By Paul Page

Sign up:With one click, get this newsletter delivered to your

inbox.

South Korea's Daewoo Shipbuilding & Marine Engineering Co.

is at a crossroads as the troubled shipyard tries to survive in a

changed and much smaller market for new ships. The company unveiled

a new $2.6 billion bailout package that would provide badly needed

cash, the WSJ's In-Soo Nam reports. The shipbuilder's biggest state

creditors, Korea Development Bank and the Export-Import Bank of

Korea, are providing funds to improve Daewoo's cash flow and

convert its liabilities into equity to cut debt, alongside Daewoo's

third bailout in the past four years. The crisis extends the pain

in South Korea's shipping industry, a critical piece of the

country's export-focused economy, following last year's collapse of

container-shipping giant Hanjin Shipping Co. Daewoo is being

dragged down by similar forces -- excess capacity on the water has

eroded demand for new ships, raising the need for more state

support.

Top U.S. auto makers believe the best place to start rethinking

trade policy is on car lots in China. The automobile companies are

pressing the Trump administration turn its trade focus toward

automobile sales in China and take a harder line over hefty tariffs

that provide a big advantage to Chinese companies, the WSJ's Trefor

Moss, Chester Dawson and William Mauldin report. The auto makers

are facing big changes in North American trade policies, including

President Donald Trump's demands to boost U.S. manufacturing, that

could drive up their production costs. But Mr. Trump also wants to

level the playing field on trade with China, where the car

companies want a bigger slice of the country's big automobile

market. Beijing sees its auto industry as a strategic asset,

however. And although Chinese companies have been investing in auto

production in the West, they see little chance of gaining a

significant foothold in U.S. sales.

Sears Holdings Corp. is sending a stark message to investors --

and to suppliers. The company raised doubts in a securities filing

about its ability to keep operating after seven years of losses,

the WSJ's Anne Steele reports, putting new clouds over the iconic

business in a retail market in upheaval. Sears insists the company

remains viable, but the fresh concerns rattled businesses tied to

the retailer: Shares in retail real-estate investment trusts

slumped as shopping-center landlords around the U.S. started

weighing their exposure over a possible bankruptcy filing. The

company has already sold off a large swath of real-estate holdings

to generate cash, but Sears is still struggling as consumers leave

department stores for online retailers. The shakeout is hitting

harder as the impact of a tough holiday season for brick-and-mortar

operators takes hold: retailers including Bebe Stores Inc., Payless

Shoes, Nine West and J.Crew are the latest in a growing field of

storefront operators facing tough choices over closing stores or

entering bankruptcy.

TRANSPORTATION

An avian influenza outbreak that may be the worst in seven years

is upending the poultry industry in Asia. The human death toll in

China is rising and chickens are being culled across Asia, the

WSJ's Lucy Craymer reports, weighing on prices in China and leaving

other markets to rely on imports from countries such as the U.S. to

ease domestic-supply shortages. Market watchers say bird-flu has

often created volatile swings in the global poultry industry, and

that markets have been hit this year as outbreaks have hit in

China, South Korea and on a Tennessee chicken farm. While China

banned U.S. chicken outright in 2015 over avian-flu concerns, other

importers, such as Thailand, could benefit. The U.S. Department of

Agriculture estimates that China's chicken imports will rise nearly

10% for all of 2017. If that happens, China would become the

world's second-biggest poultry importer behind Mexico.

The troubled demise of trucker Jevic Transportation will have an

impact across the world of bankruptcy law. The U.S. Supreme Court

handed the company's former truck drivers a victory, the WSJ's Peg

Brickley reports, rejecting the tactic known as structured

dismissal that put some creditors ahead of drivers for payment

claims. A lawyer for the drivers, who were left in the lurch when

the company simply locked its doors one morning in 2008 and stopped

operating, says the decision affirms their claim. But the drivers

won't get paid anytime soon -- it simply sends the case back to

bankruptcy court for what will likely mean more costly legal work.

The ruling will be felt across other bankruptcy cases, however, by

showing that companies can't take a back door through chapter 11 to

set their own priorities for who's paid and who's left behind.

QUOTABLE

IN OTHER NEWS

Sales of previously owned U.S. homes fell 3.7% in February amid

rising prices and tight inventory. (WSJ)

Brazil is racing to convince concerned markets that meatpackers

accused of bribing inspectors did so to get their products out

faster, not to sell rancid meat. (WSJ)

Future orders for Nike Inc. are down 4% as the retailer faces

growing competition and discounting from online sportswear sales.

(WSJ)

China's Zhejiang Geely Holding Group Co., withdrew its planned

bid for a controlling stake in Malaysian auto maker Proton Holdings

Bhd. (WSJ)

General Electric Co. promised to cut another $1 billion in costs

from its industrial operations after discussions with an activist

investor. (WSJ)

A U.S. officials says negotiations for a big trans-Atlantic

trade deal are still alive. (Agence France-Presse)

Women's apparel retailer Bebe Stores Inc. is closing all its

stores to focus entirely on e-commerce sales. (WSJ)

Wal-Mart Stores Inc. will start construction of a Mobile, Ala.,

distribution center the retailer will use to manage imports coming

through the Port of Mobile. (Birmingham News)

Starbucks Corp. plans to open 12,000 stores by 2021, including

3,400 new sites in the U.S. (MarketWatch)

Federal transport regulators are dropping a new rule heavily

opposed by the trucking industry that would change how carrier

safety fitness is determined. (Commercial Carrier Journal)

Maersk Line says there is enough container ship capacity to

support 3% annual trade growth for the next five years. (Journal of

Commerce)

Kerry Logistics Ltd. is selling its stake in a Hong Kong air

freight terminal in part to build reserves for its acquisitions

strategy. (The Loadstar)

Chinese airline STO Express, a supplier to Alibaba Group Holding

Ltd., is starting freighter flights between Hong Kong and Italy.

(Lloyd's Loading List)

Greece's Thessaloniki port is expecting four bids this week for

a majority stake in the country's No. 2 ocean gateway. (Splash

24/7)

The number of Americans killed on railroad tracks rose sharply

last year. (Progressive Railroading)

ABOUT US

Paul Page is deputy editor of WSJ Logistics Report. Follow him

at @PaulPage, and follow the entire WSJ Logistics Report team:

@brianjbaskin, @jensmithWSJ and @EEPhillips_WSJ and follow the WSJ

Logistics Report on Twitter at @WSJLogistics.

Subscribe to this email newsletter by clicking here:

http://on.wsj.com/Logisticsnewsletter .

Write to Paul Page at paul.page@wsj.com

(END) Dow Jones Newswires

March 23, 2017 06:56 ET (10:56 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

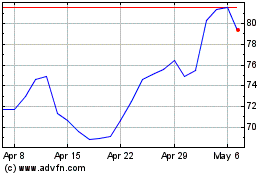

Alibaba (NYSE:BABA)

Historical Stock Chart

From Aug 2024 to Sep 2024

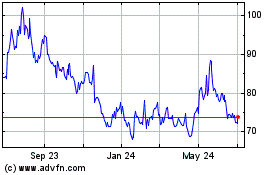

Alibaba (NYSE:BABA)

Historical Stock Chart

From Sep 2023 to Sep 2024