in November 2016. The good performance was due to a record production from the Moatize operation. Total coal production was 41.3% and 46.4% higher than in 4Q16 and 1Q16, respectively, despite a 139 kt and 763 kt production of coal from Australian mines reported in each of those quarters. Mozambique operations Production at Moatize was 2.4 Mt in 1Q17, a quarterly record production, as a result of successive production records in January (0.8 Mt) and March (0.9 Mt). Production increased for both metallurgical and thermal coal, due to the continued and strong ramp-up of the second Coal Handling and Preparation Plant (CHPP2). CHPP2 production grew by 86% in 1Q17 compared to 4Q16. Production of metallurgical coal was 1.6 Mt in 1Q17, 62.2% and 170.6% higher than in 4Q16 and 1Q16, respectively, and production of thermal coal was 802 kt, 38.8% and 170.0% higher compared to the same quarters. 18 TOTAL COAL 2,4341,7241,66341.3%46.4% Metallurgical coal 1,6321,1451,36642.5%19.5% Thermal coal 80257929738.8%170.0% Thermal coal80257929738.8%170.0% AUSTRALIA-139763--% change 000’ metric tons 1Q174Q161Q161Q17/4Q161Q17/1Q16 MOZAMBIQUE2,4341,58590053.7%170.4%

In 1Q17, our logistics operations in Mozambique reached all-time records, with railed volume4 achieving 2.7 Mt in 1Q17, 12.5% higher than the 2.4 Mt railed in 4Q16 and shipped volume6 reaching 2.6 Mt in 1Q17, 24% higher than the 2.1 Mt shipped in 4Q16. Australian operations Due to the divestment of the Carborough Downs operations in November 2016, no production was reported in 1Q17. 4 Includes Sena-Beira and Nacala logistics corridors. 19

Table of Contents

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

Vale S.A.

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

By:

|

/s/ André Figueiredo

|

|

Date: April 20, 2017

|

|

Director of Investor Relations

|

20

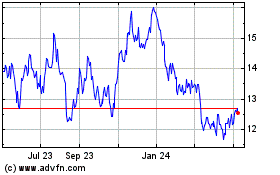

Vale (NYSE:VALE)

Historical Stock Chart

From Mar 2024 to Apr 2024

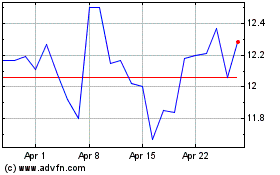

Vale (NYSE:VALE)

Historical Stock Chart

From Apr 2023 to Apr 2024