Prospectus Filed Pursuant to Rule 424(b)(3) (424b3)

April 18 2017 - 5:19PM

Edgar (US Regulatory)

Prospectus Supplement filed pursuant to Rule 424(b)(3)

in connection with Registration Statement No. 333-213489

Aytu BioScience, Inc.

Prospectus Supplement No. 2 dated April

18, 2017

(to Prospectus dated April 4, 2017)

1,076,596 shares of common stock

This Prospectus Supplement No. 1 updates,

amends, and supplements the information previously included in our prospectus dated April 4, 2017, which we refer to as our prospectus,

relating to the offer for sale or other disposition of an aggregate of 1,076,596 shares of common stock, $0.0001 par value per

share, of Aytu BioScience, Inc., issued and issuable to Lincoln Park Capital Fund, LLC, the selling shareholder named in the prospectus.

Material Information Reported in Current Report on Form 8-K

On April 18, 2017, we filed a Current Report

on Form 8-K to report the entry into employment agreements with each of Joshua R. Disbrow and Jarrett T. Disbrow. The material

portions of that Form 8-K are set forth below.

On April 14, 2017, we entered

into an employment agreement with each of Joshua R. Disbrow and Jarrett T. Disbrow, each effective April 16, 2017. The agreements

are identical, except for the positon that each executive is to occupy, and are identical to the two-year employment agreements

entered into effective April 16, 2015. Joshua Disbrow is currently our Chief Executive Officer and Jarrett Disbrow is currently

our Chief Operating Officer. Each will occupy the same position during the term of his respective agreement, and Joshua Disbrow

will also serve as our Chairman of the Board during the term of his agreement.

Each agreement is for a term of

24 months beginning on April 16, 2017, subject to termination by us with or without Cause (as defined below) or as a result of

the officer’s disability, or by the officer with or without Good Reason (as defined below). Each officer is entitled to receive

$250,000 in annual salary, plus a discretionary performance bonus with a target of 125% of his base salary, based on the officer’s

individual achievements and company performance objectives established by the board or the compensation committee in consultation

with the officer. Each officer is also eligible to participate in the benefit plans maintained by us from time to time, subject

to the terms and conditions of such plans.

We agreed to issue each officer

on or promptly after August 1, 2017 stock options to purchase shares of our common stock in an amount agreed upon by us and the

officer, but not less than the highest amount of options issued to any other employee of our company during the term. The exercise

price will be the last sale price of our common stock as reported during the period immediately preceding the date of grant, and

in accordance with our 2015 Stock Option and Incentive Plan, and will vest as follows: 50% will vest on the date of grant; 25%

will vest 365 days after the date of grant; and 25% will vest 730 days after the date of grant. All such options will vest in full

upon a Change in Control (as defined below), death, disability, or termination with or without Cause or for Good Reason.

In the event either officer’s

employment is terminated without Cause by us or either officer terminates his employment with Good Reason, we will be obligated

to pay him any accrued compensation and a lump sum payment equal to two times his base salary in effect at the date of termination,

as well as continued participation in our health and welfare plans for up to two years. All vested stock options will remain exercisable

from the date of termination until the expiration date of the applicable award. So long as a Change in Control is not in effect,

then all options which are unvested at the date of termination without Cause or for Good Reason shall be accelerated as of the

date of termination such that the number of option shares equal to 1/24

th

the number of option shares multiplied by

the number of full months of the officer’s employment will be deemed vested and immediately exercisable by the officer. Any

unvested options over and above the foregoing shall be cancelled and of no further force or effect, and will not be exercisable

by the officer.

