Financial

Highlights

Required GAAP disclosures:

- GAAP Net Income of $71.6 million for

the fourth quarter and $113.7 million for the year ended December

31, 2016

- GAAP Income before Taxes of $72.4

million for the fourth quarter and $120.0 million for the year

ended December 31, 2016

- Diluted EPS of $0.63 for the fourth

quarter and $1.06 for the year ended December 31, 2016

- After-Tax GAAP Return on Average

Equity of 18.0% for the fourth quarter and 7.7% for the year ended

December 31, 2016

- GAAP Book Value per Share of $13.57

at December 31, 2016

Core Earnings disclosures:

- Core Earnings of $44.6 million for

the fourth quarter and $158.2 million for the year ended December

31, 2016

- Core EPS of $0.37 for the fourth

quarter and $1.48 for the year ended December 31, 2016

- After-Tax Core Return on Average

Equity of 10.8% for the fourth quarter and 10.7% for the year ended

December 31, 2016

- Undepreciated Book Value per Share

of $14.76 at December 31, 2016

Ladder Capital:

- Declared a fourth quarter dividend

of $0.460/share of Class A common stock paid on January 24, 2017,

bringing total dividends to $1.285/share of Class A common stock in

2016

- Increased the cash component of the

quarterly dividend rate by 9.1% to $0.300/share

- Originated $701.6 million of

commercial mortgage loans in the fourth quarter resulting in total

originations of $2.1 billion in 2016, comprised of $1.1 billion of

mortgage loans held for sale and $969.4 million of mortgage loans

held for investment

- Contributed $663.8 million of loans

to 3 securitization transactions in the fourth quarter resulting in

a total of $1.3 billion of loans contributed to 6 securitization

transactions in 2016

Ladder Capital Corp (NYSE:LADR) (“we,” “Ladder,” or the

“Company”) today announced operating results for the quarter and

year ended December 31, 2016. GAAP Income before taxes for the year

ended December 31, 2016 was $120.0 million compared to $160.7

million for the year ended December 31, 2015. The annual results

reflect the unfavorable market trends prevailing in 2016 as

compared to 2015, which resulted in lower gains on sales of loans

and real estate as well as securities trading, offset by a more

favorable net result from derivative transactions. GAAP Income

before taxes for the three months ended December 31, 2016 was $72.4

million compared to $67.1 million for the three months ended

December 31, 2015. A larger increase in interest rates in the

fourth quarter of 2016 than in the fourth quarter of 2015 led to

lower gains on sales across all asset types offset by higher

derivative gains. The Diluted EPS for the three months and year

ended December 31, 2016 was $0.63 and $1.06, respectively, compared

to $0.50 and $1.42 for the three months and year ended December 31,

2015, respectively. After- tax GAAP return on average equity was

18.0% in the fourth quarter of 2016.

Core Earnings, a non-GAAP financial measure, was $44.6 million

for the fourth quarter of 2016, compared to $50.1 million earned in

the fourth quarter of 2015. For the year ended December 31, 2016,

Core Earnings was $158.2 million compared to $191.5 million for

2015. The results reflect lower securitization volumes due to

unfavorable market trends prevailing during the first half of 2016.

We believe Core Earnings, which adjusts GAAP income before taxes

for certain non-cash items including depreciation related to our

real estate equity portfolio and unrecognized derivative results,

is useful in evaluating our earnings from operations across

reporting periods. Core EPS, a non-GAAP financial measure, was

$0.37 for the fourth quarter of 2016 and $1.48 for the year ended

December 31, 2016, compared to $0.45 and $1.85 for the three months

and year ended December 31, 2015, respectively.

"We are pleased to report Core Earnings of $158.2 million and an

annualized after-tax core return on average equity of 10.7% for

2016," said Brian Harris, Ladder's Chief Executive Officer. “Loan

origination activity increased substantially in the second half of

2016, and we grew our portfolio of balance sheet loans and real

estate equity investments as well as contributed loans to multiple

profitable securitizations during the year."

As of December 31, 2016, we had total assets of $5.6 billion,

including $2.4 billion of commercial real estate loans, $2.1

billion of commercial real estate-related securities, $822.3

million of real estate, $64.0 million of cash and $237.1 million of

other assets. As of December 31, 2016, 78.0% of our total assets

were comprised of senior secured assets, including first mortgage

loans, commercial real estate-related securities secured by first

mortgage loans, and cash. During the fourth quarter, senior secured

assets comprised 98.6% of the total $889.7 million investment

activity.

During the quarter ended December 31, 2016, we originated $701.6

million of loans comprised of $263.2 million of commercial mortgage

loans held for sale and $438.4 million of commercial mortgage loans

held for investment. We participated in 3 securitization

transactions during the fourth quarter of 2016 contributing a total

of $663.8 million in face amount of commercial mortgage loans. The

sale of loans into these securitization transactions resulted in a

net loss from the sale of loans of $4.1 million in the fourth

quarter. After factoring in related hedging results and other

related adjustments, income from sales of securitized loans, net of

hedging during the fourth quarter was $18.0 million. We also

received $88.4 million from the repayment of mortgage loans during

the three months ended December 31, 2016.

In total, we contributed $1.3 billion of commercial mortgages to

6 securitization transactions during 2016, which resulted in net

income from the sale of loans of $23.1 million and income from

sales of securitized loans, net of hedging of $38.4 million for the

year ended December 31, 2016.

Our portfolio of CMBS and U.S. Agency Securities decreased by

$550.0 million during the fourth quarter to $2.1 billion as we

purchased $124.1 million and sold $230.9 million of securities

during the quarter. We also received $376.3 million of proceeds

from the repayment of securities.

