Citizens Survey Finds Business Owners More Optimistic

March 22 2017 - 9:11AM

Business Wire

Majority now believes U.S. economic conditions

will improve this year

Optimism is on the rise among owners of mid-sized U.S.

companies, according to a new Citizens Commercial Banking survey

examining the impact of the presidential election on the appetite

for mergers and acquisitions.

More than half (52 percent) of owners now believe that economic

conditions will improve in the coming year compared with only 34

percent prior to the U.S. election. The follow-up survey of

business leaders, conducted last month, also found that 38 percent

of respondents thought the election would boost what the previous

Citizens Commercial Banking Middle Market M&A Outlook revealed

were high expectations for M&A activity in 2017.

“The election results added more fuel to a positive outlook for

mergers and acquisitions among middle market U.S. companies this

year,” said Bob Rubino, executive vice president and head of

Corporate Finance and Capital Markets at Citizens Commercial

Banking. “Some CEOs are still in wait-and-see mode, but they are

optimistic about possible changes that could improve their bottom

lines and generate more deal-making opportunities.”

Middle market companies – with annual revenue between $5 million

and $2 billion – are key creators of jobs and drivers of economic

activity in the United States. Citizens Commercial Banking serves

thousands of middle market clients in a wide range of industries

across the country.

Citizens Commercial Banking’s survey provides insight into the

behaviors, attitudes and perceptions of business owners and CEOs as

they consider their corporate development strategies for the year

ahead. Other key findings include:

- Among middle market business owners, 71

percent anticipated lower health-care costs to their business in

coming years and 68 percent expected fewer federal

regulations.

- Seventy percent said they expected

lower corporate tax rates while 54 percent anticipated lower

individual tax rates and 39 percent expected capital gains tax

rates to go down.

- Twenty-two percent of business owners

are even more likely to engage in M&A activity in 2017

following the election.

- The percentage of survey respondents

who expect a significant financial crisis in the next three years

dropped from 48 percent to 41 percent.

A leader in middle market banking with expanding M&A

advisory capabilities, Citizens consistently ranks as a Top 10

middle market loan arranger in league tables. Citizens recently

served as advisor on Safe Harbor Marinas’ acquisition of Brewer

Yacht Yard Group and recently published its sixth annual nationwide

Middle Market M&A Outlook.

Citizens Commercial Banking recently became the first U.S. bank

to partner with Opportunity Network to offer Citizens’ clients

access to an innovative business-to-business networking platform

designed to promote growth by connecting business owners to a

network of 13,500 CEOs and $35 billion of deal flow.

Citizens aims to be a go-to strategic and financial partner by

offering unrivaled industry expertise, great ideas and seamless

deal execution. The Citizens Commercial Banking approach puts

clients first, and offers solutions that help clients make the best

decisions throughout the life cycle of their business.

For more information, please visit the Citizens Commercial

Banking website.

Survey Methodology

Last month, Citizens Commercial Banking conducted a follow-up

survey of 200 U.S.-based middle market business decision-makers who

are open to or currently engaged in some form of corporate

development activity, including mergers, acquisitions and raising

capital. For the purposes of this survey, middle market businesses

are defined as private or public companies with annual revenue

between $5 million and $2 billion.

About Citizens Financial Group,

Inc.

Citizens Financial Group, Inc. is one of the nation’s oldest and

largest financial institutions, with $149.5 billion in assets as of

December 31, 2016. Headquartered in Providence, Rhode Island,

Citizens offers a broad range of retail and commercial banking

products and services to individuals, small businesses,

middle-market companies, large corporations and institutions. In

Consumer Banking, Citizens helps its retail customers “bank better”

with mobile and online banking, a 24/7 customer contact center and

the convenience of approximately 3,200 ATMs and approximately 1,200

Citizens Bank branches in 11 states in the New England,

Mid-Atlantic and Midwest regions. Citizens also provides wealth

management, mortgage lending, auto lending, student lending and

commercial banking services in select markets nationwide. In

Commercial Banking, Citizens offers corporate, institutional and

not-for-profit clients a full range of wholesale banking products

and services including lending and deposits, capital markets,

treasury services, foreign exchange and interest hedging, leasing

and asset finance, specialty finance and trade finance.

Citizens operates through its subsidiaries Citizens Bank, N.A.,

and Citizens Bank of Pennsylvania as Citizens Bank, Citizens

Commercial Banking and Citizens One. Additional information about

Citizens and its full line of products and services can be found at

www.citizensbank.com.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170322005669/en/

Citizens Financial Group, Inc.Frank Quaratiello,

617-725-5851frank.quaratiello@citizensbank.com

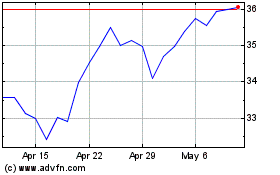

Citizens Financial (NYSE:CFG)

Historical Stock Chart

From Aug 2024 to Sep 2024

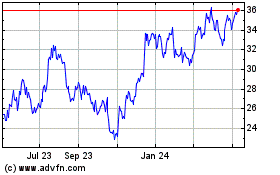

Citizens Financial (NYSE:CFG)

Historical Stock Chart

From Sep 2023 to Sep 2024