Additional Proxy Soliciting Materials (definitive) (defa14a)

March 06 2017 - 4:53PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 3, 2017

VERTEX PHARMACEUTICALS INCORPORATED

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

MASSACHUSETTS

(State or other jurisdiction of incorporation)

|

000-19319

(Commission File Number)

|

04-3039129

(IRS Employer Identification No.)

|

50 Northern Avenue

Boston, Massachusetts 02210

(Address of principal executive offices) (Zip Code)

(617) 341-6100

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

x

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01 Entry into a Material Definitive Agreement.

On March 3, 2017, we entered into an asset purchase agreement, or APA, with Concert Pharmaceuticals, Inc., or Concert, pursuant to which we have agreed to purchase CTP-656, an investigational cystic fibrosis transmembrane conductance regulator, or CFTR, potentiator that has the potential to be used as part of future once-daily combination regimens of CFTR modulators that treat the underlying cause of CF and Concert's other CF research and preclinical programs.

Pursuant to the agreement, we have agreed to pay Concert an initial payment of $160.0 million. If CTP-656 is approved as part of a combination regimen to treat CF, Concert could receive up to an additional $90 million in milestones based on regulatory approval in the U.S. and reimbursement in the UK, Germany or France.

The closing of the APA is subject to customary conditions, including, among other things, (i) the absence of a termination of the APA in accordance with its terms, (ii) approval of the APA by the stockholders of Concert, (iii) that any applicable waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, and the rules and regulations thereunder, shall have expired or otherwise been terminated, (iv) the absence of a material adverse effect on the assets and (v) no governmental authority shall have enacted any law or order which has the effect of enjoining or otherwise preventing or prohibiting the APA or the closing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

Exhibit Description of Document

99.1 Press Release, dated March 6, 2017

Additional Information about the Transaction and Where to Find It

This disclosure is being made in respect of the proposed asset purchase with Concert. The proposed asset purchase and the asset purchase agreement will be submitted to Concert's shareholders for their consideration and approval. In connection with the proposed asset purchase, Concert will file a proxy statement with the SEC. This disclosure does not constitute a solicitation of any vote or proxy from any shareholder of Concert. Investors are urged to read the proxy statement carefully and in its entirety when it becomes available and any other relevant documents or materials filed or to be filed with the SEC or incorporated by reference in the proxy statement, because they will contain important information about the proposed asset sale. The definitive proxy statement will be mailed to Concert's shareholders. In addition, the proxy statement and other documents will be available free of charge at the SEC's internet website, www.sec.gov. When available, the proxy statement and other pertinent documents may also be obtained free of charge at the Investors section of Concert's website, www.concertpharma.com, or by directing a written request to Concert Pharmaceuticals, Inc., Attn: Investor Relations, in writing, at 99 Hayden Ave, #500, Lexington, MA 02421.

Certain Information Concerning Participants

Vertex and its directors, executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies in connection with the proposed asset purchase. Information about Vertex's directors and executive officers is included in Vertex's Annual Report on Form 10-K for the year ended December 31, 2016 filed with the SEC on February 23, 2017.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

VERTEX PHARMACEUTICALS INCORPORATED

|

|

|

(Registrant)

|

|

|

|

|

Date: March 6, 2017

|

/s/ Michael J. Parini

|

|

|

Michael J. Parini

Executive Vice President, Chief Legal and Administrative Officer

|

|

|

|

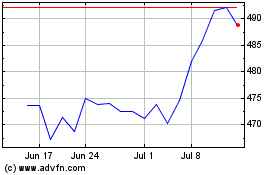

Vertex Pharmaceuticals (NASDAQ:VRTX)

Historical Stock Chart

From Mar 2024 to Apr 2024

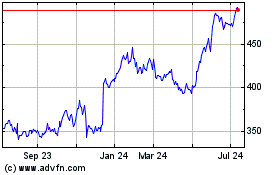

Vertex Pharmaceuticals (NASDAQ:VRTX)

Historical Stock Chart

From Apr 2023 to Apr 2024