Net interest income for the fourth quarter of 2016 was $28.5

million, compared to $33.4 million for the comparable period in the

prior year, primarily due to a decrease in the weighted average

coupon on mortgage loans receivable as well as higher interest

expense as a result of higher outstanding financing obligations and

an increase in prevailing market rates. Other income for the fourth

quarter of 2016 was $89.2 million compared to $72.2 million for the

comparable period in the prior year, which reflects an increase of

$49.1 million in the net result from derivative transactions,

offset by decreases in income from sales of loans and real estate,

net of $15.6 million and $14.0 million, respectively, as rising

interest rates during the quarter led to a decline in asset values

and an increase in hedge values. Costs and expenses totaled $45.3

million for the fourth quarter of 2016, a $7.0 million increase

compared to the fourth quarter of 2015.

During the fourth quarter of 2016, we acquired 4 single tenant

net lease and other properties for a total investment of $12.2

million. During the three months ended December 31, 2016, our

mortgage loan financing increased by $14.6 million primarily due to

the contribution of 8 loans secured by our real estate investments

to securitizations. We sold 31 condominium units for a total of

$13.7 million during the fourth quarter, which generated income

from the sale of real estate, net, of $5.0 million. Our total real

estate portfolio as of December 31, 2016 was $822.3 million.

Portfolio Overview

The following table summarizes the book value of our investment

portfolio as of the following dates:

December 31, 2016 December

31, 2015 ($ in thousands)

Loans Conduit first

mortgage loans $ 357,882 6.4 % $ 571,764 9.7 % Balance sheet first

mortgage loans 1,828,961 32.8 % 1,453,120 24.6 % Other commercial

real estate-related loans 167,134 3.0 % 285,525 4.8 %

Total loans 2,353,977 42.2 % 2,310,409 39.1 %

Securities

CMBS investments 2,043,566 36.6 % 2,335,930 39.7 % U.S. Agency

Securities investments 57,381 1.1 % 71,287 1.2 %

Total securities 2,100,947 37.7 % 2,407,217 40.9 %

Real

Estate Real estate and related lease intangibles, net

822,338 14.7 % 834,779 14.2 % Total real estate 822,338 14.7

% 834,779 14.2 %

Other Investments Investments in

unconsolidated joint ventures 34,025 0.6 % 33,797 0.6 % FHLB stock

77,915 1.4 % 77,915 1.3 % Total other investments

111,940 2.0 % 111,712 1.9 % Total investments

5,389,202 96.6 % 5,664,117 96.1 % Cash, cash equivalents and cash

collateral held by broker 64,017 1.1 % 139,770 2.4 % Other assets

125,118 2.3 % 91,325 1.5 %

Total assets

$ 5,578,337 100.0 % $

5,895,212 100.0 %

Note: CMBS investments and U.S. Agency Securities are carried at

fair value.

We originate conduit first mortgage loans eligible for

securitization that are secured by cash-flowing commercial real

estate properties. These first mortgage loans are structured with

fixed rates and five- to ten-year terms. As of December 31, 2016,

we held 10 first mortgage loans that were substantially available

for contribution into future securitizations with an aggregate book

value of $357.9 million. Based on the outstanding loan principal

balances at December 31, 2016 and the “as-is” third-party FIRREA

appraised values at origination, the weighted average loan-

to-value ratio of this portfolio was 62.9%.

We also originate and invest in balance sheet first mortgage

loans secured by commercial real estate properties that are

undergoing lease-up, sell-out, and renovation or repositioning.

These mortgage loans are generally structured with floating rates

and terms (including extension options) ranging from one to five

years. As of December 31, 2016, we held a portfolio of 84 balance

sheet first mortgage loans with an aggregate book value of $1.8

billion, 98.0% of which was floating-rate. Based on the outstanding

loan principal balances at December 31, 2016 and the “as-is”

third-party FIRREA appraised values at origination, the weighted

average loan-to-value ratio of this portfolio was 64.3%.

We selectively invest in other commercial real estate loans in

the form of note purchase financings, subordinated debt, mezzanine

debt, and other structured finance products related to commercial

real estate. We held $167.1 million of other commercial real

estate-related loans as of December 31, 2016, 100% of which were

fixed-rate. Based on the outstanding loan principal balances

through the mezzanine or subordinated debt level at December 31,

2016 and the “as-is” third-party FIRREA appraised values at

origination, the weighted average loan-to-value ratio of this

portfolio was 74.0%.

As of December 31, 2016, our portfolio of CMBS investments had

an estimated fair value of $2.0 billion and was comprised of

investments in 191 CUSIPs ($10.7 million average investment per

CUSIP), with a weighted average duration of 3.5 years.

As of December 31, 2016, our portfolio of U.S. Agency Securities

had an estimated fair value of $57.4 million and was comprised of

investments in 28 CUSIPs ($2.0 million average investment per

CUSIP), with a weighted average duration of 8.5 years.

As of December 31, 2016, we owned 7.2 million square feet of

real estate, comprised of 115 single tenant net lease properties, 5

individual office buildings, 3 portfolios of office buildings, 1

warehouse, 1 shopping center, 59 condominium units at Veer Towers

in Las Vegas, and 88 condominium units at Terrazas River Park

Village in Miami. Our total real estate portfolio had an aggregate

book value of $822.3 million. We typically originate internal non-

recourse mortgage loan financing secured by an individual property

or a group of properties in our real estate portfolio and

subsequently seek to securitize these loans. Once the loans have

been securitized, they are included on our balance sheet as

mortgage loan financing. As of December 31, 2016, we had $590.1

million of such mortgage loan financing, secured by certain of our

real estate properties.

Liquidity and Capital

Resources

We held unrestricted cash and cash equivalents of $44.6 million

at December 31, 2016. We had total debt outstanding of $3.9 billion

as of December 31, 2016, and we had an additional $1.7 billion of

committed financing available for additional investment through our

FHLB membership, our revolving credit agreements, and our committed

repurchase facilities.