“Good Reason” means,

without the officer’s written consent, there is:

|

|

·

|

a material reduction of the level of the officer’s compensation

(excluding any bonuses) (except where there is a general reduction applicable to the management team generally, provided, however,

that in no case may the base salary be reduced below $250,000);

|

|

|

·

|

a material reduction in the officer’s overall responsibilities

or authority, or scope of duties (it being understood that the occurrence of a Change in Control shall not, by itself, necessarily

constitute a reduction in the officer’s responsibilities or authority); or

|

|

|

·

|

a material change in the principal geographic location at which the

officer must perform his services (it being understood that the relocation to a facility or a location within 40 miles of the State

Capitol Building in Denver, Colorado will not be deemed material).

|

“Cause” means:

|

|

·

|

willful malfeasance or willful misconduct by the officer in connection

with his employment;

|

|

|

·

|

gross negligence in performing any of his duties;

|

|

|

·

|

conviction of, or entry of a plea of guilty to, or entry of a plea

of nolo contendere with respect to, any crime, other than a traffic violation which is a misdemeanor;

|

|

|

·

|

willful and deliberate violation of any of our policies;

|

|

|

·

|

unintended but material breach of any written policy applicable to

all employees adopted by us which is not cured to the reasonable satisfaction of the board within 30 days of notice;

|

|

|

·

|

unauthorized use or disclosure of any of our proprietary information

or trade secrets or that of any other party as to which the officer owes an obligation of nondisclosure as a result of the officer’s

relationship with us;

|

|

|

·

|

willful and deliberate breach of his obligations under the employment

agreement; or

|

|

|

·

|

any other material breach by officer of any of his obligations which

is not cured to the reasonable satisfaction of the board within 30 days of notice.

|

The severance benefits described

above are contingent on each officer executing a general release of claims.

In the event of a Change in Control,

all stock options, restricted stock and other stock-based grants granted or may be granted in the future by us to the officers

will immediately vest and become exercisable and all restrictions thereon will lapse.

“Change in Control”

means the occurrence of any of the following events:

|

|

·

|

the acquisition by any individual, entity, or group (within the meaning

of Section 13(d)(3) or 14(d)(2) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”)) (the “Acquiring

Person”), other than our company, or any of our subsidiaries, of beneficial ownership (within the meaning of Rule 13d-3 promulgated

under the Exchange Act) of 50% or more of the combined voting power or economic interests of our then outstanding voting securities

entitled to vote generally in the election of directors (excluding any issuance of securities by us in a transaction or series

of transactions made principally for bona fide equity financing purposes); or

|

|

|

·

|

the acquisition of our company by another entity by means of any transaction

or series of related transactions to which we are party (including, without limitation, any stock acquisition, reorganization,

merger or consolidation but excluding any issuance of securities by us in a transaction or series of transactions made principally

for bona fide equity financing purposes) other than a transaction or series of related transactions in which the holders of our

voting securities outstanding immediately prior to such transaction or series of related transactions retain, immediately after

such transaction or series of related transactions, as a result of shares in us held by such holders prior to such transaction

or series of related transactions, at least a majority of the total voting power represented by our outstanding voting securities

or such other surviving or resulting entity (or if we or such other surviving or resulting entity is a wholly-owned subsidiary

immediately following such acquisition, its parent); or

|

|

|

·

|

the sale or other disposition of all or substantially all of our assets

in one transaction or series of related transactions.

|

* * * * *

This Prospectus Supplement No. 2 is not

complete without, and may not be delivered or used except in connection with, our prospectus, including all amendments and supplements

thereto.

___________________________________________

Investing in our common stock involves

a high degree of risk. See “Risk Factors” beginning on page 8 of the original prospectus.

Neither the SEC nor any state securities

commission has approved or disapproved our securities or determined that this prospectus is truthful or complete. It is illegal

for anyone to tell you otherwise.

The date of this Prospectus Supplement No.

2 is April 18, 2017.

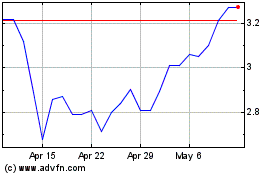

AYTU BioPharma (NASDAQ:AYTU)

Historical Stock Chart

From Mar 2024 to Apr 2024

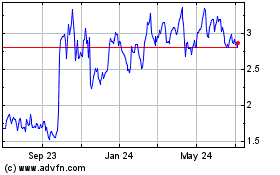

AYTU BioPharma (NASDAQ:AYTU)

Historical Stock Chart

From Apr 2023 to Apr 2024