During the year ended December 31, 2016, we retired $21.9

million of principal of the 7.375% senior notes due on October 1,

2017 and $33.8 million of principal of the 5.875% senior notes due

on August 1, 2021 for a total repurchase price of $49.7 million. We

recognized a $5.4 million net gain on extinguishment of debt after

recognizing $0.6 million of unamortized debt issuance costs

associated with the retired debt. During the same period, we

repurchased 424,317 shares of Class A common stock for an aggregate

price of $4.7 million or an average of $10.96 per share.

The following table summarizes our debt obligations as of the

following dates:

December 31, 2016 December 31,

2015 ($ in thousands) Committed loan facilities $ 567,163 $

704,149 Committed securities facility 228,317 161,887 Uncommitted

securities facilities 311,705 394,719 Total

repurchase agreements 1,107,185 1,260,755 Revolving credit facility

25,000 — Mortgage loan financing 590,106 544,663 Borrowings from

the FHLB 1,660,000 1,856,700 Senior unsecured notes 559,847

612,605

Total debt obligations $

3,942,138 $ 4,274,723

To maintain our qualification as a REIT under the Internal

Revenue Code of 1986, as amended, we must annually distribute at

least 90% of our taxable income. The REIT distribution requirements

limit our ability to retain earnings and thereby replenish or

increase capital for operations. We believe that our significant

capital resources and access to financing will provide us with

financial flexibility at levels sufficient to meet current and

anticipated capital requirements, including funding new investment

opportunities, paying distributions to our shareholders and

servicing our debt obligations.

Conference Call and

Webcast

We will host a conference call on Thursday, February 23, 2017 at

5:00 p.m. Eastern Time to discuss fourth quarter and year end 2016

results. The conference call can be accessed by dialing (877)

407-4018 domestic or (201) 689-8471 international. Individuals who

dial in will be asked to identify themselves and their

affiliations. For those unable to participate, an audio replay will

be available from 8:00 p.m. Eastern Time on Thursday, February 23,

2017 through midnight Thursday, March 9, 2017. To access the

replay, please call (844) 512-2921 domestic or (412) 317-6671

international, access code 13655415. The conference call will also

be webcast though a link on Ladder Capital Corp’s Investor

Relations website at ir.laddercapital.com. A web-based archive of

the conference call will also be available at the above

website.

Non-GAAP Financial

Measures

We present Core Earnings, Core EPS, and After-Tax Core Return on

Average Equity ("After-Tax Core ROAE"), which are non-GAAP

financial measures, as supplemental measures of our performance. We

believe Core Earnings, Core EPS and After-Tax Core ROAE assist

investors in comparing our performance across reporting periods on

a consistent basis by excluding non-cash expenses and unrecognized

results from derivatives and Agency interest-only securities, which

we believe makes comparisons across reporting periods more relevant

by eliminating timing differences related to changes in the values

of assets and derivatives. In addition, we use Core Earnings, Core

EPS and After-Tax Core ROAE: (i) to evaluate our earnings from

operations and (ii) because management believes that they may be

useful performance measures for us. Core Earnings is also used as a

factor in determining the annual incentive compensation of our

senior managers and other employees.

We consider the Class A common shareholders of the Company and

limited partners of Ladder Capital Finance Holdings LLLP other than

Ladder Capital Corp ("Continuing LCFH Limited Partners") to have

fundamentally equivalent interests in our pre-tax earnings and net

income. Accordingly, for purposes of computing Core Earnings, Core

EPS and After- Tax Core ROAE, we start with pre-tax earnings or net

income and adjust for other noncontrolling interest in consolidated

joint ventures but we do not adjust for amounts attributable to

noncontrolling interest held by Continuing LCFH Limited Partners.

Similarly, when calculating Undepreciated book value per share we

include Total shareholders' equity and the noncontrolling interest

held by Continuing LCFH Limited Partners but exclude noncontrolling

interest in consolidated joint ventures.

Core Earnings

We define Core Earnings as income before taxes adjusted to

exclude (i) real estate depreciation and amortization, (ii) the

impact of derivative gains and losses related to the hedging of

assets on our balance sheet as of the end of the specified

accounting period, (iii) unrealized gains/(losses) related to our

investments in Agency interest-only securities, (iv) the premium

(discount) on mortgage loan financing and the related amortization

of premium (discount) on mortgage loan financing recorded during

the period, (v) non-cash stock-based compensation and (vi) certain

one-time transactional items.

We do not designate derivatives as hedges to qualify for hedge

accounting and therefore any net payments under, or fluctuations in

the fair value of, our derivatives are recognized currently in our

income statement. However, fluctuations in the fair value of the

related assets are not included in our income statement. We

consider the gain or loss on our hedging positions related to

assets that we still own as of the reporting date to be “open

hedging positions.” While recognized for GAAP purposes, we exclude

the results on the hedges from Core Earnings until the related

asset is sold and the hedge position is considered “closed,”

whereupon they would then be included in Core Earnings in that

period. These are reflected as “Adjustments for unrecognized

derivative results” for purposes of computing Core Earnings for the

period. We believe that excluding these specifically identified

gains and losses associated with the open hedging positions adjusts

for timing differences between when we recognize changes in the

fair values of our assets and changes in the fair value of the

derivatives used to hedge such assets.

Our investments in Agency interest-only securities are recorded

at fair value with changes in fair value recorded in current period

earnings. We believe that excluding these specifically identified

gains and losses associated with the Agency interest-only

securities adjusts for timing differences between when we recognize

changes in the fair values of our assets. Set forth below is an

unaudited reconciliation of Net Income to After-Tax Core

Earnings:

Three Months Ended December 31, Year Ended

December 31,

2016

2015

2016

2015 ($ in thousands)

Net income (loss)

$ 71,621 $ 56,676 $ 113,720 $ 146,134 Income tax expense (benefit)

773 10,457 6,320

14,557 Income (loss) before taxes 72,394 67,133 120,040

160,691

Net (income) loss attributable to

noncontrolling interest in consolidated joint ventures and

operating partnership (GAAP) (1)

(306 ) (2,146 ) 109 (1,568 ) Our share of real estate depreciation,

amortization and gain adjustments (2) 9,207 3,905 33,828 28,704

Adjustments for unrecognized derivative results (3) (41,657 )

(20,717 ) (11,105 ) (10,213 ) Unrealized (gain) loss on Agency IO

securities 85 611 56 1,249 Premium (discount) on mortgage loan

financing, net of amortization (509 ) (982 ) (482 ) 802 Non-cash

stock-based compensation 5,512 2,338 19,039 10,277 One-time

transactional adjustments (90 ) (4) —

(3,272 ) (4) 1,509 (5)

Core Earnings

44,636

50,142

158,213

191,451

Core estimated corporate tax benefit (expense) (6) (4,202 )

(6,189 ) 627 (10,884 )

After-Tax

Core Earnings $ 40,434 $

43,953 $ 158,840 $

180,567 (1) Includes $7,639 and $29,036 of net

income attributable to noncontrolling interest in consolidated

joint ventures which are included in net (income) loss attributable

to noncontrolling interest in operating partnership on the combined

consolidated statements of income for the fourth quarter and year

ended December 31, 2016, respectively. (2) The following is

a reconciliation of GAAP depreciation and amortization to our share

of real estate depreciation, amortization and gain adjustments

amounts presented in the computation of Core Earnings in the

preceding table:

Three Months Ended December 31,

Year Ended December 31, 2016

2015 2016 2015 ($ in thousands) Total

GAAP depreciation and amortization $ 10,658 $ 9,823 $ 39,447 $

39,061 Less: Depreciation and amortization related to non-rental

property fixed assets (28) (28) (114) (108) Less: Non-controlling

interest in consolidated joint ventures’ share of accumulated

depreciation and amortization (726) (675)

(2,519) (2,830) Our share of real estate depreciation and

amortization 9,904 9,120 36,814 36,123 Realized gain from

accumulated depreciation and amortization on real estate sold (see

below) (702) (5,748) (3,007) (7,965) Less: Non-controlling

interests in consolidated joint ventures’ share of accumulated

depreciation and amortization on real estate sold 5

533 21 546 Our share of accumulated depreciation and

amortization on real estate sold (697) (5,215) (2,986) (7,419)

Our share of real estate depreciation

and

amortization and gain

adjustments

$ 9,207 $ 3,905 $ 33,828

$ 28,704

GAAP gains/losses on sales of real estate

include the effects of previously recognized real estate

depreciation and amortization. For purposes of Core Earnings, our

share of real estate depreciation and amortization is eliminated

and, accordingly, the resultant gain/losses must also be adjusted.

Following is a reconciliation of the related consolidated GAAP

amounts to the amounts reflected in Core Earnings.

Three Months Ended December 31, Year Ended

December 31, 2016 2015 2016

2015 ($ in thousands) GAAP realized gain on sale of

real estate, net $ 5,020 $ 19,039 $ 20,636 $ 40,386 Adjusted

gain/loss on sale of real estate for purposes of Core Earnings

4,323 13,824 17,650 32,967

Our share of accumulated depreciation

and

amortization on real estate

sold

$ 697 $ 5,215 $ 2,986

$ 7,419 (3) The following is a

reconciliation of GAAP net results from derivative transactions to

our hedging unrecognized result presented in the computation of

Core Earnings in the preceding table:

Three Months

Ended December 31, Year Ended December 31, 2016

2015 2016 2015 ($ in thousands)

Net results from derivative transactions $ 64,739 $ 15,657 $

(1,409 ) $ (38,937 ) Plus: Hedging interest expense 6,625 6,490

29,870 26,820 Plus: Hedging realized result (29,707 )

(1,430

) (17,356 ) 22,330

Adjustments for

unrecognized derivative results $ 41,657

$ 20,717 $ 11,105

$ 10,213 (4)

We recorded an additional $0.1 million and

$3.3 million income tax expense for the fourth quarter and year

ended December 31, 2016, respectively, for a proposed tax

settlement for pre-acquisition liabilities on certain corporate

entities acquired in certain transactions effected immediately

prior to our initial public offering. We also recorded other income

of $0.1 million and $3.3 million for the fourth quarter and year

ended December 31, 2016, respectively, relating to the expected

recovery of these amounts pursuant to an indemnification. While

these items are presented on a gross basis, there was no impact to

either net income or core earnings. Accordingly, since pre-tax

income excludes the tax effect but includes the recovery pursuant

to indemnification, the recovery amount must also be excluded from

Core Earnings.

(5)

One-time transactional adjustment for

costs related to restructuring the Company for REIT-related

operations. All costs were expensed and accrued for in the period

incurred.

(6) Core estimated corporate tax benefit (expense) based on

effective tax rate applied to Core Earnings generated by the

activity within our taxable REIT subsidiaries.

Core EPS

Core EPS is defined as After-Tax Core Earnings divided by the

Adjusted weighted average shares outstanding (diluted) during the

period. The Adjusted weighted average shares outstanding (diluted)

is defined as the GAAP weighted average shares outstanding

(diluted), adjusted for shares issuable upon conversion of all

Class B shares, if excluded from the GAAP measure because they

would have an anti-dilutive effect. The inclusion of shares

issuable upon conversion of Class B shares is consistent with the

inclusion of income attributable to noncontrolling interest in

operating partnership in Core Earnings and After-Tax Core

Earnings.

Set forth below is an unaudited reconciliation of Weighted

average shares outstanding (diluted) to Adjusted weighted average

shares outstanding (diluted):

Three Months Ended December 31, Year Ended

December 31, 2016 2015 2016

2015

(in thousands)

Weighted average shares outstanding (diluted) 66,037 97,975

107,639 51,871 Weighted average shares issuable to converted Class

B shareholders 42,582 — — 45,933

Adjusted weighted average

shares outstanding (diluted) 108,619 97,975

107,639 97,804

Set forth below is an unaudited computation of Core EPS:

Three Months Ended December 31, Year Ended

December 31, 2016 2015 2016

2015 ($ in thousands, except per share data)

After-Tax Core Earnings $ 40,434 $ 43,953 $ 158,840 $ 180,567

Adjusted weighted average shares outstanding (diluted)

108,619 97,975 107,639 97,804

Core EPS

$ 0.37 $ 0.45 $ 1.48

$ 1.85

After-Tax Core ROAE

After-Tax Core ROAE is presented on an annualized basis and is

defined as After-Tax Core Earnings divided by the average Total

shareholders' equity and Noncontrolling interest in operating

partnership during the period. The inclusion of Noncontrolling

interest in operating partnership is consistent with the inclusion

of income attributable to noncontrolling interest in operating

partnership in After-Tax Core Earnings. Set forth below is an

unaudited computation of After-Tax Core ROAE:

Three Months Ended December 31, Year Ended

December 31, 2016 2015 2016

2015 ($ in thousands) After-Tax Core Earnings $

40,434 $ 43,953 $ 158,840 $ 180,567 Average shareholders' equity

and NCI in operating partnership 1,500,134

1,488,864 1,486,772 1,498,268

After-Tax Core ROAE 10.8 %

11.8 % 10.7 % 12.1

%

Income from sales of securitized loans, net of hedging

We present income from sales of securitized loans, net of

hedging, a non-GAAP financial measure, as a supplemental measure of

the performance of our loan securitization business. Income from

sales of securitized loans, net is a key component of our results.

Since our loans sold into securitizations to date are comprised of

long-term fixed-rate loans, the result of hedging those exposures

prior to securitization represents a substantial portion of our

interest rate hedging. Therefore, we view these two components of

our profitability together when assessing the performance of this

business activity and find it a meaningful measure of the Company’s

performance as a whole. When evaluating the performance of our sale

of loans into securitization business, we generally consider the

income from sales of securitized loans, net, in conjunction with

other income statement items that are directly related to such

securitization transactions, including portions of the realized net

result from derivative transactions that are specifically related

to hedges on the securitized or sold loans, which we reflect as

hedge gain/(loss) related to loans securitized, a non-GAAP

financial measure, in the table below.

Set forth below is an unaudited reconciliation of income from

sale of securitized loans, net to income from sale of loans, net as

reported in our combined consolidated financial statements included

herein and an unaudited reconciliation of hedge gain/(loss)

relating to loans securitized to net results from derivative

transactions as reported in our combined consolidated financial

statements:

Three Months Ended December 31, Year Ended

December 31, 2016 2015 2016

2015 ($ in thousands, except number of loans and

securitizations) Number of loans 44 57 104 210 Face amount of loans

sold into securitizations $ 663,798 $ 603,556 $

1,327,856

(1)

$

2,584,939

Number of securitizations 3 3 6 10

Income from sales of securitized loans,

net (2)

$ (4,088 ) $ 11,349 $ 23,098 $ 71,066

Hedge gain/(loss) related to loans

securitized (3)

22,087 1,605 15,271 (6,475 )

Income from sales of securitized loans,

net of hedging

$ 17,999 $ 12,954 $

38,369 $ 64,591

_______________________________

(1)

Excludes one $21.7 million loan acquired

from a third party and sold into a securitization at equal

values.

(2)

The following is a reconciliation of the non-GAAP financial measure

of income from sales of securitized loans, net to income from sale

of loans, net, which is the closest GAAP measure, as reported in

our combined consolidated financial statements:

Three Months Ended December 31, Year Ended December

31, 2016 2015 2016

2015 ($ in thousands) Income from sales of loans

(non-securitized), net $ (168 ) $ — $ 2,911 $ — Income from sales

of securitized loans, net (4,088 ) 11,349

23,098 71,066

Income from sales of loans, net

$ (4,256 ) $ 11,349 $

26,009 $ 71,066

(3)

The following is a reconciliation of the non-GAAP financial

measure of hedge gain/(loss) related to loans securitized to net

results from derivative transactions, which is the closest GAAP

measure, as reported in our combined consolidated financial

statements:

Three Months Ended December 31,

Year Ended December 31, 2016 2015

2016 2015 ($ in thousands) Hedge gain/(loss)

related to lending and securities positions $ 42,307 $ 14,052 $

(15,971 ) $ (32,462 ) Hedge gain/(loss) related to loans

(non-securitized) 345 — (709 ) — Hedge gain/(loss) related to loans

securitized 22,087 1,605 15,271

(6,475 )

Net results from derivative transactions $

64,739 $ 15,657 $ (1,409

) $ (38,937 )

Undepreciated book value per share

We present Undepreciated book value per share, which is a

non-GAAP financial measure, as a supplemental measure of our

financial condition. We believe Undepreciated book value per share

assists investors in comparing our financial condition across

reporting periods on a consistent basis by excluding accumulated

depreciation on real estate, which implicitly assumes that the

value of our real estate diminishes in value predictably over time,

whereas real estate values have historically risen or fallen with

market conditions.

We consider the Class A common shareholders of the Company and

Continuing LCFH Limited Partners to have fundamentally equivalent

interests in our pre-tax earnings and net income. Accordingly, when

calculating Undepreciated book value per share we include Total

shareholders' equity and the noncontrolling interest held by

Continuing LCFH Limited Partners but exclude noncontrolling

interest in consolidated joint ventures.

We define Undepreciated book value per share as the sum of Total

shareholders' equity, Noncontrolling interest in operating

partnership, and Our share of accumulated real estate depreciation

and amortization, divided by the total Class A and Class B shares

outstanding. Set forth below is an unaudited reconciliation of

Total shareholders' equity to Undepreciated book value, and an

unaudited computation of Undepreciated book value per share:

December 31, 2016 December 31,

2015

($ in thousands, except per share

data)

Total shareholders' equity $ 971,390 $ 828,215 Noncontrolling

interest in operating partnership 533,246 657,380 Our share of

accumulated real estate depreciation and amortization (1)

112,606 76,473 Undepreciated book value 1,617,242 1,562,068

Class A shares outstanding 71,586 55,210 Class B shares

outstanding 38,002 44,056 Total shares

outstanding 109,588 99,266

GAAP book value per share

$ 13.57 $ 15.00 Undepreciated book

value per share $ 14.76 $ 15.74

(1) The following is a reconciliation of GAAP Accumulated real

estate depreciation and amortization to Our share of accumulated

real estate depreciation and amortization presented in the

computation of Undepreciated book value per share in the preceding

table.

December 31, 2016 December 31,

2015 ($ in thousands) GAAP Accumulated real estate depreciation

and amortization $ 122,007 $ 83,056 Less: Noncontrolling interests'

share of accumulated real estate depreciation and amortization

(9,401 ) (6,583 )

Our share of accumulated real

estate depreciation and amortization $ 112,606

$ 76,473

Our non-GAAP financial measures, including Core Earnings, Core

EPS, After-Tax Core ROAE and Undepreciated book value per share

have limitations as analytical tools. Some of these limitations

are:

- Core Earnings, Core EPS and After-Tax

Core ROAE do not reflect the impact of certain cash charges

resulting from matters we consider not to be indicative of our

ongoing operations and are not necessarily indicative of cash

necessary to fund cash needs;

- Core EPS and After-Tax Core ROAE are

based on a non-GAAP estimate of Ladder’s effective tax rate,

including the impact of Unincorporated Business Tax and the impact

of Ladder's election to be taxed as a REIT effective January 1,

2015, assuming the conversion of all shares of Class B common stock

into shares of Class A common stock. Ladder’s actual tax rate may

differ materially from this estimate;

- Undepreciated book value per share

excludes accumulated real estate depreciation and amortization and

may not reflect an accurate measure of the value of our real

estate; and

- other companies in our industry may

calculate non-GAAP financial measures differently than we do,

limiting their usefulness as comparative measures.

Because of these limitations, our non-GAAP financial measures

should not be considered in isolation or as a substitute for net

income (loss) attributable to shareholders, earnings per share or

book value per share, or any other performance measures calculated

in accordance with GAAP. Our non-GAAP financial measures should not

be considered an alternative to cash flows from operations as a

measure of our liquidity. Undepreciated book value per share should

not be considered a measure of the value of our assets upon an

orderly liquidation of the Company.

In the future, we may incur gains and losses that are the same

as or similar to some of the adjustments in this presentation. Our

presentation of non-GAAP financial measures should not be construed

as an inference that our future results will be unaffected by

unusual or non-recurring items.

For additional information about our non-GAAP financial

measures, please refer to the disclosures available on our website

or our Annual Report on Form 10-K.

About Ladder

Ladder is an internally-managed real estate investment trust

that is a leader in commercial real estate finance. Ladder

originates and invests in a diverse portfolio of commercial real

estate and real estate-related assets, focusing on senior secured

assets. Ladder’s investment activities include: (i) direct

origination of commercial real estate first mortgage loans; (ii)

investments in investment grade securities secured by first

mortgage loans on commercial real estate; and (iii) investments in

net leased and other commercial real estate equity. Founded in

2008, Ladder is run by a highly experienced management team with

extensive expertise in all aspects of the commercial real estate

industry, including origination, credit, underwriting, structuring,

capital markets and asset management. Led by Brian Harris, the

Company’s Chief Executive Officer, Ladder is headquartered in New

York City and has branches in Los Angeles and Boca Raton.

Forward-Looking Statements

Certain statements in this release may constitute

“forward-looking” statements. These statements are based on

management’s current opinions, expectations, beliefs, plans,

objectives, assumptions or projections regarding future events or

future results. These forward-looking statements are only

predictions, not historical fact, and involve certain risks and

uncertainties, as well as assumptions. Actual results, levels of

activity, performance, achievements and events could differ

materially from those stated, anticipated or implied by such

forward-looking statements. While Ladder believes that its

assumptions are reasonable, it is very difficult to predict the

impact of known factors, and, of course, it is impossible to

anticipate all factors that could affect actual results. There are

a number of risks and uncertainties that could cause actual results

to differ materially from forward-looking statements made herein

including, most prominently, the risks discussed under the heading

“Risk Factors” in the Company’s Annual Report on Form 10-K for the

year ended December 31, 2016, as well as its consolidated financial

statements, related notes, and other financial information

appearing therein, and its other filings with the U.S. Securities

and Exchange Commission. Such forward- looking statements are made

only as of the date of this release. Ladder expressly disclaims any

obligation or undertaking to release any updates or revisions to

any forward-looking statements contained herein to reflect any

change in its expectations with regard thereto or changes in

events, conditions, or circumstances on which any such statement is

based.

Ladder Capital Corp and

Predecessor

Combined Consolidated Statements of Income (Dollars in

Thousands, Except Per Share and Dividend Data)

Year Ended December 31,

2016 2015 2014 Net

interest income Interest income $ 236,372 $ 241,539 $ 187,325

Interest expense 120,827 113,303

77,574

Net interest income 115,545

128,236 109,751 Provision for loan losses 300

600 600

Net interest income

after provision for loan losses 115,245 127,636

109,151 Other income Operating lease income

77,277 80,465 56,649 Tenant recoveries 5,958 9,907 9,183 Sale of

loans, net 26,009 71,066 145,275 Realized gain (loss) on securities

7,724 24,007 26,977 Unrealized gain (loss) on Agency interest-only

securities (56 ) (1,249 ) 2,144 Realized gain on sale of real

estate, net 20,636 40,386 29,760 Fee and other income 21,365 15,205

11,704 Net result from derivative transactions (1,409 ) (38,937 )

(94,798 ) Earnings (loss) from investment in unconsolidated joint

ventures 426 371 1,990 Gain on assignment of mortgage loan

financing — — 432 Gain (loss) on extinguishment of debt

5,382 — (150 )

Total other

income 163,312 201,221

189,166 Costs and expenses

Salaries and employee benefits 64,270 61,612 82,144 Operating

expenses 20,552 25,103 25,398 Real estate operating expenses 29,953

35,886 32,670 Real estate acquisition costs 592 1,983 2,404 Fee

expense 3,703 4,521 3,023 Depreciation and amortization

39,447 39,061 28,447

Total

costs and expenses 158,517

168,166 174,086 Income (loss)

before taxes 120,040 160,691 124,231

Income tax expense (benefit) 6,320 14,557

26,605

Net income (loss) 113,720

146,134 97,626 Net (income) loss attributable to

noncontrolling interest in consolidated joint ventures 138 (1,568 )

370 Pre-IPO net loss attributable to predecessor unitholders — —

12,628 Net (income) loss attributable to noncontrolling interest in

operating partnership (47,131 ) (70,745 )

(66,437 )

Net income (loss) attributable to Class A common

shareholders $ 66,727 $

73,821 $ 44,187

Earnings per share: Basic $ 1.08 $ 1.43 $ 0.90 Diluted $

1.06 $ 1.42 $ 0.86

Weighted average shares

outstanding: Basic 61,998,089 51,702,188 49,296,417 Diluted

107,638,788 51,870,808 97,583,310

Dividends per share of

Class A common stock: $ 1.285 $ 2.225 $ —

Ladder Capital Corp Combined Consolidated Balance

Sheets (Dollars in Thousands) December 31,

2016 December 31, 2015 Assets Cash and

cash equivalents $ 44,615 $ 108,959 Cash collateral held by broker

19,402 30,811 Mortgage loan receivables held for investment, net,

at amortized cost 1,996,095 1,738,645 Mortgage loan receivables

held for sale 357,882 571,764 Real estate securities,

available-for-sale 2,100,947 2,407,217 Real estate and related

lease intangibles, net 822,338 834,779 Investments in

unconsolidated joint ventures 34,025 33,797 FHLB stock 77,915

77,915 Derivative instruments 5,018 2,821 Due from brokers 10 —

Accrued interest receivable 24,439 22,776 Other assets

95,651 65,728

Total assets $

5,578,337 $ 5,895,212

Liabilities and Equity Liabilities Debt obligations,

net $ 3,942,138 $ 4,274,723 Due to brokers 394 — Derivative

instruments 3,446 5,504 Amount payable pursuant to tax receivable

agreement 2,520 1,910 Dividends payable 24,682 17,456 Accrued

expenses 66,597 78,142 Other liabilities 29,006

26,069

Total liabilities

4,068,783 4,403,804

Commitments and contingencies — —

Equity

Class A common stock, par value $0.001 per

share, 600,000,000 shares authorized;

72,681,218 and 55,758,710 shares issued

and 71,586,170 and 55,209,849 shares

outstanding

72 55

Class B common stock, par value $0.001 per

share, 100,000,000 shares authorized;

38,002,344 and 44,055,987 shares issued

and outstanding

38 44 Additional paid-in capital 992,307 776,866 Treasury stock,

1,095,048 and 548,861 shares, at cost (11,244 ) (5,812 ) Retained

Earnings/(Dividends in Excess of Earnings) (11,148 ) 60,618

Accumulated other comprehensive income (loss) 1,365

(3,556 )

Total shareholders’ equity 971,390

828,215 Noncontrolling interest in operating partnership

533,246 657,380 Noncontrolling interest in consolidated joint

ventures 4,918 5,813

Total

equity 1,509,554 1,491,408

Total liabilities and equity $

5,578,337 $ 5,895,212

Ladder Capital Corp and

Predecessor

Combined Consolidated Statements of Cash Flows (Dollars

in Thousands)

Year Ended December 31, 2016

2015 2014 Cash

flows from operating activities: Net income (loss) $

113,720

$

146,134

$

97,626

Adjustments to reconcile net income (loss) to net cash provided by

(used in) operating activities: (Gain) loss on extinguishment of

debt (5,382 ) — 150 Depreciation and amortization 39,447 39,061

28,447 Unrealized (gain) loss on derivative instruments (4,224 )

(10,182 ) 14,378 Unrealized (gain) loss on Agency interest-only

securities 56 1,249 (2,144 ) Unrealized (gain) loss on investment

in mutual fund 14 — — Provision for loan losses 300 600 600

Amortization of equity based compensation 17,640 13,788 14,451

Amortization of deferred financing costs included in interest

expense 7,459 5,757 5,802 Amortization of premium on mortgage loan

financing (894 ) (902 ) (629 ) Amortization of above- and

below-market lease intangibles (108 ) (249 ) 652 Amortization of

premium/(accretion) of discount and other fees on loans (8,941 )

(12,241 ) (6,918 ) Amortization of premium/(accretion) of discount

and other fees on securities 76,475 87,906 91,306 Realized gain on

sale of mortgage loan receivables held for sale (26,009 ) (71,066 )

(145,275 ) Realized gain on disposition of loan — (820 ) — Realized

(gain) loss on real estate securities (7,724 ) (24,007 ) (26,977 )

Realized gain on sale of real estate, net (20,636 ) (40,386 )

(29,760 ) Realized gain on assignment of mortgage loan financing —

— (432 ) Realized gain on sale of derivative instruments 24 — —

Origination of mortgage loan receivables held for sale (1,128,651 )

(2,594,141 ) (3,345,372 ) Purchases of mortgage loan receivables

held for sale (73,421 ) — — Repayment of mortgage loan receivables

held for sale 1,768 2,308 1,293 Proceeds from sales of mortgage

loan receivables held for sale 1,440,195 2,509,090 3,523,689 Income

from investments in unconsolidated joint ventures in excess of

distributions received (426 ) (371 ) (1,990 ) Distributions from

operations of investment in unconsolidated joint ventures 1,017 294

1,957 Deferred tax asset 1,868 2,900 (7,175 ) Changes in operating

assets and liabilities: Accrued interest receivable (1,662 ) 621

(9,687 ) Other assets (3,673 ) (1,770 ) (17,446 ) Accrued expenses

and other liabilities (9,085 ) (12,985 )

22,126

Net cash provided by (used in) operating

activities 409,147 40,588

208,672 Cash flows from investing

activities: Reduction (addition) of cash collateral held by

broker for derivatives

7,616

16,918

(13,864

) Purchase of derivative instruments (73 ) — (7 ) Sale of

derivative instruments 39 — — Purchases of real estate securities

(977,062 ) (725,888 ) (2,157,391 ) Repayment of real estate

securities 684,143 186,902 186,310 Proceeds from sales of real

estate securities 539,295 845,648 768,590 Purchase of FHLB stock —

(7,984 ) (22,890 ) Sale of FHLB stock — 2,409 — Origination of

mortgage loan receivables held for investment (919,023 ) (963,023 )

(1,201,968 ) Repayment of mortgage loan receivables held for

investment 649,914 752,452 214,511 Reduction (addition) of cash

collateral held by broker 3,793 (5,291 ) (53 ) Addition (reduction)

of deposits received for loan originations 960 (2,368 ) (91 )

Escrow cash and title deposits included in other assets (4,014 )

5,375 (9,621 ) Capital contributions to investment in

unconsolidated joint ventures — (31,085 ) — Distributions received

from investments in unconsolidated joint ventures in excess of

income 48 3,747 3,255 Capitalization of interest on investment in

unconsolidated joint ventures (867 ) (341 ) — Capital contributions

to investment in mutual fund (10,001 ) — — Purchases of real estate

(62,495 ) (197,501 ) (254,497 ) Capital improvements of real estate

(10,640 ) (8,375 ) (5,192 ) Proceeds from sale of real estate

72,953

(1)

98,558 123,444

Net cash provided by

(used in) investing activities (25,414 )

(29,847 ) (2,369,464 )

Cash flows from financing activities: Deferred financing

costs paid (5,927 ) (2,330 ) (9,863 ) Proceeds from borrowings

under debt obligations 12,359,830 16,280,023 16,885,636 Repayment

of borrowings under debt obligations (12,689,064 ) (16,137,339 )

(14,907,233 ) Cash dividends paid to Class A common shareholders

(67,166 ) (39,934 ) — Partners’ capital distributions — — (369 )

Capital contributed by noncontrolling interests in operating

partnership 250 — — Capital distributed to noncontrolling interests

in operating partnership (39,805 ) (68,673 ) (47,926 ) Capital

contributed by noncontrolling interests in consolidated joint

ventures — 74 1,841 Capital distributed to noncontrolling interests

in consolidated joint ventures (757 ) (3,930 ) (2,207 ) Payment of

liability assumed in exchange for shares for the minimum

withholding taxes on vesting restricted stock (786 ) (4,897 ) (125

) Purchase of treasury stock (4,652 ) (994 ) — Issuance of common

stock — — 259,037 Common stock offering costs —

— (20,523 )

Net cash provided by (used in)

financing activities (448,077 )

22,000 2,158,268 Net increase

(decrease) in cash (64,344 ) 32,741

(2,524 ) Cash and cash equivalents at beginning of

period 108,959 76,218 78,742

Cash and cash equivalents at end of period $

44,615 $ 108,959 $

76,218 Supplemental information: Cash paid for

interest, net of amounts capitalized $ 115,246 $ 107,362 $ 63,171

Cash paid for income taxes $ 8,775 $ 7,306 $ 45,981

Non-cash investing and financing activities: Securities and

derivatives purchased, not settled $ (394 ) $ — $ — Securities

sold, not settled $ — $ 4 $ 3 Origination of mortgage loans

receivable held for investment $ 50,378 $ — $ — Repayment of

mortgage loans receivable held for investment $ (70,678 ) $ — $ —

Settlement of mortgage loan receivable held for investment by real

estate $ — $ 4,620 $ — Like-kind exchange of real estate:

Acquisitions $ — $ 15,249 $ — Dispositions $ — $ (62,093 ) $ —

Receivable from qualified intermediary - other assets $ — $ 6,483 $

— Real estate acquired in settlement of mortgage loan receivable

held for investment $ — $ 6,700 $ — Net settlement of sale of real

estate, subject to debt - real estate $ — $ (11,310 ) $ — Net

settlement of sale of real estate, subject to debt - debt

obligations $ — $ 51,060 $ — Exchange of noncontrolling interest

for common stock $ 145,841 $ 53,659 $ — Change in deferred tax

asset related to exchanges of noncontrolling interest for common

stock $ 980 $ (320 ) $ 1,014 Dividends declared, not paid $ 23,364

$ 17,456 $ — Stock dividends $ 64,100 $ — $ —

(1) Includes cash proceeds received in the current year that

relate to prior year sales of real estate of $6.5 million.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170223006644/en/

InvestorsLadder Capital Corp Investor Relations,

917-369-3207investor.relations@laddercapital.com

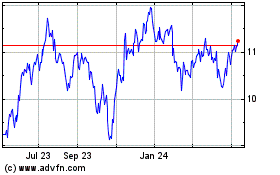

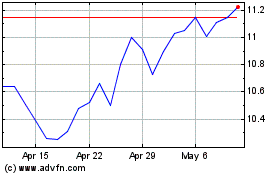

Ladder Capital (NYSE:LADR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ladder Capital (NYSE:LADR)

Historical Stock Chart

From Apr 2023 to Apr 2024